Subscribers questions

Morning everybody, after a relatively quiet start to the year we feel the markets are likely to become more active this week. The British Pound has opened down ~1.6% this morning due to comments in the UK's Telegraph around Theresa May's "strong" plans for BREXIT, initial movements by the FTSE should be interesting today. After 5 weeks of sideways choppy price action by the S&P500 it's not a "big call" to anticipate some movement its simply statistically due.

Today we received some great questions and really appreciate the initial interaction from subscribers at the start of 2017, let's make it a great year!

US S&P500 Daily Chart

Question 1

"If you are buying the call option in Feb and selling the Feb call option does this mean you do not necessarily need to own the stock as security in case of large price movements?" Peter

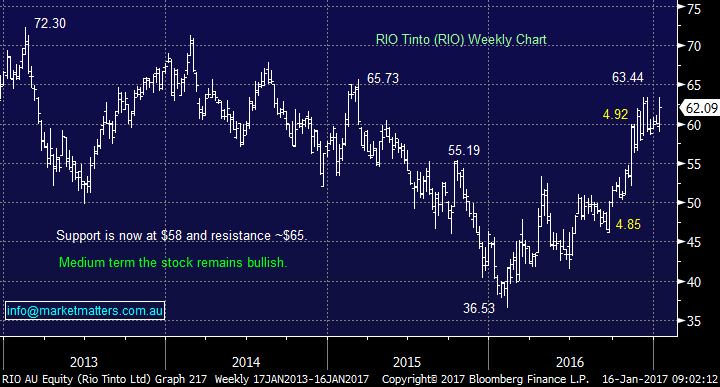

Good morning Peter, an ideal question following the bullish position we initiated on the 11th in RIO, by buying the February 61 call and selling the $66 call for $2.24.

A few important / relevant points from buying the call spread that hopefully will create some clarity:

- You’re correct, we do not need to own the stock to make a profit from a decent rally in RIO.

- However, if RIO rallies significantly past our $65 price target we would have been better off just buying the $61 call outright and not selling the $66 call.

- Conversely if RIO does nothing, or falls, we are better having sold the $66 call and will lose less.

- We chose to add the $66 call to the trade because we are targeting only a short spike towards $65 and arrived " late to the party".

- The benefit of an options trade is two-fold. 1. Less capital is required & 2. The downside is limited to the amount you spend on the initial position.

RIO Tinto (RIO) Weekly Chart

Question 2

"I know the banks have made their charge and regrettably I reduced my ANZ holdings late last year after a nice recovery. That said I have attached an old article from a research team suggesting there is more room for upside in ANZ relative to their peers. Your thoughts?" - Peter (again)

Hi Peter, Thanks for a couple of questions which resonate with so many subscribers, I hope people understand when we have answered 2 of your questions on one day! We are going to change the emphasis on the question because it's not professional for us to publish a brokers report and then potentially disagree with it, I trust this is ok Peter.

Firstly let's look at the banking sector overall which we became very bullish after Donald Trump's victory in November. The banking index has enjoyed a 20% positive swing up in only 3-months, hence a pullback feel’s close at hand and Fridays 1.6% fall in the sector illustrated its short-term vulnerability perfectly.

We sold our Westpac a touch early ~$33 as planned as we believe on a relative value basis the banks are a touch rich but WBC then rose another dollar over $34 so we know how you feel selling early.

ANZ, BEN and NAB are all up around 20% over the last years trading with only Bank of Queensland being negative (-6.5%) but over the last month they have all rallied between 2 and 6%. We are buyers of a selloff in the banking sector but not at current levels and infact we are looking to sell our Macquarie position into strength.

We will evaluate all the banks at the time if we get a pullback but CBA / BEN with dividends looming will clearly be tempting. In terms of Broker Reports, although they can be very beneficial in terms of overall themes and financial data, from experience, timing is not generally a strong point. This is where MM adds real value. We read a lot of broker reports, filter the information, apply our own views on the particular stock / sector / market, and look to time entry through technical indicators.

