Subscriber questions

A relatively small report to kick off the first full working / trading week of 2017 as subscribers like ourselves warm up for a very exciting year ahead. Please keep the questions coming at the rate of 2016 so we can ensure complete clarity on our views / approach in 2017. Additionally, we’ll be making some slight changes to report formats over the coming weeks / months, and we’d welcome your feedback on this.

Question 1

"Happy New Year to the Market Matters team, here’s hoping you nail it for 2017.What are your thoughts, if any, around the looming Superannuation contribution caps?" - Thanks Derek

Morning Derek, a great question which has actually been a topic of conversation in the office over recent weeks. Simply retirement savers have until the June cut off to add voluntary contributions to their superannuation, enjoying the subsequent tax benefits which it brings, this is not surprisingly leading to a significant increase of $$ inflows to funds.

This increase looks likely to continue into June this year, just when we are looking for a major top for global equities! We believe it's important to note a couple of points:

- These voluntary contributions are occurring because of changes in legislation, not because investors believe that equities are cheap at today's levels.

- A decent portion of these contributions will end up being invested in the local share market.

Our view is unfortunately these changes will result in many Australians investing monies into the local share market at poor levels medium term. Interestingly this reminds us of when Margaret Thatcher altered the tax laws around tax relief for property in the UK in the late 1980's - property rallied strongly into the cut-off date but then collapsed by around 50% taking 10-years to regain the losses.

US S&P500 Monthly Chart

Question 2

"Hi all. Thanks for your service- I think it's been great so far. A couple of questions:

- In today’s ASX 200 movers chart you quote CTM as moving 16.67 % . This company has a market cap of $3million – not sure it is ASX 200. Whereas SSM a stock I hold with a market cap of 282 million moved 13% but doesn’t make the list?? How is the list compiled?

- And this might make the grade for end of week subscribers question

I am a long term holder of SSM . They had a strong price rise this year before retreating 25% recently. There was a 13% gain Wednesday on reasonable volume. How does the stock look technically and have you any views on fundamentals.?? Is it worth looking at /holding? Keep up the good work." - Sean

Hi Sean, thanks for the questions to kick off 2017.

1. The movers are taken from the ASX 200 as the heading suggests, however an incorrect code was pulled out from our Bloomberg. CTM was pulled instead of CTD for Corporate Travel Management which is in the ASX 200. A system error our side in the coding of that particular stock. SSM is not in the ASX 200 with a market cap of around $300m. Currently, the smallest stock in the 200 has a cap around 500m however we suspect that will be cut with the next index rebalance.

2. SSM is not a stock we follow closely but its volatility clearly puts it in the "traders basket" - not an area we are shy of as was demonstrated by our recent successful position in Vita Group (VTG).

Technically SSM is a little tricky but our best risk / reward opinion is to buy any dip to around 75c with stops under 60c. These are obviously fairly wide parameters but the stock moved almost 13% last week hence it's no slouch when it comes to price swings.

Service Stream (SSM) Weekly Chart

Question 3

“Hi, When you guys get a chance could you please explain how bonds work? Why are bonds rallying a bad thing for bond holders? Or are they?" - Regards Julie.

Hi Julie, a handy question as we often find subscribers do not have a solid understanding of how bonds work. The two considerations are price and yield.

Assume a bond is issued at $100 with a fixed rate yield of 5%. If that bond gets bought up and trades at $110, then a new investor buying the bond at $110 is achieving a running yield of around 4.5%. It’s certainly not a bad thing for holders of bonds who bought at the original $100 value as they could sell at a profit, however for those paying $110, the buyer is locking in a capital loss of $10 if held to maturity. If however, the bond is sold off and trades at $90, then the new investor paying $90 is achieving a running yield around 5.5% however the holder from the $100 face value is sitting on a 10% capital loss. As with anything, the price you pay dictates your future return. Bonds are expensive now and with rates rising bond prices should decline (which pushes yields higher) BUT, capital losses will be incurred by those who have recently bought bonds.

In more detail:

- The current RBA interest rate is 1.5% and CBA are today offering 2.35% return on $100k invested for 12 months.

- Hence to buy a bond that paid 2.5%, a higher yield, for the same period with the same degree of safety would cost a premium.

- Let's say you bought the above theoretical exposure to a 2.5% return for $1000 i.e. you bought the $100k bond for $101,000.

- If RBA interest rates moved up to say 2.0%, interest available from banks on term deposits are likely to be higher.

- Hence the $1000 you paid for a 2.5% return would decrease in value to say $900 as higher rates would be more easily available. Hence your $100k paying 2.5% may only be worth $100,900

- Conversely if rates fall to 1% your $100k may be worth $101,500.

In simple terms bonds paying a fixed interest rate fall in value when rates rise and increase in value when rates drop. We hope this helps.

Australian 3-year Bonds Weekly Chart

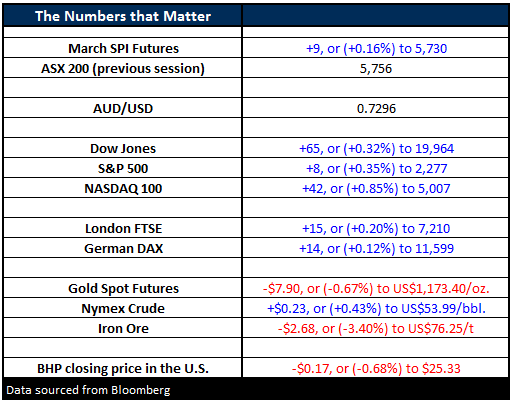

Overnight Market Matters Wrap

- The US share markets continue attempt to break new highs, with the Dow ending 65 points higher (+0.32%) at 19,964, while the broader S&P 500 closed 8 points higher (+0.35%) at 2,277.

- Iron Ore lost some ground, settling down 3.4% last Friday, with the broader miners looking to underperform the ASX 200 this morning. BHP in the US closed an equivalent of -0.68% to $25.33 from Australia’s previous close.

- The March SPI Futures is indicating the ASX 200 to open ~20 points higher this morning, testing the 5,760 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/01/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here