The interest rate train has just left the station!

The market trends since the US election continued unabated last night, adding weight to our view that some major inflection points have occurred. Three things caught our eye last night and they have large ramifications for our local stocks:

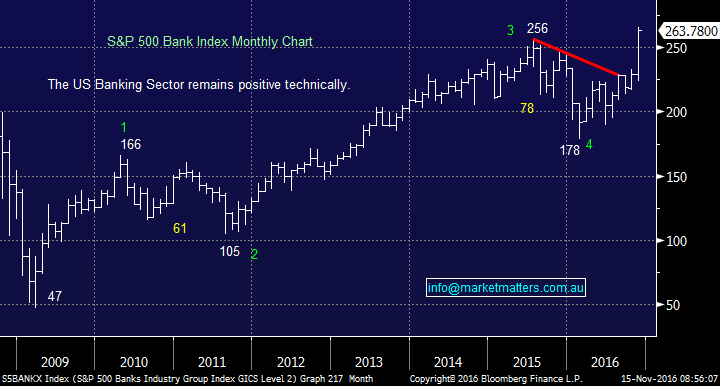

- The US banking Index soared over 3% to reach its highest level since mid-2008.

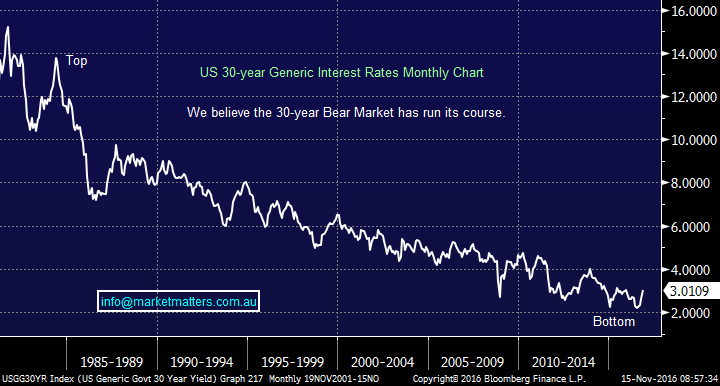

- US 30-year Bond interest rates traded over 3%, reaching their highest level in 2016.

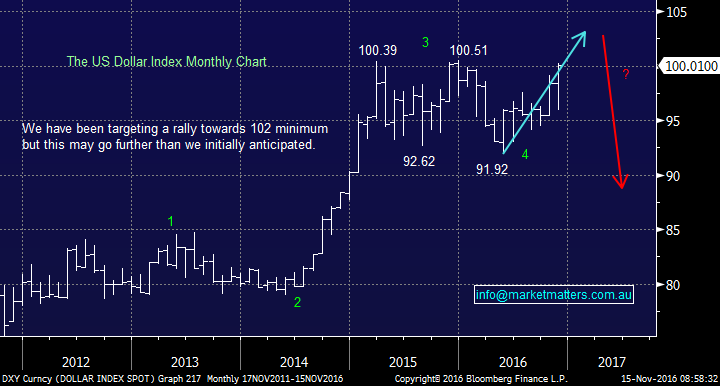

- The $US Dollar Index rallied 1% to break the 100 level for the first time in 2016.

As members of the Market Matters family, you know we have been targeting the rally from the US Banking Sector for over 6-months and Mr Trump’s victory has swept us there very quickly with an amazing 14.8% gain this month alone! This rally is being fuelled on two fronts – Firstly, rising long-term interest rates is positive for bank margins / profitability and secondly, Mr Trump’s pledge to reduce onerous and costly regulations is great for the sector. Our target for the US banks is now only ~5% higher.

CBA has gained 3.8% so far in November, about a quarter of the gains of its US counterparts - ANZ, NAB and WBC have all traded ex-dividend this month and are hence not a useful comparison. Ideally, our local banks will regain their "Mojo" into Christmas with our ideal target for the sector 6% higher.

