US Rates Play the Tune for Stocks – Part 2

Another very good session for the Australian market yesterday with the ASX 200 putting on +1.08%, to close back up above 5800. The ‘reflation’ trade was back on with the Materials up by +2.22%, versus the Real Estate stocks which we were down -1.23%. Overnight, the Tech stocks were once again the cause of more volatility in the US, with the NASDAQ off by 100 points. This dragged the DOW down by 167 points and the S&P 500 by -0.78%, however stocks finished some way up from the session lows. A few moving parts to this story - There are clearly a few ‘nervous longs’ in big US Tech and the NASDAQ for now, is leading the other markets. However, despite stocks being down overnight, we still saw positive moves in the Financial space and key commodity markets. US financial stocks were actually up overnight by 0.6%, building on a very strong week.

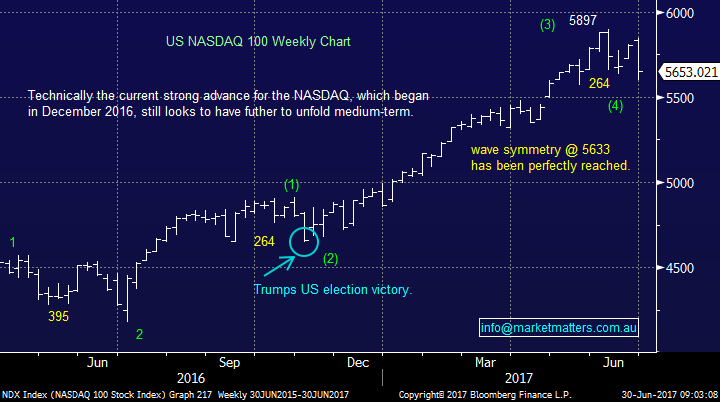

NASDAQ Weekly chart

July is a very strong month seasonally for the Australian market, particularly the two sectors that drive our index, being the financials and the materials. The break up above 5755 has us now bullish the Australian market short term, although we are likely to challenge that level again today given the weakness overseas. Our current cash position of 12% feels ‘about right,’ however we continue to think buying weakness in some sectors makes sense.

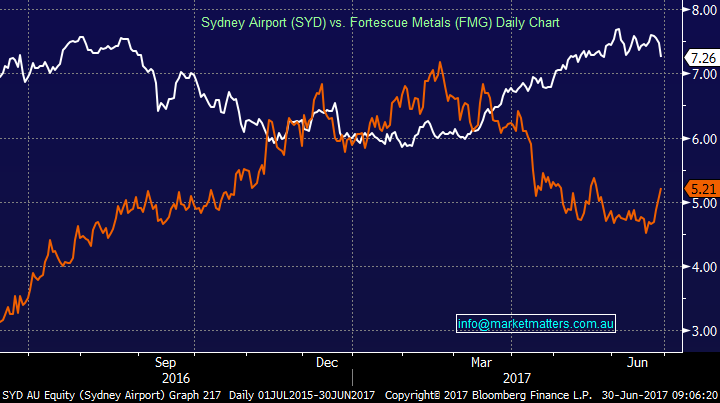

On Wednesday, we penned a report around US interest rates and what they meant for stocks. Clearly interest rates globally are tracking higher and this will impact Australian stocks / sectors in different ways. Our ‘Yield Play’ stocks copped a battering yesterday and money went from defence to offense. The opposite will likely be true early on today, however we continue to have no interest investing in the well owned ‘yield play’ with stocks like Sydney Airports and Transurban falling into this category.

Sydney Airport (SYD) Daily Chart

If we think about the yield play as being Sydney Airport and the ‘reflation’ play as being Fortescue Metals, the recent trends here are interesting.

Sydney Airport (SYD) versus Fortescue Metals (FMG) Daily Chart

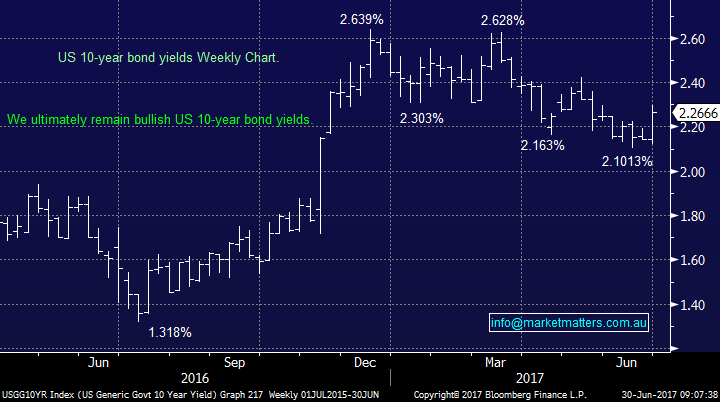

The end of 2016 was a tough period for Sydney Airport and other interest rate sensitive stocks, while there was a lot of buying for Fortescue and other growth plays. That didn’t last though, with US interest rates starting to track lower on a soft patch of US economic data. That saw money come out of offence and back into defence, pushing the miners and other growth sensitive sectors down at a fairly quick rate - and the yield play stocks rallied more than we expected them to. Now we find ourselves at the cross roads again – will interest rates move sustainably higher from current levels, or are we in for another false start? We think they’ll move higher from here, so we want to be exposed to sectors that benefit from it and clearly avoid sectors that don’t.

US 10 year Bond Yield – Weekly Chart

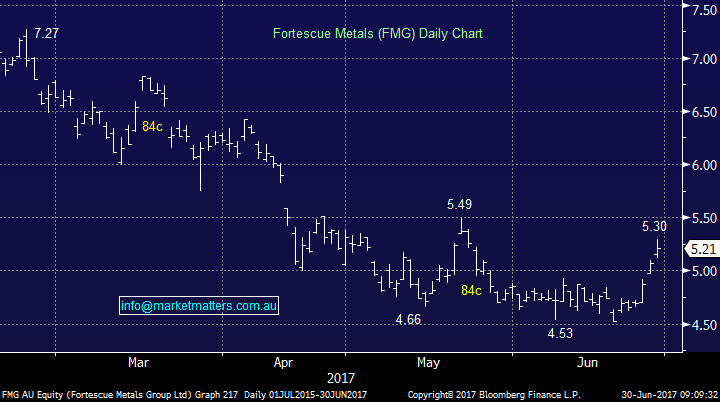

The last few days have been very bullish for resource stocks, with Fortescue up by 11.8% this week, while BHP has rallied 4.7% and RIO up 7.75% – all fairly explosive moves. We now expect a few days of consolidation to play out.

Fortescue Metals Daily Chart

Westpac has been on our buy radar and we will look to increase our current 5% holding by another 2.5% into todays weakness, below $30.60. Watch for alerts

Westpac (WBC) Weekly Chart

Conclusion (s)

· We remain negative the yield play and would use any strength here as a selling opportunity

· We remain bullish US interest rates and this should see financials and material stocks do well

· We will look to increase our Westpac position by another 2.5% into weakness this morning

Overnight Market Matters Wrap

· A Tech stocks led the markets lower as investors rotate out of growth stocks and into value stocks.

· European stocks fell sharply as the Euro rose to its highest level in a year vs the USD.

· Metals on the LME were better and iron ore moved into bull market territory, up another 3.8%

· The June SPI Futures is indicating the ASX 200 to open 57 points lower, towards the 5760 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/06/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here