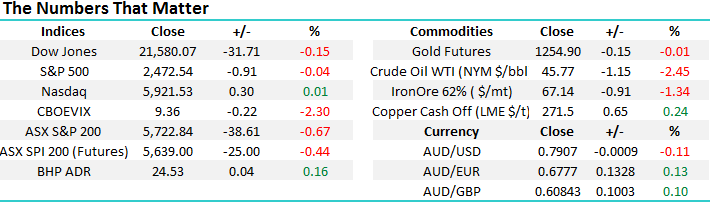

Subscribers questions

As we discussed in the Weekend Report MM has unfortunately now turned more cautious the ASX 200, at least over the next few months after the market has failed to adhere to the usual July Strength. We are now looking for a pullback towards the 5500-major support area which should provide an excellent risk / reward buying opportunity. Firstly, having an open mind and the ability to amend a view will be very important over the next few years, plus we think having an active approach will be key. Importantly, investors need to fully understand our view for stocks for the approaching years because some “fun” is looming!

MM is looking to build its cash position from the already healthy 18.5% level, a break of 5665 will generate an important index sell signal.

Medium-term view

We are now looking for a pullback by global stocks over the next few months which should ideally provide a good buying opportunity for the seasonally strong run into Christmas.

Subscribers should remember we believe the major bull market that commenced back in March 2009 is maturing fast, hence volatility within the markets should slowly start to increase. The ASX200 has certainly been choppy and erratic of late whereas the US has continued to simply grind higher.

ASX200 Weekly Chart

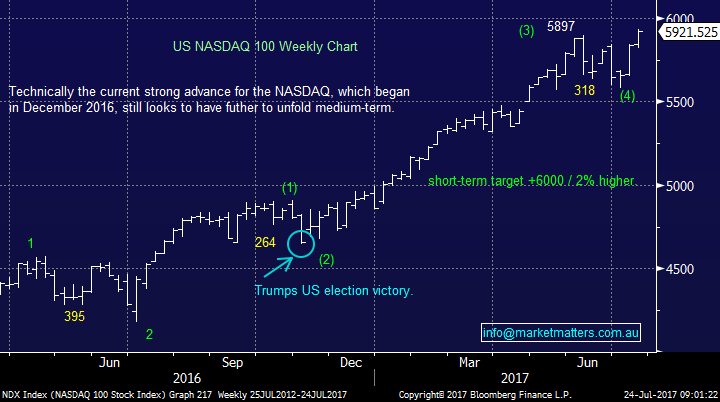

The tech NASDAQ Index has followed a perfect technical path since mid-2016 and until it deviates we will continue to use this as our medium-term guide for global stocks.

We expect a further ~2% advance to fresh all-time highs, around the 6000 area, this month prior to a decent 7-8% correction. Importantly the risk / reward has now swung from the buy to sell side.

NASDAQ Weekly Chart

Long-term view

The evolving position of the US S&P500 has enabled us to maintain a bullish stance while many have become “scarred” too early moving to cash and subsequently missing some healthy returns from stocks - especially while global interest rates remain at historically low levels. However, alarm bells are slowly starting to ring.

We see another ~5% upside in 2017 from US stocks, in a choppy volatile manner, but importantly moving forward we still see a +20% correction on the horizon, back towards the lows of 2016.

1. We remain firmly committed to our view that the US S&P500 will correct back towards its early 2016 lows in coming years i.e. the 1800 area for the S&P500.

2. Unfortunately, our view that the ASX200 would finally, after over a decade, start to outperform US stocks looks only likely to unfold by default if we see a correction led by the US.

