Some bullish scenarios are unfolding for stocks, both home & abroad

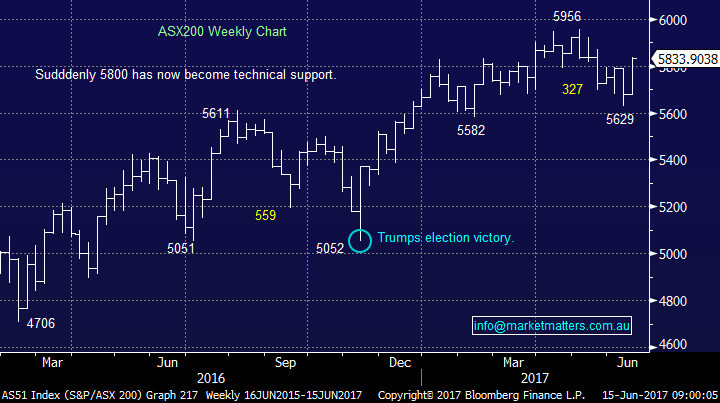

In just 2-days the ASX200 has evolved from a market threatening to break under its important 5600 support to one suddenly only 2% below its 8-year high. We were bullish on Tuesday but have been slightly surprised by the explosive nature of the last 48-hours. Normally we would stand back and look at the statistics and decide to buy any dips as we approach July, the markets seasonally second strongest month of the year, simply be quoting the following:

1. The ASX200 has already rallied 207-points from its June low making it unlikely to trade significantly higher over the coming 2-weeks.

2. The ASX200 has already rallied 159-points this week making it unlikely to trade much higher over the coming few days.

3. The ASX200’s average gain in July since the GFC is an impressive +4.3%, its been up 7 out of 8-years closing near its high every one of these times.

The clear and simple standout is be exposed to local stocks in July when a 250-point rally is a strong possibility, this year it may easily be an explosive break over 6000. However there are a two important local factors in play for June 2017 which make us believe further short-term bullish surprises must not be ruled out, and are even likely:

1. The much discussed Super changes kick in on the 1st of July which are likely to lead to significant money flow into stocks in the next 2weeks – this already feels underway.

2. The market remains too bearish and many fund managers feel underweight which was illustrated by the lack of selling this week as the market rallied like a knife through butter.

Our current view is June outperforms as July buying is brought forward by many investors because of the looming Super changes and then July follows up with some relatively modest gains. A few days consolidation to end this week also feels likely following the typically strong rally into today’s June XJO option expiry.

With combined positive influences of the Super changes and 3 of the big 4 banks paying their dividends in early July it feels likely that hedge funds are initiating long Australia-short the US trades for the next month which will obviously be short-term bullish the ASX200.

ASX200 Weekly Chart

US Stocks

US stocks closed mixed last night following the Feds anticipated hike in interest rates with the Dow closing up +0.22% but the technology based NASDAQ was down -0.43%. The Fed remains confident inflation will eventually improve providing them with the ammunition to hike once more in 2017 and the market clearly took all this in its stride.

Over the last 8-years both the US and most developed global markets have enjoyed what many describe as the most “unloved” bull market in history. Its most certainly not like the bull market from the late 80’s to 2000 when stocks were the usual topic of conversation from BBQ’s to taxi rides, nowadays it’s all property! To get a decent top markets often need a period of euphoria as opposed to today’s non-believing grind higher. Bring on Donald Trump!

Although a recession is the more likely catalyst for the 25% correction we are targeting moving forward an artificial surge to unrealistic levels could easily create a very vulnerable market. Many pundits have incorrectly called stocks to tumble over the last few years citing reasons like weak economic growth, rising interest rates, geopolitical instability and of course too many gains in the FANG stocks which as we know are currently experiencing a hiccup. We’ve been very patient with our “exit stocks” call but it does not mean we do not expect to be delivering this message in next 12-months.

Donald Trump’s tax reform may well create a “blow off top” for US stocks, he’s proposing taxing funds held overseas by US companies whether or not they actually repatriate the cash. Hence it feels highly likely that a large percentage of this money will find itself back onto US shores with share buybacks and M&A as likely destinations which would be very supportive of US stocks. At this point in time we are talking about a cash pile of well over $US900bn, enough to create the move we are considering.

Some household and very influential stocks dominate the volume of funds held overseas including APPLE ~$US240bn, Microsoft ~$US103bn, Google ~$US56bn, Johnson & Johnson ~$US41bn and Coca-Cola $US22bn.

US S&P500 Monthly Chart

Conclusion(s)

We remain bullish the ASX200 over coming months still targeting a decent break over 6000 in 2017/8.

We will feel very confident with our 25% correction call if we witness a surge in US equities courtesy of repatriation of funds following Trump’s tax reform.

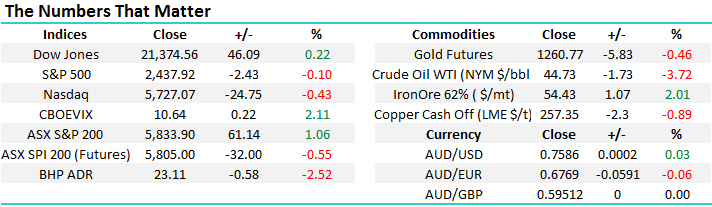

Overnight Market Matters Wrap

· Despite a majority consensus in the street of a rate rise in the US, most indices sold off from their intraday highs

· As mentioned, the US Federal Reserve raised its interest rate for the second time in the last three months with the committee also stating that they would begin to cut its bond and securities holding this year.

· On the commodities front, oil slipped 3.72%, as did copper, off 0.89%.

· The September SPI Futures is indicating the ASX 200 to open down 21 points towards the 5810 level, however volatility is expected as it is June Index expiry this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/06/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here