Three stocks we anticipate avoiding in 2017

The local market was relatively strong yesterday advancing 0.2% even as NAB and Macquarie Group traded ex-dividend, which took a combined 14-points off the ASX200. The market clearly remains choppy and range bound and our “best guess” over the coming sessions is a continued bounce back over 5900 prior to another leg lower, with an initial target of 5700.

We simply believe the market will get its almost self-fulfilling “sell in May and go away” correction, especially considering the ASX200 is trading on its highest valuation, minus resources, in well over a decade. With local PE’s clearly on the rich side and investors very conscious of the seasonal influences the market just “feels” ready to crack back under the strong psychological 5800 support area, if only for a quick clear out of the weak longs.

ASX200 Daily Chart

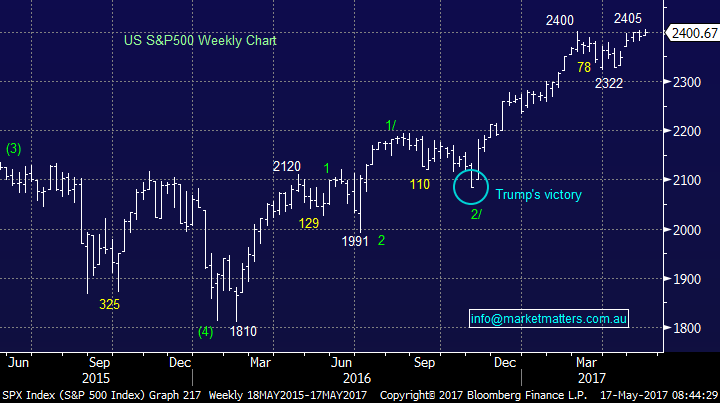

US markets were quiet last night again retreating after making fresh all-time highs with the exception of the Tech. NASDAQ which continues to power higher. From a risk / reward perspective our preferred strategy at present is to remain patient in an attempt to buy the next pullback, when / if it finally unfolds. If our current projection is correct and equity markets are in the mature stage of their 8-year bull market we should see some decent “choppy style” retracements as the market slowly completes its strong advance since March 2009.

US S&P500 Weekly Chart

Today we are going to look at 3 stocks we are likely to steer well clear of during 2017 / 8, while we ‘never say never’ some drastic changes would need to occur before we changed our prognosis.

1 Westfield Corp. (WFD) $8.53

It is common knowledge that the Australian retail sector is facing the approaching tsunami called Amazon, MM has made it very clear that the we believe moving forward picking any winners in the sector is just too hard. Amazon is likely to smash the margins of many of our household names and the shopping landscape we enjoy today is likely to be very different in just 5-years’ time.

So today we are moving our attention down the line to Westfield (WFD), the shopping centre operator. Our view is simple, as the best ideas often are, if retailers are going to come under immense pressure this cannot be good for WFD. Either rents will fall or some retailers will go broke which will hit occupancy. While it’s hard to know the exact impact for WFD we believe the simple implications will be negative and it is far simpler just to stay away.

Hence although WFD looks ok technically we will not be buying WFD – the market is currently agreeing with us, over the last year the ASX200 is up +8.4% while WFD is down -19.8%.