US S&P500 Monthly Chart

Question 1

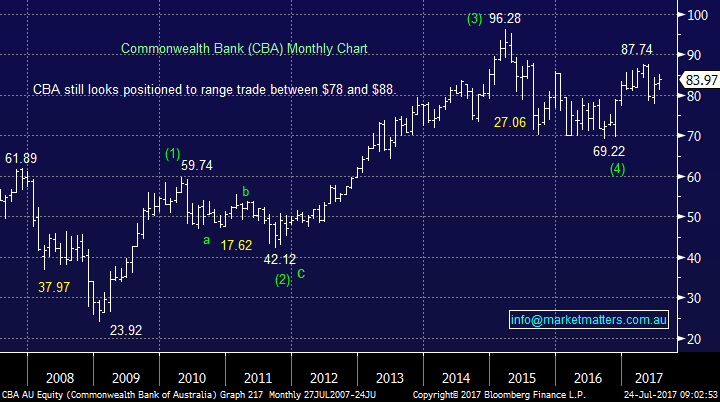

“Within your Growth portfolio, you continue to like CBA and WBC however following the recent APRA announcement it does favour ANZ (and NAB) who have a smaller capital gap to chase to meet the tier 1 equity ratio of 10.5%. Has this changed your short-medium term view of these two banks (despite CBA soon to deliver a dividend)? Also, do you anticipate that CBA will announce any surprises in upcoming results in order to meet the capital requirements required or do you believe they will try and organically grow?” Regards –Peter W.

Morning Peter, your definitely correct that the recent APRA news favours ANZ but in the medium term we believe this will become relative noise fairly quickly. Last week, following the announcement, ANZ rallied +4.3% compared to CBA gaining only +1%, hence we feel most of the relative benefit has already been baked into the share prices. Importantly, this announcement is all about capital, not growth. To get ‘sector leading’ capital, ANZ has sold off a lot of their growth assets – which will have an earnings impact in the future. Markets are strange and focus on different things at different times. Because the current focus has been on capital, the most highly capitalised bank has done best – that will change.

The most important issue is none of the big banks need to issue new equity to raise capital and the uncertainty has been removed. We continue to like CBA given they have the best platform of growth in a difficult operating environment. Their core banking system is superior and this will drive performance. We think the valuation premium is justified.

Commonwealth Bank (CBA) Monthly Chart

Question 2

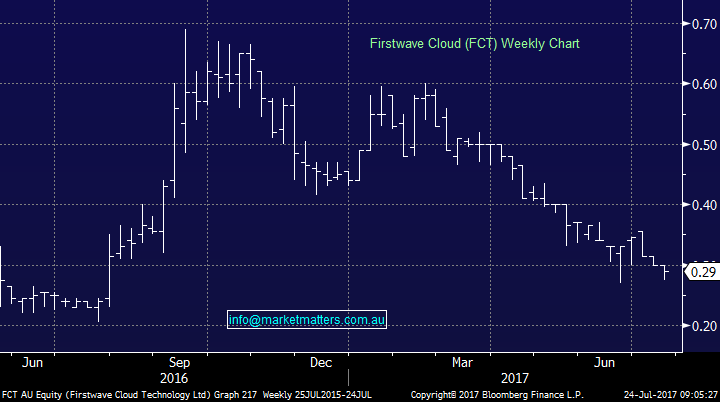

"Earlier in the year you highlighted FCT as one to watch. It seems to have drifted lower over the last couple of months. Can you update me on your current views on FCT as a buy." Carl

Hi Carl – firstly, apologies for the delay in responding to this question - we simply missed it when it was sent. Firstly, we did mention FCT as a speculative stock to watch and the share price has gone down since then. Secondly, anything we mention is an idea for further investigation however we don’t run a long list of BUY/HOLDS/SELLS. We run our two portfolio’s and those are the stocks we are happy to own – we continually monitor and will make amendments to the portfolios when we think it is appropriate. Those are the stocks that get our attention.

In terms of FCT, for those that don’t know, they do cloud based security services mainly to protect business and Government networks from online threats. The big ‘selling point’ of FCT was their integration with Telstra solutions for business. Essentially, the FCT security system was imbedded in the Telstra offering and this opened the door to a huge market of SMEs. The company gave an update on the 13th July and they are performing well, however below previous stated guidance. This is a $36m market capitalisation so very speculative, however they are addressing a big market, have a good foothold with Telstra and good scope to grow. Technically, support in the stock sits just below current levels at 27c creating a good risk/reward buying opportunity here, although we stress, this is a high risk speculative stock that will not appear in our portfolios.

Firstwave Cloud Technology (FCT) Weekly Chart

Question 3

“What are your thoughts on medical marijuana stocks with the legalisation process pending and any recommendations Up until now I have been with the major banks plus Bendigo and BOQ. Have just sold out and am cashed up. Concerned about your predictions for man as I want to buy back in when bank market falls. I chase dividends for living income” - Thanks Kevin N.

Hi Kevin, being a yield hungry investor puts you in the same boat as many local investors. Taking into account our short-term cautious view on stocks we are looking to increase our cash position.

