Subscriber Questions

The G20 dominated news flow over the weekend, however not a lot to drive markets overall – which is fairly typical. Some positive news for Australian Steel and Aluminium producers which are set to be exempt from US Import Tariffs in a deal apparently agreed to on the sidelines of chinwag. Most focus will continue to be on global bond markets with the US 10 year yield settling around 2.39% on Friday, however it’s not just relevant to the U.S, interest rates globally are heading up and this impacts asset prices across the board.

In terms of trade this week, the ASX 200 needs to hold above Fridays low of 5676 to remain neutral/positive in July, while a break back up above 5750 would get us more bullish. For now, we continue to target a move back above 5900 in July however keeping an open mind continues to remains key.

In terms of our lead this morning, SPI Futures are up +10pts with Tech, Financials, and Materials doing well in the US which should provide a reasonably positive undertone for our market today.

ASX200 Daily Chart

Question 1

Good morning James and MM Team, Wanting to follow-on from the topic of NCM from the webinar broadcast from last week with spot gold likely to test the $1,200/ounce level. I understand the initial investment in NCM was around $24 back in April this year, whether the key $1,200/ounce level will likely to hold or not, I guess NCM will dip towards $18.00 - $19.00 and would MM average down around this level. If MM view is that the $USD have topped out for 2017, then spot gold along with other commodities will likely to be supported. What’s MM medium view on gold given Mr Trump still have a lot of promises to deliver plus geopolitical tensions have not eased since 6 months ago and will likely to persist well into 2018. From a technical point of view, do MM see NCM falling towards the lows of $16 which was December 2016 shortly after Mr Trump took the White House and started this inflationary tone – I would like to get your overall thoughts on this – thanks. Regards, Tianlei

Thanks Tienlei – Gold is clearly interesting at the moment and was down another ~$13 on Friday night to settle around ~$US1209. From memory, the price was around $US1250 at the time of the webinar. There are a number of conflicting aspects to Gold at the moment. The $US has been tracking lower which all things being equal is good for Gold, however Global Interest Rates are having more of an impact at the moment. Gold pays you nothing to hold so carries a high ‘opportunity cost’.

When interest rates are very low then that opportunity cost is lower. For example, at the low point in interest rates you could buy a 10 year bond in the US that pays you 1.30%, so the margin over Gold was low, therefore Gold is more appealing in a relative sense. As interest rates move up, then the margin gets more and you start to question ‘ do I really need to hold Gold?’ You hold Gold as a hedge against a few different things, mostly bad things and that’s why we’ve got a small position in it, however fund managers at the moment have high cash levels relative to history and therefore it seems they have less desire to hold Gold.

We actually think a spike below $US1200 becomes the time to add to our NCM holding and in terms of the stock, that likely makes it around $18.

Gold Weekly Chart

Newcrest Mining Weekly Chart

Question 2

Good Morning Team – I’m a new subscriber and really enjoy the insight so far - does Market Matters manage money for individuals and if so can you give some information on this around, costs / performance if you can. Thanks Lloyd

Morning Lloyd, glad to have you on board. We manage our own money in the Market Matters portfolio however we don’t do this for individuals through the Market Matters business. I’m the Primary Contributor to Market Matters (James Gerrish) and I operate within Shaw and Partners – a large wealth management firm with offices around the country. We do manage money for individuals through Shaw (not Market Matters). For full disclosure, I am a major shareholder of Market Matters and Shaw also owns shares in Market Matters.

