Subscribers questions

Subscribers questions

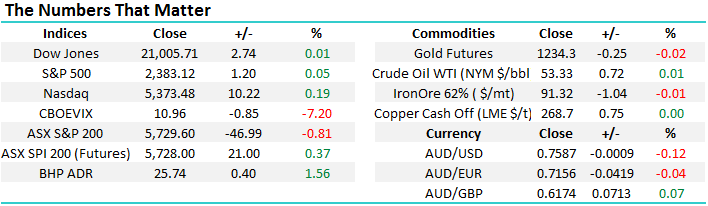

The US market feels ready for some consolidation after its excellent performance both in 2017 and since Donald Trump's election victory - The Dow is up 6.2% and 17.4% over these respective timeframes. As the following chart illustrates March is usually a dull month for local equities before April gets a decent lift, assisted by many investors receiving juicy dividends from some large local companies who have just traded ex-div. e.g. CBA, TLS and WES. Overall we currently anticipate March will be relatively quiet for MM with our focus on potential further "tweaks" to our portfolio and buying into the currently unfolding weakness in the resources sector. Today's questions will be focused on the growing market sector Hybrids plus a question which is also angled to the yield side of investing.

ASX200 Seasonality Chart

Question 1

Dear MM,

1) In a recent piece you made the brief statement ; for income investors CNI [ Centuria Capital ] is offering circa 10% on the ex-div price. Today the company announced forward guidance of 6.7%. Is there any hidden factor I am missing?

2) An advice on hybrid investing was fore-shadowed. It would be of interest. Regards, Paul

Good morning Paul, thanks for a great question, we’ve had a number of emails recently on hybrids perhaps as we’ve seen 3 new issues out recently from 3 well known Australian companies, plus we’ve witnessed a resurgence in the prices of many of the existing hybrids on issue. Before we cover hybrids though, lets address CNI

As we wrote some time ago, this is a funds management business but not your typical operation - they do property funds management, investment bonds, reverse mortgages and some insurance and they just recently bought 360 Capital – another funds management business to give them more than $3.5bn in assets. They are big in property funds management and obviously property has been through a very strong period, however the 360 Capital deal is a positive one for earnings and it will give the stock a lot more liquidity and eventual inclusion in the ASX 300 we think. Cheap, high yield, low debt and a reasonable pathway to grow earnings over the next few years.

In terms of yield, we actually think they’ll pay 6.2% in FY17 going to 6.9% in FY18. These are 40% franked. We’ve lowered our expectations here from when the original note was penned, and reduced our expectation around franking from 100% to 40% given company guidance. In terms of price to BUY the stock, we would advocate buying at $1.10 while leaving some $$ to average at $1.05 if the stock drops a little further. We like the stock for yield.

Centuria Capital (CNI) Weekly Chart

Hybrids

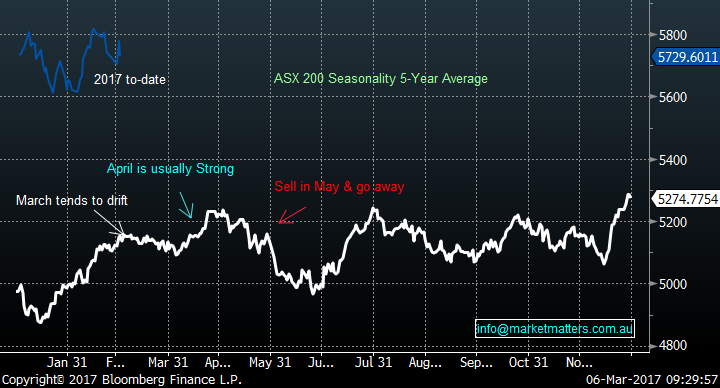

Over the past few weeks we’ve had a number of questions on the Hybrid market, ranging from our thoughts on new issues, to why the CBAPD is trading below its $100 face value. As a start, here’s the current pricing of some of the major bank hybrids already issued.

Source; Fixed Income Team – Shaw and Partners

Hybrids are a bit of a strange asset class given they don’t really fall into one particular bucket. They’re not true debt securities and they’re not true equity investments. The professional investment community is typically broken up into equity investors, and bond investors so from an institutional level these don’t really fit. That said, more institutions are now investing in these as the understanding of hybrids improve. In short, we think they’re good if you understand what you’re getting. A number of questions have been focussed on the CBAPD, so we’ll start here

CBAPD; You could blame CBA for putting a cap on the hybrid market for almost 2 years after they issued a huge $3bn convertible preference share back in Oct 2014 at a margin of 2.80% over the 90 Day Bank Bill. That was the biggest size issue at the lowest margin we’ve seen for Basel 3 compliant securities. It cashed in on the huge amount of demand from retail investors, but proved to be too big, and too slim, and has never traded at or above its $100 issue price. It got to a low of $85.40 and now trades at $95.60.

