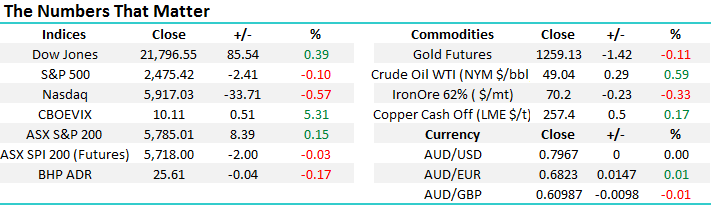

The strong $A is starting to cause a few blushes.

The recent rally in the ASX200 seemed to run out of puff yesterday with the market finally managing a small gain for the session as it shied away from the psychological 5800 area. There were limited standouts from an overall quiet session but MM was pleased to see ongoing strength from Harvey Norman (HVN) which was added to the income portfolio earlier this week.

Interestingly overnight Amazon shares fell almost 4% from its intra-day high following a disappointing profit result showing like all companies it’s not always perfect.

Our current view around the overall index is unchanged but the market needs to close back under 5750 to suggest thecurrent bounce is complete.

1. The ASX200 remains range bound between 5629-5655 support and 5836-5810 resistance.

2. Our preference is still for a further correction back towards 5500 in August / September and the more begrudging the pullback the keener MM will become to buy the retracement.

ASX200 Daily Chart

US Stocks

Last night the broad US market reversed early strong gains led by the tech NASDAQ which closed down 0.57% after reaching 5996, just shy of our 6000-target area. We are now short term bearish US stocks after being bullish all year – we are targeting a 7% correction for the NASDAQ. Traders in the US last night appeared to be agree with us as they pushed up the “Fear Index (VIX)” over 5% as downside protection quickly came into vogue.

Importantly for local investors when the NASDAQ corrected sharply over 5% in June / July the ASX200 basically ignored the move. The broad S&P500 will need to correct before we are likely to take notice, MM is looking for a slightly smaller5% correction here.

US NASDAQ Weekly Chart

European Stocks

No change, Europe has recently been tricky with the German DAX now approaching strong support in the 12,000-areafollowing a 6.2% correction while the UK FTSE looks vulnerable to further declines, especially as investors understandably get increasing concerned around BREXIT.

German DAX Weekly Chart

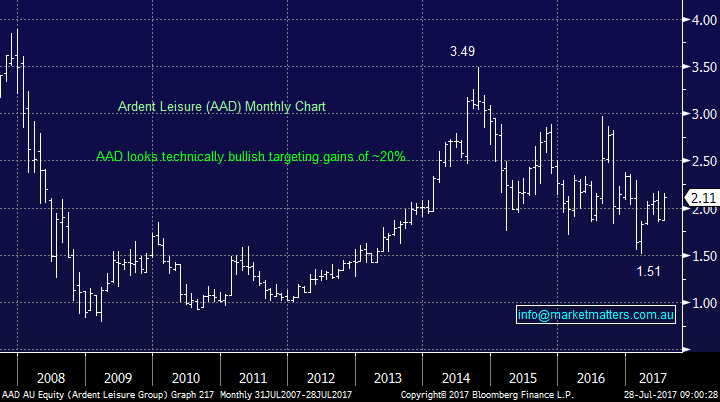

Most market analysts and pundits alike have been bearish the $A for many months but suddenly it’s poked its head backover 80c this week, the highest level since May 2015. Fortunately, although we felt the $A looked heavy and was potentially headed for a test of the 65c area our strongest conviction view at the start of 2017 was the $US would fall at least 10%, hence we have avoided following many investors who have flocked into the $US earners during the year – the $US is down 9% so far in 2017.

With the $US close to our target we feel it’s now crunch time for the $A but while it’s an extremely interesting time we are now 50-50 just here. Hence following the large $A rally in 2017 we thought today was an opportune time to look for $US earners that may have been oversold.

If the $A closes back under 77c we will become bearish $A targeting ~65c and will be looking for the $US earners to again enjoy a period of outperformance.

Australian Dollar ($A) Monthly Chart

This morning we scanned the $A - $US exposed stocks for any opportunities and 3 stocks jumped out at us for different reasons.

