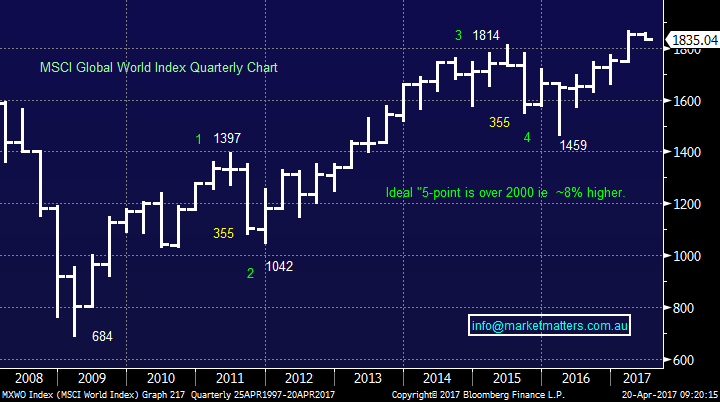

The waters are slowly clearing in certain sectors

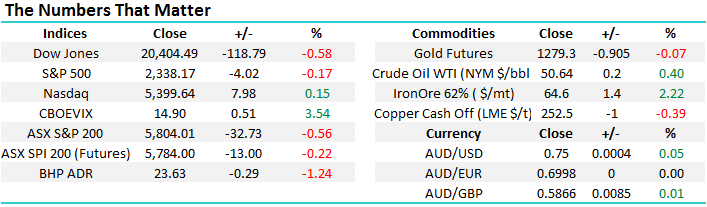

Yesterday we saw further weakness for the ASX200 but importantly we feel a few stocks / sectors are slowly showing their hand and today we are going to outline where we perceive this clarity is emerging within the local market. The local index has now corrected 160-points (2.7%) in under 2 weeks and our "GUT Feel" is the market will at least consolidate around the psychological 5800 area for a few days. No significant direction has materialised overnight with the S&P500 falling 0.17% as the US enters its choppy earnings season - IBM disappointed helping drag the Dow down 118-points while the NASDAQ climbed 0.15% as tech. companies continued to outperform. Notable weakness is likely today in the energy and gold sectors which fell 1.5% and 3.6% respectively in the US overnight.

Overall the local market looks vulnerable to continued weakness with simple monthly ranges targeting ~5725 this month, or 1.4% lower. Assuming that 5800 eventually gives way for the ASX200 the standout areas of support are the 5700 and 5600 areas, which would equate to 4.2% and 5.9% corrections from this month's high. Considering the makeup of the ASX200 this weakness is likely to be driven by the banks over coming weeks, a sector which remains up almost 2% over the last month.

We recently read in a blog that the average stock market investment duration has fallen from 7-years to 1-year which as active investors we believe makes sense. Our strong view at MM is the stocks are in the final throws of a major bull market which commenced back in March 2009 which implies indices / sectors and stocks alike are likely to be choppy and volatile until equity markets finally do top out - I feel readers would agree this is how the market currently feels. Lets quickly glance at some different stock / sector performances of recent times to illustrate why we believe investors need to be more flexible and open-minded than in recent years, at MM we are not traders but investors who recognise the market is evolving:

1-month

Winners - Brambles +11.3%, CYB +10.6%, Seek +11%, Origin +11%, Ramsay (RHC) +6.6%, Evolution Mining +9.6%, Westfield +6% and Transurban +7% - the market bought back into the "yield play".

Losers - Macquarie -2.2%, QBE -4.2%, Fortescue -21.8%, Bluescope (BSL) -12.3%, Vocus -18% and Telstra -11.4% - the market smacked Resources and Telco's.

1-year

Winners - ANZ +30.4%, NAB +19.5%, Aristocrat +85.7%, Macquarie +30.8%, Woodside +23.9%, Woolworths +19%, Ansell +17.5%, QBE +10.3%, Fortescue +51.4%, Bluescope +65% and Evolution +36% - the market bought Banks and Resources.

