Subscriber’s questions

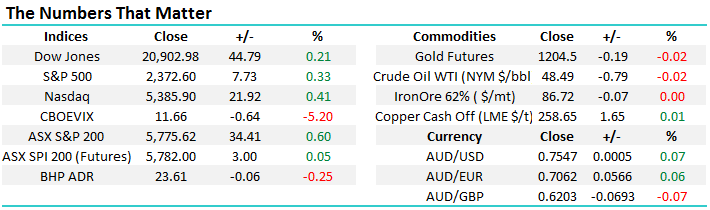

An interesting week ahead with both the overall statistics and seasonality, especially in April, pointing to higher prices. However it feels likely that the outperforming banks will need some help with the heavy lifting. Over the last week alone the banks rallied +2.6% while the Energy Sector was -0.5%, Healthcare -0.1% and the battered Resources Sector was 0.7% weaker. Perhaps some comments from senior officials over the weekend around the Chinese economy improving in 2017 will support these under pressure sectors. Our preferred scenario is the Dow can rally another ~3%, before a decent correction should unfold but the local market has shrugged off any weakness in the US so far in March.

Today's questions are unsurprisingly following MM's investments last week are focused around gold and the $.

ASX200 Seasonality Chart

Question 1

"Dear MM, Can you please advise why Regis Resources (RRL), and not Newcrest (NCM) …. I do not hold gold at present." - Thanks Anne

Good morning Anne, a great question to help us clarify our thought process to subscribers around last week’s transactions. The decision to purchase RRL over NCM was a close one and we simply went for a combination of relative value and "bang for our buck":

1. Since the gold sectors low in December 2016 NCM'smaximum gain was 46.7% and its recent correction has been 13.7%.

2. Over the same period RRL's gain was 58.8% and its recent correction a decent 18.5%.

Firstly, NCM is often Australia's go to gold producer for investors and we believe probably due to this, RRL currently is better value. Secondly as the numbers above show, RRL is slightly more volatile than NCM giving us better bang for our buck, only of course if we are correct! However, the correlation between NCM and RRL is clearly extremely high and if you have a preference for NCM, we would have no issues with purchasing the stock at current levels.

Subscribers should remember that we regard the gold sector as very much an active part of our portfolio as was illustrated by the comfort we had recently taking profit on NCM around the $23.50 area, prior to its recent correction.

Newcrest Mining (NCM) Monthly Chart

Question 2

"Hi there, Just a question, I received and read your emails and saw your alerts on the gold stocks RRL today and EVN a few days ago. I did not buy EVN at $2.95, because gold just seems to be in a downward spiral. With the dollar and the FED likely raising interest rates next week, would that not drive the gold price down further and then dragging the Aussie gold stocks with it? So i guess my question is, should I rather wait until after the FED raises rates and see if gold is in a declared downtrend on a technical and fundamental basis before adding it to my short term portfolio?" Thanks so much, Sharon

Hi Sharon, a great question very much in line with today's theme. The key is to remember markets look at least 6 months ahead, and the $US which has a huge correlation to gold remains down in 2017 i.e. the market is already positioned for the US interest rates to rise, the phrase "buy on rumour, sell on fact" feels appropriate here, this can be applied both ways around. Our view remains that gold can rally back up to the $US1450 area and this current pullback is one to buy. We have held this view / plan for most of 2017, hence we have simply followed our process and bought weakness, now after the purchase of the gold sector it's time to "manage the investment" in case we are wrong.

So in summary, we like gold because we believe the $US will fail in 2017, one of our core views at the start of the year and the Chinese will continue to accumulate gold as method of receiving overseas currency exposure - the average Chinese investor loves both property and gold. The advent of ETF's has produced a significant increase in volatility for many underlying stocks, we believe especially in sector like gold e.g. Gold has fallen 4.7% and NCM 13.7% of the same period.

Gold in $US Monthly Chart

Question 3

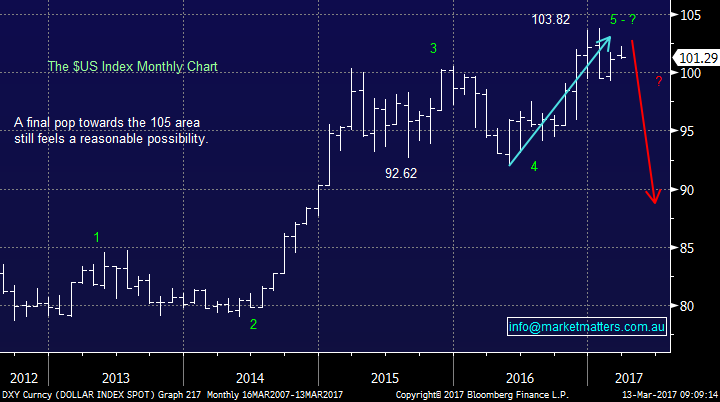

"What is your view on the US$? My view is that the US$ - will go higher. If I am correct can commodities go up at the same time?" - Thanks Michael.

