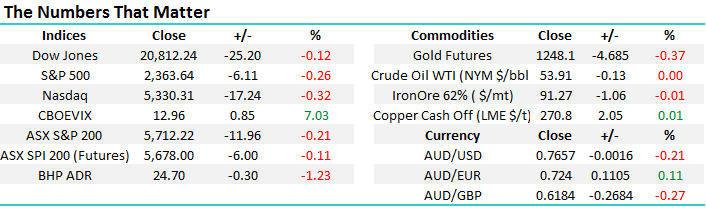

Trump trepidation time may equal opportunity

Today at 1pm AEST Donald Trump will address the US Congress with markets looking for clarity and details within his plans moving forward e.g. Infrastructure spending and tax cuts. The Dow Jones has enjoyed the best run in over 30-years and as we commence writing this report it is down a mere 29-points with one hour of trade remaining. After a phenomenal 16% rally since the US election we remain bullish US stocks but from a risk / reward perspective we would not buy until they experience a correction of around 4%. Today's speech could potentially be the catalyst for this degree of correction and hence plans need to be laid for any buying opportunities that may arise this afternoon, or in the near future - the Australian market often over reacts during these volatile times simply because we are open when other major western indexes are tucked up in bed e.g. US election last November.

The MM portfolio is holding 23% in cash ideally looking to acquire some resource / gold stocks into weakness hence we will focus closely on this area this morning. I know this is going over ground we have covered during recent reports but when it feels like there is a strong possibility we will be buying soon reinforcing our plans makes sense. We firmly regard ourselves as active investing, using our decades of experience in the market to add value to portfolios e.g. We sold Newcrest Mining (NCM) on Monday around $23.40 before yesterday’s 4% fall and more importantly before Evolution Mining, where we are looking to allocate the funds fell 4.3%. With Australian official interest rates at 1.5% any 5-10% improvements to a portfolio is valuable.

