The pieces of the puzzle are coming together

We often say when all the pieces of the puzzle are in place it’s too late to act but today we are seeing both the major indices and a number of high profile stocks unfolding as we have been predicting. Yesterday we saw what certainly looks like the completion of an initial 140-point decline for the ASX200 since the 1st of May, we now believe the 5800 area should probably hold for a at least a week, or two. However considering we still expect a 5% decline for US stocks from current levels in the near future it’s hard not to imagine at least a test of the 5700 area during the end of May / June.

Today we are going to look at some markets that make us comfortable with our outlook moving forward for both global and local stocks. These are indices / stock’s we will be using as our yardsticks when making important portfolio decisions in 2017/8.

MM’s short-term negative view for the ASX200 remains intact with our initial target of ~5800 now basically satisfied, while our potential targets of 5700 / 5600 for a May-June retracement will look very attainable technically if we close under 5816.

Please note yesterday we missed out on buying both CBA under $80 and WBC which failed to break $32, both of these orders will remain “Live” in the market until the 18th of this month when WBC trades ex-dividend.

ASX200 Daily Chart

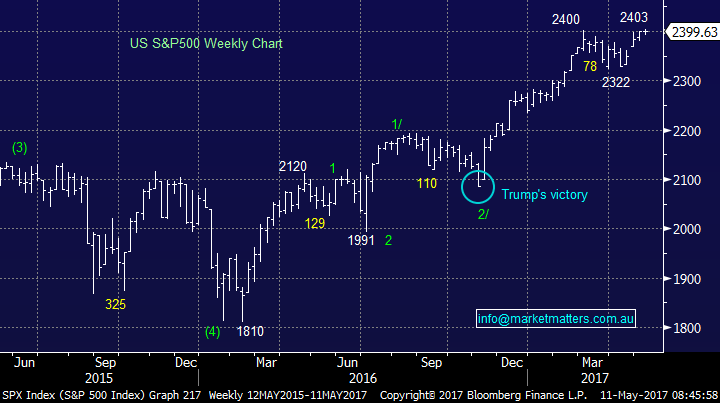

1 US Stocks

Overseas markets were again extremely quiet last night - we continue to feel US stock markets are feeling “tired” which is no great surprise after their excellent rally over the last 5-months. Our view at current levels remains unchanged:

a. The US S&P500 remains around all-time highs but it may now struggle to reach our previous 2425 target area.

b. We sense a 5% correction is very close at hand, it still feels like we are heading towards a classic "sell in May and go away" scenario for US stocks.

c. Assuming we get a 5% correction over May / June, similar to last year, we will be keen buyers into this weakness targeting further gains later in 2017. The NASDAQ is likely to be our yardstick for a buy area with US stocks and we will be simply looking for a correction of ~265-points, similar to that of October / November 2016.

Importantly we now feel the short-term risks for US stocks are on the downside.

US S&P500 Weekly Chart

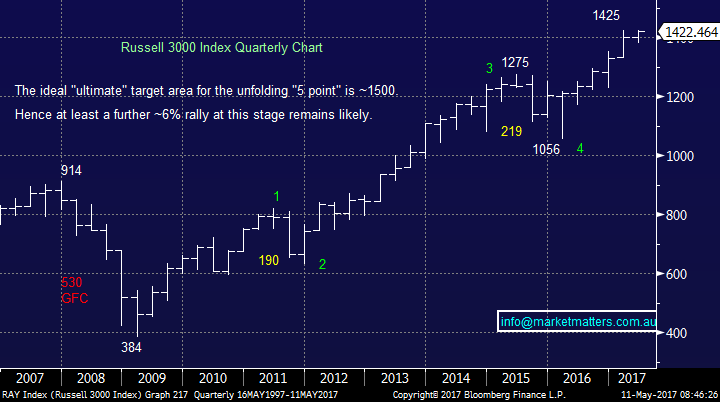

d. Longer-term we still see a further ~6% upside for the broad US Russell 3000 index but ultimately our conviction belief remains that the 2016 lows will ultimately be tested, a correction of at least 25%!

Hence it’s important to understand moving forward MM will become comfortable with increasingly higher cash levels / more defensive / opportunistic positioning

US Russell 3000 Quarterly Chart

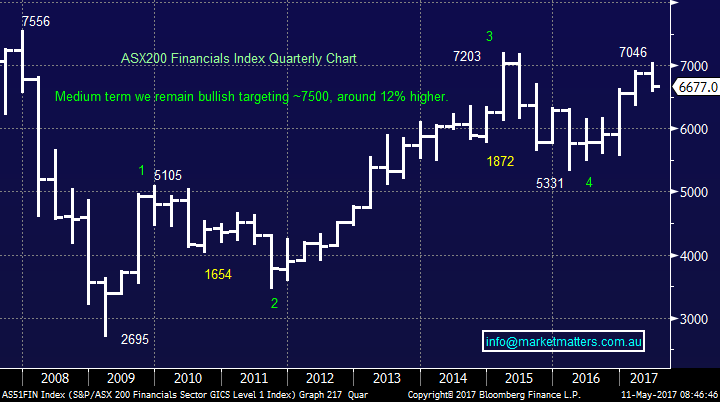

2 ASX200 Financials

The local financials index has enjoyed a stellar 2017 but we now believe the weakness in our big 5 banks (incl. Macquarie) should lead to further consolidation and potentially more downside. Hence considering the following 3MM opinions we see no reason to “chase” banks at current levels:

1. Our ideal target area for the financials index is ~6400, or 4% lower.

2. We are anticipating ~5% weakness in US stocks from current levels.

3. While we do see over 10% upside for our financials we are aware of the bigger picture which targets a 25% correction for US stocks yet only ~6% more upside.

