The Year of the Dog remains on track for MM (SUN, TLS, NCM, EVN, S32)

Chinese New Year’s Eve has passed and the dog has taken over from the rooster, when we pause and consider some of the statistics around this festive season it’s not hard to envisage why China has become such an economic powerhouse – 390 million train trips, retail spending in excess of $140bn plus the classic red envelope has moved digital with $46b being sent on WeChat in just 6-days!!

Our view at the start of 2018 remains intact and will remain the basis for our investment decisions until further notice:

1. Stocks would have a” warning style” correction for a short-term buying opportunity in early 2018 – this has occurred and we bought it.

2. Many global indices will make fresh all-time highs between now and April before its time to get off the stock market express – see the S&P500 Monthly Chart.

So far, the Dow has already recovered over 1800-points / 55% of its recent aggressive plunge and we now believe that global markets are in the final phase of this 10-year bull run - being too fussy when selling stock from here could prove costly, hence:

· At MM we have dusted off our “sellers hat” and plan to slowly start taking some profits within our 2 portfolios moving forward.

I reiterate we are happy to slowly increase our cash positions prior to ideal targets just in case we are wrong, remember we believe the next ~20% move for stocks is down.

Today’s report will be in 2 halves:

A. I am going to quickly keep my finger on the pulse of the 2 most important markets for 2018 in our opinion.

B. Go back to basics and look at some of yesterday’s company reports which as usual has sent the volatility of individual stocks soaring e.g. Domino’s Pizza (DMP) -13.13% since it’s result,

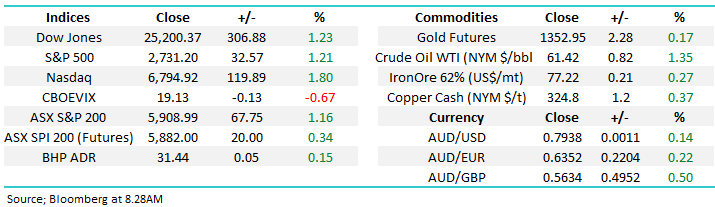

ASX200 Daily Chart

US S&P500 Monthly Chart

1 The $US Dollar

We have been discussing the $US at length since late 2017 but its inverse correlation to stocks is ‘as good as it gets’ and hence should not be ignored. We are targeting one final low, probably under 88, around 1% lower, for the $US Index before we are looking for a major trend reversal in the US currency.

We will be increasing the overall MM cash position and will likely hold this in US Dollars when this move unfolds.

$US Index Daily Chart

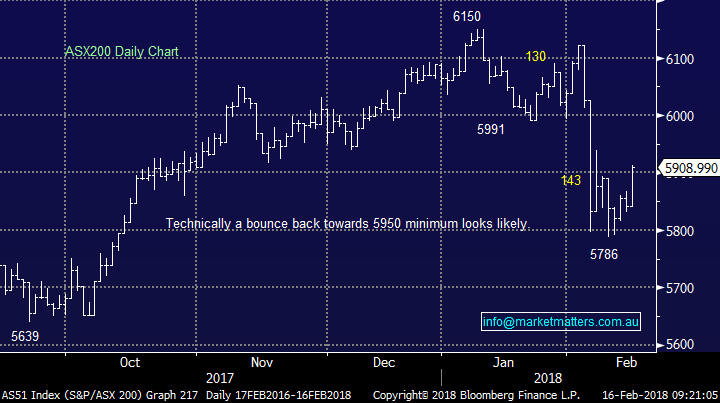

2 Bond yields

As most of us are very aware global bond yields are rallying, albeit from a very low base - 2 interesting points that many readers may not be aware:

1. US 10-year bond yields are almost higher than our local equivalent for the first time in decades. We believe this will ultimately be negative for the $A and hence we like $US earners on a relative basis.

2. US bond yields are rallying above the yield of the S&P 500 as we have pointed out previously but this also implies an improving economic outlook. What is good news for stocks is although we have seen 5 rate hikes in the US the cost of capital has not gone up in the US for corporates because credit spreads have tightened assisted by Central Bank buying i.e. Arguably no tightening yet for the market.

US v Australian 10-year Bond Yields Weekly Chart

3 Reporting

It feels like we’ve had more misses than hits this reporting season to date, however I’ll get the data at the end of this week (haven’t had a chance). At the end of last week, we were about 50/50 for hits to misses however there was a very slight ‘upgrade’ skew to overall numbers. Yesterday was a big day in terms of reporting, and we didn’t get a chance to cover yesterday afternoon.