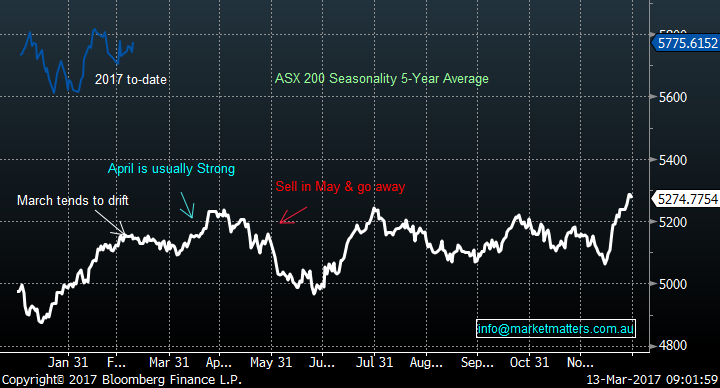

Hi Michael, another thoughtful and macro question, keep them coming. As I mentioned earlier we are bearish the $US for 2017/8, believing the next 10% is down. Short-term it may still have the ability to pop up towards the 105 area on an index level. In a nutshell if we thought the $US went higher as you do, we would not be buying gold stocks and probably not resource ones either.

We have mentioned in previous reports that the standout view from analysts globally is the $US rises in 2017/8, another reason we are comfortable to take the opposite side. Lastly, like all opinions we evaluate constantly and subscribers will hear immediately if we have changed this bearish for the $US view.

$US Index Monthly Chart

Question 4

"Dear Sir, re ANZ, what I ask myself every time, do I wait for the suggested price or do I go in "now" at what is usually a higher price. Maybe it will pull back to the suggested level tomorrow or some later day, but I don't know this. So the question is, do I wait for the price and maybe miss out, or do I pay something over recommended to get in?" Regards, Bob.

Hi Bob, an interesting question that I am sure many subscribers is confronted with daily. My first thought is to consider two phrases from the trading / gambling fraternity - not our ideal place to be quoting but appropriate for this question:

1. "Back the horse, not the price" - no idea who said this.

2. "If you limit your price too much, you will always be set when you are wrong, but often not when you are right". - a Futures trader friend of mine.

If we combine these two thoughts with Baron Rothschild'sreason for his incredible success, of happily buying and selling too early, I think you can see where we are going.

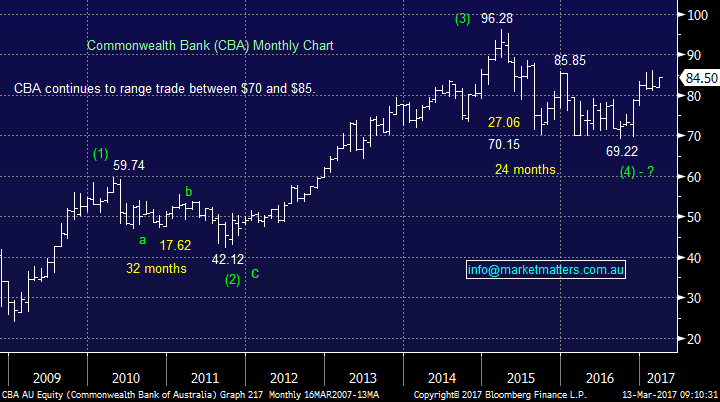

Once we have identified a company we wish to buy on both a company and sector level, we then look at price. Price is clearly very important, even an excellent business like CBA has endured two +25% corrections during this massive bull market since 2008.

Hence if the stock in question is close to your perceived value we would suggest buying 50% immediately and then applying two triggers to accumulate the next half, either further weakness to your ideal level or into strength if the stocks starts to rally.

Commonwealth Bank (CBA) Monthly Chart

Overnight Market Matters Wrap

- The US markets closed lower overnight, as the probability of an interest rate increase this month grew close to 100% with the REITs being the laggard.

- US February’s jobs report showed continued strength in the economy and all but assures the Fed will increase rates this week. Current probability is 100%.

- Oil prices continue to drift lower as US stockpiles rise, while iron ore also continues to slip. On the LME, copper and aluminium rose, while nickel fell 2.5%

- BHP in the US closed an equivalent, -0.25% to $23.61 from Australia’s previous close, however we see some strength in the major miners today, as Labor takes reigns in WA and will not follow through with the previous government’s proposed $5/t tax hike.

- The ASX 200 is expected to open marginally higher, towards the 5,785 level, as indicated by the March SPI Futures this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/03/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here