The ASX200 gets smacked, should we panic?

Following the previous day’s weakness, the local share market continued its sell-off with a truly horrible day yesterday, falling 91-points / 1.6%. In Wednesday’s morning report, our conclusion was that we had turned short-term bearish but the savage nature of the decline was even a surprise to us:

“We are now negative equities in the short-term, looking for a 4-5% pullback by US / European stocks. On balance, we believe we will see a test below 5550 by the ASX200.” – MM Wednesday.

Yesterday’s selling was attributed by many to China’s inclusion in the MSCI index creating an alternative market for fund managers to Australia, but the weakness was already unfolding with Moody’s downgrade of our banks and the resources under renewed pressure. Another downgrade by perennial problem child, QBE that we hold, aided the negative sentiment.

A few days rest would not surprise, but unless the ASX200 can rally back over 5755, we will maintain our negative bias. There are only 7-trading days remaining in the seasonally weak May-June period and it certainly has lived up to its reputation – will July as the second strongest month of the year? So far, we have corrected only 5.5%, still short of the average 6.9% since the GFC which targets 5545.

The MM portfolio is now sitting on 15% cash, following our realised profit in JHG, and we will put some / all of this money to work around the 5550-area, ideally at the end of June / start of July.

ASX200 Daily Chart

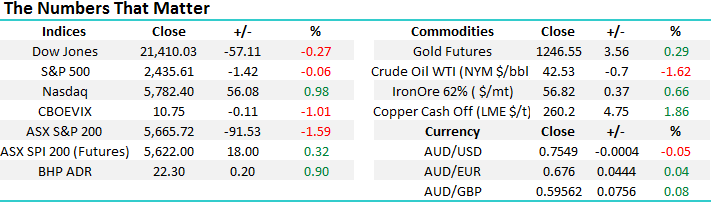

US Stocks

Last night, US equities were marginally lower courtesy of the energy sector but a 1% bounce in the tech NASDAQ stopped any aggressive decline. Although no sell signals have yet to be generated over recent times, our “gut feel” is the most likely direction for US stocks over coming weeks is now down, with our preferred scenario a 4-5% correction.

Many pundits are discussing how we have not seen US stocks fall over 10% since 2015, but we still believe it may be a while until we get a decline of this magnitude, as we said above we are only looking for a 4-5% pullback.

US S&P500 Weekly Chart

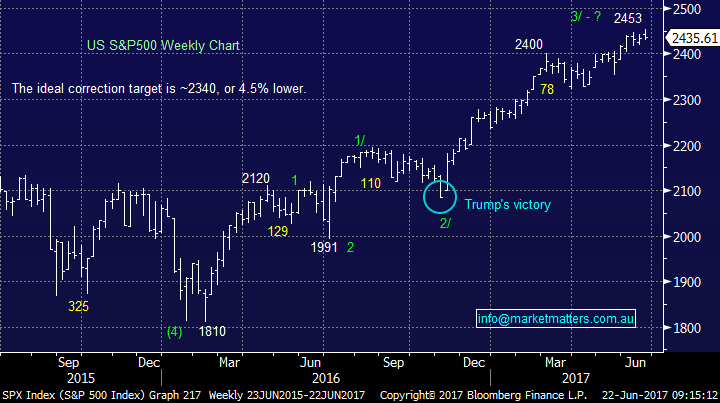

The NASDAQ is certainly enjoying a period of increased volatility and we are 50-50 what path the market follows but either way we still target another test of the 5600 area, or 3% lower.

US NASDAQ Weekly Chart

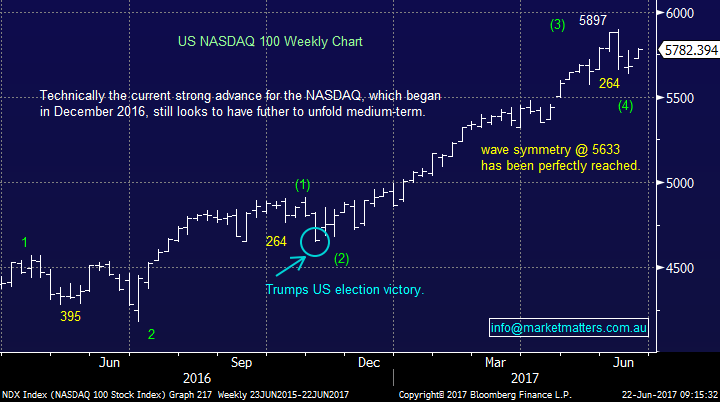

European Stocks

No change, when we look closely at the German DAX the picture is very similar to that of US stocks. We are targeting a pullback of ~5% towards the 12,300 area before a resumption of its strong bull market.