ASX200 Banking Index Monthly Chart

Question 3

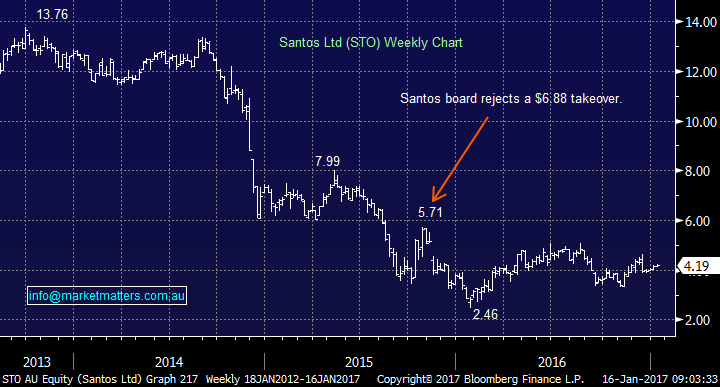

"Hi team, I have a question about the participation in the Santos Capital Raising. The raising closes on the 31st January and currently the shares are trading at circa $4.22 whilst the buy price under the raising is either $4.06 or 2% discount on the weighted average price during the trading period. Whilst I see you're not great fans of the management of Santos or the raising itself, do you think it is worth taking up for a short term profit or are the shares likely to drop significantly once the allocations have been made. Would appreciate your thoughts, Thanks" - Jon

Morning Jon, you are right we have not been fans of STO management in the past but we must all remain open-minded to the future. Firstly we cannot give Personal Advice so we will look at STO in general terms.

We took an excellent profit on our Origin holding last week, a company we prefer to STO, as the stock reached our profit target area. Hence our answers are fairly easy:

- We are not buyers of STO / the energy sector at current levels as an investment.

- From a trading perspective we would wait until the last moment and make a decision then, a lot can happen to the oil price in 2 weeks.

- In terms of price, the pricing period is from Tuesday 24th January to Tuesday 31st January, at an Issue Price which is the lesser of $4.06, which is the price at which Placement Shares were issued to institutions or a 2% discount to the Volume Weighted Average Price during the pricing period. In other words, if we assume the average price for the period is Friday’s close ($4.19) shares would be issued at $4.10 under the SPP. If however Santos drops and the average price is $4.00 during the period, the price available under the SPP will be $3.92 (i.e a 2% discount applied to $4.00)

- In our experience, a 2% discount is not enough for us to take the risk of buying stock that will take time to be issued. We like being nimble (and liquid) particularly in a stock like Santos.

Santos (STO) Weekly Chart

Question 4

"Good morning, Welcome back for another year, looking forward to the reports starting up again. Just wondering if you could help with a quick query to kick off the year? Question is two parts about the same thing: - Are BetaShare Bear Hedge Funds (like BEAR or BBOZ) safe to buy as a fund (ie. how likely are they to disappear/go broke)? - If/when the large correction MM anticipates begins to take place, are these funds something you would consider buying into? Appreciate any feedback on the above. Thanks" - Leigh

Hi Leigh, another great question that is likely become very topical as we become bearish and one we will be discussing in more depth in the future. Simply the BEAR / BBOZ funds go up as the market goes down and is a product we will likely use.

In terms of safety, if Betashares were to ‘disappear / go broke’ as you have queried, in theory nothing dramatic should happen. The assets that underpin the fund are held by a custodian so are segregated to the actual provider. A company like Betashares would not take on a lot of financial risk so are unlikely to find themselves in difficulty due to market swings – they simply create and market the product and have assets underpinning it held by a custodian. This creates the next obvious question of, what happens if the custodian fails? Under regulation custodians have to segregate assets so they are ring fenced from their normal operations, and therefore should be safe.

The other obvious safeguard is that Betashares is an ASX listed product, that sits on an individual investors HIN. In short, we are comfortable with the safe guards in place.

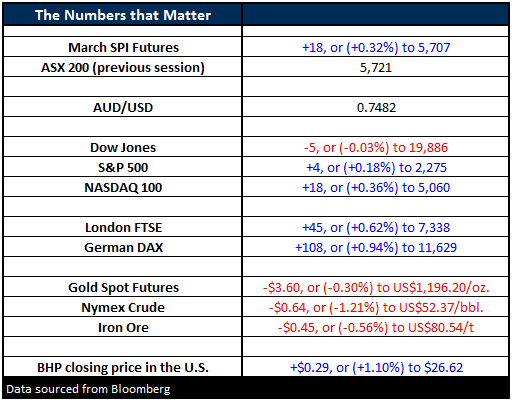

Overnight Market Matters Wrap

- The US earnings kicked off on Friday, with some financials reporting a positive Q416. The share markets however, closed mixed, with little change.

- The Dow lost 5 points to 19,886, while the broader S&P 500 edged 4 points higher to 2,275.

- Iron Ore rallied 4.93% higher, assisting BHP in the US to close an equivalent of 1.11% higher at $26.63 from Australia’s previous close.

- A quiet session is expected in the ASX 200 today given the US is closed tonight, but with a positive bias, with the index expected to open ~34 points higher, towards the 5,755 level as indicated by the March SPI Futures this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/01/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here