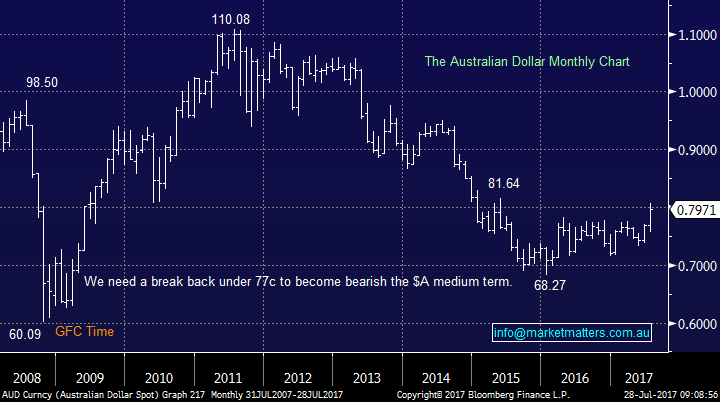

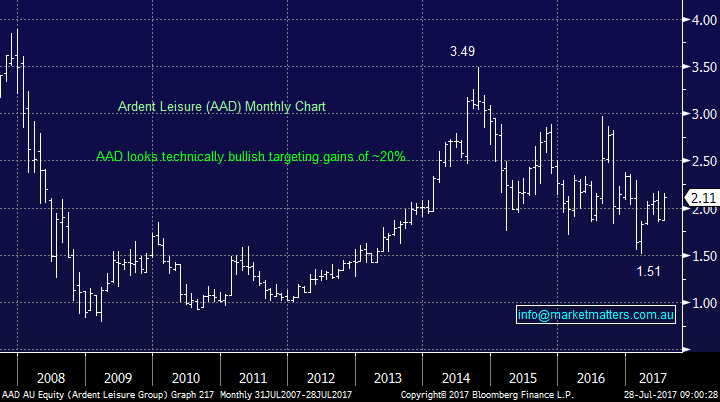

1 Ardent Leisure (AAD) $2.11

AAD has had an awful few years with the Dreamworld disaster clearly attracting significant negative publicity. The company has undergone significant management changes which the market seems to have approved. However, what is often overlooked is its US main event business which makes up ~60% of the company’s total profit.

Technically the stock looks excellent targeting gains of ~20% which would be greatly assisted if the $A fell back from the 80c area.

Ardent Leisure (AAD) Monthly Chart

2 Aristocrat Leisure (ALL) $20.27

ALL is an Australian gaming machine manufacturer who generates over 60% of its revenue from the US hence a pullback in the $A from ~80c would greatly assist their profits. The company is performing excellently, including a great result in March, which has seen a strong run in the share price but recently it has corrected back over 15% with the weak $US obviously not helping.

We like ALL after its correction in the $20 area, initially targeting ~$25.

Aristocrat Leisure (ALL) Weekly Chart

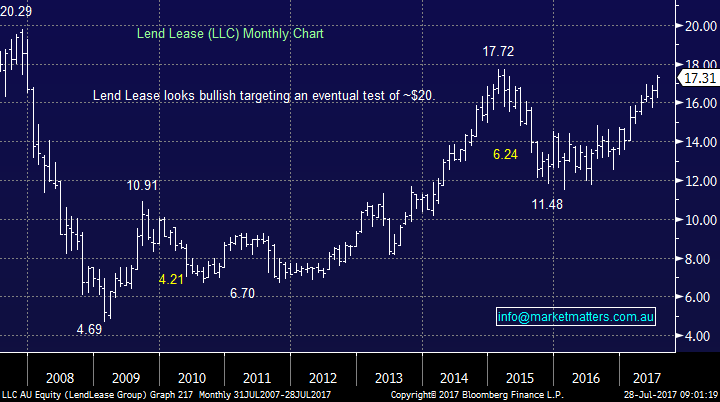

3 Lend Lease Group (LLC) $17.31

LLC has caught our eye because it has ignored the weak $US even though it generates ~25% of its revenue from the US. A stock that ignores bad news is a strong stock. We are bullish LLC targeting a retest of the significant $20 area but the risk / reward is average at current levels. The stock pays a dividend of ~33c in August but it’s not franked.

We are buyers of LLC on a correction back towards the $16 area.

Lend Lease (LLC) Monthly Chart

Conclusion (s)

With the MM portfolio sitting on 23.5% cash while we are on the hunt for buying opportunities our clear bearish bias over August / September will keep us “fussy”. With the strong advance in the $A the following 3 stocks have crossed our radar:

1. We like Ardent Leisure (AAD) around $2.10 – looks to be the higher risk of the 3.

2. We like Aristocrat Leisure (ALL) in the current $20 region.

3 Wee like Lend Lease (LLC) on a correction back towards $16.

**Watch for alerts**

Overnight Market Matters Wrap

The US share markets closed mixed overnight, with the Dow the only on in positive territory, ending in record highs.

Amazon reported a 77% fall in quarterly profit and initially fell sharply in after-hours trading, while bears are focusing on the consequences of the Fed reducing its balance sheet and the very low levels of volatility. As such, the VIX spiked intra-day nearly 20% as a sign that investors are getting twitchy.

The June SPI Futures is indicating the ASX 200 to open 8 points lower, towards the 5775 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/07/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here