Subscriber questions for today

Only a month out from the US election and it feels like Donald Trump has already ended his own chances. Offending a massive proportion of the population cannot be good news for his chances in what was being touted as a close election. While there probably are a few more twists in the tail the recent events do feel terminal and markets will probably switch 100% of their focus to other factors over coming weeks.

The simple question remains can the S&P500 push away from the 2150 area that's been holding the market for around a year.

US S&P500 Monthly Chart

Question 1

"Hi Market Matters, I have been following your reports with interest. One observation, my past experience is that October is the Australian equity market worst performing month for 7 out of every 10 years, over the long term, and granted we did have a 10% rise in October a few years ago, as you mentioned, although that year did not follow a normal cycle and from memory had a very poor August /sept. I’m expecting a volatile and negative October, and agree always difficult to predict. Your comments" - Brendan

Morning Brendan, a good and obviously very topical question given we’re at the start of October.

We've often pointed out that people can play with statistics to fit their view e.g. for the US S&P500 October is usually a positive month gaining on average 0.8% but it's hard to forget the historical years of 1987 and 2008. As we have pointed out previously November in an election year is usually very strong. However, unfortunately for many years the ASX200 has found ways to fall while US indices rallied.

More importantly with regard to our local market you have pointed out October having a poor performance 70% of the time over the last decade whereas we have been focusing on the local banking sector having an excellent October over the last 5-years - in theory, we both could be on the money. What we see as important for our market over the next few weeks:

1. We continue to be positive the banking sector as it rallies from a very oversold position.

2. After a 300-point rally over recent weeks a pullback towards the 5375-5400 area would fit technically.

3. There are enough sectors of our market under pressure that could easily offset a positive banking sector.

4. Overall the ASX200 feels fully valued.

5. There is no reason to believe that the recent choppy price action will change even as the US election starts to look more one-sided.

We write a lot about the market in general, and expectations around it’s direction, however, the market is made up of many different sectors, and as we’ve written about in recent weeks, being in the right sectors at the right times is obviously very important. For instance, last week saw the banking sector up +1.4%, Financials +2%, Energy +4.6% but Real Estate was -4.1%, Telco's -6.3% and gold stocks were hammered while the market overall was up +0.6%. So in our view, looking at seasonals relative to sectors holds more weight than looking at seasonals on the market in general.

ASX200 Daily Chart

Question 2

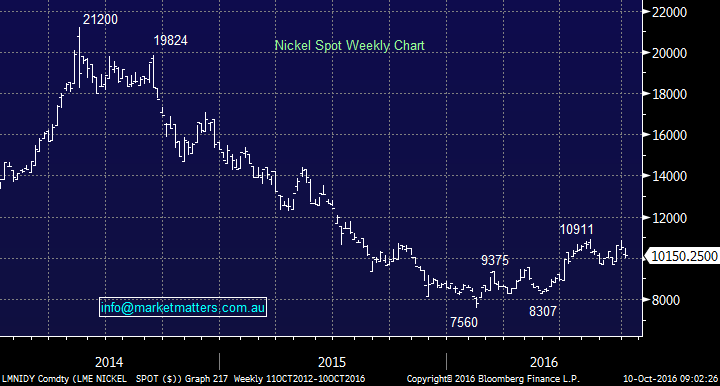

"What is your views on the Nickel market ? I know you have an interest in IGO. What about some of the others, Western Area and Axiom?" Thanks. Rob

Hi Rob, our ride with IGO has been a volatile one as the stock swings around on both the Nickel and gold prices, this volatility is typical of this space.

Supply issues out of the Philippines has driven the recovery in the base metal and many economists are now forecasting supply shortages moving forward - we have to ask ourselves now, how much of this news is built into the price. Over the weekend more news flowed from the Philippines with the new President aggressively fighting the countries drug issues - another 3700 dead. This is likely to be short-term bullish for Nickel.

We are looking to take profits in IGO shortly which I guess says it all, time to take some money off the Nickel table in our view.

