Searching for opportunities in the $US earners (QBE, NAN, RMD, ALL)

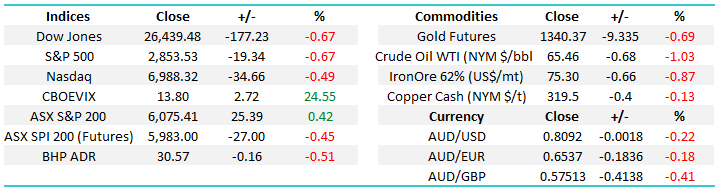

Yesterday the local market traded strongly during the day to close up +0.42% but today looks a very different proposition as US stocks have tumbled, with the Dow -177-points, and our market looking set to give back all of yesterday’s gains, and more. We certainly won’t be so bold as to say the US has started a correction but please keep in mind that the S&P500 is currently experiencing its longest rally in history without a -5% correction – worth keeping at the back of one’s mind!

Both yesterday and in the Weekend Report we focused on the $US believing it be the key to markets in 2018 and this morning the $US has only bounced +0.26% and stocks and gold fell pretty hard. Similar to US stocks the $US may not have bottomed but we believe from a risk / reward perspective all the dangers are up with the next 5-10% move far more likely to be a rally, which importantly is totally against how the market is positioned.

MM ideally will invest a decent part of our 20.5% cash position in the Growth Portfolio back into the market between 5925 and 5950 area for the ASX200 but individual opportunities may arise in some stocks / sectors beforehand.

ASX200 Daily Chart

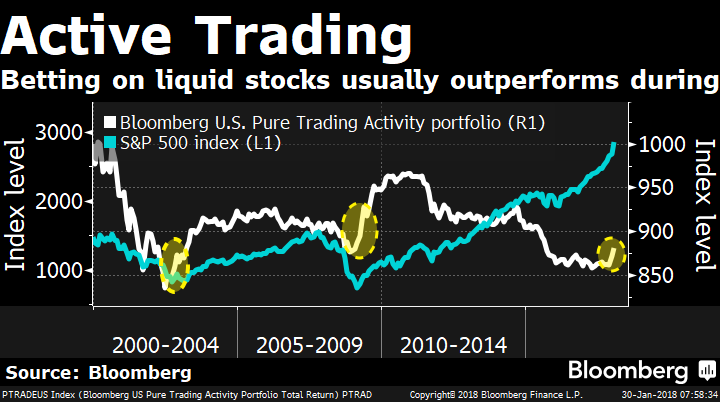

An interesting chart that Bloomberg highlighted this morning was the activity in the most liquid stocks. Simply the most liquid stocks rally the hardest at market bottoms when fund managers pile into stocks i.e. the Fear of Missing out (FOMO) on a major low. However we are witnessing the same characteristic now at the mature stage of the rally in US stocks which is unusual but implies strongly that again stocks are rallying due to FOMO – if you are buying simply because the market is going up you’d obviously prefer to be in liquid stocks – a warning sign which should be a very disconcerting conclusion for the bulls.

US “Active Trading” Chart

Following on from our belief that the $US is set to rise ~10%, Australian stocks with $US earnings are highly likely to outperform. Today we have looked at 4 stocks which MM is considering buying / holding taking this theme into account.