Losers - Brambles -18.7%, Star Entertainment -3.1%, Flight Centre -21.9%, Henderson Group -18.3%, Healthscope -18.8%, Westfield -11.1% and TPG Telecom -44.9% - the market sold stocks that missed earnings and of course the Telco's.

One standout is that over the two timeframes a number of stocks jumped the fence from winners to losers and vice versa - it should eventually be the Telco's time.

NB From both our MM portfolio and previous positions you can see that we often hold stocks for well over a year but conversely we also are happy to tweak holdings quarter to quarter when opportunities present themselves.

ASX200 Daily Chart

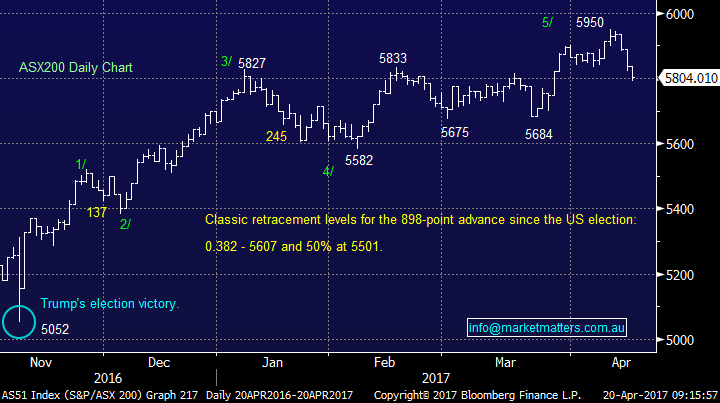

Last night the Dow made fresh lows since mid-February having extended its correction to 790-points (3.7%). While the judge remains out on whether this retracement has further to unfold we would not be surprised to at least see a strong countertrend bounce from current levels as the retracement matches that from August 2016.

To rally strongly from current levels US stocks simply need reaffirmation from the new Trump administration that the important corporate tax cuts plus bank reforms will be forthcoming, in line with his election promises. As we know the new President has recently been very busy with Syria and now North Korea but logic would say that once this calms down he will be keen to regain some popularity and what better way to achieve this goal than to cut taxes!! We believe Donald Trump will eventually give stocks the "shot in the arm" they are waiting for leading to a solid blow-off top for stocks.

US Dow Daily Chart

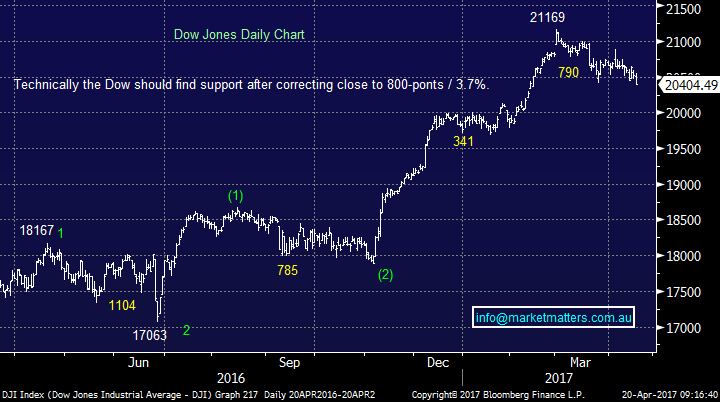

At least once a fortnight we like to remind subscribers of our medium to long term outlook for equities, just in case we all get caught up in the day to day noise which markets generate. Today we have focused on the MSCI Global World Equity Index which comprises of the developed world's equity indices. Firstly let's look at the technical picture, which to-date has followed our forecasted path of the last 2-years - fingers crossed it doesn't deviate now!

1. Since the GFC the index has experienced two precise 355-point corrections, a great example of why we look at "Symmetry Waves" to identify buy areas during market corrections - if anyone is unsure on this concept please let us know and we can cover in Mondays report.

2. We believe the global equity index is in the final phase of its mature bull market, which commenced in 2009.

3. Ideally our target for this final phase is around the 2000 area.

4. The final phase of a bull market is often choppy and definitely not one way traffic as the market slowly looks for a meaningful top - feels familiar!

