Trump & May combine to rattle markets

In a 45 minute speech last night Theresa May outlined her plans / hopes for BREXIT which was tough enough to send European equities lower, led by the UK FTSE which fell 1.5%. There is a long and potentially torturous journey ahead in the negotiations between Britain and the EU, hence a correction is hardly surprising after the 10% gains since early December by the UK's FTSE.

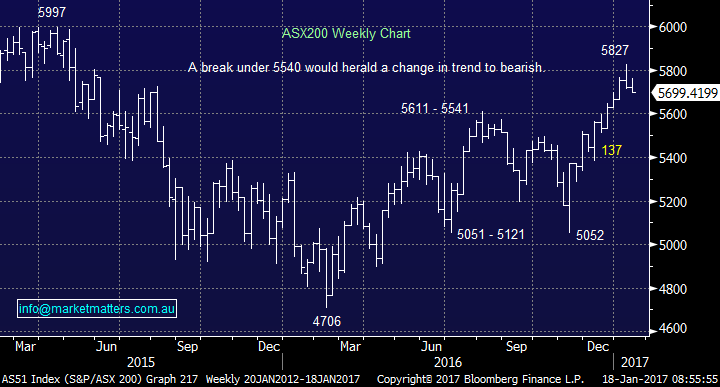

The ASX200 picked the negativity creeping into global equities perfectly yesterday falling almost 1% with no obvious lead. We held back from purchasing Henderson Group in our targeted sub $3.80 region simply because the market felt "wrong" and Theresa May's speech was likely to increase volatility. We are now short-term cautious as this correction unfolds - to date our selling strength in 2017 has worked perfectly now it's time to buy weakness when we feels it offers value and / or has simply become exhausted.

ASX200 Weekly Chart

Donald Trump, who is not yet President, has now started speaking in earnest, often via Twitter! He has just criticized a Republican corporate tax plan and stated the $US was too strong, citing currency manipulation from China as the cause - the market swings around his mood changes have begun . These comments were enough to send the greenback lower with the currency making fresh lows for 2017, down 3.5% from its highs of the year - as we have said recently a crowded trade is a dangerous trade.

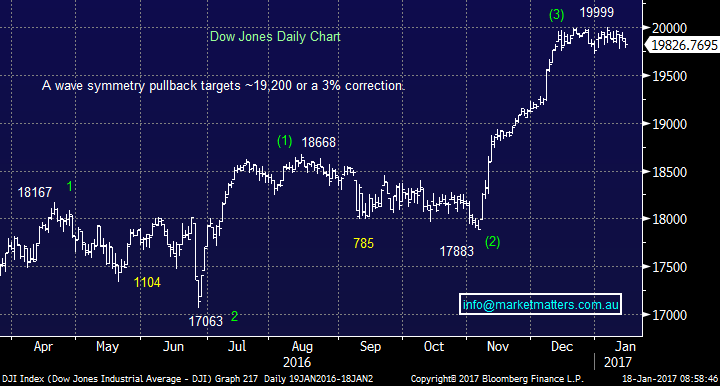

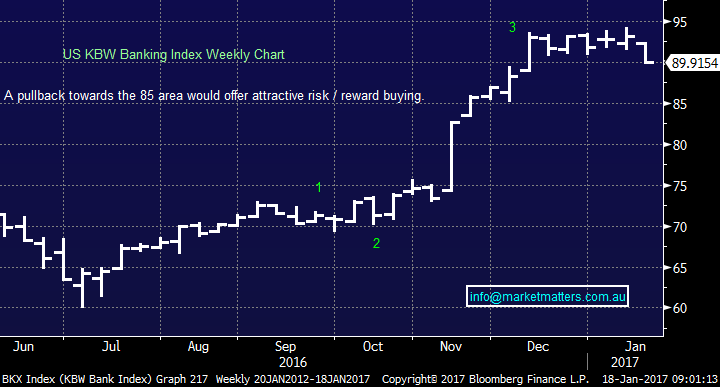

If Trump's comments can send the $US lower it's not surprising that investors decided to lock in some profits in stocks after their enormous gains since his victory in November. The financials led the declines with the US KBW Bank Index falling ~3.5% at one stage - this maybe good news for MM as we are looking to buy financials into weakness. Note we still like HGG and the strong reaction by the pound to Theresa May is a solid uplift to its earnings profile - see yesterday’s morning report.

