The RBA gives clear signals

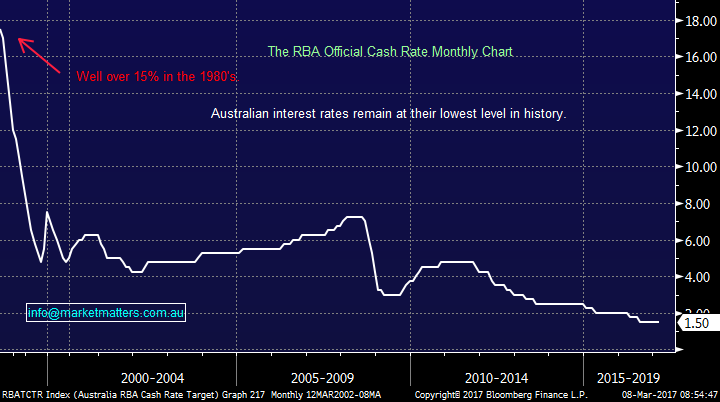

Yesterday the RBA yet again left local interest rates unchanged at 1.5%, their lowest level in history. The rhetoric from the accompanying RBA statement was clear to us, the interest rate cycle domestically has bottomed and the next change to interest rates in Australia will be an increase. The markets are finally agreeing with our view which we have held for well over 6 months and they are pricing in a 60% probability of a hike during the next 12-months. The main 2 components of their statement that reinforced our prognosis were:

- "Taking account of the available information the Board judged that holding the stance of policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time." - The RBA.

- "having easing monetary policy in 2016." - This was removed by the RBA statement

For the record while November will be many pundits guess for the hike we are inclined to lean towards early 2018. The Australian Financial Review recently ran a story that 1 million Australians would default on their home loans if interest rates went up by 3%. What is a little unsettling is the following graph which shows this is simply interest rates going back to where they were in 2010. Of course the AFR are simply trying to sell newspapers and bad news is the best recipe to meet this end. We do believe that interest rates will eventually rise to the 4% area which is just a blip over the last 30-years but the RBA will be extremely mindful of the impact this might have on property prices. The Australian economy remains extremely vulnerable to a fall in property prices hence politicians and policy makers alike will do all in their power to cushion any impact of rising interest rates on property values. We do think this is clearly not the time to be leveraging to local property but a "crash" feels highly unlikely at present.

NB We will write a report on "bubbles' in the near future and we believe global bond markets have been in one of the greatest in history. I often wonder about how generations of the future will judge our period of negative interest rates – it seems nuts even now!

RBA Cash Rate Monthly Chart

The market reaction to the RBA statement was exactly what we would expect and importantly are positioned for:

- The banking sector, whose margins increase as interest rates rise, were strong with Westpac hitting fresh 18-month highs.

- Interest rate sensitive stocks were generally weak e.g. Westfield fell 1.5% and Sydney Airports closed back under $6.

- The $A jumped half a cent although it has failed to hold these gains as the $US was slightly stronger overnight.

In addition gold also fell ~US10/oz last night as higher interest rates in the US plus a stronger $US is an obvious headwind for precious metals. We still plan to accumulate gold stocks into weakness but there is no hurry to add to our small exposure in EVN at this stage.

No change to our current view and positioning - remain overweight banks / financials and avoid interest rate sensitive stocks for now

The local market is trading as we expect on a sector basis and this creates an upside bias for the overall index with the banks / financials the dominant sector. As we have outlined a few times the local market usually advances into late April prior to correcting in May / June. April is often the best month for the local market, a statistic which would surprise many who might understandably assume it was December with its famous "Santa Rally".

The banks simply love this time of the year and with the tailwind of rising interest rates this statistic may be exaggerated this year. With big dividends being paid in the last few days of March / April from the likes of CBA, Telstra and Wesfarmers it's easy to see where some of the support for stocks comes from. Hence the combination of the RBA comments and the Fed likely to raise interest rates next week leaves us comfortably overweight our financials via ANZ, CBA, HGG, MQG, PTM, QBE and SUN still with a view to lightening our exposure around the end of April.

ASX200 Monthly Chart

Lastly, revisiting the resources sector which we have on high alert with a view to purchasing into this current weakness. Last night copper fell 1.4% to its lowest level in 7 weeks, technically we can see a spike down of around 3.75% which may coincide with a low in our resources sector. This is classic stalking an investment which hopefully pays dividends.

We are still targeting RIO under $59, BHP around $24.25 and FMG under $6.

Copper Monthly Chart

Conclusion

We have 2 clear and important conclusions that are likely to lead to some activity in the MM portfolio next month:

- Remain long / overweight financials until the end of April.

- Remain very patient with buying interest sensitive stocks.

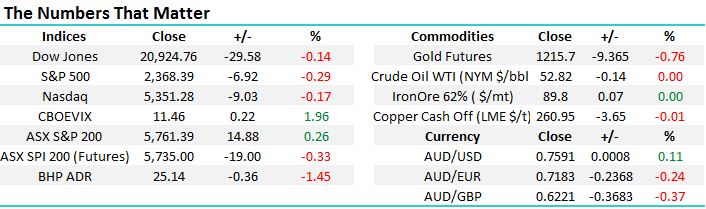

Overnight Market Matters Wrap

- Another mild drag to the downside was witnessed overnight in the US share markets, with the Dow off 0.14% and the broader S&P 500 down 0.29%.

- The Energy sector remains to be the laggard where we expect BHP to underperform the broader market today, after ending it’s US session down an equivalent of -1.45% to $25.14 from Australia’s previous close.

- The March SPI Futures is indicating a weak open in the ASX 200 this morning, expecting to lose yesterday’s gains and hover near the 5,745 area.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/03/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here