5. Once the advance from its 2009 lows is complete we are targeting a ~25% pullback to under 1500.

Hence the important conclusion is while we remain bullish in the short / medium term looking for ~8% further upside the next major move on our radar is a significant decline.

MSCI Global World Index Quarterly Chart

Below is a quick snapshot of our updated views of 5 market sectors / dominant stocks moving forward.

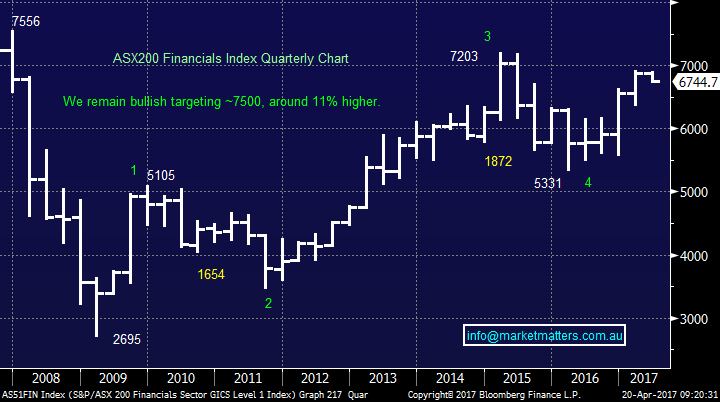

1. Financial Sector

We remain very bullish the financial sector targeting further gains in excess of 10% - this is one of the clearest set-ups on a technical level. Hence our overweight position in the MM portfolio to banks and financials.

ASX200 Financial Sector Quarterly Chart

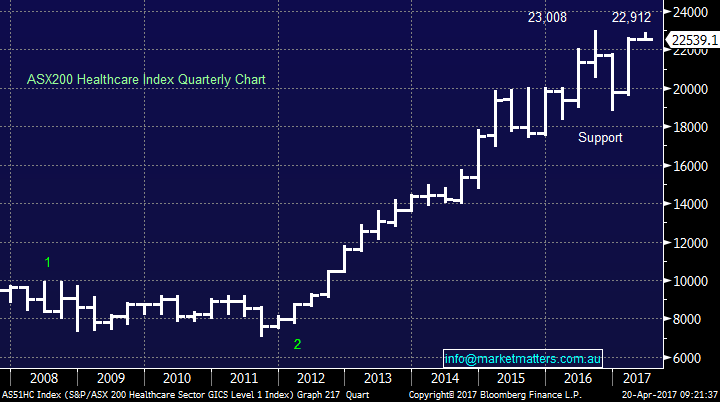

2. Healthcare Sector

We see limited upside in the Healthcare Sector from current levels hence our recent sale of Ramsay Healthcare (RHC) - we are monitoring our positions in PRY and ANN very carefully.

ASX200 Healthcare Sector Quarterly Chart

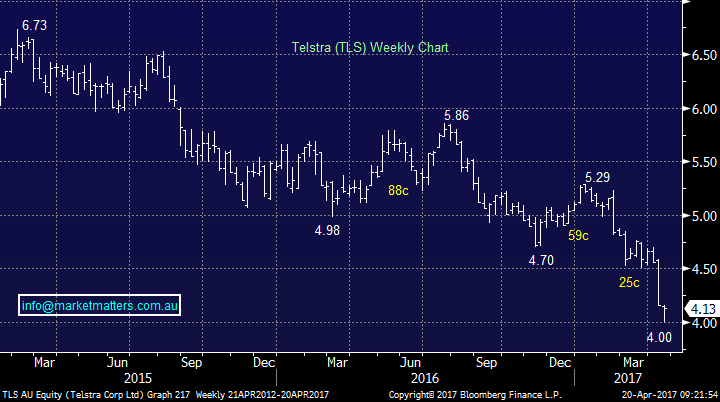

3. The Telco Sector

Yesterday the Telco Sector finally bounced strongly, gaining 6.9% but obviously not making a significant dent in its 43% decline for the year. We now see TLS range trading between $4 and $4.25 over coming weeks. Hence our likely strategy moving forward:

