Subscribers questions

The first of May has finally arrived, equities have enjoyed a strong start to 2017 with the ASX200 gaining 4.6%, and an even more impressive 17.3% since Donald Trump's US election victory last November. The question we were repeatedly asked during March and April was along the lines of "why stay long stocks with so much bad news around?", our simple answer was too many investors / fund managers are in cash hoping for a fall, plus they are battling the seasonally strongest period for local stocks. As we discussed in the Weekend Report this dynamic has now changed as we enter the seasonally weakest time for stocks and the same fund managers look to have been forced back into the market. We looked at CBA in detail yesterday because they are not influenced by looming dividends, today lets switch our attention to the overall market since the bull market commenced in March 2009:

1. The average gain for the ASX200 between January and the end of April is +3.8% hence 2017 has been better than average. Twice the market fell -1.3% and -0.8% respectively, while the greatest performance was in 2013 when the market advanced 11.7%.

2. The average correction during the May-June period has been 6.9%, less than CBA's average pullback of 7.8% which makes sense as the banking sector experiences selling pressure with ANZ, NAB and WBC all going ex-dividend in May. We can find no clear correlation between the strength from January and April and the weakness in May / June.

3. The average "pivot top" in May was around the 6th with not surprisingly over half the time May turning lower in its first week.....i.e. this week!

Our interpretation of these numbers is the bank results over the coming days have a high possibility of producing a top in our market, whether they are good, or bad. Combined with our technical picture that US stocks should rally 1-2% higher but a minimum ~5% correction is looming tells to be very cautious in the short-term. Do not be surprised if MM move to a higher cash position next week.

This week we have again received a record number of questions so a big thanks to all who sent one in and apologies if we did not have the time to get to yours.

ASX200 Daily Chart

Question 1

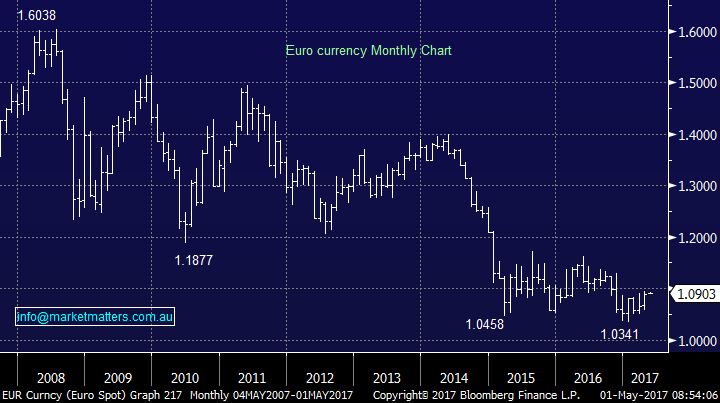

"Is there a ETF I can buy to short the Euro" - thanks Daniel.

Hi Daniel, there is however they are not listed on the ASX, you’ll need to access US exchanges to be able to short the Euro via ETFs. Importantly, this is short the Euro versus the USD. Try the EUFX from ProShares. We do not trade / invest in the FX markets at present but technically we feel the Euro looks poised for a bounce from current levels......that's what makes a market!

Euro currency Monthly Chart

Question 2

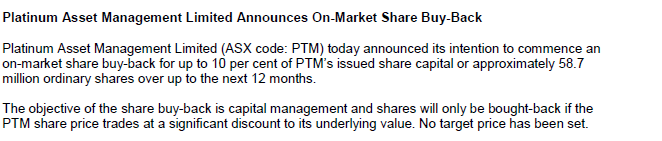

" Hi Market Matters. PTM getting hammered today, is this a short term thing in regards to announcement this morning or time to bail?" - Regards Neil

Hi Neil, you have asked the million dollar question for MM over recent days. A snapshot of our thoughts:

1. PTM was smacked 6.6% on Friday after announcing they would reduce fees to attract new FUM (funds under management) but if they fail the likelihood is revenue will fall close to 9%.

2. It feels unlikely the PTM share price will now recover until the company see some traction from this bold move, i.e. 6-12 months. By that we mean an increase in actual FUM to offset margin compression. That said, if there is a fund out there that can handle lower fees, it’s PTM given its industry leading expense ratio, however the results will take time.