Suncorp (SUN) $13.00 / -2.40%; Half year results out yesterday and the numbers were weak with the market expecting $486m profit for the half versus the $452m they delivered. The main factor for the miss was the massive hail storms in Victoria just a couple of days before they ruled off their books for the half. The stock opened down sharply yesterday – around 4.5% but recovered to be down ~2.5% at the close in a strong market. The CEO talked a very big game going forward + provided a number of specific target points which probably helped to pick the stock up off the mat. Commentary this morning has been upbeat – upgrades from Credit Suisse to outperform and Morgan’s to add – which both equate to buys. We hold across both portfolios – it’s our largest position so clearly we’ll be tracking these developments closely. We remain bullish with initial target of ~$15.

Suncorp (SUN) Daily Chart

Telstra (TLS) $3.45 /+0.58%; the result was inline yesterday at $1.7bn and 11cps dividend in aggregate – made up on a 7.5cps normal dividend and a 3.5cps special which relates to the NBN payments. Top line revenue was ok – up 5.9% to $14.51 billion which was ahead of some estimates, but their earnings were down due a well flagged impairment coming from the Ooyala. Before impairments, earnings were $1.976 billion which was on the positive side. Although it’s hard to get excited about the TLS result, it was okay and we’re comfortable holding the stock leading into the dividend on the 28th Feb.

Broker moves for TLS yesterday

Telstra Corp. (TLS) Daily Chart

Newcrest Mining $23.05 / 3.36%; Was a miss yesterday however the strength in the Gold price was enough to offset and see the share price rally. We think it’s about a ~3% miss on the underlying profit line + the full year result now relies on a very strong second half – which they normally do given that’s generally how Cadia operates – but still, the result felt a bit light on and comparing it to Evolution which was good, I think we’ll more than likely give NCM a wide birth from here, focusing more in the mid cap space for our gold exposure, albeit we don’t expect to be there in the coming months given our view on the $US.

Newcrest Mining (NCM) Daily Chart

Evolution $2.85 / +2.15%; A good / inline result for EVN yesterday but it was impressive because expectations were high. As Peter O’Connor suggested yesterday, it highlighted the robustness of group cash flow and the pace of deleveraging.

Evolution Mining (EVN) Daily Chart

South 32 (S32) $3.50 / -5.41%; The result was a miss, cost pressures the main issue within the BHP spin off, capital management was good however not enough + and it does nothing to improve the underlying operational result. That said, these guys have done a good job in many areas and the share price rally has factored that in – simply a case where the price has gotten ahead of itself.

South 32 (S32) Daily Chart

Conclusion (s)

No major change, at this stage we are comfortable with our short-term bullish call targeting new all-time highs from a number of global indices in the next few months, encouragingly a number of local stocks have at this stage turned nicely bullish.

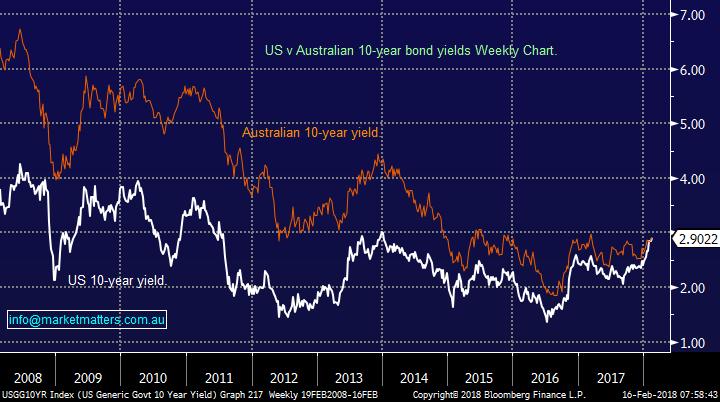

Overnight Market Matters Wrap

· US investors continued to push aside any inflationary concerns and implications for higher interest rates and focussed instead on the underlying strong earnings trend overnight, with the both the Dow and broader S&P 500 up over 1.2%. Bonds steadied, while the VIX rose slightly to below 20.

· And as we head into the Chinese New Year (Year of the Dog), commodities consolidated this week’s gains, with zinc and nickel in particular hovering around multi-year highs.

· Corporate earnings today are Medibank (MPL), Whitehaven Coal (WHC), IOOF Holdings (IFL), Super Retail (SUL) and Primary Health Care (PRY).

· The March SPI Futures indicating the ASX 200 to open 17 points higher this morning towards the 5925 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/02/2018. 8.24AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here