The final 3 Healthcare stocks under our microscope

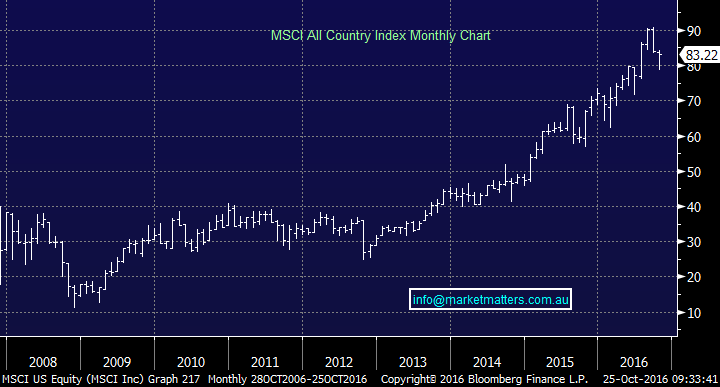

Last night US equities again rallied nicely with the tech NASDAQ Index again making fresh all-time highs - as we have said previously this index often leads the broader market. Takeover activity and solid earnings numbers were the major catalysts, a very different feel to our local market where earnings numbers have recently belted a number of household names. Yesterday the MSCI All Country World Index (MXWD) gained 0.3% while our local market fell 0.4% - The MXWD is a combination of both emerging and developed world markets. We remain bullish global equities targeting ~10% further gains - hopefully the ASX200 can participate if we are correct!

The seasonality theme again continued locally yesterday with our banks up 0.28% and health stocks down 2.2%. This feels likely to continue today with in the US financials rallying 0.43% while healthcare fell 0.12%.

Today we are going to complete our look at the major healthcare stocks to sharpen the pencil on our shopping list for the coming days / weeks. The current de-rating of high valuation (PE stocks) that have been on a huge bull market since around 2011 has improved the opportunities within the healthcare sector which has been one of the major culprits of excessively optimistic valuations.

MSCI All Country World Index Monthly Chart

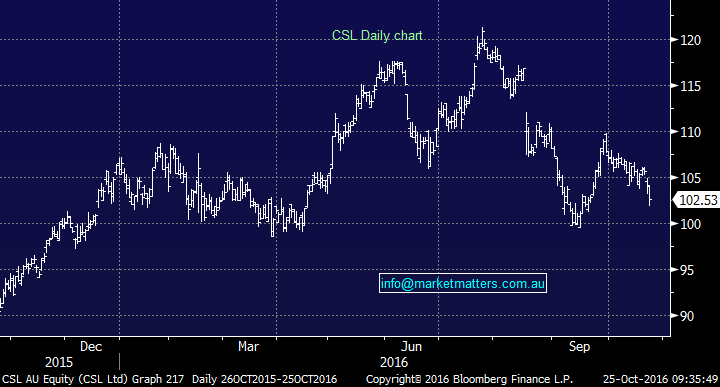

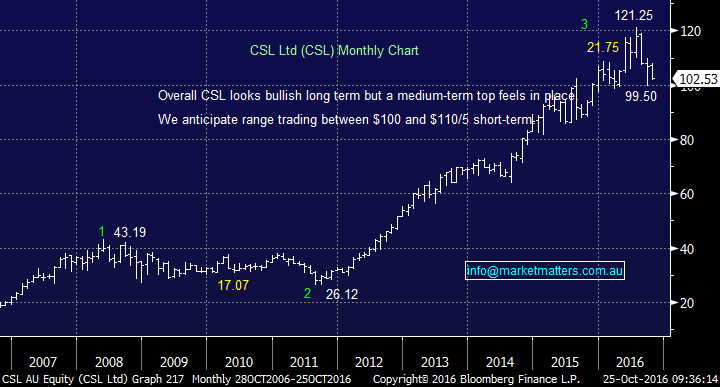

1. CSL Ltd (CSL) $102.53

CSL is a Melbourne based global biotherapy leader which works across 30 countries. After making fresh all-time highs in July the stock has corrected ~18% following the company missed profit earnings estimates but the overall annual numbers remain solid. The simple problem was the stock was trading too expensively and a lot of investors were complacently long. CSL has also been hindered by BREXIT and a recovering $A due to its significant offshore earnings including the UK.

