The Dow hits another all-time high

**CORRECTION; In the afternoon report yesterday, we referred to a buy price in SGR of ~$3.76. This obviously should have been ~$4.76**

US stocks again hit all-time highs last night with energy and resource stocks the noticeable drag on the small gains. While we continue to feel US stocks are overdue a pullback after the impressive rally since Donald Trump's victory the current resilience illustrates the simple impact of supply and demand - fund managers have been caught underweight equities and continue to buy any weakness. The Dow traded in a choppy / sideways manner for around 3-months in mid-2016, if this is repeated we are likely to get no directional assistance from the US until ~March.

Dow Jones Index Daily Chart

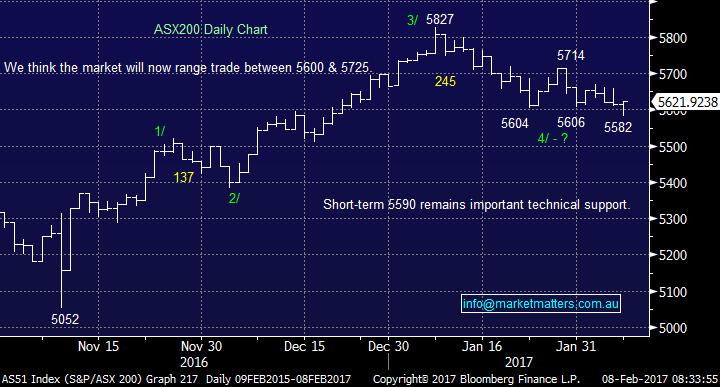

The solid 40-point recovery yesterday by local stocks was encouraging and on an index level we now expect the ASX200 to recover back towards the 5700 area. Australian stocks have fallen 4.2% while US stocks remain at all-time highs, hence we should be able to recover some of these losses even if global indices remain quiet. Reporting season will obviously be a significant influence.

ASX200 Index Daily Chart

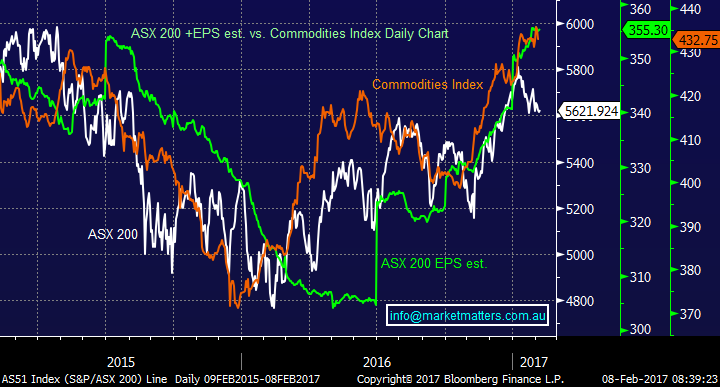

In terms of expectations leading into reporting season, they’re high with the market forecasting earnings growth of ~18% - seems impressive however it’s a direct result of higher commodity prices as the chart below highlights. Resources earnings growth (12 month forward earnings versus 12 month trailing earnings) is now up to 163.8% - contrasting this is Industrials earnings growth which is -0.1%, which is probably a better representation of the underlying strength of the Australian economy.

Throughout 2015 commodity prices were weak, the earnings profile of the market was weak and the index suffered. We’ve now seen commodity prices bounce (orange line), the ASX 200 bounce (white line) and then earnings start to get upgraded by analysts (green line). Commodity prices are clearly the key it would seem. Right now we’re seeing a slight disconnect between commodity prices and the ASX 200. Stocks are pricing in a pullback in commodity prices – of course if this doesn’t eventuate , then stocks should rally back strongly.

ASX 200 + Earnings + Commodity Index Daily Chart

Two stocks caught our eye yesterday as reporting season gets underway with it encouraging to see some positives emerge on the company level – the first in a while.

1. Transurban (TCL) $11.04

TCL announced an solid upgrade yesterday with profits after tax growing 42% to $88m, allowing the toll road operator to raise its dividend guidance by ~13% - the 12-month gross yield is approx. 4.6%.(unfranked)

We had a nice trade in TCL after its 25% plunge with the "yield play" as markets focused on higher interest rates globally in 2016, our exit looks a little premature after yesterday’s 6.4% rally. We remain neutral TCL in the current environment but if Donald trump fails to accelerate economic growth and the rise in interest rates falters TCL should perform extremely well.

Transurban (TCL) Monthly Chart

2. Macquarie Bank (MQG) $82.75

There was nothing new in MQG's trading update yesterday but the bank did not beat guidance as it often does hence the market was a little disappointed. We remain long MQG and comfortable at present but we will look to exit on a move to the $90 area that we are targeting.

Macquarie Bank (MQG) Monthly Chart

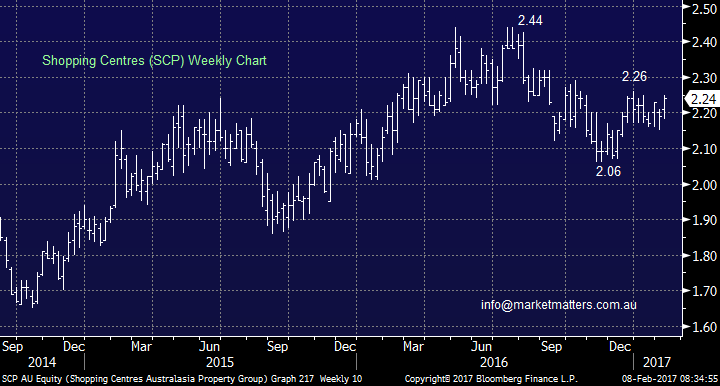

3. Shopping Centres Australasia (SCP) $2.24

SCP beat market expectations sending the stock up 2.7%. The increased guidance for future distributions is a clear positive with the stock currently yielding ~5.6% unfranked.

Technically the stock looks an ok buy with stops under $2.15, however we think better opportunities exist elsewhere.

Shopping Centres Australasia (SCP) Weekly Chart

Summary

With RIO reporting this evening, after our market closes, and Suncorp / Henderson Group tomorrow reporting season is really kicking into gear.

Remaining flexible as opportunities may present themselves is clearly important over coming days / weeks - we like our 23% cash holding with this degree of news flow crossing our screens.

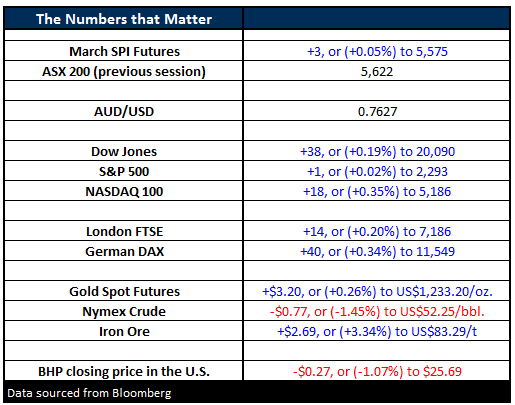

Overnight Market Matters Wrap

- The US share markets started the session with a bang, with the Dow hitting an all-time high of 20,155, before retreating with all indices closing marginally higher.

- The Energy sector continues its decline, as oil led its slide, down 1.45%.

- The ASX 200 is expected to open slightly higher this morning, up 8 points towards the 5,630 level as indicated by the March SPI Futures.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/02/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here