Subscriber Questions (GXY, ORE, Z1P, HVST)

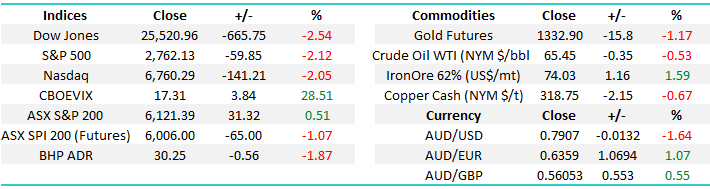

This morning will be fascinating as the ASX200 opens after having time to digest / fret about the 665-point plunge on Wall Street – interestingly the 1987 Crash / Black Monday was only 508-points but back then it amounted to 22.6%, not the relatively meagre 2.5% of Friday night. The local SPI futures are pointing to a ~1% decline early this morning, led by BHP which was down close to 2% in the US.

Subscribers know we are wearing our “buyers hat” hence we see this decline as a potentially excellent short-term opportunity, cash is king when these moves occur and the main reason we regularly advocate a decent cash holding is to give us flexibility. The Weekend Report outlined some of our targeted stocks / buy zones but keep your phones close to hand as we anticipate a few alerts are in the offing.

- Our “Gut Feel” at MM remains the ASX200 will reach the 5925-5950 support area in the next 1-2 weeks for a short-term buying opportunity at an index level.

ASX200 Daily Chart

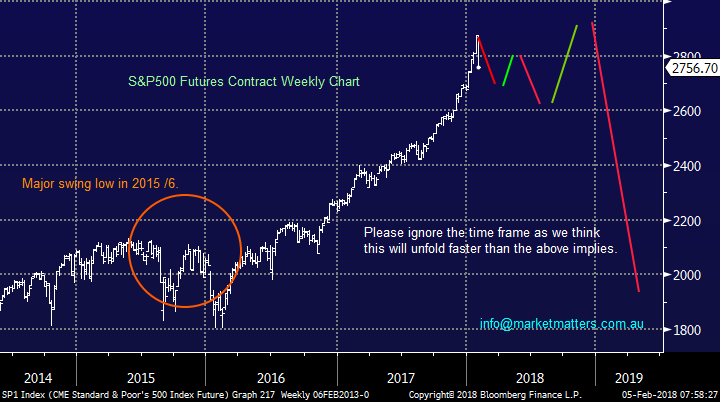

The US S&P500 is looking likely to end its longest run in history without a 5% correction, below we have outlined how we currently see US stocks evolving in the coming weeks / months – importantly note the ASX200 is certainly doing its own thing to a large degree.

The standouts to us from the following 2 charts:

- We are looking for the US S&P500 to correct another say 4% during February.

- We believe this is the “Warning Shot” for stocks that we have discussed a number of times over recent months for a short-term buying opportunity.

- We still see fresh highs from US stocks, potentially into the dangerous April / May timeframe where we are likely to become aggressive sellers.

- We still anticipate holding a significant cash position / bearish positions at least once in 2018.

- The German DAX has been following our anticipated path nicely in 2017/8 and this index still looks likely to fall another ~6%.

- The combination of these 5 points explains our current buying preference but with patience, plus our likely very large cash holding, defensive position, or even bearish play via ETF’s later in the year.

Obviously we cannot see into the future but the below is based a combination of history & market statistics - until the market deviates from this path, which it eventually will, we will use this roadmap to determine our equity / sector holdings moving forward.

US S&P500 Weekly Chart

German DAX Weekly Chart

This week we have again received an excellent group of questions with the vast majority around what to do this morning / moving forward which has been covered above at length over the weekend and again this morning

We’ve answered 3 others in this morning’s report.

Question 1

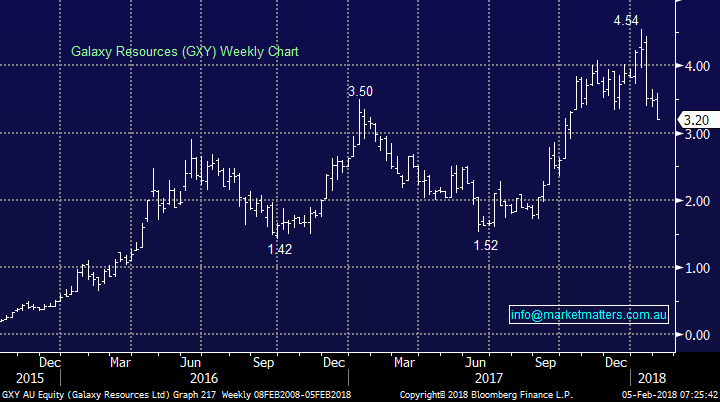

“Hi James, Hi, I own GXY and noticed it broke support on Friday’s close. Would appreciate your thoughts on this stock.” - Thanks, Peter T.

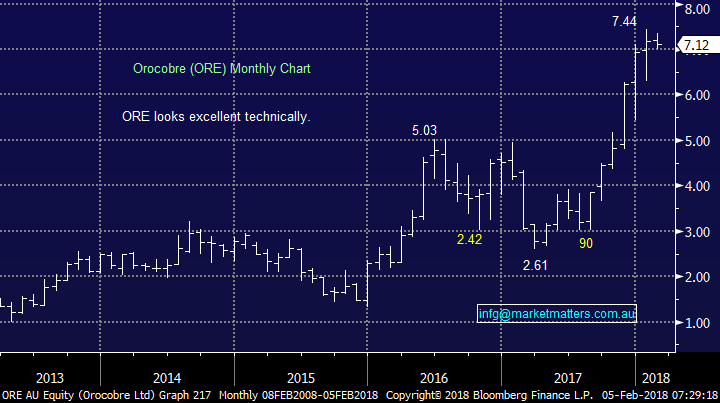

Morning Peter, as you know we have been investing in the lithium space over recent times, enjoying an excellent win in Orocobre (ORE) and currently holding Kidman Resources (KDR) which is showing a very small profit before today’s trade.