We do not offer personal advice but CBA goes ex-dividend soon and we like the stock as mentioned in question 1, however if we get a pullback towards 5500 by the ASX200 the likelihood is that the banking sector will be marginally lower in the in the short term. We have no interest in marijuana stocks at the moment.

Question 4

"The 4 Big Australian Banks. Here is my take on the Banks: I believe that the market is sitting short the banks because investors and funds are waiting for a property crash. This has not happened and in the short term any price adjustment in the property market may be gradual and over a number of years and therefore not a crash. The property market has appreciated due to real supply and demand pressure i.e. not enough property to meet increased demand due to population growth (like any market we have speculators that are highly leveraged in that market). Think of the bank's balance sheet, unlike gold or other commodities there isn't an exact “marked to market” for the bank's mortgage book, and it is usually priced in a conservative manner. The banks also stress their asset value and impact to revenue - e.g. CBA a 30% drop in property prices will impact earning by wiping out 1/4 of its earning. Intuitively Higher property prices improve the bank's position. I believe that there is a gap - either property prices fall by +30% or banks move up 20% from current levels. The banks still have tremendous opportunities for cost cutting and they still have the ability to tweak the spread. Yes, there are other risks and growth opportunities are limited, however I believe that banks are a strong buy with a 20% capital growth opportunity plus continuing strong yield.” - Thanks Michael S.

Morning Michael, an excellent well thought out question as always! We simply agree with you and believe the banks are good value at current levels, notwithstanding our short term cautious view over the next few months. We can see an eventual test of ~$100 by CBA in the next 12 months all things being equal however we are very mindful that we are looking for a +20% correction from US stocks, probably over 2018-19.

Question 5

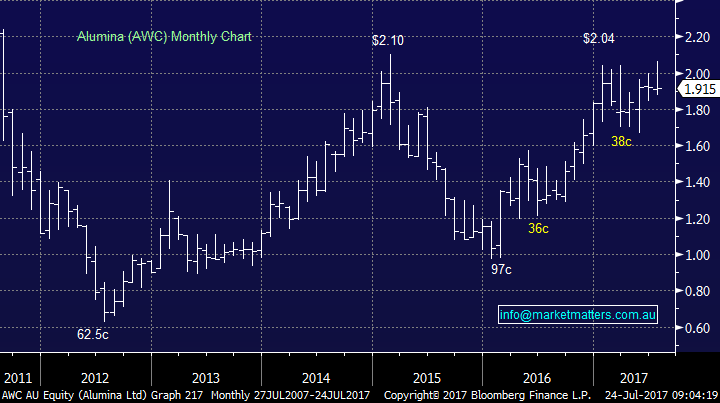

“Hi is it still a good idea to invest in AWC As I wasn't in a position to do so when first recommender” - Kind regards Patrick T.

“Hi MM, I read a report this weekend where a broker had a Sell on AWC due to "record Chinese supply on refinery restarts and new supply. I would be interested in your thoughts on this matter.” - Cheers, Michael H.

Morning Patrick and Michael, we have combined your questions for obvious reasons. We were disappointed with Alcoa’s result last week which led to the ~4% decline in the AWC share price.

At this point in time we still like both AWC and Alcoa but a few weeks underperformance would not surprise. We are unlikely to sell, or add to our AWC position at this stage.

Alumina (AWC) Monthly Chart

Question 6

“Hi, James, as you may recall I have a fair exposure to ALK. They are a gold miner (plus) but also a developer of a Zirconia Mine with rare earths etc. The share price appears to be recovering from a sell off last year. Does it say anything from a charting perspective? Appreciate any insights you may have.” - Kind Regards Peter H.

Morning Peter, Thanks for taking us out of our comfort zone! ALK is clearly an extremely volatile stock which can both fall and rally by ~50% in just a few weeks. From purely a technical perspective we could stay long with stops under 28c.

Alkane Resources (ALK) Weekly Chart

Overnight Market Matters Wrap

· The US equity markets had a quiet session last Friday, ending the day with little change with investors patiently waiting for further data this week, such as the FOMC US Fed Rate decision (expecting no change at present).

· Europe however experienced a similar experience to our local, with the EuroStoxx down -2.11% for the week.

· Locally this week, Australian inflation data will be released on Wednesday, which will be closely looked at by the RBA to determine the timing of future rate hikes.

· The ASX 200 is expected to open 26 points weaker, testing the 5700 level as indicated by the September SPI Futures this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/07/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here