Subscriber questions; Capilano (CZZ), Banks, Regis Resources (RRL)

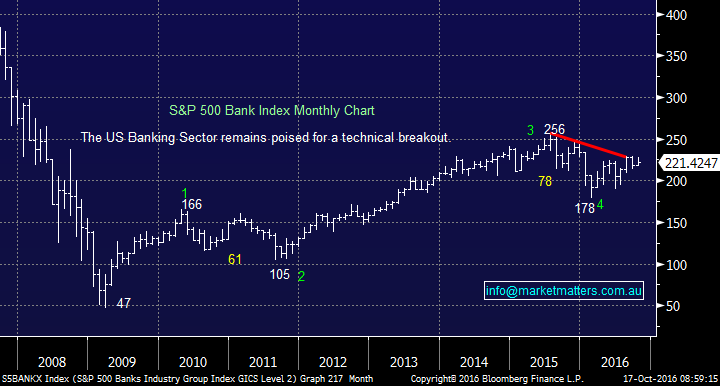

Last week ended in the same quiet manner as the previous few weeks. The market is showing a frustrating inability to rally on good news, or fall on bad news, for more than a few hours. On Friday, 3 of the largest US banks beat estimates - JP Morgan, Citigroup and Wells Fargo. While the US banking Index closed up an ok 0.49% for the day overall it was a disappointing session with the Dow closing up 39-points, well below its up 160-ponts intra-day high.

We have said in the past when a market cannot rally on good news it's time to be cautious, however, with a looming US election its very typical that US stocks are basically hibernating. Hence we remain patient and open-minded with a positive bias.

We are still comfortable with our short-term preference for banking stocks in the current strong seasonal period but selling into strength is not far from our minds e.g. CBA's average gain in October over the last 5-years is 6.6%, so far this October it's up 3% .

US S&P500 Banking Index Monthly Chart

Question 1

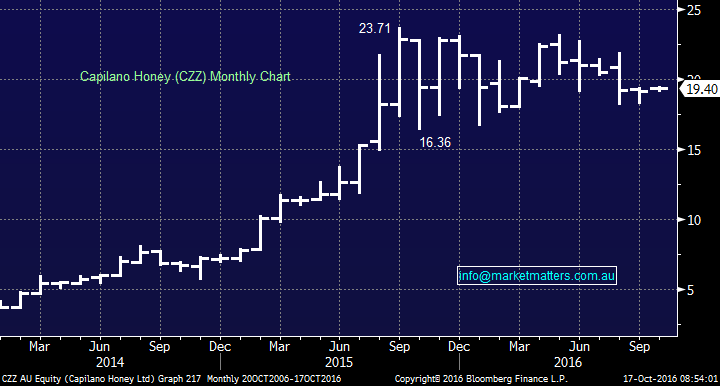

"Hi. Are you guys still keen on CZZ? Obvious caveat being a market sell-off in general." Regards Andrew

Hi Andrew, We discussed CZZ and its legal situation back on 26th of September. There has been no change to CZZ since, with the stock now trading sideways for well over a year - consolidation after a strong advance is usually interpreted as bullish.

Updating our thoughts from last month is CZZ remains positive while over $16.

1. If we were looking to buy our levels to accumulate would be $19, $18 and $17 with stops under $16.

2. If we were long we would remain so with stops under $16 but our allocation would be no more than 5% of a portfolio as a rapid 10% decline for the "China facing" stocks is very common e.g. Bellamy's and Blackmore's.

Capilano Honey (CZZ) Monthly Chart

Question 2

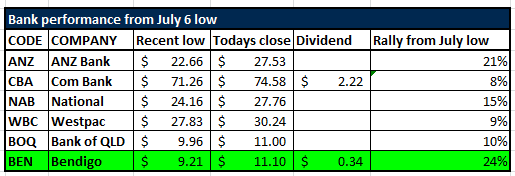

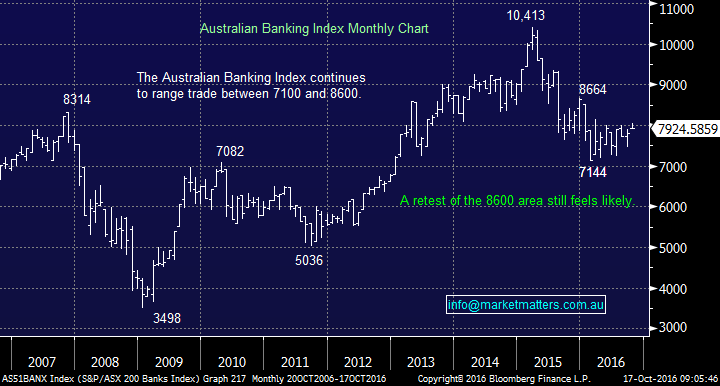

"Which bank are you likely to sell next out of your ANZ, Commonwealth or Westpac" - Steve.

