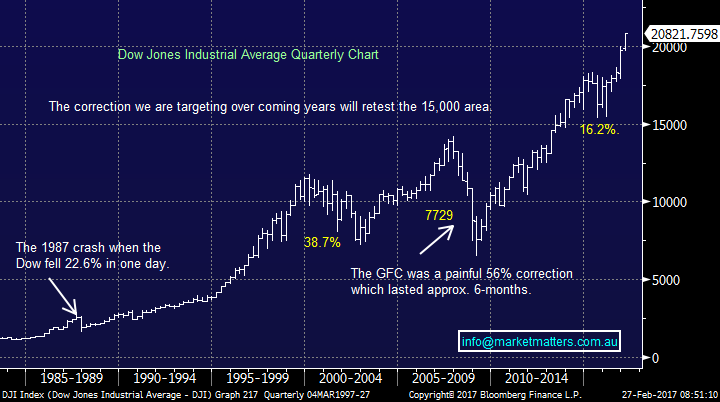

Subscribers questions

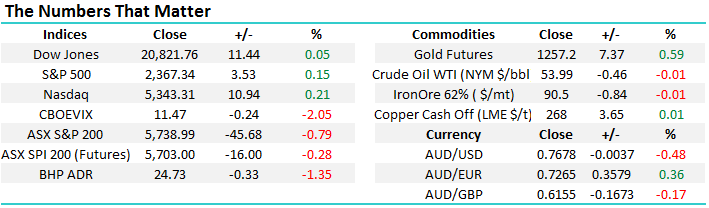

The Dow Jones has now rallied for 10 consecutive days, an advance investors have not enjoyed since 1987 - the infamous year of the stock market crash. This morning we have used this very "scary" event which shook the very foundations of the capitalist world to put the last few decades for share markets into perspective, while importantly casting an eye towards the next few years. When we look at the Dow since the early 1980's, when Australian interest rates (RBA) were well over 10%, a few points catch our eye:

- The 1987 crash (22.6% in one day) has now become an almost unnoticeable blip on the chart and was clearly an excellent buying opportunity - remember “Be Fearful When Others Are Greedy and Greedy When Others Are Fearful” - Warren Buffett.

- The GFC was a significantly larger correction in both time, being over 6-months as opposed to one day, and in magnitude being an almost 56% correction as opposed to the 22.6% one day plunge in the crash.

- There were two other decent pullbacks over these 30 years which catch the eye on the following chart (1) The ~39% fall between 2000 and 2002 (2) The recent 16.2% fall in 2015.

As subscribers know we are forecasting a 25% correction in the coming years to potentially retest the 15300 lows of 2015 for the Dow Jones, this will likely be another relatively minor pullback and a great buying opportunity when we stand back and look at stocks retrospectively from the year 2020! See below the following subscriber question for more details but one of our major goals for the next 2 years is to help our subscribers be flexible and hence be able to buy this correction as opposed to panic selling near a major bottom.

Dow Jones Quarterly Chart

Question 1

"Hi there, I have some questions;

- you have mentioned few times that the market is due for a big correction this year, how big of a correction (%) are you expecting and how soon do you see this happening.

- couple of recent positions from MM like PTM and ALU, HGG and SGR are not doing well, what is your opinions on this and what should we do?

- is MM target value researched carefully??? Eg recommendation for ANZ before was to buy it at $29.1 level but it only went down to $29.2 I think and I didn't buy as I stick to the recommendation, I turned out that I missed a good deal just for 10c difference."

Thanks and regards Tony.

Morning Tony, a large and challenging question but a great one that will hopefully add some value to all subscribers. We have split the question into 3 for obvious reasons:

Part 1

This is obviously the million dollar question Tony and one we are constantly assessing as the US bull market continues to mature. We would highlight 3 things on this subject:

(1) We have nailed the last 3 major swings in the S&P500, both lows around the 1800 area and the top in the 2100 area. Arguably this is our area of strength but importantly our time for a "top" will evolve as this rally unfolds hence "remain flexible" is the phrase we are stating repeatedly.

(2) Our current view is US stocks are likely to rally another ~8% and the ASX200 will break over 6000 later in the year but as said above this will be tweaked moving forward. Markets are fluid and our views should also be fluid.

(3) We believe the pullback will be over 25% when the correction unfolds. This, in the context of our discussions above, will provide a very good buying opportunity for those that remain level headed. Its like anything, if we have a chance to ponder something and prepare for it, if/when it happens it’s not as scary as it otherwise would be, and we have a lot better chance of making smart, rational decisions rather than emotional ones underpinned by panic.

US S&P500 Monthly Chart

Part 2

We have added a quick comment on the 4 stocks you highlighted below but do not think on balance the positions are going too badly. Not everything can be up 10% in one week and just keep rallying like QBE did after we bought it! Incidently, QBE have just reported this morning and it looks like a +10% beat to consensus + a share buyback.