Westfield Corp. (WFD) Monthly Chart

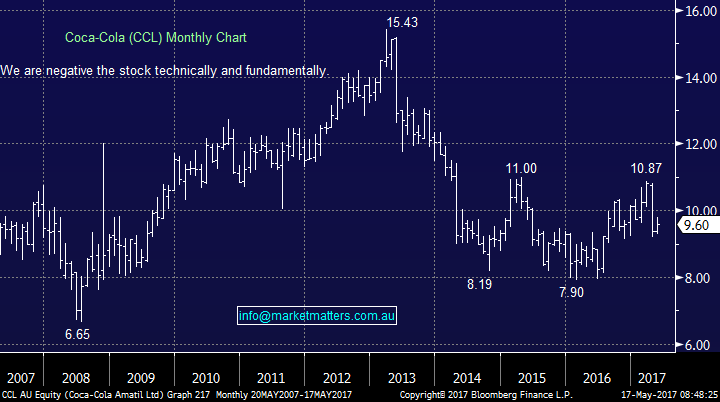

2. Coca-Cola Amatil (CCL) $9.60

Coca-Cola (CCL) is a stock we have remained negative towards over recent years. In this case the health landscape is changing rapidly and consumers, you and I, are realising the harm processed sugars are doing to our health. This is clearly illustrated by the fact that more government funds are now being used to treat diabetes in hospitals than smoking related diseases.

As we, and especially the banks know from the recent Federal budget, Australia is struggling to “balance the books”. We believe it’s a matter of time before soft drinks will be slugged with ever increasing taxes just like smoking has over recent decades.

Our view is until CCL can reinvent themselves there is no reason to invest in a company facing such major headwinds.

Coca-Cola Amatil (CCL) Monthly Chart

3. Carsales.com (CAR) $11.70

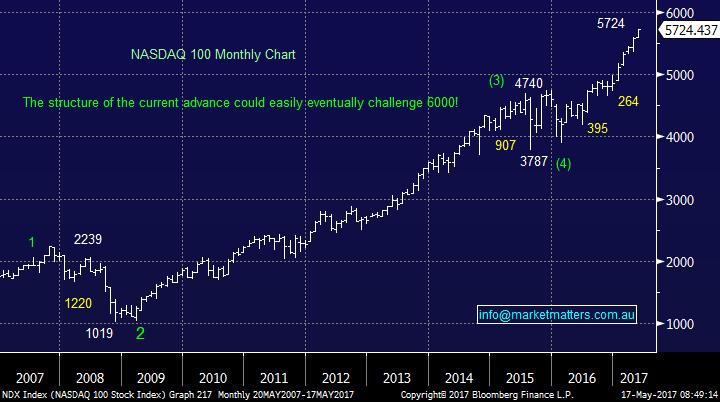

A stock that actually has a very good story, is in the right sector (just look at the tech dominated NASDAQ which has appreciated +17.7% in 2017) and has a pretty good track record of growing earnings, so why would we avoid it? In 2017 the ASX 200 is up +3.3% while the IT sector has put on +8.36% following the strong performances by the sector overseas. CAR is up just +2.6% dramatically underperforming its sector but also the broader market generally. The issue is two-fold. The stock is expensive (24x) so priced for strong growth in earnings, but those earnings are under pressure – and have been for some time. To pay 24x for that earnings profile you need to have confidence in the Management, and their future strategies.

CAR Earnings Expectations (RED Line)

We do not believe CAR has the structural of the previous 2 stocks we simply believe a lot of ‘future positivity’ is already priced into the share price. We’re not alone given the underperformance of the stock in recent times

Technically we can see a decline under $9 which coincides with our valuation thoughts. Hence we have no interest in CAR at current prices. However unlike WFD and CCL we will consider buying CAR into weakness.

Carsales.com (CAR) Monthly Chart

US NASDAQ 100 Monthly Chart

Conclusion (s)

We intend to steer clear of WFD, CCL and CAR until further notice.

Overnight Market Matters Wrap

· The US equity markets drifted lower after the broader S&P 500 hit intraday highs overnight. Of the sectors, the IT and Financials were in positive territory, while the defensive names led the negative team.

· BHP is expected to outperform the broader market today, led by its performance in the US, rallying an equivalent of +1.14% higher, courtesy of the 0.61% rally in Iron Ore.

· Oil lost 0.39% overnight, after reports of higher than expected inventory was recorded.

· Domestically, we expect CYB to underperform following its report and weakness in London.

· The June SPI Futures is indicating the ASX 200 to open 12 points higher, towards the 5,860 area, however US Futures have become soft in recent minutes courtesy of ‘Twitter’ and +12points may be a stretch!

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/05/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here