Nickel Spot Price Weekly Chart

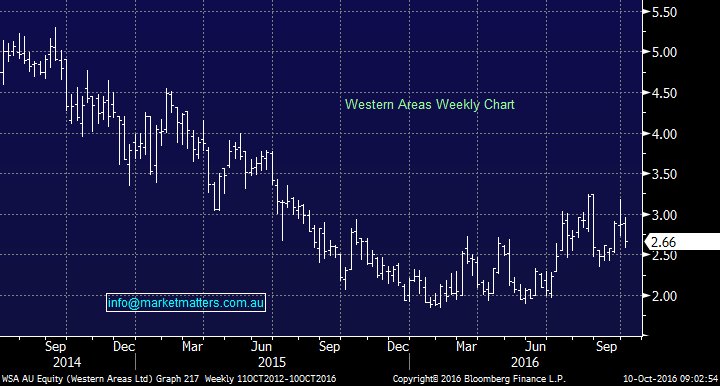

Western Areas (WSA) follows the Nickel price almost tick for tick which makes sense as it's a purer play than IGO and is producing more from mature operations. To buy WSA is simply to buy Nickel after it’s bounced a long way already.

Western Areas (WSA) Weekly Chart

Question 3

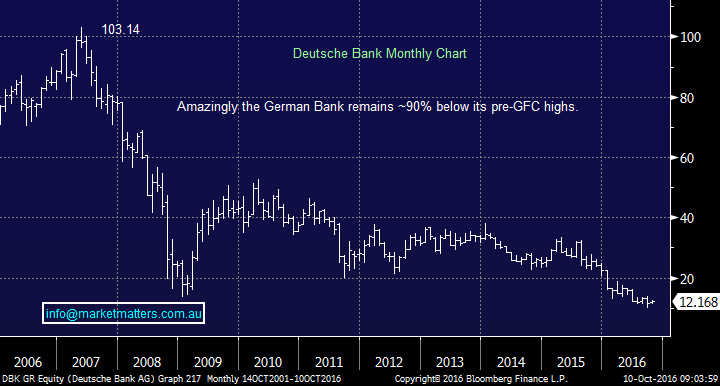

"Just a question on DB for possible Monday questions. Its seems that there was a major set up trade in DB that I missed. The shares closed up 14% on Friday on rumours of a settlement with US Gov of 5.4 B instead of 14B. The setup for a short squeeze was; 1. Huge short positions be Hedge Funds. 2. Capitulation of share price last week. 3. Media comparing it to Lehman collapse. 4. Market over pricing for banking crisis. What are MM views?" – Mark

Morning Mark, we have touched on this a few times but thought today would be an ideal opportunity to clarify our view.

1. Firstly, news in a large German paper over the weekend has now said the rumoured US Gov deal has not in fact been achieved, however offsetting that DB did get away a debt deal for $3bn priced at 3.25% over swap, which is a good result as is not reflective of a corporate about to go to the wall!

2. We believe that European banks, including, Deutsche Bank, will have a decent bounce from current levels - Deutsche Bank has bounced 20% from its lows over the last 2 weeks.

3. Hence if DB falls tonight we believe it is a good trading buy looking for at least 25% return - note this is aggressive trading.

4. Overall we do not believe that Germany can let DB fail and a deal will be done with the US Govt.

In conclusion, we are aggressive buyers of DB, as you mentioned short covering will likely help this rally and rumours will continue to filter through.

Deutsche Bank Monthly Chart

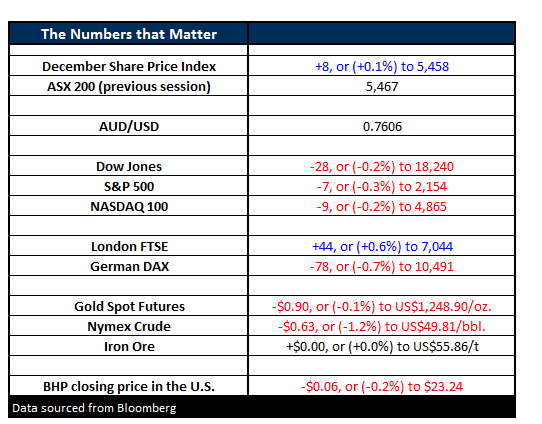

Overnight Market Matters Wrap

- The Dow closed lower on Friday, down 28 points (-0.2%) to 18,240 whilst the S&P500 closed down 7 points (-0.3%) to 2,154. For the week the Dow broke a three-week winning streak, finishing down just 68 points (-0.4%) and the S&P500 closed slightly weaker for the week, down 15 points (-0.7%).

- The highly anticipated monthly jobs number came in slightly under what was estimated at 156,000 jobs added. The market consensus was for an addition of 176,000.

- Oil fell on Friday more than 1% after seeing the price rally nearly 15% over the last four months. There was also the worry of more oil rigs starting up in the US as prices headed towards US$50/bbl. Crude finished down 63c (-1.2%) to US$49.81/bbl.

- The December SPI Futures is indicating the ASX 200 to open marginally higher this morning, testing the 5,479 area.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/10/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here