German DAX Weekly Chart

Today we are going to look at 3 holdings in the MM portfolio as we consider whether to sell our exposure or increase it if our targeted correction to 5550 unfolds.

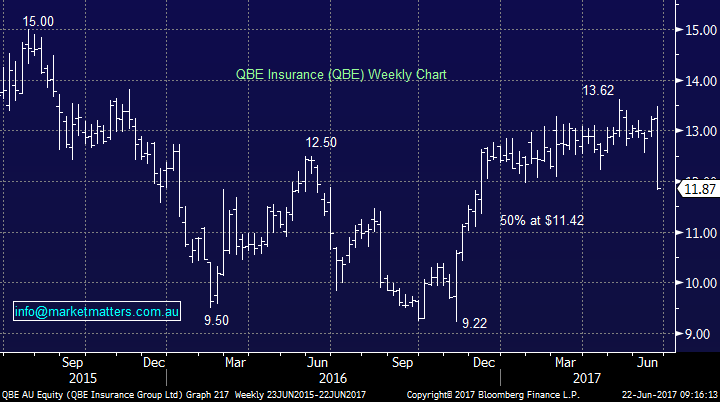

QBE Insurance (QBE) $11.87

Yesterday QBE was slammed over 10% on a profit downgrade due to increased claims in the emerging market countries, which are likely to impact earnings by an average of less than 5% p.a. for the next 3-years. The underlying issue is QBE has ‘done it again’,just as the market was starting to forget its past indiscretions. Statistically, investors should remember that buying a stock in the days following a downgrade usually leads to further paper losses in coming weeks / months.

However, at MM we still believe long term interest rates will actually rise and the $A falls under 70c, both are very earnings accreditive to QBE. Hence, we have a 2-prong attack:

1. We will buy an additional 3.5% QBE under $11.50, taking our position to 7.5% in the MM portfolio.

2. We will take a good profit on our QBE position if it quickly bounces back over $12.50.

Conversely, sophisticated investors may want to sell call options against their holdings as we believe trading is likely to be choppy over coming weeks.

QBE Insurance (QBE) Weekly Chart

Westpac Bank (WBC) $29.77

WBC has now corrected 16.9% since May’s high, pretty dramatic stuff even taking into account property wobbles and a Moody’s credit downgrade. While the banks still have plenty of work to do moving forward, an est. valuation of under 12.5x 2017 earnings and a grossed yield over 9%, we believe will prove an attractive entry in the medium term, especially when we consider the dividend yield has been the most attractive aspect of the ASX200 over the last decade.

We plan to buy an additional 2.5% WBC taking our holding to 7.5% if we get the opportunity arises ~$29.

Westpac Bank (WBC) Weekly Chart

RIO Tinto (RIO) $58

RIO has fallen along with the whole materials sector as investors have lost confidence in a global economic recovery. We still believe that long term global interest rates will eventually rise strongly, implying that resource stocks will find some love later in 2017 /8. Our exposure is relatively heavy to resources for MM hence any additional buying will be extremely “fussy” in nature.

We will buy an additional 2.5% RIO if the opportunity arises under $55.

RIO Tinto (RIO) Weekly Chart

Conclusion(s)

We remain negative equities in the short-term looking for a 4-5% correction by US / European stocks. On balance, we believe lead to a test below 5550 by the ASX200 which yet again appears to have led the correction by its global piers.

1. We are buyers of QBE under $11.50 but sellers over $12.50.

2. We are buyers of WBC towards $29.

3. We are buyers of RIO under $55.

We are still watching TLS very carefully as we look for an optimum exit level.

Overnight Market Matters Wrap

· The oil price remained under pressure overnight despite a slightly better than expected decline in US crude inventories, which fell by 2.7mmbbls vs consensus expectations of a 2.1mbbl decline. The US benchmark WTI price fell below US$43/bbl and the global benchmark, Brent price fell below US$45/bbl , as fears of oversupply continued to weigh on sentiment.

· The weakness in energy stocks, coupled with weakness in material, retail and telco stocks, saw both the S&P 500 and Dow indices slightly easier. A solid rebound in the technology sector helped the tech heavy NASDAQ rebound 0.7%.

· Other commodities fared better, with iron ore prices recovering towards US$57/tonne, copper recovering yesterday’s losses, rallying 1.6% and gold also slightly firmer at US$1246/oz. The moves helped RIO rise 0.8% in US trading, while BHP held ground, which should be supportive in the local market today. ASX Futures are pointing to a small rebound of about 0.3% after yesterday’s 1.6% broad based selloff on the ASX 200.

· The June SPI Futures is indicating the ASX 200 to open 17 points higher, testing the 5680 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/06/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here