US rates play the tune for stocks

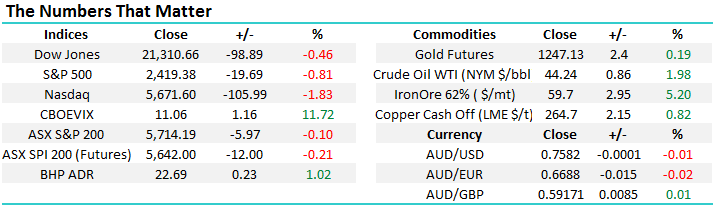

An interesting session in global markets overnight with US stocks falling the most in around 6 weeks with the DOW down ~100pts / 0.46%. Clearly not a big move in historical terms however volatility has been very low in US stocks for much of 2017. The NASDAQ was the big mover down by -1.61% and the positive trends here since December 2016 are showing signs of faltering. We’ve often discussed the crowded long US Dollar trade and the risk that creates – this led us to be negative the US dollar at the end of 2016 and for 2017 and the currency is down by 7% YTD. The thinking behind it is fairly simple, if everyone a bullish a particular theme and already long that theme, then who’s left to be the marginal buyer? In recent months, the NASDAQ has taken the mantle as the ‘most crowded trade’ according to that same survey and once again we see this as a risk.

We continue to think the US looks ripe for a ~5% correction led by Tech stocks however no sell signals are generated in the DOW until a break below 21,000, and importantly our market looks set to outperform any US led decline.

NASDAQ Weekly Chart

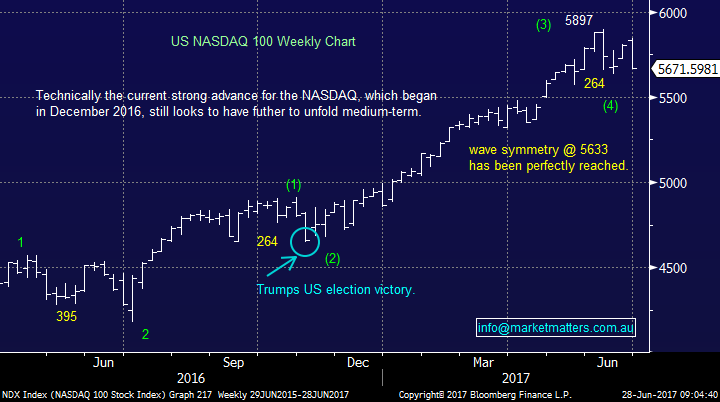

Financials were the strongest link in the US overnight as US bond yields rose strongly with the 10 year yield now back to 2.20% - a theme we’ve been discussing recently. Overnight the Chair of the Federal Reserve made ‘hawkish’ comments saying that the Fed remains on track to tighten even as the US goes through a short term period of weaker than expected economic data. The Fed seems to view these trends as transient and they’re being very clear about their intensions to hike rates. As is stands, the markets are pricing in 1, maybe 2 more rate hikes this year and 1 next while the Fed is guiding for a lot more. There is a massive disconnect between current market pricing and where the Fed see’s rates. We tend to think that what eventually plays out will be somewhere in between the two lines of thought - if that is the case then US Bond Yields trade higher from current levels – as they did last night. We remain bullish global interest rates.