We think CSL is an excellent company which we are comfortable holding but after such a stellar advance since 2011 our view is the stock rotates between ~$100 and $115 for months to come hence we will consider selling around $110-115.

NB We currently have 10% of our portfolio in CSL from the $109 area.

CSL (CSL) Monthly Chart

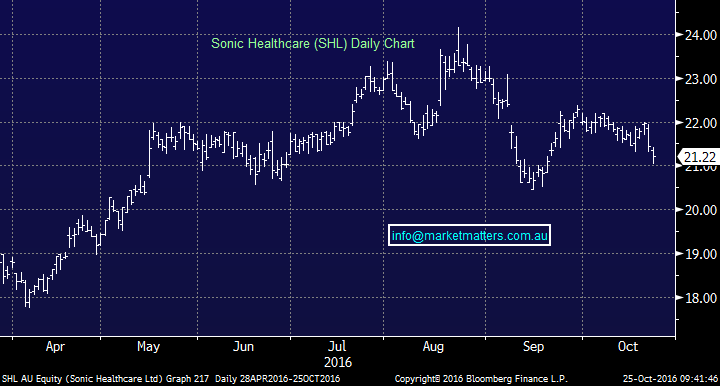

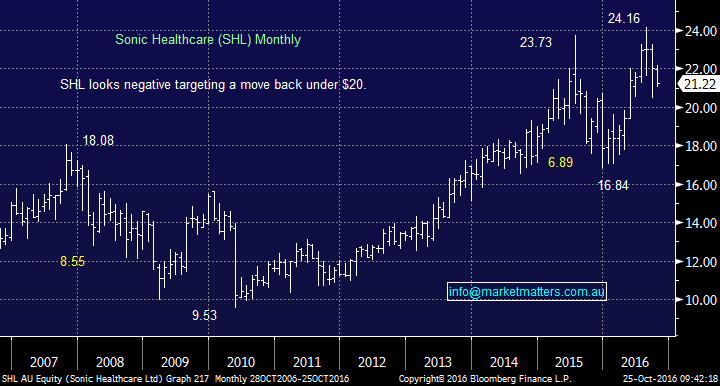

2. Sonic Healthcare (SHL) $21.22

SHL is a pathology and diagnostic image provider who like many stocks in the sector has enjoyed an excellent run since 2011. The stock made fresh all-time highs in August after releasing impressive full year results, with a headline profit after tax of $451 million. The stock is trading on a est. 2017 PE of 19.3x which is around fair value.

Technically SHL looks average after its false attempt at breaking out over $24 with a pullback under $20 looking possible.