We are now mildly bearish the Dow short-term with a 19,200 target area.

US Dow Jones Daily Chart

When we look specifically at the US Banking sector another 4% downside would not surprise but we would regard this as a buying opportunity.

We remain buyers of the financial sector into weakness

US KBW Banking Index Weekly Chart

Both RIO and BHP satisfied our target for a break over 2016 highs yesterday enabling us to take profit on our RIO option trading position even though it failed to reach our $65 target (it traded to a high of $64.09) – another example of remaining open minded in this environment. We are now targeting a pullback to ~$59 (6%) in RIO where we will again consider a short-term / trading buy position.

RIO Tinto (RIO) Daily Chart

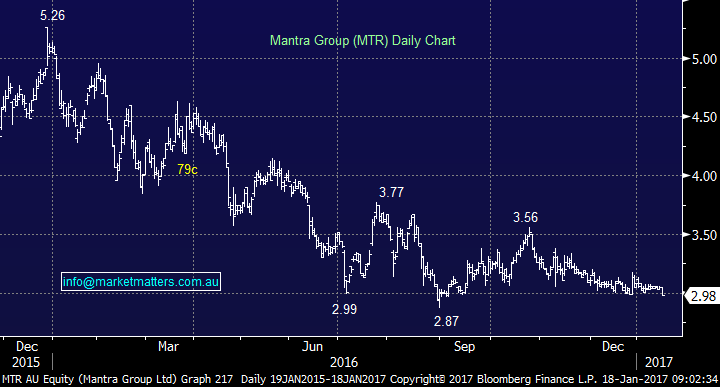

Lastly Mantra closed under its $3 support level yesterday, this position has been frustrating us for a while. We see the underlying appeal in this business however recent price action in a strong market concerns us. We think it’s best to step aside for now and we are likely to exit today.

Mantra (MTR) Daily Chart

Summary

We feel a correction is unfolding in US equities that is likely to provide some solid opportunities in the domestic market - remember our theme for the start of the year, buy weakness and sell strength.

Today we will consider selling our MTR position and potentially allocating part of the monies into HGG.

*Watch for alerts.

Overnight Market Matters Wrap

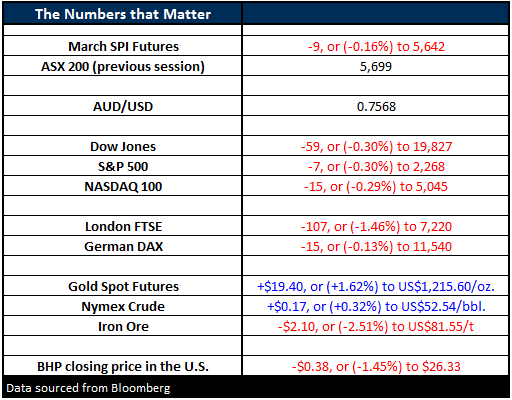

- The US share markets started their short week in the red, with the three major indices all ending 0.3% lower, led by the financial and health care sectors.

- The Dow closed 59 points lower at 19,827, while the broader S&P 500 closed 7 points lower at 2,268.

- Iron ore followed Asian trade and reversed overnight, settling 2.51% lower at US$81.55/t. BHP is expected to continue its slide today, after its performance in the US, closing down an equivalent of -1.45% to $26.33 from Australia’s previous close.

- The March SPI Futures is indicating a softer start, testing the 5,690 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/01/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here