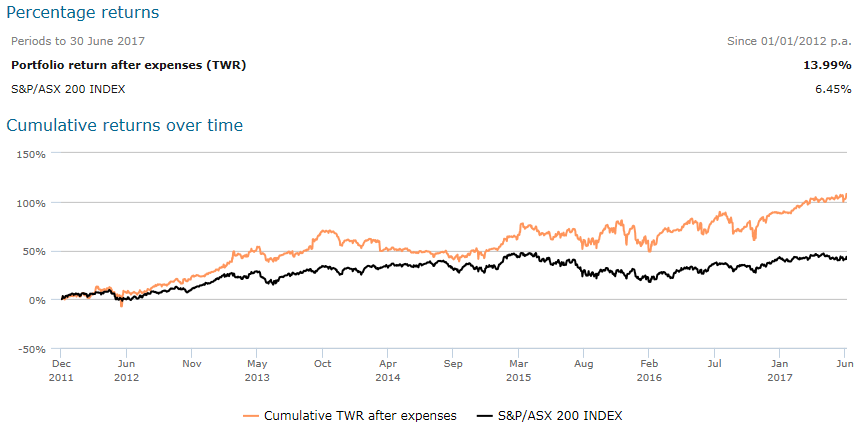

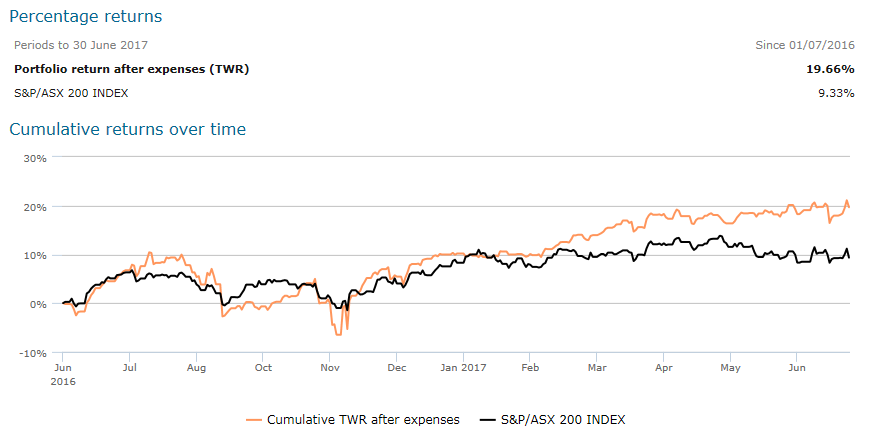

My team and I within Shaw primarily operate Managed Accounts where an individual investor would open an account through Shaw, in their own name or an entity they operate, and the portfolio would be managed on their behalf taking into consideration that particular investors personal circumstances. Quite a number of Market Matters Subscribers have accounts with me & my team at Shaw and have done so for many years. Below is some performance stats of a current Market Matters subscriber that has an account with us at Shaw. This particular portfolio was included given the time it has been operated (greater than 5 years). Longer term performance is more relevant than shorter term performance.

Please note, and we do stress this, that past performance is not a reliable indicator of future performance & importantly, each portfolio is managed individually and returns will vary between portfolios. This particular portfolio holds equities and also sells options to generate additional income. The returns are after fees. Fees are dependent on the amount of money invested. For more information on minimum investments, applicable fees and the nuts and bolts of the service, please get in touch.

Annual performance since January 2012

Performance FY17

Question 3

Hi Guys, I have a holding of HVST (Beta Harvester Fund) in my SMSF. I would be interested in your opinion of this fund. It is paying ~11% Monthly with Franking Credits. My understanding is that they use Dividend Stripping of many of the top company's on ASX. Depending on when they sell the shares could this not lead to a capitol loss compared to the Dividend if done over a period of time? Is this type of investment to good to be true, or is it sustainable in your opinion? I see you are going to include an Income Report soon. Maybe you could look at some Hybrids, I know James Gerrish has covered them in the past. Regards, Michael.

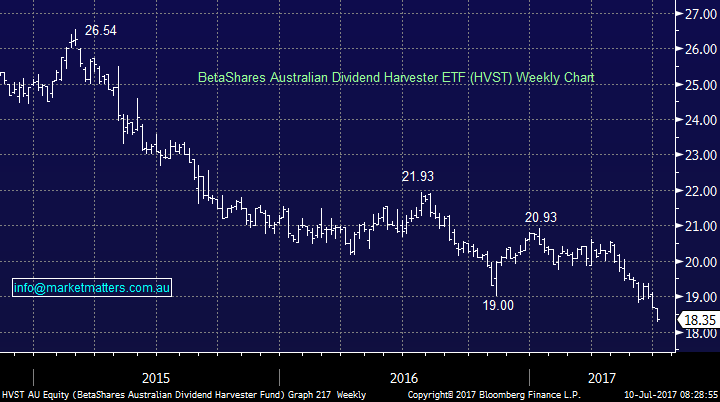

Hi Michael – to be fair to Beta Shares, they have a lot of good products and they’re a well-run operation, however this (to us) is not one of them. 11% pa paid quarterly is attractive however not if your capital is going backwards. You’re right in terms of dividend stripping however they also have a hedging component to it (which we haven’t looked at in depth) however the chart below we think tells the story.