NB Because we believe that global markets are in the last phase of an 8-year bull market we are likely to only buy bank stocks with a view to receiving a healthy “free” dividend, not for long-term capital appreciation. For sophisticated investors, we can also overlay this with an option strategy, something James and him team at Shaw and Partners can assist with.

ASX200 Financials Index Quarterly Chart

One of our favourite stocks both fundamentally and technically continues to be Suncorp (SUN) and hence it’s not surprisingly our largest holding in the MM portfolio at 12%. Our target of the last few years remains intact at ~$16, or 10% higher. The insurer has benefitted tremendously from the recent weakness in the banks as investors look for quality diversification within the financial sector i.e. Over the last month the banking sector has fallen 1.4% while SUN has rallied over 10%.

NB Due to our large holding in SUN we are likely to sell half the position around $15.50.

Suncorp (SUN) Monthly Chart

We discussed the banks in some detail in Wednesday’s reports and while we saw buying emerge in the sector during the panic selling early yesterday morning we feel the bigger picture fundamentals will stop fund managers chasing any strength in the big 5 banks.

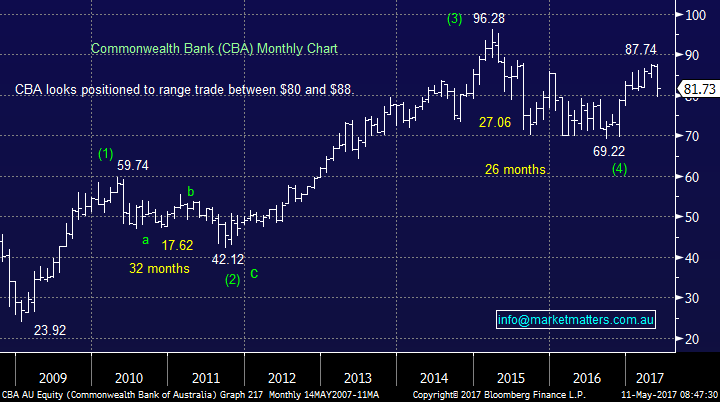

CBA has hit our $80 target area and has now corrected 9.3% from its recent high. We remain comfortable buying under $80 but weakness in US equities now feels required in coming weeks to get us positioned at these levels.

Westpac (WBC) would also make a good addition to our portfolio if it weakens over the next week, prior to its 94c fully franked dividend. Before its dividend we still like WBC around $32 i.e. around 2.7% lower.

Watch for alerts that may change our price levels on CBA and WBC.

Commonwealth Bank (CBA) Monthly Chart

3 The Australian Resources Sector

Our continued anticipation of at least a decent rebound for the main Australian miners raises definite doubts whether to ASX200 can correct back to the major support at 5600 but if we see some further weakness in the financials the 5700 area remains a strong possibility.

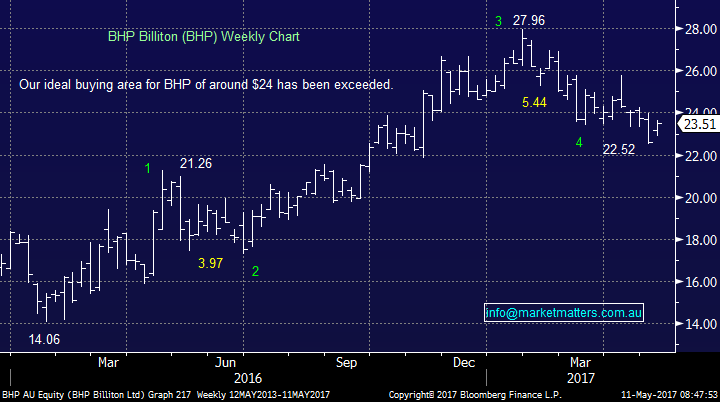

This morning BHP will support the MM positive view for local resources by opening ~$23.85, or 1.5% higher. Technically we continue to believe a close over $24 will see a rapid appreciation towards $26.

Its felt like a tough journey since we bought into the local miners a few weeks ago but this morning RIO will be in profit, BHP approaching breakeven and only OZL causing us some pain. As mentioned previously we are not planning to increase this exposure and may reduce if we see a quick 7-8% rally as mentioned above in BHP.

BHP Weekly Chart

Conclusion (s)

The market still remains positioned for an ongoing period of seasonal weakness – “sell in May and go away”. We still see US stocks correcting ~5% from current levels before resuming their upside rally.

We continue to like Australian banks into weakness .

We believe local resource stocks will rally from current oversold levels lead by resources.

Overnight Market Matters Wrap

· The US Equity markets closed mixed, with marginal change as the S&P 500 and Nasdaq creeped slightly higher to set new records.

· A marginal close in the US overnight, with the energy sector outperforming yet again as more members of the OPEC committee joined Saudi Arabia’s call for extending the current supply cuts.

· The June SPI Futures is indicating the ASX 200 to open 27 points higher, above the 5900 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/05/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here