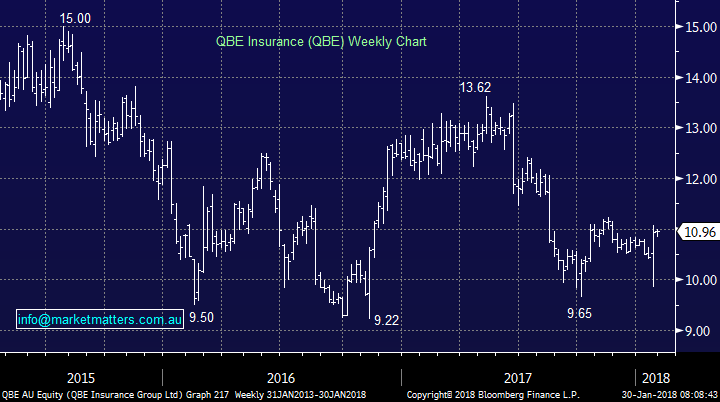

1 QBE Insurance (QBE) $10.96

QBE looks to have “cleared the decks” following the arrival of new CEO Pat Regan and optimistically we feel the awful, almost regular negative market surprises are behind this (sort of) iconic Australian insurer. It’s been a long time since QBE actually provided some good news to the market but we feels this may be on the horizon. As we discussed at the time of the resent downgrade which saw the stock sold hard initially, before being bought hard shortly after, it seems expectations have been lowered to a level that will ensure meets or beats going forward!

Fundamentally QBE enjoys both a higher $US and higher interest rates which sits well in today’s position of the economic cycle. Technically if / when the stock can break clear of $11.50 we can see an eventual test of $13, and perhaps the $15 we were targeting previously. Given our large position, the $13 mark would be very tempting to at least take some off the table.

We currently hold 7% of the MM Growth Portfolio in QBE which feels correct at present but we do not intend to increase the holding.

QBE Insurance (QBE) Weekly Chart

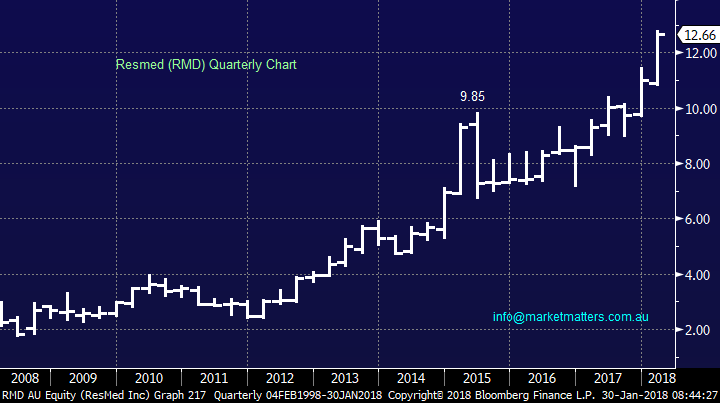

2 Resmed (RMD) $12.66

RMD is a reasonably defensive style company with excellent $US earnings. The sleep disorder business excited the market this month with a cracking trading update showing solid growth spearheaded by US optimism following Donald Trump’s tax cuts. It’s easy to think this horse has bolted, especially with the stock trading on a valuation of ~30x for 2018 but the long term trend looks excellent.

We are bullish RMD around current levels but would leave $$ to add on the next $1.50 pullback.

Resmed (RMD) Quarterly Chart

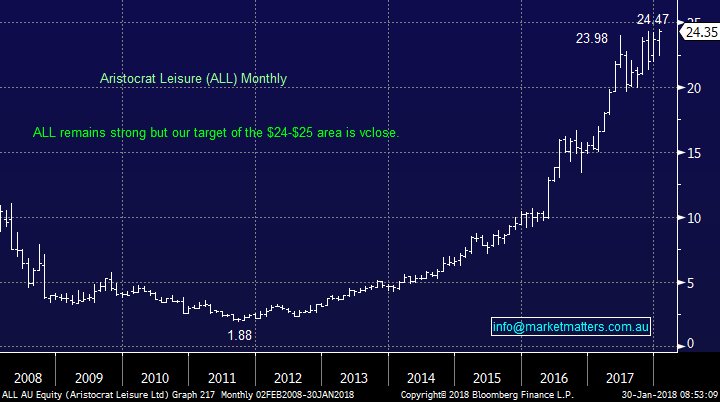

3 Aristocrat (ALL) $24.35

We had a decent win from ALL in 2017 but the stocks has so far failed to retreat back to the $20 for us to re-establish our long position after the stocked bounced strongly from $21.30. Following the companies significant investment in 2 online gaming firms there exists potential volatility from the next couple of corporate earnings numbers.

