The US is on a different planet to us! (BEN)

The local market struggled yesterday led by the banks, and especially Bendigo (BEN) which fell almost 5% as it flagged zero loan growth with the CEO trying to push most of the blame towards APRA. In Australia the brakes have been firmly applied to investor and interest only loans leading to tougher competition, hence reduced margins for the likes of the lower risk owner occupied loans as banks fight for fewer loans. Recently many stocks have recovered following “knee jerk” sell-offs as cash rich local investors look for bargains amongst any carnage, of course there have been exceptions like Telstra (TLS).

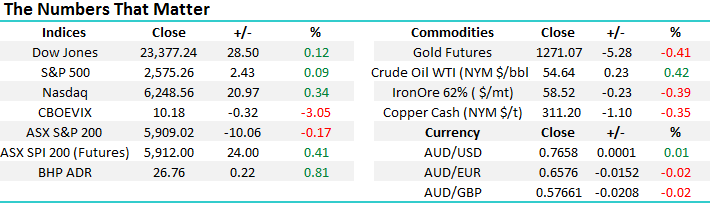

However in the case of BEN we are not keen to buy the short-term weakness seeing some larger issue for the bank to address moving forward. The current 5.98% fully franked yield is not attractive when compared to say NAB’s 6.06% fully franked, at this stage we will only have interest in BEN under $10, over 10% lower.

Bendigo & Adelaide Bank (BEN) Monthly Chart

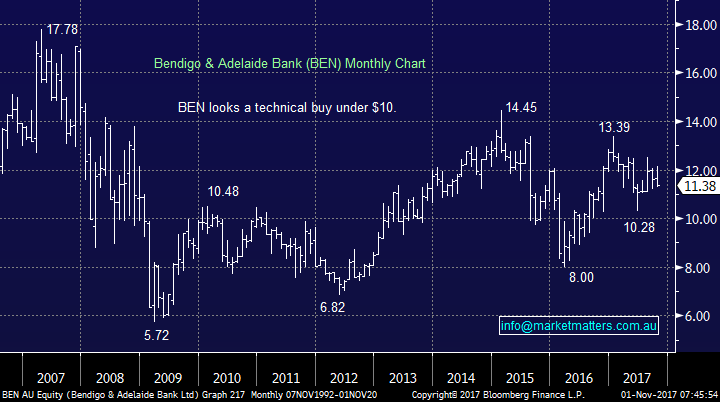

We have noticed a number of our rivals in the stock market research space now talking about an imminent correction / fall, we believe they are premature with 3 very important points not getting enough air-time:

1. Global equities remain in a bull market which is supported by current economic conditions, we believe these are likely to push markets through all the negative rhetoric well into 2018.

2. At MM we still believe the ASX200 will almost challenge / make fresh decade highs, well over 6000, before its time to “get off the train” – when we stand back and look at the bull market advance since early 2009 the 6500 area does not seem out of the question.

3. Both the timing and what stocks to buy when / if this correction materialises is not even warranting a mention – we remain very proud at MM with our timing to buy the 2016 lows, basically to the day!