CBA Capital Note (CBAPD) – Weekly Chart

This is a convertible preference share, which is the typical sort of Tier 1 security. Its tier 1 because it adds to a banks tier 1 capital. To be considered tier 1 capital, it must be permanent capital, hence the security is convertible to underlying equity if it needs to be. The redemption of recent issues with a cash payment (or option to roll into a new security) suggests banks will more likely than not give you an out as a holder, but they don’t have to. There are conditions built into these securities that allow them to be converted to equity, therefore making the capital permanent.

Firstly, there’s a capital conversion trigger which comes into play if bank capital drops by a significant amount, and secondly, there is a non-viability trigger which the regulator is less descriptive on. The other consideration is around distributions, which are discretionary and non-cumulative, or in other words, they don’t have to be paid, and if they miss they don’t have to make it up. That said, they cannot pay a dividend on the stock if they suspend the dividend on the hybrid .

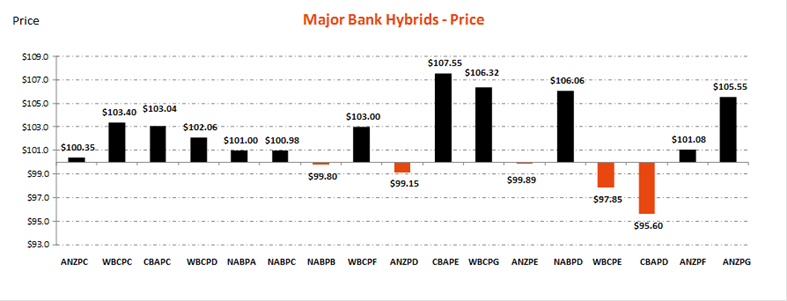

Anyway, we realise it gets a little convoluted here, however we need to be conscious of these aspects. In terms of assessing a Hybrid quickly, look obviously in terms of margin over the bank bill rate while duration is also key. The longer the maturity date, the more risk and the higher the rate should be. Look at its structure. A tier 1 security is higher risk than a tier 2 security (Subordinated Note), given tier 2 securities sit higher in the capital structure, they must be repaid in cash at maturity, distributions are non-discretionary and they are generally more like a bond. They should pay a lower rate of interest as a consequence.

Below is chart from Shaw and Partners covering the major bank Hybrids, their yield to call and Margin over the bank bill rate. On balance, hybrids are less attractive than they were 6-12 months ago, but still reasonable. In terms of securities currently trading, we like ANZPE as a middle of the road bank security, the CBAPD looks like going higher in terms of price, but it does have a longer duration and is a bigger size issue, while the new CBA Hybrid – PERLS 9 (CBAPF) looks good. Challenger Group Financial (CGFPA) has also just issued a note at 4.40% over the 90 day bank bill, and this security looks appealing.

Source; Fixed Income Team – Shaw and Partners

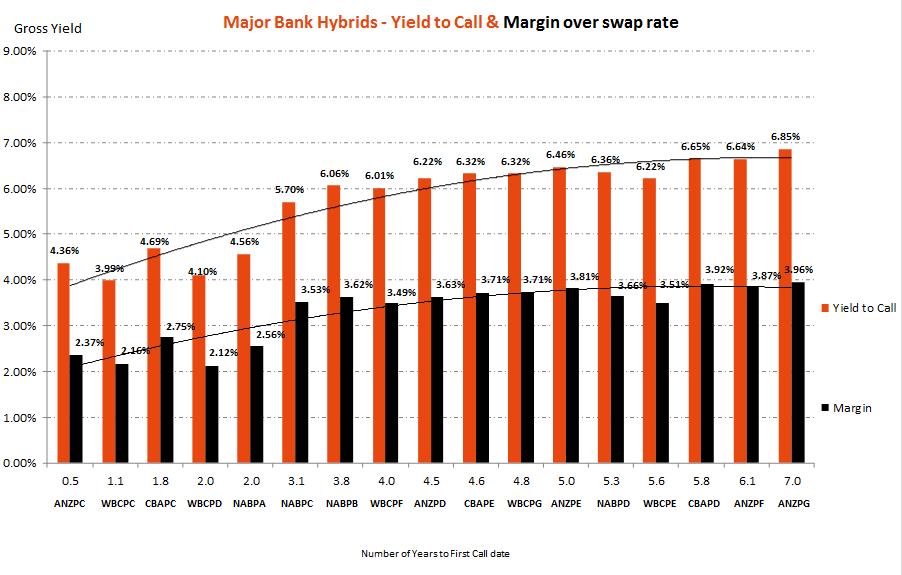

Overnight Market Matters Wrap

- The US markets closed with little change, digesting comments made by US Fed Chairwoman, Janet Yellen.

- Iron ore fell 1% on Friday before the news out of China. Resource stocks are likely to get a boost today as infrastructure spending, business tax cuts and stabilisation were featured in Premier Li’s speech.

- BHP is expected to outperform the broader market today, after closing an equivalent of +1.56% in the US from Australia’s previous close.

- The March SPI Futures is indicating the ASX 200 to open marginally higher, up 12 points above the 5,740 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 02/03/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here