US 10 Year Bond Yield Weekly Chart

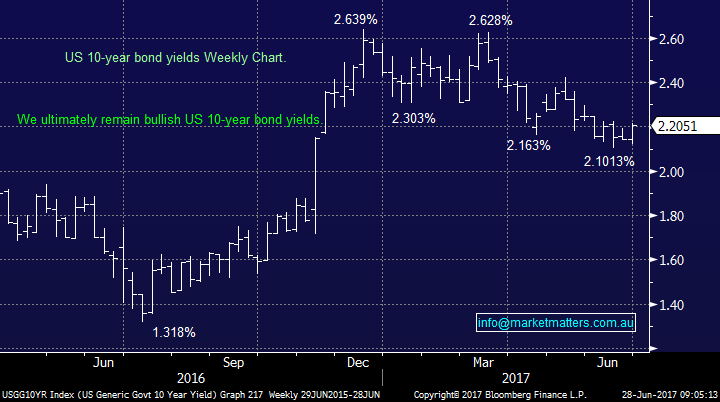

This has big ramifications for our investment decisions – the sectors we should be involved in and the stocks we should hold – and importantly, avoid. Two key sectors (other than Tech) were in focus overseas last night. The US Financials were the only sector that finished in the green overnight, up by +0.51%. Financials benefit from higher rates and we remain bullish financials in the US which should filter through to local buying into July.

We added to our exposure here yesterday by buying another 3% of QBE Insurance (QBE) at $11.63. This takes our holding to 7% with an average price of $10.92. Insurance stocks are key beneficiaries of higher interest rates with QBE more exposed to US Interest Rates than others. The recent downgrade was clearly disappointing and the market is now likely to remain sceptical of QBE until proven otherwise, however the stock is now cheap trading on an estimated PE of 11.4 times FY18 earnings versus their 10 year average of 12.60 times, plus we’re assuming they deliver margins of 10% rather than the 11% they are suggesting. In a report shortly, we will focus on the 3 key insurance stocks in Australia and why we hold Suncorp & QBE in the portfolio, with a high portfolio weighting.

US Financials Monthly Chart

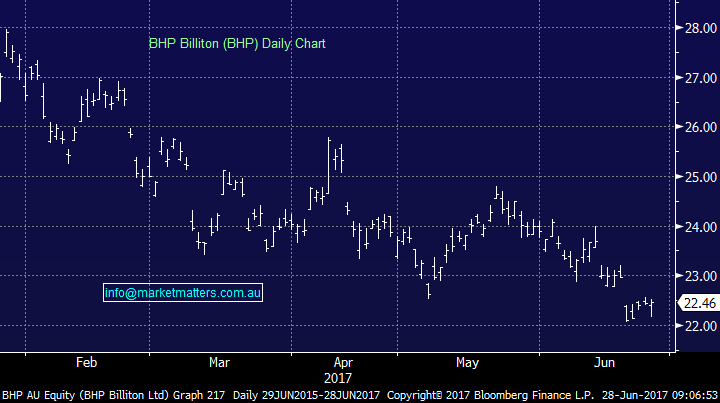

Commodity markets were very strong overnight with Iron Ore up by +5.20% and the broader commodity complex higher. This got traders keen on BHP and RIO overseas, and we see BHP likely to open around $22.69, a jump of ~1% while RIO was up over 2% in New York. Our report yesterday was timely and we think commodity stocks to do well from here. In terms of BHP, Elliot Advisers are in Sydney doing the rounds of Analysts garnering support for their plan. We’ll have some insight here in the coming days.

BHP Billiton Daily Chart

Not all commodities are the same however and we continue to be cautious on Coal stocks, particularly Whitehaven (WHC) and South 32 (S32). Both have been strong in recent years on the back of a very strong Coal price which have seen very good momentum in earnings. That trend though seems to be changing and Whitehaven in particular looks susceptible to a pullback in price. Interestingly, the Quant fund Vinva which is a large ‘momentum investor’ based out of the US has just ceased to be a substantial holder in the stock. In our view consensus earnings are too high in WHC and downgrades are now a strong possibility.

Whitehaven Coal (WHC) Weekly Chart

Overnight Market Matters Wrap

· All major US indices closed in the ‘red sea’ with the NASDAQ 100 deeper than most, down 1.83% overnight.

· A record fine imposed on Alphabet by the EU led to the sell-off in tech stocks, while Trump’s agenda is being questioned as a healthcare bill was delayed in the US senate.

· US 10 year Treasury yields rallied to 2.2% as Janet Yellen signalled that the gradual rise in interest rates is on track.

· Metals on the LME were stronger, oil was better and iron ore rallied 5.2%.

· The June SPI Futures is indicating the ASX 200 to open 10 points lower, towards the 5705 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/06/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here