The “Trump Bump” accelerates

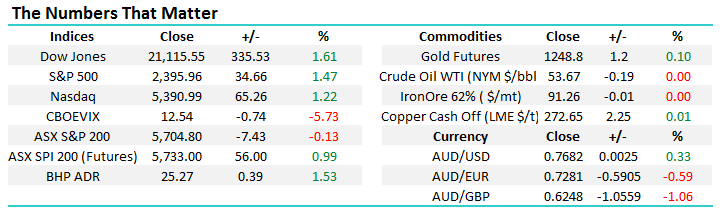

Yesterday's speech by Donald Trump appeared to lack detail while being big on rhetoric, in other words exactly what most commentators thought the market would hate, yet the Dow is up over 300-points as we start typing this report. Listening to his inaugural address to congress sounded like a simple extension of his campaign speeches, although he definitely did appear significantly more statesman like than in the past. In the Weekend Report we revised higher our ideal target for US stocks and this is already feeling on the money, investors should not underestimate how far this final phase of the bull market which began back in March 2009 can extend - another 10% higher for US stocks would not surprise. Again putting things into perspective, the broad US market has now advanced 260% since March 2009, we continue to target the rally to continue for another 8-10% before correcting over 25%, definitely not outlandish swings considering the last 8-years.

Today we will again look at the overall market themes which continue to evolve in an extremely exciting manner. Let's look at last night's rally of 1.5% in the US market on a sector level because we believe it will give some excellent insights into where investors should have exposure over the next 6-months:

- The Financial sector was the best performer gaining 3%. We remain happy with our large exposure to this sector via ANZ, CBA, HGG, PTM, MQG, QBE and SUN.

- Resources bounced ~2% - BHP is set to open up around 44c, the stock will still be over $2.50 / 9.4% below its January high. We remain buyers in the $24 area and will not be chasing BHP, FMG or RIO into strength at this stage.

- Healthcare was +1% - Again we remain happy with our exposure to ANN, CSL and RHC but do expect the financials to outperform. Our target for the US healthcare space is only 5-6% higher, or 1/2 of what we believe the broad market can achieve.

- Real Estate and Utilities (the "yield play") were marginally lower - we continue to have no interest in stocks which will be adversely affected by rising global interest rates.

US Dow Jones Daily Chart

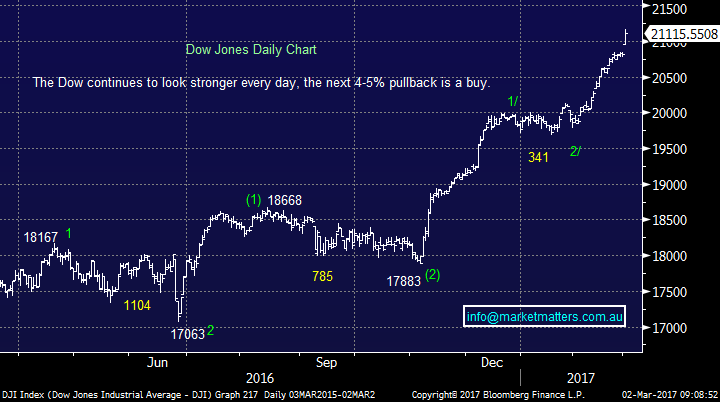

Last night US bonds were sold off aggressively clearly assisted by Trump's $1trilion rebuilding America plan. Anything that stimulates the already firm American economy is likely to send interest rates higher and subsequently bonds lower. The global bond market dwarfs its equivalent stock market and hence any movement of monies from bonds to equities is very bullish for stocks short-term, we believe a degree of this is unravelling at present. We continue to target 3% minimum for the US 10-year bond yield which is importantly over 20% higher than where they are today on a pure yield basis.

When we consider this move in interest rates we revert to a saying by the often touted world's greatest investor: “Diversification is protection against ignorance. It makes little sense if you know what you are doing.” - Warren Buffett.

We are strong believers at MM that classic portfolio theory is for those who have non informed and thought out opinions on the market. In this particular case we continue to have no interest in our "yield play" stocks until further notice. Their performance over the last year, when the ASX200 has rallied 13.6%, strongly supports this view e.g. Westfield (WFD)-13.5%, Transurban (TCL) -1.2% and Sydney Airports (SYD)-4.4%. They bounced last month as growth came under pressure however as we suggested in Tuesday afternoons report, the trends of February were likely to be short term, a counter trend move and nothing more.

US 10-year bond yield Monthly Chart

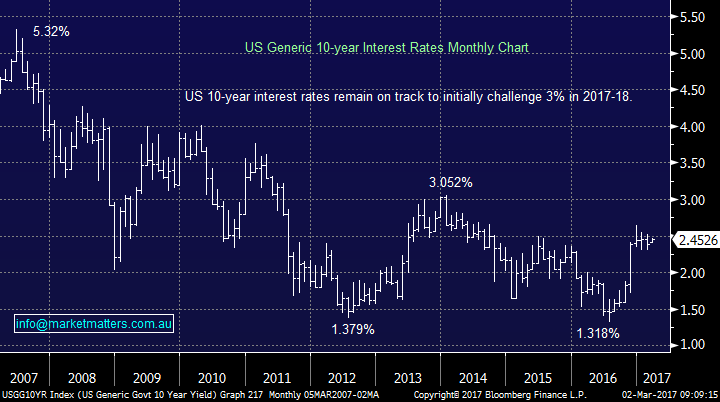

When we cast our eyes to the local share market, using the SPI futures, for reasons explained recently it remains simply bullish while the market is over 5650. Technical analysts amongst our subscribers will smile when they see that as Donald Trump spoke our market quickly sold off 30-points as traders assessed his lack of detail and tried to second guess the reaction from US stocks but the SPI held its 50% support perfectly touching 5654 before bouncing almost 30-points - we strongly believe Technical Analysis should be part of any investors arsenal - we believe this is a big value add from MM. Let’s consider March moving forward on both a statistical and seasonal basis:

- Assuming that yesterday’s low in the ASX200 of 5675 is the low for March recent ranges target a break up to 5900 this month.

- Assuming that yesterday’s low in the ASX200 of 5675 is the low for the week recent ranges targets 5780 this week, about 30-points over where we are set to open this morning at 5750.

- Seasonally the ASX200 usually rallies from January, consolidates in March before a very strong April. This is still unfolding but March does feel a touch stronger than just consolidating at present.

- Banks are usually stronger than resources from January until the end of April, this is unfolding as expected.

ASX200 March Share Price Index 60-mins Chart

Conclusion

We remain bullish stocks until at least late April when a 4-5% pullback may unfold as is a seasonal habit. Hence,

- Stay long stocks until further notice with financials our preferred sector.

- Look to buy resources at marginally lower levels.

Overnight Market Matters Wrap

- The US markets resumed its rally, with the major indices accelerating over 1.1% overnight post President Trump’s speech.

- The Financials continued to benefit the most with Trump’s tenure overnight, with Real Estate and Utilities being the laggard.

- A strong open towards the 5,750 level is expected this morning in the ASX 200 as indicated by the March SPI Futures.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 02/03/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here