US Dow Jones Daily Chart

1. Resource Stocks

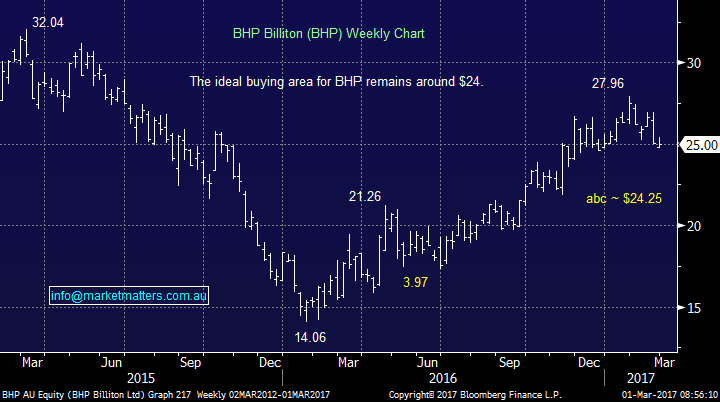

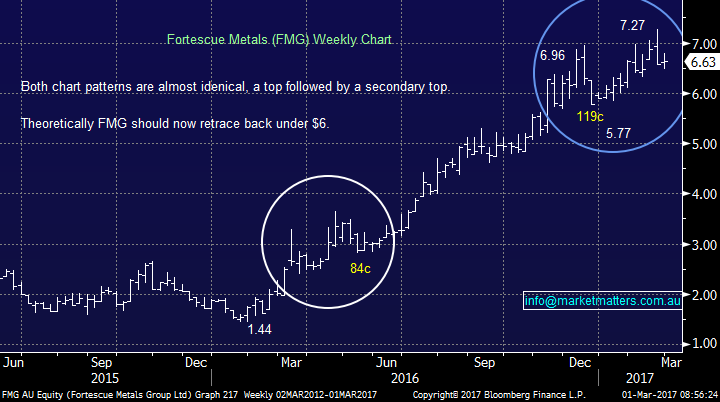

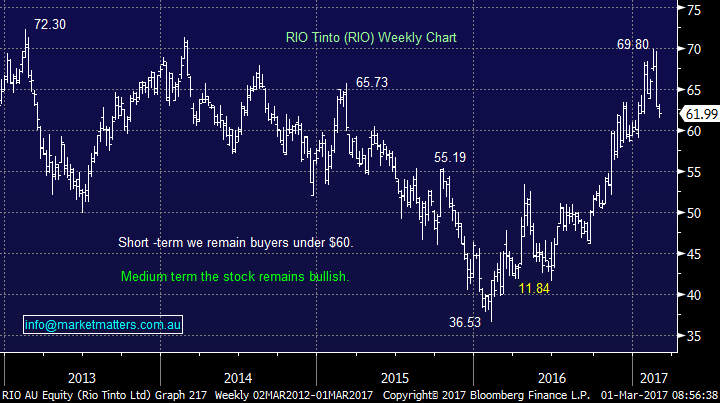

We have been targeting buy levels in BHP, Fortescue (FMG) and RIO Tinto over recent weeks and these levels are now looming fast with all 3 stocks down around 10% from their recent highs.

BHP - Our buy area is ~$24, which would be an almost 14% correction from its January high. BHP is set to open down over 1% today around $24.67, less than 3% to go. Also, BHP goes ex-dividend 40c fully franked on the 9th of this month, which would have it in our buy zone if this occurred today.

FMG - Our target for FMG remains around $6 which is still 10% from yesterday's close but FMG goes ex-div. 20c fully franked tomorrow which quickly takes us into striking distance of our buy zone for this very volatile stock - FMG regularly swings 25c in one day!

RIO - Our ideal target for RIO is around $58, or 6% lower. The stock has already corrected 11% but it has traded ex-div. $1.64.

BHP Billiton (BHP) Weekly Chart

Fortescue Metals (FMG) Weekly Chart

RIO Tinto (RIO) Weekly Chart

2. Gold Stocks

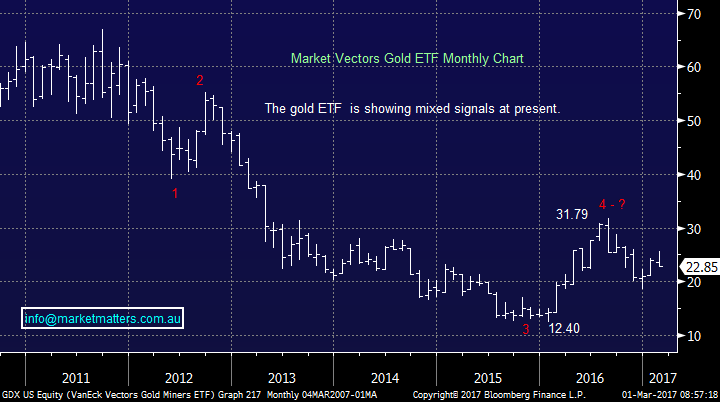

After selling our NCM on Monday we are looking to re-enter the sector into the weakness which is currently unfolding. The gold ETF's fell almost 10% on Tuesday night and failed to bounce last night, any aggressive talk by Donald Trump on economic stimulus that the market interprets is likely to send interest rates up higher and faster than anticipated which is likely to be bearish for gold.

Evolution Mining (EVN) - We are buyers of EVN under $2.10 which is now only ~3% lower. EVN went ex-div. 2c last week.

Newcrest Mining (NCM) - We would consider re-entering NCM under $21, or 10% below our exit this week. NCM goes ex-div. 7.5c on the 23rd of this month.

Regis Resources (RRL) - Our initial buy zone for RRL is around $3.20, or 5% lower. RRL goes ex-div. 7c fully franked on the 7th of this month.

Gold ETF Monthly Chart

Conclusion

We remain buyers of the following stocks at the levels shown, we may start accumulating on the back foot into weakness if it unfolds before these exact levels.

Resource stocks : BHP around $24, FMG under $6 and RIO around $58.

Gold Stocks : EVN under $2.10, NCM around $21 and RRL around $3.20.

*Watch for alerts*

Overnight Market Matters Wrap

- The US markets closed marginally lower, with the Dow snapping its 12-day winning streak as traders wait to digest President Trump’s speech to Congress today, where investors are looking for details on tax cuts, infrastructure spend and plans for growth.

- Most commodities on the LME were better, however nickel fell. Gold is weaker and iron ore is down 1.2%

- Australian 4th quarter GDP is due at 11.30am today and Telstra trades ex-dividend (15.5c per share)

- The March SPI Futures is indicating the ASX 200 to test the 5,700 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/03/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here