Relax, the market feels tired but not spent!

Yesterday the local market was very quiet closing up 0.1% after staging a brave fightback on the close – in hindsight picking the overseas markets strength correctly. There was no great points of interest except perhaps the lack of any evident fresh money flowing in / or out of the ASX200. While we saw some “nibbling” away on the buy side of our banks finally pushing them up 0.5% it felt like this accumulation, following the sectors recent weakness, was being funded on the day by selling of other areas e.g. Insurance, supermarkets, real estate and retail. We continue to believe it remains very much a stock / sector pickers market as the 8-year bull advance slowly matures.

Yesterday MM allocated 5% of our portfolio into Westpac looking to gain the 94c fully franked dividend on Thursday – we will touch on this in more detail later. Importantly this allocation only reduced our cash position to a still lofty 28.5%, in other words we want this market lower to buy stocks, but we are wary that others are in the same boat.

MM’s short-term mildly negative view for the ASX200 remains intact with our initial target of ~5800 now basically satisfied, while our potential targets of 5700 / 5600 for a May-June retracement will look very attainable technically if we close under 5816.

ASX200 Daily Chart

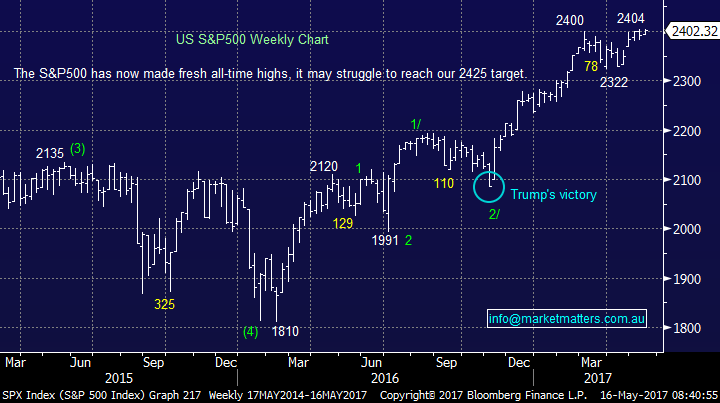

Overseas markets were strong last night enjoying gains in the oil price as Saudi Arabia and Russia are coordinating their rhetoric in an attempt to support the underlying energy price. Both the S&P500 and NASDAQ made fresh all-time highs but on balance we still favour a 4-5% correction by the end of June.

From a risk / reward perspective our preferred strategy at present is to remain patient in an attempt to buy the next pullback, when / if it finally unfolds. If our current prognosis is correct and equity markets are in the mature stage of their 8-year bull market we should see some decent “choppy style” retracements as the market slowly completes its strong advance e.g. CBA recently corrected 9.3% in under 2 weeks.

US S&P500 Weekly Chart

The logic behind our purchase of Westpac yesterday should be simple to understand:

1. We sold our 5.5% holding in CBA around $87, in late April, the stock is still 5.5% below our exit even after bouncing over the last few days.

2. We decreased our banking exposure about a week ago by selling our 8% holding in ANZ ex-dividend and switching only 3.5% into NAB before today’s dividend.

3. Hence the 5% allocation into WBC before Thursdays dividend was almost a little insurance just in case we don’t get another 2-3% decline in our banks and they rally from here.

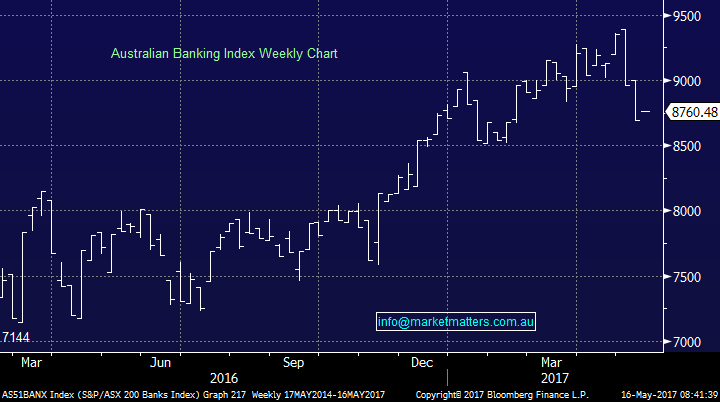

Ideally we will still invest at least 5% of the MM portfolio back into CBA around the $80 area. Our overall view for our banking index is the current correction should continue for another ~3% but the easy part is complete.

ASX200 Banking Index Weekly Chart

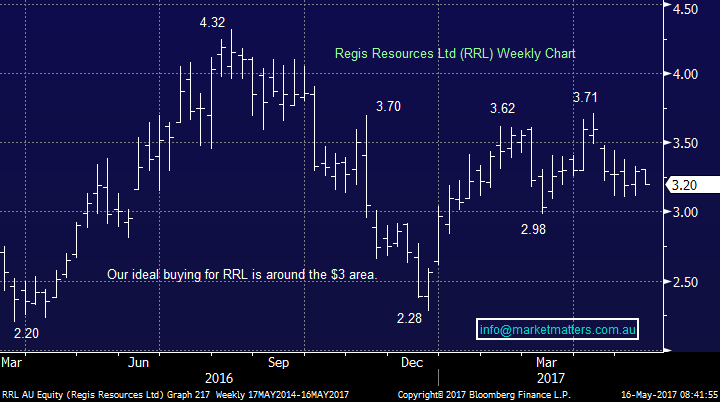

Another stock we mentioned in the Weekend Report as a potential buy early this week was Regis Resources (RRL) however the current momentum in the gold sector remains poor so we are sticking with our original $3.05 buy area until further notice.

Regis Resources (RRL) Weekly Chart

A number of subscribers are asking us why we still are looking to buy stocks when we see a 25% correction for stocks on the horizon, certainly a fair question! We simply believe that global equities have some further gains that can be enjoyed before we will say it’s time to position more defensively. When banks are paying us only a few % on term deposits some potential capital appreciation and attractive fully franked dividends should not be ignored – just yet.

There are a number of reasons why we remain comfortable buying stocks at present, albeit ideally into weakness:

1. Investors are not particularly long stocks at present, unlike property in Australia. Hence aggressive forced selling is unlikely, this is currently the same in the US.

2. Hedge Funds have enjoyed a strong year to-date hence less likely in a “twitchy” panic reactive style selling on any poor market news – exactly what we are currently experiencing.

3. Investors stock / sector holdings are not aggressive i.e. in the US for the year to-date Tech, growth and healthcare are outperforming cyclicals and financials.

In simple English many investors remain in cash hoping to buy stocks at lower levels hence any May / June correction is likely to be shallower than the majority anticipate.

US S&P500 Monthly Chart

Conclusion(s)

We remain short-term mildly negative but we continue to look for areas to put our large holding to work. Ideally we will be strong buyers in the 5700 and 5600 areas.

Overnight Market Matters Wrap

· The major indices in the US closed in positive territory overnight, with the Telcos, Financials and Energy sectors leading the pack.

· Oil continues to climb ahead in its snakes and ladders game, following Russia and Saudi Arabia’s comments of extending their current production measure through to March 2018.

· Today, National Australia Bank (NAB) trades ex-dividend at 99c a share and Orica (ORI) releases its half yearly earnings.

· The June SPI Futures is indicating another marginal open to the upside with the ASX 200, towards the 5,840 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/05/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here