Stocks are enjoying a period of euphoria and complacency

Global equity markets are “on fire”, soaring to decade / all-time highs over recent weeks depending on the country you focus on. Locally the ASX200 had a fairly muted 2017, gaining 7% before dividends, but we’re still managing to trade around decade highs this morning. Our concern at MM is around the bullish sentiment / crowd, virtually all market pundits are calling stocks higher in 2018 as global economic growth improves. Interestingly so many of these very same pundits were bearish / cautious this time last year having major concerns around Donald Trump, North Korea, rising interest rates etc.

I would go as far as saying that it’s been many years since I’ve seen such a vast number of “experts” believe stocks will rally strongly leading to headlines such as the one on Bloomberg this morning….

Source; Bloomberg

These are significant warning bells and we believe this complacent optimism will lead to increased volatility in 2018, with some decent corrections at the very least. When you stand back and consider that since the GFC, we have had massive QE / Central Bank economic stimulus, including record low interest rates, money printing, bond buying, manufactured liquidity and the like which has helped stocks rally the world over (the ASX200 gaining 96% and the Dow an amazing 291%) in what has often been described as the most hated / disbelieved bull market in history, BUT only now 9-years into the rally investors are becoming bullish – this is clearly a concern.

At Market Matters, we believe there has never been a more appropriate time to become an active investor as both opportunities and traps will increase over the coming year(s).

ASX200 Monthly Chart

We have remained bullish longer term since early 2016 targeting the 2150 area for the MSCI Global World Index which has now been achieved. We look for markets that are in clear patterns / rhythms which coincide with our fundamental view, thus enabling us to invest with solid risk / reward. The following Global Index’s advance since 2009 is about as good as it gets!

- The market corrected exactly 355-points in both 2011 and 2015/16.

- In both cases, the market gave us a warning before the major correction.

Moving forward following the 50% advance from early 2016, we now believe.

- Another warning style pullback is overdue.

- Following such a correction a severe deeper correction is a strong possibility.

Hence we have switched our market stance from outright longer term bullish to neutral / bearish, BUT no sell signals have yet materialised – bull markets fuelled by excessive optimism do have a habit of lasting longer than many anticipate.

MSCI Global World Index Quarterly Chart

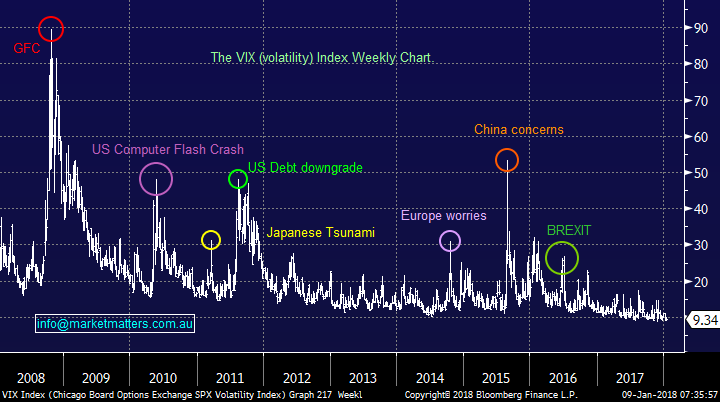

The Fear Index (VIX), clearly illustrates the markets confidence that any hiccups by stocks will be short-lived and should be bought – this is easy to understand as it’s worked for almost 10-years!

The VIX remains around decade lows, historically following an extended period below the psychological 10% area - a nasty surprise for stocks may not be too far away.