1. Scratch our position ~$4.25.

2. Buy / average on any spike under $4.

Telstra (TLS) Weekly Chart

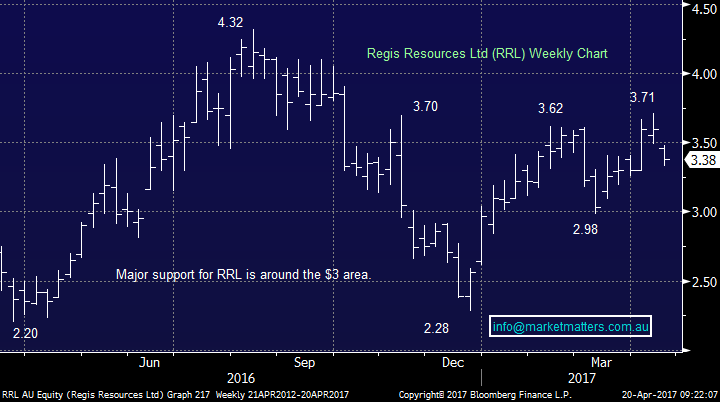

4. The Gold Sector

We now think gold has shown its hand and a reasonable correction is likely to unfold over coming weeks to provide an excellent buying opportunity. Hence we have refined our likely actions from yesterday's report:

(a) While we now feel we have bought NCM too early this week, as we are keen on the sector moving forward we will hold it and look to average as previously planned ~$21.

(b) Yesterday RRL closed ~ 8% below where we exited our last position. We are keen buyers ~$3 - note RRL can be more volatile than NCM.

Regis Resources (RRL) Weekly Chart

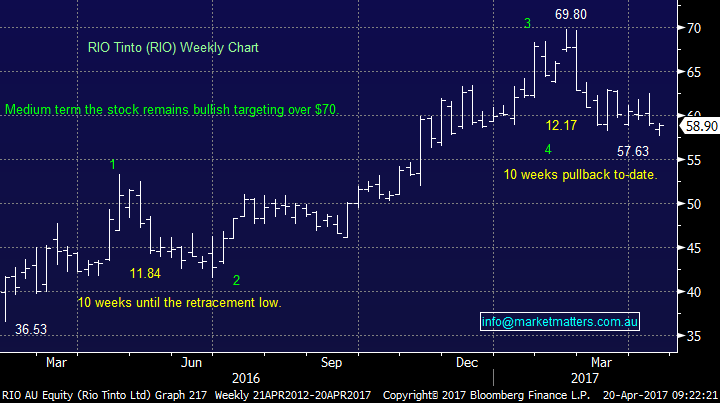

5. The Iron Ore Sector

We remain keen the reflation trade and believe current weakness in the mining sector is a buying opportunity. When we look at RIO it has corrected to an ideal buy zone from both a "Symmetry Wave" and a timeframe perspective (10-weeks).

We will look to top up our RIO holding if the opportunity arises under $58.

RIO Tinto (RIO) Weekly Chart

Conclusion

No change: We remain bullish stocks in 2017/8 with the ASX200 targeting well over the psychological 6000 area before we prefer cash / more defensive positioning or sitting on the sidelines.

We believe it's time to slowly re-establish the reflation trade by selling healthcare / utilities and buying cyclical stocks like banks / resources.

Overnight Market Matters Wrap

·The earning season continues to dictate the daily movements in the US, with yesterday’s being mostly a disappointment. However so far in the US, we have seen 75% of companies beating earnings estimates.

·In the commodities side, crude oil declined as US gasoline supplies rose against analysts’ predictions for a fall of 2m barrels, while Iron ore bounced, up 2.2%

·The June SPI Futures is indicating the ASX 200 to open with little change, above the 5800 level, with volatility expected this morning as it is April Index Expiry.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/04/2017. 8.50AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here