3. The company still has not triggered its $300m buy back which was lodged with the market last September. See below.

Announced 13thSeptember 2016

They have up until September 2017 to do something here, the obvious question is, what is a ‘significant discount to its underlying value’?

On balance we think it's likely we will reduce or sell our holding in PTM

Platinum Asset Management (PTM) Weekly Chart

Question 3

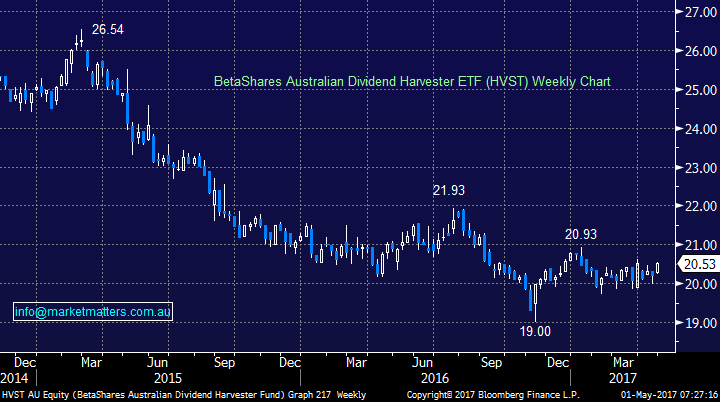

"Hi Guys, I have attached a chart and am hoping you can explain the long candle lines. It’s ironic the chart is of HVST which I bought a month ago for my SMSF as I believe a safe means to park some cash at a good interest rate. I have also seen these long candles on other charts." - Cheers, Michael.

Hi Michael, as you can see below we have no issues with our Bloomberg candles chart. Unfortunately it must simply be an issue with your data provider which can be very frustrating if you are using them for investment decisions! We suggest you give them a nudge to improve the data quality.

BetaShares Australian Dividend Harvester ETF (HVST) Weekly Chart

Question 4

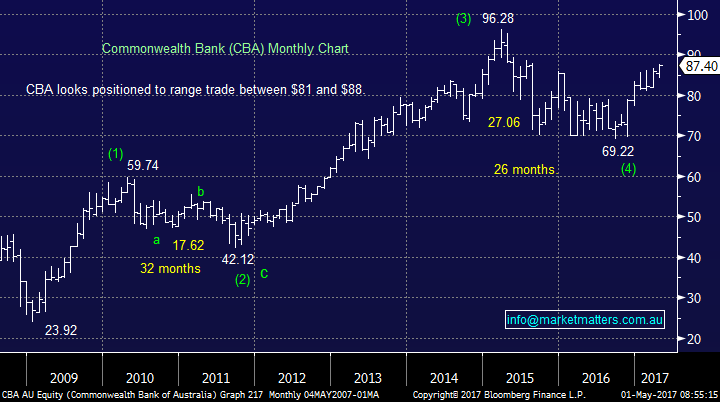

"Good morning MM, just a quick question. I just noticed that the short interest in CBA is now 9.33% an increase of 4.48% from 26/4. Is this an indication were at a top for CBA, is this something you take notice of?" - Thanks Mark.

Hi Mark, not sure where you get data however shortman.com.au is a good / easy source which republishes info in a nice way. In terms of your dates, short positions published have a 4 day lag, so no one knows exactly short interest until four trading days after the fact. From the data we see CBA's short position remains relatively small (1.21%) and subsequently not one we would look at that closely. We do look at short positions but you obviously must also take into account a number of different market circumstances e.g. some traders might be shorting CBA and buying either ANZ, NAB or WBC in anticipation of outperformance with their respective dividends looming in coming weeks, hence not a particularly negative view on the CBA share price just a relative strength play.

Commonwealth Bank (CBA) Monthly Chart

Question 5

"Assuming the classic 'Sell in May' scenario starts to play out which all indicators appear to be lining up. How much in cash holdings are you seeking to build to minimise the impact of this small correction in the markets/portfolio?" - Thanks Peter.