ASX200 Monthly Chart

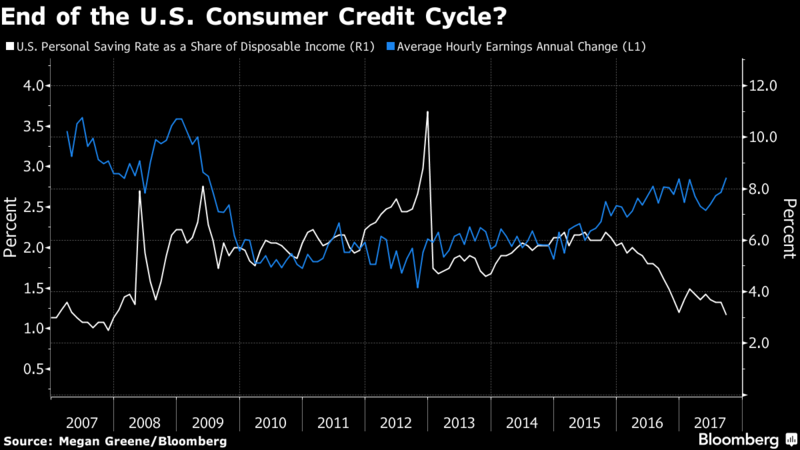

US Consumer Confidence soars

The confidence in the USA is now at almost 17-year highs with Americans growing increasingly confident about both their employment prospects and by definition the economy. Not surprisingly the correlation in the US between the stock market and Consumer Confidence is high although it’s easy to argue that stocks have got ahead of themselves over recent years but the combination of the lowest interest rates in history and rapidly improving corporate profits can be used to justify the numbers.

We have made no secret of our view that stocks will have a ~20% correction moving forward, now probably over 2018-9 but we want to see some fundamental negative triggers to threaten the increasing exuberance / optimism.

US Consumer Confidence Monthly Chart

US S&P500 Monthly Chart

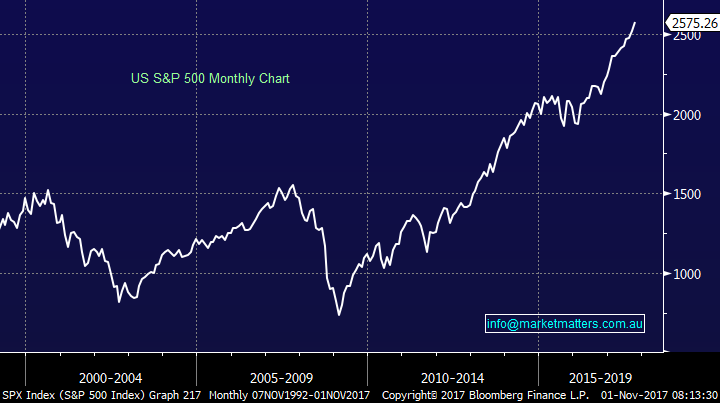

The optimism in the US is slowly but surely generating some warning signals that a correction is on the horizon, without even talking Bitcoin – although they are getting lots of air time which usually means the press is too early. I could have easily added a list of 5-10 charts at this stage to try and scare our subscribers but we are just trying to illustrate a pullback should not surprise but in our opinion it’s not yet time to run for the hills. We have selected just one chart which not only shows our view on the economic worries but importantly also the retail sector.

1 – Savings are running out in the US making an argument that spending must soon be about to turn lower as the credit cycle – spending drives the US economy.

The story is very similar in Australia and one the main reasons why we need to be very selective in any consumer facing stocks

Canada’s diminishing Confidence

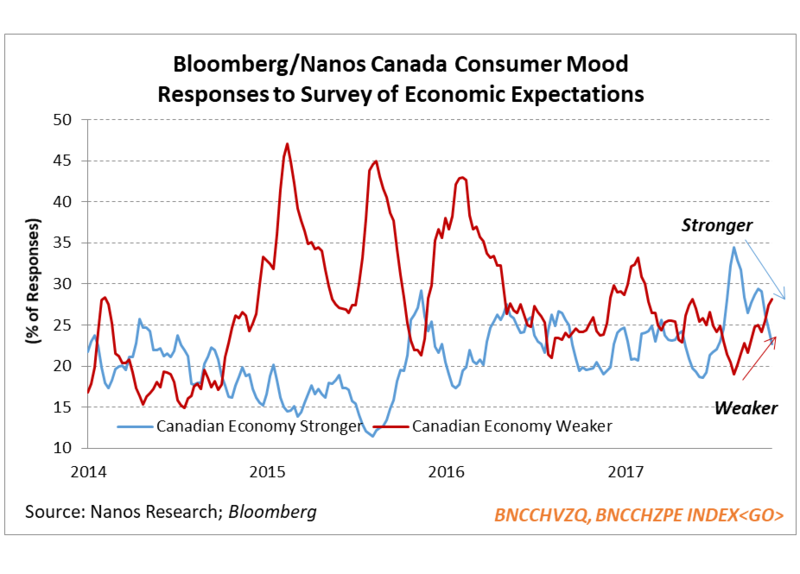

However all is not rosy around the world when it comes to consumer confidence and optimism, especially in Australia and the highly correlated Canada. Firstly let’s look at a few points for Canada:

- Consumer confidence fell in Canada in September and October with controls around housing lending doing the most damage – sounds like Australia.

