Quality shines through as the Fed sounds hawkish

There has been a clear trend evolving over recent months which is whenever Janet Yellen (Chairwoman of the US Fed) speaks, she is clearly hawkish and it leads to support for the $US and weakness in the "yield play" sector of stocks. Investors should not forget that interest rates are at artificially low levels, after years of financial engineering by central banks to avoid a deep global recession / depression after the GFC. As interest rates rise, it simply offers an alternative to stocks for investors seeking some yield for income which has not been available for many years.

Hawkish - When the Federal Reserve uses ‘Hawkish’ language to describe the threat of inflation, it implies that interest rate rises can be expected from the Fed – ‘Dovish’ is the opposite. We believe that US 2-year bond yields are at least headed back to the ~3% area, an enormous increase from the panic lows close to 0%, during a period when many global bonds actually went negative.Importantly, when we consider where two of the ASX200's major "yield play" stocks were trading when US rates were at these levels, the answer is around 50% lower. We reiterate there is no reason in 2017 to be invested in the "yield play" space while interest rates remain set to increase.

US 2-year Bond yield Monthly Chart

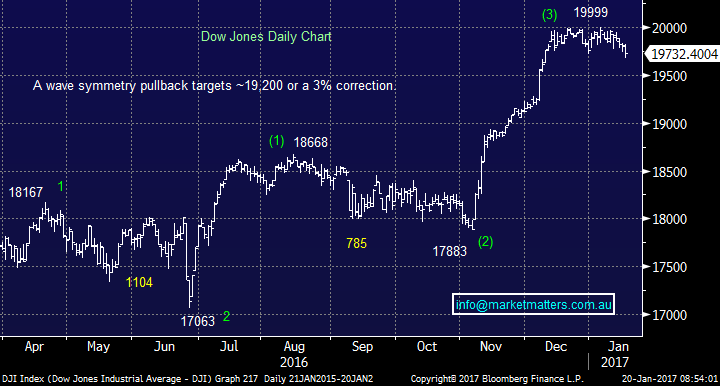

US stocks have been slowly weakening over recent days with Janet Yellen's comments, especially weighing on the Utilities / Real Estate sectors of the market. Our current view remains this pullback is likely to unfold for another 3%, or 500-points, before we would consider buying US stocks in general. Interestingly, like our ASX200, the Dow has now given up all of its gains of 2017.

We remain mildly bearish the Dow short-term with a 19,200 target area.

US Dow Jones Daily Chart

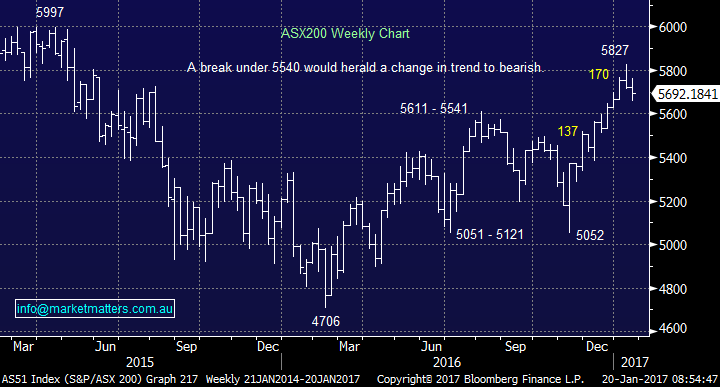

This morning, the local market looks set to open around 3% under the highs of 2017, with our cash holdings now sitting at close to a lofty 40%, we anticipate accumulating into this weakness relatively soon - remember our current mantra "sell strength and buy weakness".

ASX200 Weekly Chart

Yesterday was a great result for the MM portfolio, with our large 10% holding in CSL Ltd rallying 12.5% after a very impressive upgrade on profit guidance from management. We took a profit on half our holding, understandably enjoying the 21.76% recovery from the stock over the last 2 months.

This is a quality company, with quality management that simply corrected 24%. A number of times stated our intention to increase our holding if the stock fell under $90 - it got close!

This is a great illustration of our investment approach at MM:

- Identify great companies in sectors where we see growth.

- Use both valuation and technical analysis to identify optimum levels of entry to these stocks.

While in hindsight we bought CSL too early in its decline from all-time highs, we had confidence in the business, management and sector which enabled us to remain comfortable with our investment. Importantly, yesterday’s rally enabled us to reduce our position size to a more suitable level.

CSL Ltd (CSL) Monthly Chart

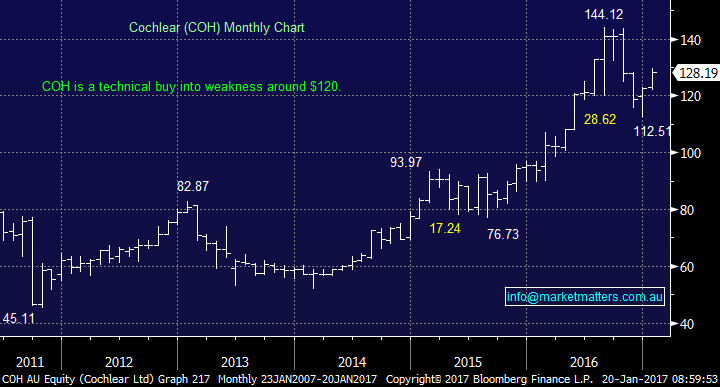

Another quality company in the healthcare sector we like for similar reasons is Cochlear (COH). While it’s certainly not cheap (PE of 30.7 times) which is pretty typical for this stock, they report earnings on the 14th February and strong growth is expected (~20% EPS growth).

We would look to buy COH into weakness towards $120.

Cochlear (COH) Ltd Monthly Chart

Summary

- We remain buyers of stocks into weakness - for now!

- We currently like BEN ~$12.25, RIO ~$59, SGR ~$4.60 and COH ~$120.

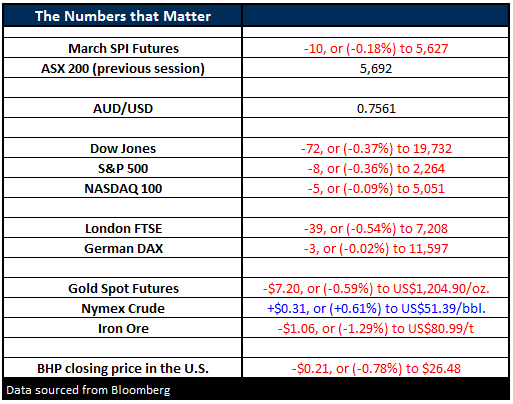

Overnight Market Matters Wrap

- Some weakness in the US markets overnight, with the Dow wiping all of its gains in 2017 as investors took risk off from the table.

- Iron Ore lost 1.29% to US$80.99/t., while Crude Oil gained 0.61% to US$51.39/bbl.

- The March SPI Futures is indicating the ASX 200 to open lower towards the 5,675 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/01/2017. 8.40AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here