Fear Index (VIX/Volatility Index) Weekly Chart

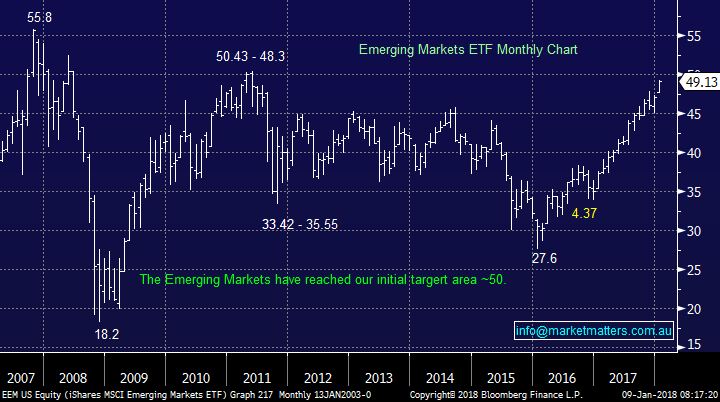

Conversely, we do believe the economic optimism is well founded as is clearly illustrated by the following 3 markets.

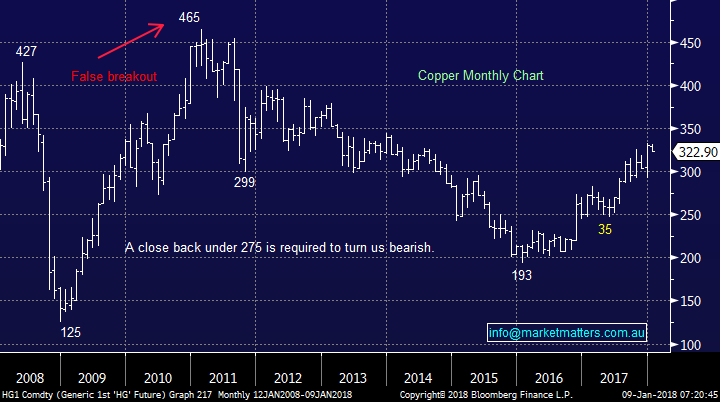

1 Copper

Copper reached fresh 4-year highs last month and we all know “Dr Copper” is regularly regarded as the best market indicator for the global economy with the base metal having many industrial / manufacturing uses.

However both copper and the highly correlated Emerging Markets Index reached our target area last month, enabling us to take some nice profits in Independence Group (IGO) and OZ Minerals (OZL). We are now neutral / bearish looking for a pullback towards the December lows i.e. a ~10% pullback.

Hence our current view at Market Matters is we would rather have cash than resource stocks until this view is proved wrong, simply again looking to accumulate at lower levels.

Copper Monthly Chart

Emerging Markets ETF Monthly Chart

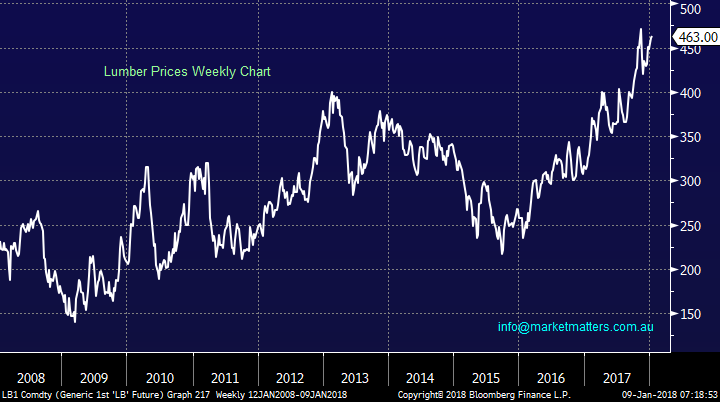

2 Lumber

The lumber price, in a similar manner to copper, is a strong indicator of economic activity being a major material used in construction.

Lumber prices have doubled since the lows of 2015, after such a rally a pullback / period of consolidation would not surprise, but there’s no reason to be bearish at present as the positive momentum is clearly intact.

