Understanding the $A and its implications (JHG, WFD)

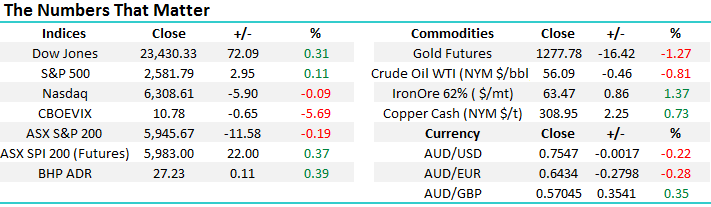

The ASX200 closed down only 11-points yesterday but noticeably very close to the day’s high as it shrugged off news that Angela Merkel, Germanys Chancellor since 2005, was struggling to form a collation government – remember a market that does not fall on bad news is a strong market. There was very little of interest over the day that was best summed up by very low volumes.

Technically the perfect picture would be a rally up towards 5985 followed by another leg down towards the major support ~5850. While markets rarely give us the ideal scenario, especially over just a few weeks, it’s always best to have them clear just in case. For now we remain short-term bearish with local stocks having already corrected around half of the usual ~5% pullback in November.

In the bigger picture we remain bullish the ASX200 following its +7% advance since early October and are keen to allocate more funds into appropriate stocks if this current downturn continues.

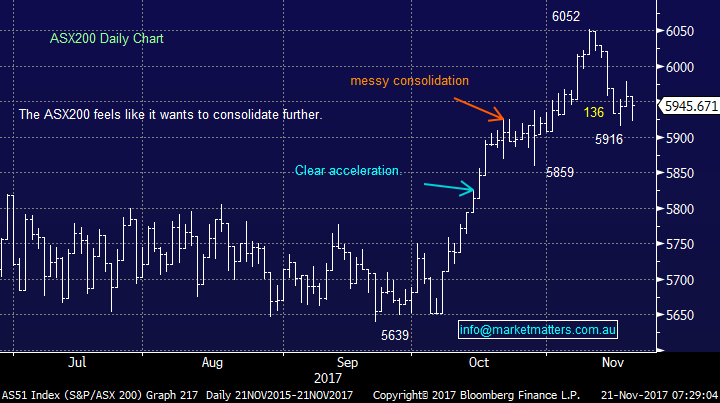

Today we are going to focus on the weak Australian Dollar $A, which has tumbled over 7% since September alone.

ASX200 Daily Chart

The little Aussie battler - $A.

We have been bearish the $A for a long time with an eventual target around 65c and today I smiled when reading an article that major US investment bank Morgan Stanley have just come out with the same target! We can get a clear understanding behind the logic for a depreciating $A when we simply look at interest rates, generally a reflection of a countries economic health.

Historically the $A has been supported by its perception / position as a high yielding currency but consider what’s unfolding before our eyes:

- The RBA cash rate is rooted firmly to its all-time low of 1.5% with the combination of a “wobbling” housing market and record levels of household debt making it very hard for the RBA to consider any meaningful increases over 2018/9.

- The US Fed is well down the path of normalizing interest rates, with 2 increases already in 2017 and Goldman Sachs now forecasting 4 hikes in 2018.

- Hence by this time next year it would appear that official interest rates in the US will be higher than in Australia, clearly damaging the case for holding $A.

Hence we have 2 important negative factors influencing the $A moving forward:

- The $A is highly likely to yield less than the $US in 2018 /19.

- The $A is highly likely to still be regarded as a higher risk currency than the $US.

Australian Dollar ($A) Monthly Chart

Since the GFC the gap between the US and Australian 10-year bond yield has been steadily narrowing as their economy continues to improve far quicker than our sluggish Australian equivalent. The last time the spread between respective 10-year bond yields were fixed around these levels the $A was trading under 50c. Considering we can see the US 10-year yield rallying over the local rate a 65c call is probably conservative!

US v Australian 10-year bond yields Weekly Chart

Let’s now consider this weaker $A theme to our investment process moving forward - simply the MM portfolio wants to be skewed to companies who benefit from a weaker $A and higher US interest rates. Although we must acknowledge that this is a mature theme with the $A already down 30% since its dizzy highs in 2011, our target remains another ~13% lower so there’s likely to be more “meat in this sandwich” for now.

Stocks with a large percentage of revenue in $US are likely to be solid places to be invested in 2018/9 e.g. Altium, Amcor, Ansell, Aristocrat, Brambles, Breville, Cochlear, Computershare, CSL, Graincorp, Henderson Group, James Hardie, Resmed and Westfield. Also because commodities are priced in $US a falling $A, as opposed to a generally strong $US, benefits our resource companies.