However, you do bring up a relevant point, the most important thing from an investment standpoint is about managing the tough positions, so they are not a significant drag on the good ones,.

Platinum Asset Management (PTM) - We are currently down 4.5% on this position. We like PTM for reasons outlined in the Friday Afternoon Report and the Weekend Report. We may average this position in the very near future.

Altium (ALU) - We are now down 5.5% on this "High Risk" position after showing an excellent profit just before they reported. The report was good but ALU is in the high growth / high valuation basket of stocks that have had a tough year and hence they need to report "great" numbers to maintain share price strength. We remain comfortable at present with the stock but will not add to the position and will potentially sell into strength.

Henderson Group (HGG) - We are currently down 4.2% on this position but remain comfortable targeting well over $4.

Star Entertainment (SGR) - We are currently up almost 5% on this position which is ok in under one month. We remain bullish targeting ~6-8% higher levels.

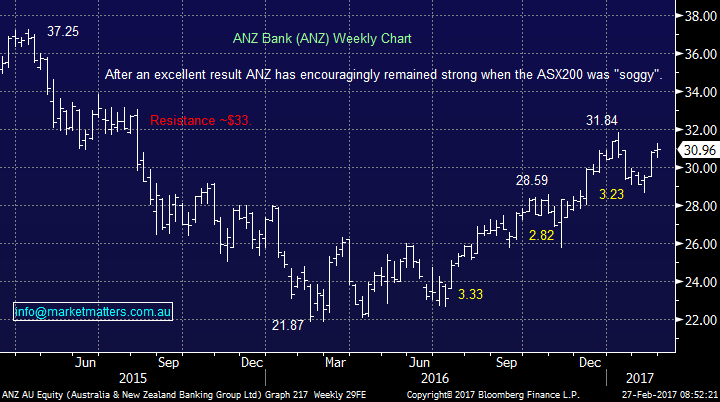

Part 3

We’re a bit confused on this question Tony as we bought ANZ on the 22nd of February at $29.10 and an alert went out to all subscribers, plus the stock actually reached $28.62.Importantly we regularly say our exact levels are often "tweaked" and hence watch for alerts, that’s why we send email and text alerts to all subscribers whenever we transact

ANZ Bank (ANZ) Weekly Chart

Question 2.

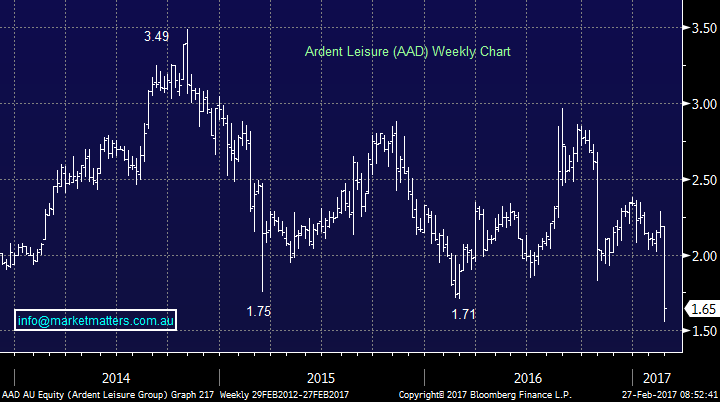

"Hi There, Any comments on AAD. Do you think it's worth buying now or do you think it got more downside risk? Really appreciate if you can advice on this." Regards Lakshan.

Hi There, a very sad story with the awful Dream World accident last year. Obviously, this part of the business has come under pressure and the company was forced to write down the value of these assets. This was not the issue however in the latest update from Ardent last week. The Main Event business which includes bowling alleys / bars / amusements areas in the US is where future growth was coming from, and in the latest update, the trends in this business were weaker than the market thought. Compounding the disappointment was that they only recently updated the market in January and analysts re-based expectations then, on the presumption (fuelled by Managements comments) that conditions would not deteriorate between then and their report last week. They did and the stock was hit hard. It seemed like 1. The result disappointed 2. Investors were annoyed at disclosure 3. It’s now all too hard and better to simply sell the stock.

We have not owned AAD and when it’s trading on 21x FY18 numbers with negative earnings momentum, it’s hard to get excited about it. If you are considering an aggressive trade you could buy now with stops under $1.50 BUT we feel there are far better opportunities elsewhere.

Ardent Leisure (AAD) Weekly Chart

Overnight Market Matters Wrap

- The US share indices gained marginally higher overnight, with the Dow currently up 11 days straight.

- President Trump speaks on Wednesday morning (AEST) and investors will be looking for concrete details on his pro-growth policies.

- Iron ore and oil were both weaker while LME metals and gold (3 ½ month high) were all better.

- As we approach the end of the month, we have GTY, HVN, JHC, LLC, and QBE reporting today.

- A soft open is expected this morning, with the March SPI Futures indicating the ASX 200 to open 5 points lower, testing the 5,730 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/02/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here