The weakness in lithium stocks at the end of last week looks likely to continue at least short-term and we can see MM again buying ORE under $6.50, close to 10% lower.

However if this unfolds we could easily see the more volatile GXY close to $2.50. Overall we like lithium but prefer ORE and KDR.

Galaxy Resources (GXY) Weekly Chart

Orocobre (ORE) Monthly Chart

Question 2

“We bought Zip Co (Z1P.ax) when you did, and it is up 28% since then. A great example of effective MM trading help, as this trade alone has paid my annual membership fee. Their current goal appears to be cashflow break-even each month in Fy18. However we look forward to hearing more details regarding why you purchased it, how their integrated Retail Finance solutions avoids the risks and actually makes money. What future growth might there be? Do you have a target sell value or are you a longer term investor? Their website is http://zipmoneylimited.com.au/company.html” - Regards and thanks Phil B.

Hi Phil, We unfortunately did not get filled given the stock did not trade at / below our 84c limit price following the alert – we eat our own cooking and in that instance we slightly missed the mark!

Back to your question: in the short-term we still think Z1P is a trading buy around $1.15 but are currently targeting the $1.45 area which will have a lot of good news built into the stock price. From this area 3-6 months consolidation feels likely as investors wait for confirmation on the company’s performance. Potentially a good place to at least take some money from the table.

ZIP Co Ltd (Z1P) Weekly Chart

Question 3

“Hi Leonard. I think HVST is an ETF listed on the ASX. The share price dropped $5000 since October of last year . Wander what might the reason be? I am on the lookout for dividend generating share on the ASX . Does MM possess such a list in its library?” - Thanks Siak Q.

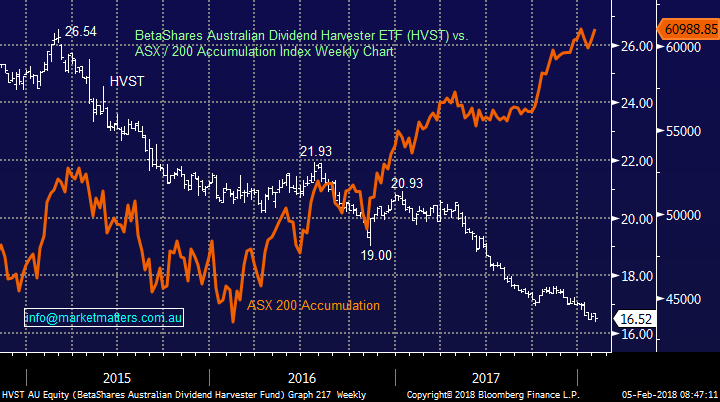

Hi Siak, thanks for the question, a product we have discussed in the past with the conclusion that we have no interest in buying / holding HVST. While we think Betashares has some very good funds, this is not one of them. In terms of its composition, it essentially strips dividends from high yielding equities, holding them before they go ex-dividend and selling them soon after. Because of this, the product has a very high dividend yield, paid monthly however by definition they are often selling when stocks are down (post dividend) and the capital struggles. If dividends are reinvested the performance is not as poor however the idea of the product is to provide regular income.

HVST versus the ASX 200 Accumulation Index

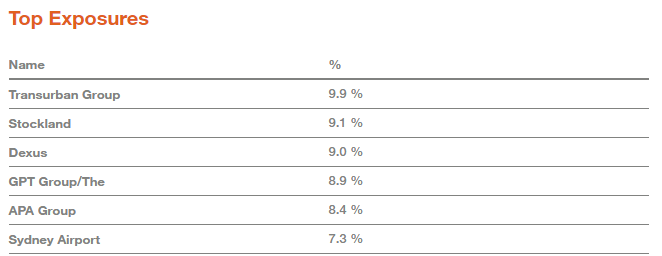

Looking at their top holdings currently tells an interesting story – all held for income without consideration for external factors influencing the share price – from our perspective, we would not hold any of these stocks at this point in time. Really, this is a very good example of why, simply investing for income / dividends can be a false economy. We have no interest in HVST.

Conclusion (s)

We are adding to our existing position in CBA this morning, up-weighting by 2% below $80 this morning – watch for alerts.

While this weakness may have further to play out, we will use it to buy stocks, with our downside target on the ASX 200 ~5950

Overnight Market Matters Wrap

· The global markets sold off aggressively last Friday, with the US majors off over 2% as investors come to realisation of an interest rate increase cycle. The overall consensus reveals an anticipated increase US rate rise next month, followed by another 2 to 3 this year.

· US bond yields rose as a result, and are now on par with Australian bonds. Most pundits are expecting a rate rise in the US next month, followed by 2 or 3 more this year.

· Most metals on the LME fell, with nickel down 4%. Oil and gold fell while iron ore rose 2%.

· The ASX 200 is expected to follow the US performance last Friday, with the March SPI Futures indicating a soft open towards the 6065 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 5/2/2018. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here