A great question Steve as it's the one we have been asking ourselves repeatedly over the last few weeks. Firstly let's look at the 3 banks at a glance:

1. ANZ has rallied strongly since its low in April and feels a touch tired ~$28. It reports in coming weeks and pays a healthy fully franked dividend in November. Technically resistance comes in around $29.

2. CBA paid a $2.22 fully franked dividend in August. Technically resistance comes in around $78-79.

3. WBC has rallied strongly since its low in January and feels a touch tired ~$31. It reports in coming weeks and pays a healthy fully ranked dividend in November. Technically resistance comes in around $32-33.

Our current view, assuming banks remain firm over coming weeks, is whichever bank gets ahead of its self, as in outperforms the others, we will trim / sell that one. At the moment, the market is in the frame of mind that buys weakness and sells strength which is the pragmatic view we believe would serve us best with our current holdings.

In terms of bank performance, we can see that BEN has given the best total shareholder return from the recent bank low point on the 6th July.

Australian Banking Index Banking Index Monthly Chart

Question 3

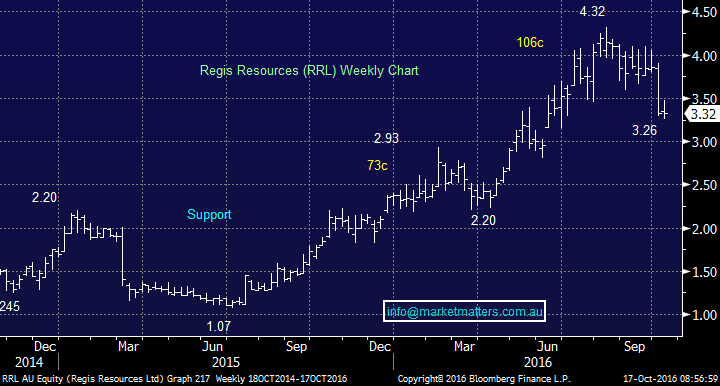

"A simple question, why did you not buy Regis Resources after discussing it over a number of weeks?" - Colin.

Morning Colin, RRL is an excellent trading stock that we have made $$ from back in June, although we did take our profits too early in hindsight.

The simple answer is a combination of "Gut Feel" and the $US.

1.Our core view that US interest rates are heading higher and that the $US is on track to make fresh highs over 101 is bearish for gold and hence not ideal for RRL. The $US spiking over 102 and gold / RRL not falling would be a trigger to buy RRL in the future.

2. Our "Gut Feel" was too many people were long and bullish gold / gold stocks with ETF's showing the large inflows implying the path of most pain was down for gold and the gold sector which has proved correct e.g. Newcrest (NCM) has corrected over 25%.

RRL remains our preferred gold stock and we still note the strong China demand hence we do expect to be a buyer in months ahead.

Regis Resources (RRL) Weekly Chart

The US Dollar Index Monthly Chart

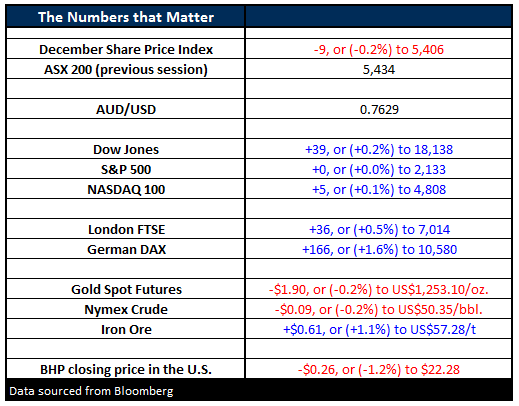

Overnight Market Matters Wrap

- The US markets were all positive at the close of last week. The Dow managed to climb over 150 points earlier in the day but succumb to selling pressure, to finish up just 40 points (+0.2%) to 18,138. For week the market was off 102 points (-0.6). On the broader S&P500 the index closed up, but only just, finishing less than half a point in the black, to 2,133. For the week though the market was down nearly twice as much as the Dow, falling 21 point (-1%).

- Oil took a backward step on Friday, with oil drillers continuing to ramp up activity. Crude finished down 9c to US$50.35/bbl

- Iron Ore managed to keep heading up, with a rise of 61c (+1%) to US$57.28.

- The ASX 200 is expected to open flat to slightly weaker this morning, around the 5,429 level, as indicated by the December SPI Futures.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/10/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here