The unfortunate problem is that most of the above list have already run very hard hence leaving decent value and risk / reward pretty thin on the ground. Two companies we currently find attractive are:

- Janus Henderson (JHG) - good risk / reward buying around current prices with stops under $45 – these 2 companies are combining successfully and 50% of their earnings are in the $US. The main risk remains a messy BREXIT.

- Westfield (WFD) – a contrarian entry today but WFD has now corrected almost 35% since mid-2016 providing some solid risk / reward in a stock / sector where most investors are feeling the glass is half empty. We like WFD around this $8.25 region with stops under $7.90 i.e. 4% risk but we can easily see 15% upside hence an attractive play. Previously we were hoping to buy closer to $7 but as investors we must remain flexible.

Janus Henderson (JHG) Weekly Chart

Westfield (WFD) Monthly Chart

Global markets

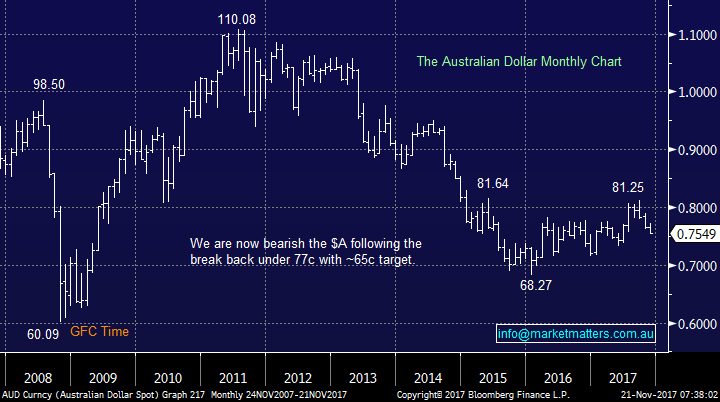

US Stocks

The US continues to oscillate around all-time highs and although we need a ~5% correction to provide a decent risk / reward buying opportunity, no sell signals have been generated to-date. We actually expect to see another test of 2600 into this week’s Thanksgiving holiday.

US S&P500 Weekly Chart

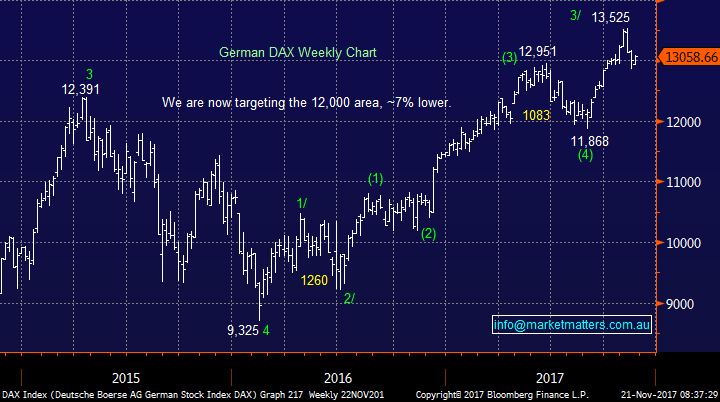

European Stocks

European stocks look to be failing after their recent break out to fresh 2017 highs, we are now neutral / negative Europe over the next few weeks.

German DAX Weekly Chart

Conclusion (s)

No change from our previous thoughts around the $A – at MM we want to maintain a bias to $US earning stocks.

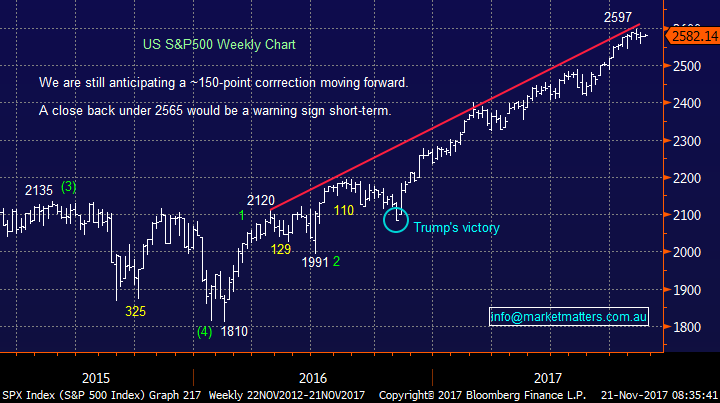

Overnight Market Matters Wrap

· The US equity markets closed mixed overnight, with the tech index, NASDAQ 100 ending its session in the red sea.

· In the European region, the markets were also firmer, despite Germany Chancellor’s Angela Merkel abandoning attempts to form a Coalition Government leaving the door open for potentially another election.

· The December SPI Futures is indicating the ASX 200 to open 30 points higher testing the 5975 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/11/2017. 8.00 AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here