We are currently long CBA, Macquarie Group (MQG) and Westpac (WBC). We ideally plan to sell our WBC holding between $32-33 region, prior to Christmas.

US S&P500 Banking Index Monthly Chart

Last night 30-year bond interest rates hit 3%, reaching their highest level in 2016. It should not be underestimated that global interest rates have been falling for ~30-years and at a minimum, we are likely to be witnessing a significant bounce towards 4% i.e. interest rates 30% higher than where they are today. The RBA cash rate which is 1.5% today was at a very scary 17% back in 1990 - never underestimate what markets can do in both directions. At some point in the relatively near future, we believe the prospect of rising interest rates will put stocks under pressure, but not yet.

Two big elections are looming in Italy and France, they feel very 50-50 after BREXIT and Donald Trump. If the current governments lose these elections, it will very likely lead to the respective countries leaving the EU and in the short-term, money flowing back into safety of bonds, pushing interest rates lower. This is a very real risk to the recent market trends, but the French election in mid-2017 is likely to far more important than the Italian referendum in early December. Assuming stocks continue to rally into 2017, we would not advocate being over exposed to stocks into the French election / mid-2017.

US 30-year Bond Interest Rates Monthly Chart

The $US looks poised to make fresh multi-year highs in coming days / weeks. We have been calling this move followed by failure and a 10% drop in the $US. However we are reviewing this, at least short-term.

- When Ronald Reagan came into power and started spending, the $US rallied an astonishing 45% in his first 4 years.

- US interest rates rising should be positive for the $US.

- If either of the European election risks come to fruition over the next 6-months, the $US should again rally becoming a safe haven away from Europe.

Overall it's hard to see any negatives for the $US short-term, BUT we all know things can change.

Assuming Donald Trump starts spending quickly, inflation and US interest rates are likely to rise quickly taking the $US with it. Hence $US earning Australian stocks should be very well positioned over coming months e.g. Amcor, Cochlear, Resmed, Brambles, Ansell, CSL, Computershare, James Hardie, Henderson Group and Westfield Group.

$US Dollar Index Monthly Chart

Summary.

We remain bullish banks, but now anticipate our next move in the sector is likely to be taking profit on Westpac.

We continue to believe global interest rates are set to rally over coming years and hence like QBE that we bought yesterday - note we only bought 4% and we will average on any decent pullback towards $10.

Lastly, we are becoming more positive on the $US and now like Westfield (WFD) who receive 75% of the earnings in $US. The stock has now corrected 26% over the last 5-months and we believe now presents solid risk - reward. We are a happy buyer of WFD under $8.50.

*Watch for alerts today.

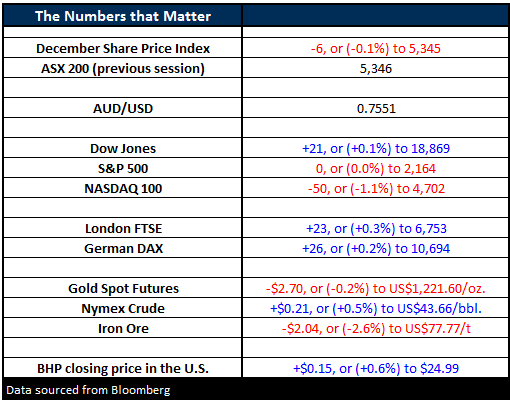

Overnight Market Matters Wrap

- The US markets closed mixed, with Dow up slightly, 21 points to 18,869, while the broader S&P 500 unchanged at 2,164. The Nasdaq 100 however lost momentum and closed down 50 points (-1.1%) at 4,702.

- Investors are still pricing in the risk of unknown as we wait for further transparency on the policies from US President-elect, Donald Trump.

- With uncertainty weighing, the bond market was the focus overnight.

- The December SPI futures is indicating the ASX 200 to open marginally lower this morning, testing the 5,340 level.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/11/2016. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here