The question and weekend news

We have had one question dominating from all directions over the last week - "what makes you believe a significant correction is looming" , we will address this is simple form today but first 2 important pieces of news caught our eye on the weekend.

1. Saudis support the deal by non-OPEC countries

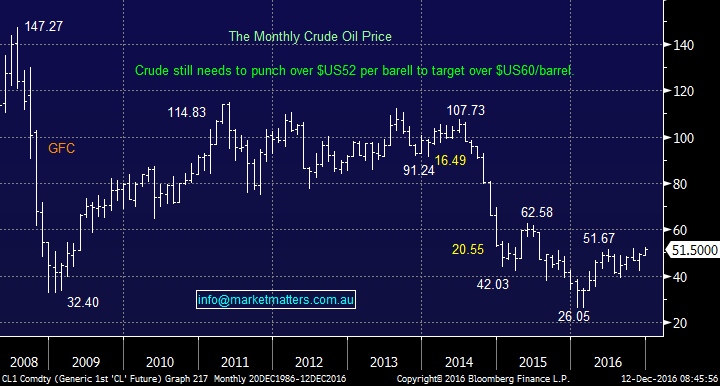

The news over the weekend that non-OPEC countries, including Russia, had agreed to output cuts to support the oil price is clearly bullish in itself. However, the follow up announcement from Saudi Arabia that they would cut more than promised at the recent OPEC meeting is a huge bullish surprise.

The weekend news should send crude oil into a fresh trading range between $US51/barrel and $US60/barrel. Conversely a failure to do so and weakness back under $US51/barrel we would interpret negatively i.e. markets should rally on good news!

Crude Oil Monthly Chart

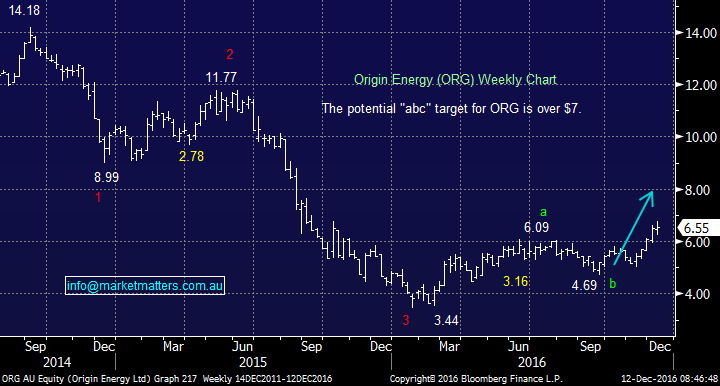

We hold Origin Energy (ORG) that should benefit from this news, we still intend to take profit around $7 but we will revaluate if the stock fails under $6.50 before challenging $7.

Origin Energy (ORG) Weekly Chart

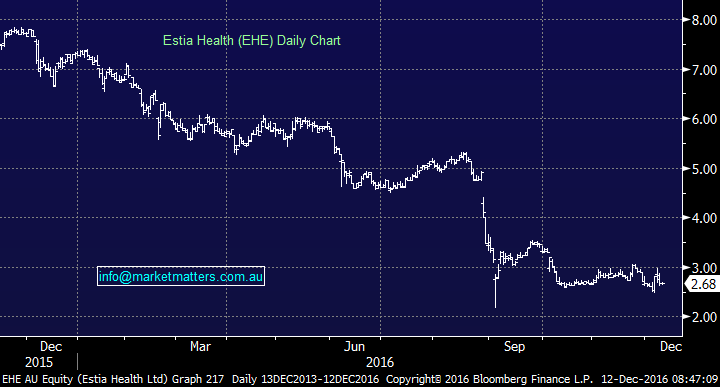

2. Macquarie in capital raising for Estia Health

The AFR reported on the weekend that Macquarie have been mandated to raise $137m for aged care provider Estia Health (EHE) - a substantial raise for a company with a market cap. of ~$524m. EHE have downgraded their earnings twice in recent months sending the shares crashing 65% below their high of 2015. However this capital raising should remove debt pressures and allow management to focus on growing the business organically moving forward.

For a few compounding reasons the EHE earnings for 2017 look set to fall under $90m but we believe all the current gloom and doom around the stock may provide an opportunity. Over the last few months we have stated that we would consider an investment in EHE if the stock challenged the $2 area and a capital raising, depending on its structure, may create this weakness.

Aged care is a sector we like for the years ahead due to our ageing population, we are buyers of EHE ~$2.

Estia Health (EHE) Daily Chart

Why a correction is looming?

We look at markets in a number of ways combining fundamentals, seasonality, statistics and technical analysis - we never understand somebody that does not use all the information at their fingertips!

Firstly, over the last 2 years we have regularly referred to the monthly US S&P500 chart illustrating the "5 Phases" that historically make up a bull market, we are now finally in the theoretical final Phase 5.