Hi Peter, a great question and one we have been discussing at great length over recent weeks. Importantly the optimum answer which we decide upon may not suit your / other subscribers personal circumstances and these must be thought through individually by all readers. We simply publish what we do, and this does not take into consideration your circumstances. Currently we hold just over 21% in cash so a quick outline of our thoughts on current MM positions:

1. Resources - OZL, BHP and RIO, we have just established these positions and are unlikely to sell in coming weeks.

2. Gold's - NCM, we are looking to accumulate NCM and RRL into further weakness.

3. Telstra - we are buyers ~$3.80.

4. Banks - CYBG, ANZ and NAB - we like the banks for coming months but anticipate short-term weakness. Assuming no surprises in the next few days results we are comfortable with these holdings and will review after ANZ and NAB trade ex-dividend. We are buyers of CBA under $81.

5. Insurers QBE, SUN simply our favourite sector at present.

6. Fund managers - HGG and PTM, we are comfortable with HGG but not PTM after Fridays fall.

Hence the only obvious candidate for cutting in coming days is PTM which we have discussed earlier. The likelihood is we will stay at 21.5% cash or increase to 29% if we sell PTM.

Question 6

"Thanks for all your good advice recently. Its working well for our super fund. Interested in Admedus, AHZ. We invested some time ago and it always looks like a good story. Has MM looked at this venture?" - Thanks Steve.

Hi Steve, unfortunately the answer is no and when we look at the stock technically it's not jumping out at us after falling over 80% during the last 5 years. This bio-medical company is probably similar to most in the sector and likely to be news driven, clearly it's been lacking anything meaningfully positive over recent years. Sorry to not be able to add / assist more.

Ademedus Ltd (AHZ) Weekly Chart

Question 7

"I hold BEN,CBA and SUN and hoping to switch to ANZ or NAB or WBC that will shortly report and go ex div in first week of May. Your esteemed thoughts on whether to hold over next few days and eke some more gains before switching and incur paying more for new Bank stocks and their dividends. Will ANZ,NAB,WBC rise more than BEN, CBA,SUN over the next few days ? Will they then flounder in the 'Sell in May' season? A perennial question I am sure you have been asked before!" - Bruce.

Morning Bruce, a question we have touched on earlier and unfortunately one that is little more aligned to the "2 up ring" than analysis. We have sold our CBA position because on balance we believe there is a strong possibility of re-entering back towards $80 but when switching stocks around reporting / dividends the volatility and noise really does make it guess work. We are happy holding our ANZ and NAB looking for their dividends but on balance expect them to be lower over the May / June period.

We have made a balanced decision selling only our CBA, we will still be happy if banks continue to rally. Generally ANZ and NAB do outperform CBA over April and into their dividends but the easy pre-result part of this is now behind us e.g. over the last month ANZ is up 2.95% and NAB 2% but CBA has only gained 1.7%.

Question 8

"Re your comment on the gas industry, sorry gas guys but everyone who has a superannuation account is well familiar with regulatory risk. If Santos et al thought they could build an over-capacity LNG plant (two compressor trains instead of the one they had their own gas for) and feed it by stripping gas out of the domestic gas distribution system to the extent that local prices sky rocket and shortages result and that there would be no regulatory response then they are stupid,. Sorry gas guys, no prizes for stupidity." - Cheers, Rob.

Hi Rob, a tough but relatively fair comment. Nothing we can really add but all investments carry risks, some obviously higher than others and an obvious reason why we hold a few stocks, not just our favourite 1, or 2.

Overnight Market Matters Wrap

· The US closed with little change last Friday, as investors took risk off the table on the last session of April with recent data reports showing the US economy growing at its slowest pace in 3 years.

· Iron Ore rallied 3.58% higher, with BHP expected to open marginally higher after its last US session being up an equivalent of +0.26% higher to $23.78 from Australia’s previous close.

· Domestically this week, we see ANZ, NAB, WOW and QAN all report this week, while the RBA will likely leave rates on hold tomorrow.

· We expect a quiet start for the month of May, with a handful of exchanges in Asia and Europe closed. The June SPI Futures is indicating the ASX 200 to open marginally higher, up 6 points higher testing the 5930 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/05/2017. 8.55AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here