Lumber Weekly Chart

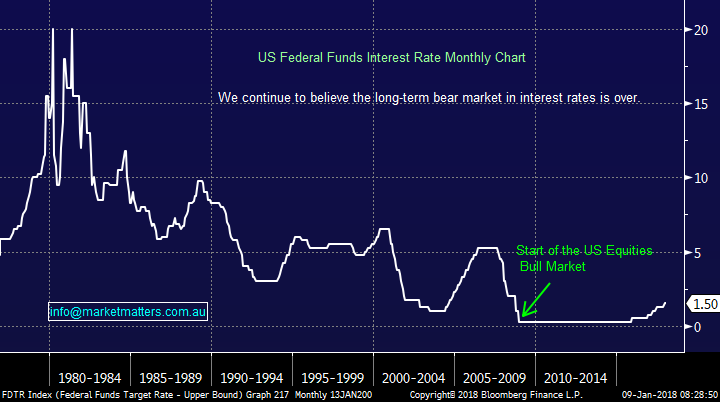

3 US short-term interest rates

Short-term bond yields in the US are accelerating towards 3% -not excellent news for Americans with variable interest loans but a solid sign that the economy is firing on all cylinders.

The US Fed has been lifting rates for about 2-years with more expected / flagged in 2018. At some time this should weigh on equities but it’s not been the case to-date as economic optimism remains the focus for investors.

US 2-year Bond Yields Monthly Chart

US Fed Funds Rate Monthly Chart

We constantly preach that investors should remain open-minded, hence we thought this was an opportune time to show the one market that we are watching carefully to change our outlook for stocks in 2018/19.

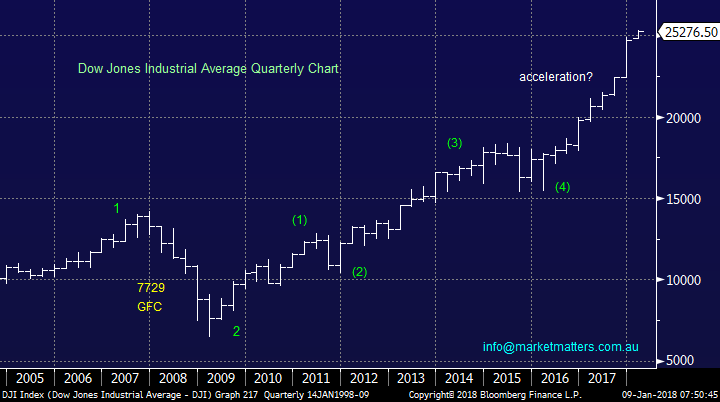

The US Dow is clearly accelerating higher unlike other major stock markets generating a very different and far more bullish picture. At this stage we are giving the market less than a 10% weighting in our thought process because it’s only 30 stocks, but we will continue to watch carefully.

Dow Jones Quarterly Chart

Conclusion

Remain open-minded and flexible as 2018 is shaping up to be an exciting, but volatile year.

Global markets

US Stocks

US stocks continue to remain strong on optimism around the economy with no sell signals being generated. For our interpretation that stocks are in the final phase of the bull market since the GFC, the current upside acceleration / momentum needs to slow down pretty soon.

The current strong rally since Donald Trump’s election adds to our confidence with buying the first decent ~5% pullback.

US S&P500 Monthly Chart

European Stocks

European stocks look set to make fresh recent highs, the big question is will they fail or kick on. At this stage we are sitting on the fail side, but only just!

German DAX Weekly Chart

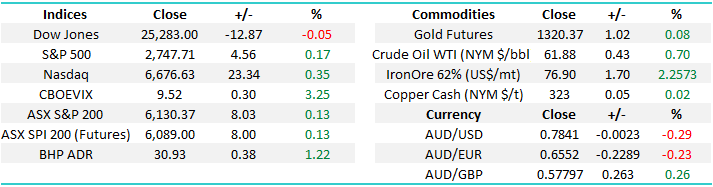

Overnight Market Matters Wrap

· A mixed session was experienced overnight in the US after hitting another round of fresh all-time highs, with the Dow off slightly by 12points, while the broader S&P 500 closed 4 points higher. The tech heavy, Nasdaq 100 outperformed, up 23 points, or 0.35%.

· Iron Ore settled higher overnight, with BHP expected to outperform the broader market after closing in the US an equivalent of 1.21% higher from Australia’s previous close to $30.92.

· The March SPI Futures is indicating the ASX 200 to open marginally higher this morning, testing the 6140 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/01/2018. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here