US S&P500 Monthly Chart

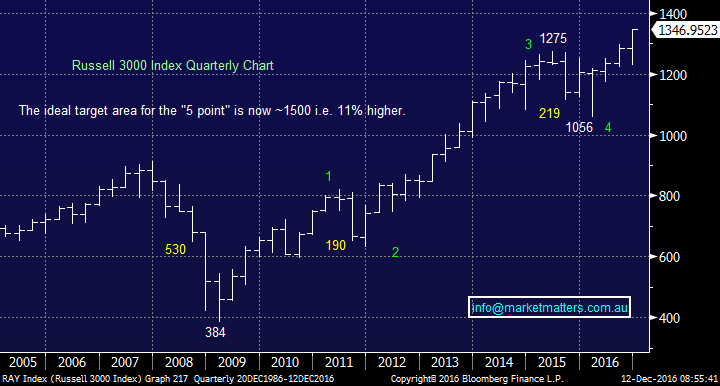

Secondly, we like the technical analysis method called Elliott Wave, when and only when, it's very clear. We believe too many people try and curve fit with technical analysis as opposed to utilising it when it adds the most value.

We have used the Russell 3000 as it's a broad index for the Elliott Wave count. This methodology has the market in the final 5th wave on the longer term basis, ideally targeting ~1500. After reaching a top the market should correct back towards 1050 i.e. around 22% and will be 30% if the Russell 3000 reaches the 1500 area.

This Elliott Wave count has been working perfectly for the last 2 years allowing us to aggressively buy stocks in both October 2014 and early 2016 when many investors ran away.

US Russell 3000 Quarterly Chart

Thirdly, we like a technical method called Symmetry Waves i.e. markets have a habit of retracing by similar amounts.

- The Russell on a Quarterly basis corrected 190 and 219 points respectively. We believe the next pullback will be similar to the 530 point GFC fall.

- As expected the pullbacks on the S&P500 are of similar magnitude i.e. 296 and 325-points respectively.

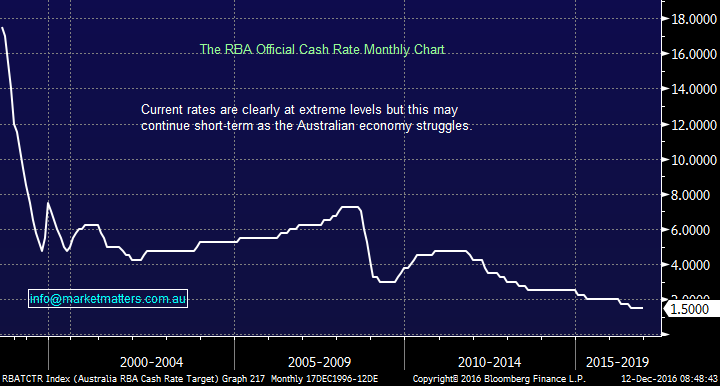

Fourthly, markets are trading on stretched valuations which are currently being sustained by historically low interest rates and optimism around economic growth in the years ahead. We remain committed to our view that interest rates have bottomed for this 30 year bear cycle - the RBA cash rate is 1.5% today but it was 18% back in 1990. Unfortunately we also know that economic growth has continually failed to live up to expectations since the GFC; will Donald Trump make the difference?

RBA Cash Rate Monthly Chart

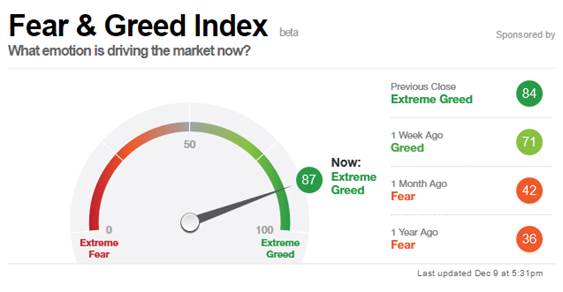

Lastly, the simple market psychology has finally turned positive after years of being negative. This has been the most unloved bull market in history but we need optimism for a major top and its definitely slowly manifesting itself. As we have mentioned at length in recent months the market was far too "cashed up" and negative for stocks to fall far and this has proven very accurate.

The short-term "Fear & Greed" Index is definitely in dangerous territory.

Hence we stick with our strong opinion that when this mature bull market runs out of puff we are in for a ~25% correction over 2-years - this will provide excellent and exciting opportunities for the informed!

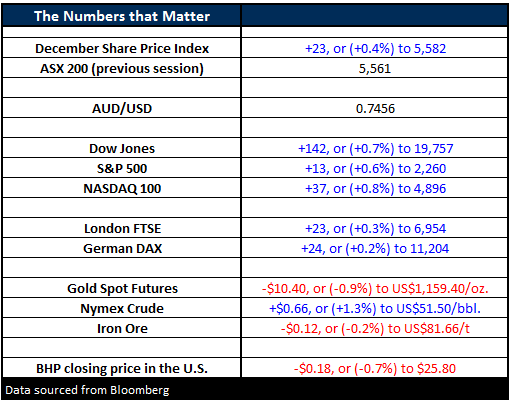

Overnight Market Matters Wrap

- The running of the bulls continued to flush out the bears last Friday, all in tune for the Santa Rally.

- The Dow closed 142 points higher (+0.7%) at 19,757, while the broader S&P 500 rallied 13 points (+0.6%) to 2,260.

- On the commodities markets, Iron Ore closed marginally lower, down 0.2% to US$81.66, however Oil rallied 1.3% to US$51.50/bbl. We maintain our view that Crude Oil still needs to punch over US$52/bbl to target over US$60/bbl. (see recent weekend report)

- The ASX 200 is expected to open 20 points higher this morning, towards the 5,580 level as indicated by the December SPI Futures – however a bullish open following news in the energy markets could occur.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/12/2016. 8.00am

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here