- Two interest rate hikes in July obviously adds caution to the layman.

- Just like we are slowly experiencing locally Canadian investors / people in general are becoming cautious / bearish on property at the current elevated levels.

- We now have a situation with more people negative the Canadian economy than positive.

When we look at the Canadian consumer confidence over the last 4-years in a chart its obviously pretty volatile having had 3-4 false dawns of negativity but if property prices continue fall and interest rates rise we may see a more sustained period of pessimism and importantly “belt tightening”.

Bloomberg Canadian Consumer confidence

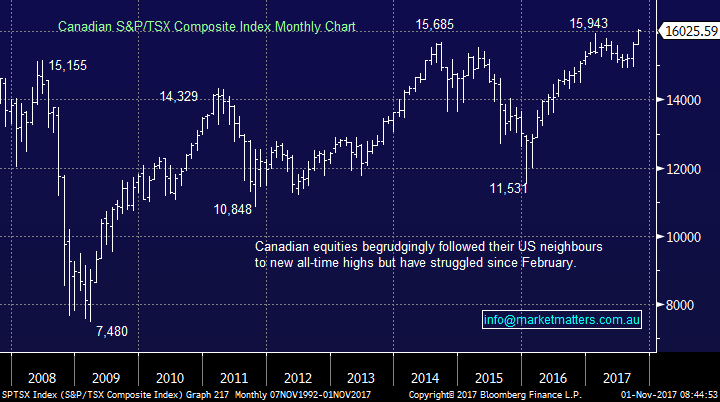

Hence after looking at the local consumer confidence it’s not surprising to see the significant underperformance by Canadian equities when compared to the US although they did make marginal fresh all-time highs last night – we are 16% away from that milestone!

Canadian S&P Composite Index Monthly Chart

Australia’s mixed Confidence

Australians finally felt more optimistic this month for the first time since last November using the Westpac consumer confidence numbers. Apparently the positive feelings around the global economy are likely to have offset persistent worries around rising interest rates and a cooling property market. Conversely business confidence measured by NAB is at its highest level in a decade! We believe the difference between business and individual confidence makes total sense and is likely to have further to unfold, probably until we hit a pothole for business. Our take outs:

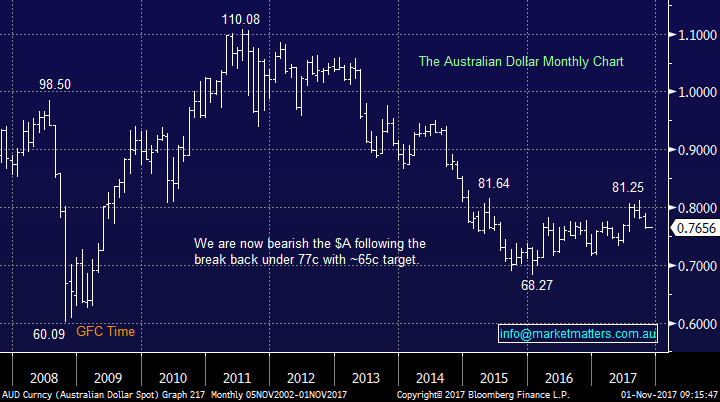

- We believe one month improvement in our consumer confidence may become a temporary blip on the radar as interest rates look set to rise globally.

- Australian stocks with offshore earnings remain well positioned, especially as the $A looks very weak.

- Be very selective or avoid the Australian consumer and interest rate sensitive stocks

The Australian Dollar Monthly Chart

Conclusion (s)

- Australian stocks with offshore earnings remain well positioned, especially as the $A looks very weak.

- Be very selective or avoid the Australian consumer and interest rate sensitive stocks

- We still believe the ASX200 will trade well over 6000 in 2017/8.

- If / when we get a ~5% correction in global equites remember the above 3 points with your decision making.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/11/2017. 9.30AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here