We remain keen to buy back into ALL around $20 but short-term do not want to chase the stock into strength.

Aristocrat (ALL) Monthly Chart

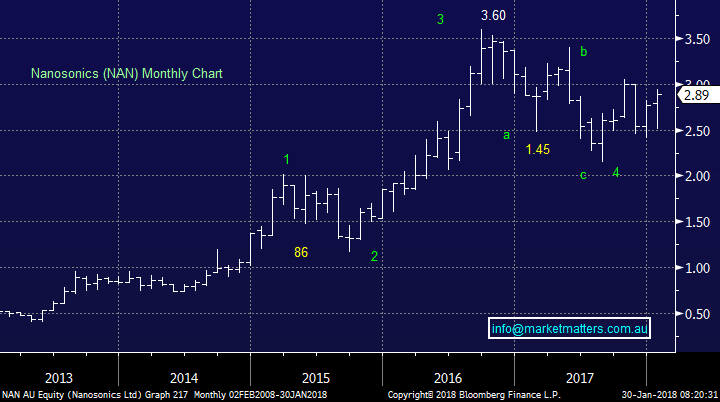

4 Nanosonics (NAN) $2.89

The hospital disinfectant company NAN was a rare loser for MM in 2017, in hindsight primarily because of poor entry into the stock. As discussed previously this US based company ticks our $US revenue box. While that revenue is low at present it is expected to increase. Additionally, the stocks is in the more defensive part of the market which we like after recent strong gains from global stocks. The market still likes NAN with targets back up above $3 per share, however it remains a high risk play.

Technically the stock looks good and we could be buyers ~$2.80 with stops under $2.60 – note from experience we regard this as a more high risk play.

Nanosonics (NAN) Monthly Chart

Conclusion

No change, at this stage on the macro level, MM remains keen to accumulate stocks into weakness and sell gold (NCM) into strength, or potentially weakness.

On the $US theme we like QBE, NAN, RMD and ALL as discussed above.

We are looking at taking a position in the US Dollar ETF

Global markets

US Stocks

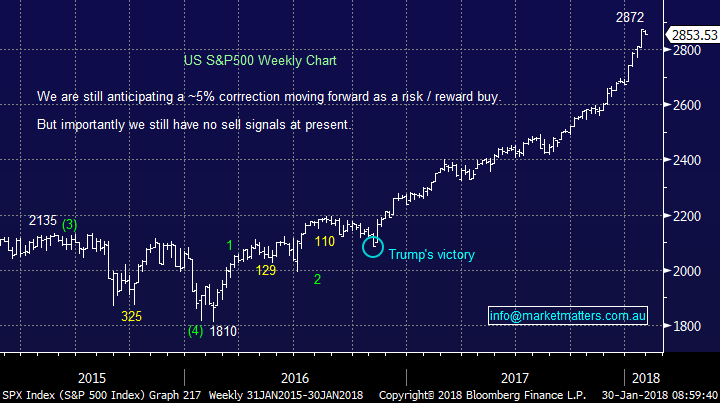

The S&P500 has continued its record breaking advance and with no sell signals at present investors should be long, or out – we would choose out just here.

US S&P500 Weekly Chart

European Stocks

European stocks look set to make fresh recent highs the big question is will they fail, or kick on. At this stage we are sitting on the fail side.

German DAX Weekly Chart

Overnight Market Matters Wrap

· The US major markets sold off overnight, both in the equities and US treasuries, with the benchmark 10 year bonds touching 2.7%, its highest level in four years!

· The US interest rate hike cycle is now the focus with investors, with the FOMC rate decision later this week.

· US corporate earnings continue, with 80% of companies reported beating overall analyst expectations.

· The March SPI Futures is indicating the ASX 200 to open 35 points lower this morning, towards the 6,040 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/1/2018. 8.00 AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here