Betashares Australian Dividend Harverster (HVST) Weekly Chart

Simply buying things for dividends is a flawed strategy in our view. The chart above does not include dividends so downplays the actual performance however when we add back in dividends and the franking benefits the overall performance of the fund is +0.06% since inception inclusive of all dividends and franking (as at June 30 2017). From what we can see, it started in October 2014. So in short, no, this is not too good to be true.

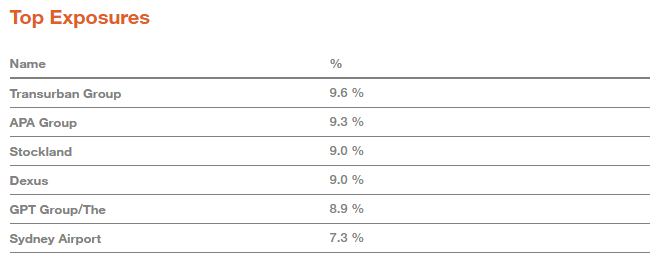

Here are their top 6 holdings – all in companies that we feel have big headwinds at the moment – for us, our focus is about total return, not just dividends and being in the right sectors at the right times.

Question 4

Hi, Is this alert for the new Income Portfolio? The alert is not clear. Thanks Denis

Sorry Denis – we like to be clear in our communications and obviously we were not in this instance. Going forward we will make it clear what portfolio each recommendation falls into. In terms of the new Income portfolio, subscribers receive an email alert when an amendment to the portfolio happens, but not an SMS.

Question 5

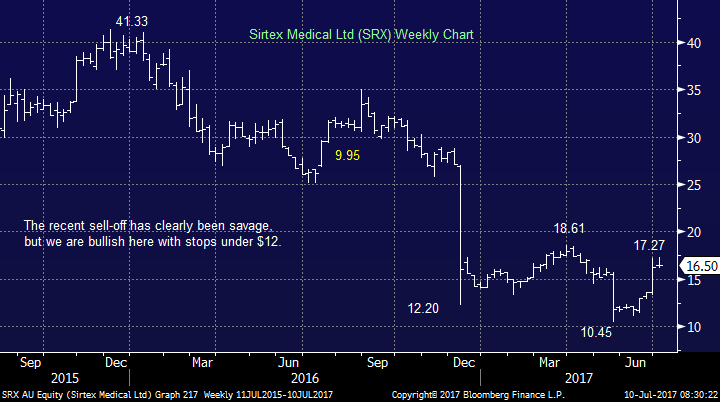

Hi MM team, Thank you for all you advice knowledge and information. Recently I brought 900 SRX 11.832 currently 16.840 and not that long ago I also brought 1500 BLA at 6.891 currently 9.540.You valuable opinion Sell or Hold ? Once again Thanks Paul

Hi Paul – Glad you got on Sirtex and BLA has also been good to you. Our target on SRX is $18 and in terms of Blue Sky Alternative (BLA), this is the holding company of four dedicated alternative investment fund managers in Australia. The investment offers across four alternative asset classes: private equity and venture capital, private real estate, hedge funds, and real assets. We’ve met these guys on numerous occasions and they run a very good operation. Investing in the actual operating company that earns the fees from the actual investment companies we think is a better way to go (which you have done), although the stock is now on a forecast P/E of 24.5 times and a 2.4% yield. Suffice to say, a lot of ‘Blue Sky’ is clearly priced in. Technically the trend remains strong so following with a stop loss makes sense – positioned below $9.20.

Sirtex (SRX) Weekly Chart

Blue Sky Alternative (BLA) Weekly Chart

Question 6

On 30 May I attended the seminar at the Four Seasons. Very informative My understanding was that the presentations would be made available Can you please advise the if that is the case? Regards Lester

Hi Lester – CLICK HERE to view an unedited copy of the presentations.

Conclusion (s)

July has started ‘flat’ however the seasonality suggests we should retain a positive stance until proven otherwise.

We will look to average Newcrest (NCM) into further weakness

We are watching BT Investments (BTT) closely today **Watch for Alerts**

Overnight Market Matters Wrap

· The US Equity markets ended on a positive note last Friday, after a better than expected non-farm payroll numbers. This data is a leading indicator of consumer spending which narrates the overall health of economy.

· The volatility (fear) index, continues to settle at ultra-low levels, down 10.77% as nerves have calmed after worries of US rates rising at a faster than desired rate.

· Plenty of activity is expected to be seen in the Iron Ore names particularly BHP, after ending its US session down an equivalent of -0.39% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 11 points higher, towards the 5715 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/07/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here