Sonic Healthcare (SHL) Monthly Chart

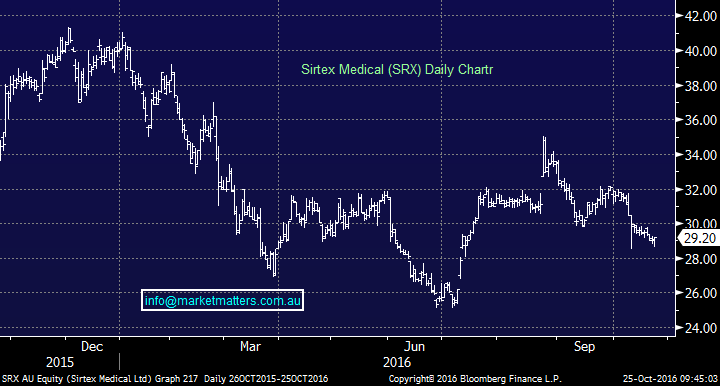

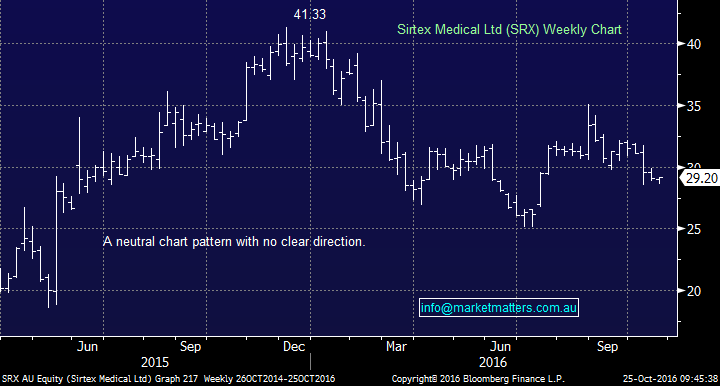

3. Sirtex Medical (SRX) $29.20

SRX has a product for the treatment for liver cancer. SRX is a quality but risky company trading on an estimated P/E for 2017 close to 26x hence its unsurprisingly not cheap. Risks always exist from current operators and new players when you’re a one trick pony.

Technically SRX is neutral with no clear direction.

Sirtex Medical (SRX) Weekly

Chart Summary

Below is a summary of our views on the healthcare stocks recently covered with a clear eye likely action:

1. Ansell (ANN) - We are keen buyers of ANN ~$22, the stock has corrected hurt by a recovering $A and falling pound due to its offshore earnings. ANN trades on an est. 2017 P/E of 15.8x.

2. Cochlear (COH) - COH now looks set to pullback to ~$120 where we like the stock. COH trades on an est. P/E of 33.2x.

3. CSL Ltd (CSL) - We are long CSL and envisage the stock range trading between $100 and $115 for a while. CSL is trading on an est. 2017 P/E of 28x.

4. Healthscope (HSO) - we recently bought HSO at $2.33 which may have been a touch premature as the "shorters" have started to hit the stock. We like the overall theme and are not panicking. The stock is trading on an est. 2017 P/E of 20x.

5. Primary Health (PRY) - We are neutral PRY and see better opportunities elsewhere. The stock is trading on an est. 2017 P/E of 18.5x.

6. Ramsay Healthcare (RHC) - A great company but too similar to HSO to add to our portfolio. The stock is trading on an est. 2017 P/E of 27.4.

7. Resmed (RMD) - We are keen on RMD around current prices. The stock is trading on an est. 2017 P/E of 22.5x.

8. Sonic Healthcare (SHL) - We see likely short-term weakness for SHL. The stock is trading on an est. 2017 P/E of 19.3x.

9. Sirtex Medical (SRX) - We like SRX as a company but are neutral just here. The stock is trading on an est. 2017 P/E of 25.7x.

Watch for alerts.

Overnight Market Matters Wrap

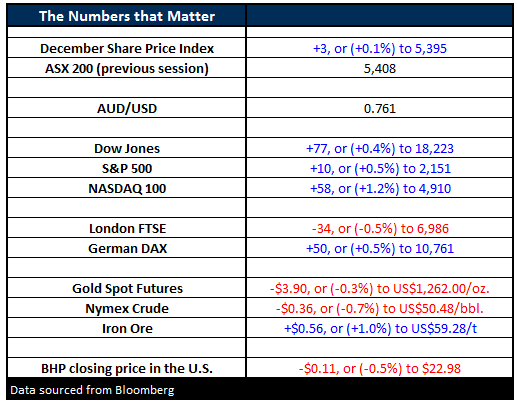

- Wall Street closed higher across the board last night with the Dow closing up 77 points (+0.4%) to 18,223 after being up as high as 129 points earlier in the session. The S&P500 closed up 10 points (+0.5%) to 2,151.

- The market lost ground as the price of oil declined and the US$ went higher. Crude finished the day down 36c (-0.7%) to US$50.48/bbl after Iraq came out and said they wanted to be exempt from the OPEC deal cutting production.

- Iron Ore managed to pick up, rising 56c (+1%) to US$59.28/t

- The ASX 200 is expected to open ~12 points higher this morning, around the 5,420 level, as indicated by the December SPI Futures.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/10/2016. 7.30AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here