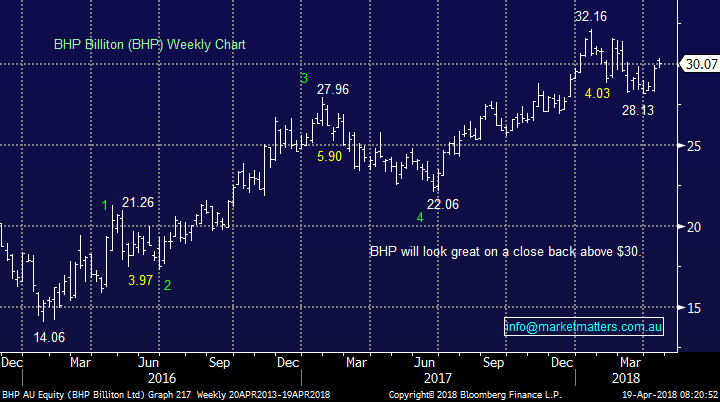

Trade War – What Trade War? (BHP, RIO)

A reasonable day for the Australian benchmark yesterday, buoyed largely by strength in the consumer discretionary stocks while the resources also showed some promise. Overnight U.S. stocks edged higher although unconvincingly so with a mixed bag of earnings and a sharply higher Oil price, however it was in the commodity complex that we really saw things heat up - nickel the standout adding ~8% , breaking out to new 3 year highs. Expect a very bullish day for our mining stocks with BHP likely to open up just below $31.00.

SPI Futures are pricing a rise of around 25 points on open however that may be ‘undercooked’ given the strength in both resources and banks overseas.

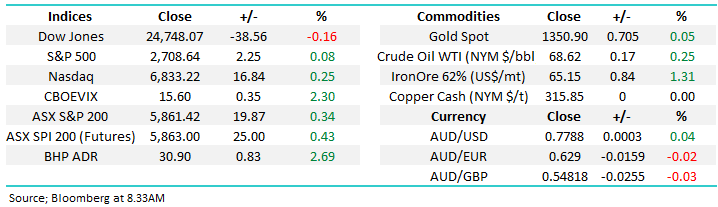

We still need a close back above 5900 before we can see a real possibility of a test of 2018 highs, while a failure to hold the 5800-support area will concern us. Remember at MM we are cautiously bullish stocks from current levels, but definitely not chasers of strength.

The resource stocks have started to perform strongly, however our very influential banks have continued to lag. It’s simply very hard for our market to be overall bullish unless our banks join the party – something that has been very illusive for the usually strong months of March and April.

ASX 200 Chart

Today’s report is going to take a review at a few important aspects of the market as investors look past recent trade tensions and geopolitical rumblings and instead embrace strong corporate earnings – an air of stability returning to the markets, for now.

Overseas Markets

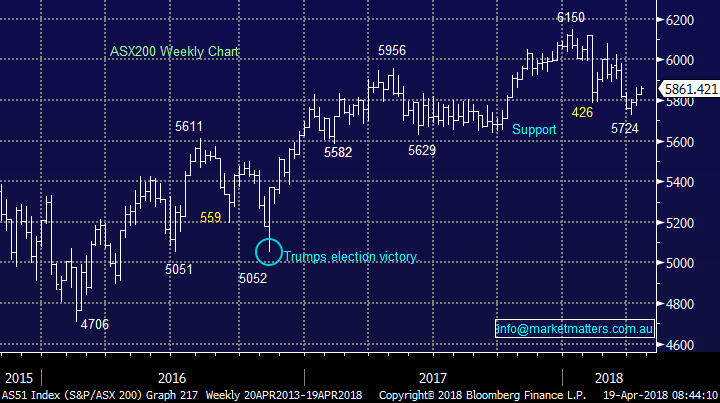

The US market was up for a third straight session overnight with the tech stocks once again seeing most buying – although only by a small margin. We continue to use the NASDAQ as a strong leading indicator for global equities / risk appetite and expect an eventual re-test of the previous highs, as long as Trump and Chinese President Xi Jinping can progress trade discussions with the more conciliatory approach that seems to be currently playing out. Trump came out firing on trade however China’s response has clearly taken the wind out of the Trump sails – for now.

NASDAQ Chart

Volatility has abated fairly quickly to now trade back below its longer term average but still above the level it traded for much of 2017. The market is now suggesting that all is calm. If the status quo is maintained, expect volatility to drift lower but stay above the 10 handle. Right now, 15 on the volatility index feels about right.

Volatility Index Chart

US interest rates continue to edge higher and the 3% level on the 10 year bond seems simply a matter of time. The US economy continues to perform strongly with the recent tax cuts now showing through into strong earnings. An interesting component of the Goldman Sachs quarterly report was a big increase in wage costs aligned with an increase in earnings. Higher earnings typically flow to higher wages which underpins rising inflation, and ultimately higher interest rates.

US 10 year bond yield

The Emerging Markets, which are highly correlated to our resources sector, also enjoyed a strong night rallying nearly 1%. We remain bullish the EEM targeting fresh 2018 highs, a bullish sign for both local heavyweight BHP and RIO.

NB Overnight BHP closed at $30.89 in the US, up a healthy +2.67%.

Emerging Markets (EEM) ETF Chart

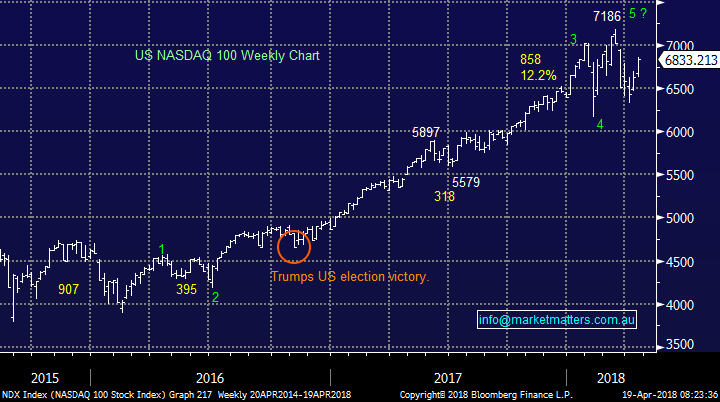

BHP & RIO

Now to again look at these two stocks given recent strength. BHP is our larger weighting in the Growth Portfolio at 6% while we hold 3% in Rio – both positions are in profit. While we remain bullish on the commodity stocks our original plan has been to sell strength and Rio in particular is likely to be strong today.

We expect to sell RIO above $80 today should it trade there.

BHP closed yesterday above $30 which brings into play our $32 price target – now just ~6% away. By taking a nice profit on our smaller holding in Rio Tinto (RIO) – hopefully today – we can then give our larger BHP position more room to move. NB. We have BHP in both the Platinum & Income Portfolio’s.

Rio Tinto (RIO) Chart

BHP Chart

Conclusion

· We remain sellers of strength and today we are looking to sell Rio Tinto above $80 should it get there, giving BHP more room to move

**Watch for alerts**

Market Matters Overnight Wrap

· The SPI is up 25 points as the S&P 500 and NASDAQ made small gains and despite the DJIA closing slightly in the red.

· Britain’s FTSE 100 rallied 1.25% as the pound fell on weak inflation numbers, while resource stocks surged with BHP and RIO rising circa 5%.

· Sanctions on Rusal are continuing to disrupt the base metals market with huge gains on the LME. Aluminium rose to its highest level since 2011 and nickel jumped 7.5%.

· Iron ore rose 2% while oil rallied 3% to a three year high and helped energy stocks to be among the best performers in the US.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/04/2018. 9.05AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here