Patience Remains Vital at this Stage of the Cycle – BHP, CYB, HVN, STO

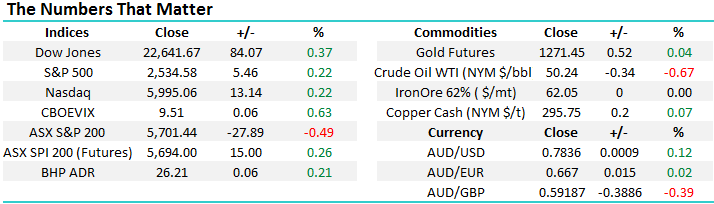

The local market continues to struggle as US stocks in particular make fresh all-time highs with the ASX200 dragged 0.5% lower yesterday primarily by the banks, insurance and energy sectors. The local market remains out of favour compared to most indices at present and this may be strongly influenced by global investors believing the $A is overvalued around 80c, remember we have performed ok as an index in $US terms - overseas investors definitely feel like they are net sellers of our market at present with the $A trading fairly close to 80c.

CYBG Plc (CYB) which we are selling 50% of our holding at $5.30, illustrates perfectly the influence of currencies on a stock price:

1 CYB in Australia is trading almost 11% below its 2016 high i.e. pre-BREXIT.

2 CYB in London, priced in British Pounds, made fresh all-time highs this week.

1 CYBG Plc (CYB) Weekly Chart

2 CYBG Plc (CYB) London Weekly Chart

It’s easy to understand the strength within the US market as Donald Trump’s tax reforms become front and centre of the markets consideration. Famous investor, Warren Buffett has even said he “may be compelled to buy or sell shares in his investment portfolio based on the outcome of the legislation”, in particular his comments around selling stocks at the moment caught our attention “I would feel kind of silly if I realized a $1bn worth of gains and paid $350 million of tax on it if I just waited a few months and would have paid $250 million”. Do we have a scenario slowly brewing in the US where investors are queuing up to sell / take profits following the bull market since the GFC, but are holding back to avoid tax? If this is true, who will be on the buy side after the tax reforms become law?

Considering the Dow has rallied over 4% since early August, while the ASX200 remains both down over the same period and close to the bottom end of its 20-week trading range, we have no reason to change our view that a broad market buying opportunity is on the horizon around the 5500 area i.e. we are short-term bearish targeting a 3-4% correction.

ASX200 Daily Chart

Global Markets

US Stocks

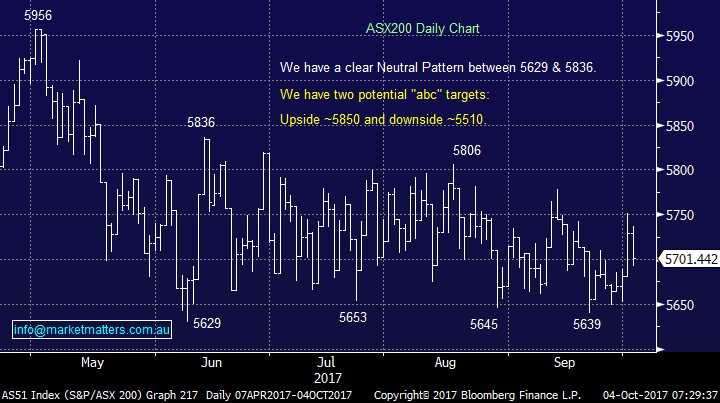

Last night, the broad based S&P500 closed up 0.2% at another all-time high, we are concerned around the current complacency within the US market e.g. apparently there are now more margin loans in operation in the US than prior to the tech wreck which did not end nicely!

There is no change to our short-term outlook for US stocks, we are targeting / need a ~5% correction before the risk / reward favours buying this market.

US NASDAQ Weekly Chart

US NASDAQ Quarterly Chart

European Stocks

No change, European stocks look poised to make fresh 2017 highs in the next few days / weeks but we would not be surprised to see this rally fail and another pullback towards 12,000 unfold for the German DAX.

German DAX Weekly Chart

Asian Stocks

The Hang Seng remains strong, especially after enjoying a 2.25% advance yesterday but we continue to believe this 28,000 area will be a magnet for the market over coming weeks / months.

Hong Kong’s Hang Seng Weekly Chart

3 Australian stocks we may buy in 2017

1 BHP Billiton (BHP) $26.15

We are believers in the reflation trade moving forward, hence are buyers of quality stocks at the correct levels, within the resources sector. BHP has already corrected 18.7% and 21.1% since it commenced rallying back in early 2016, so any decent pullbacks are reasonably common. Considering we believe US stocks are approaching a 5% pullback, there feels no hurry just here to re-enter BHP, ideally we will start accumulating slowly under $25.

BHP Billiton (BHP) Weekly Chart

2 Harvey Norman (HVN) $3.99

HVN is obviously in a volatile out of favour sector at present, as investors fret over both Amazon and the Australians lack of “free cash” in their pockets. We are buyers of HVN if we see panic selling to fresh 2017 lows.

Harvey Norman (HVN) Weekly Chart

3 Santos (STO) $4.01

STO is an aggressive buy under $4 and ideally under $3.95, targeting a rally towards the $4.50 area.

*Watch for alerts.

Santos (STO) Daily Chart

Conclusion (s)

We remain happy to increase our market exposure into weakness but see no reason to chase stocks at current levels.

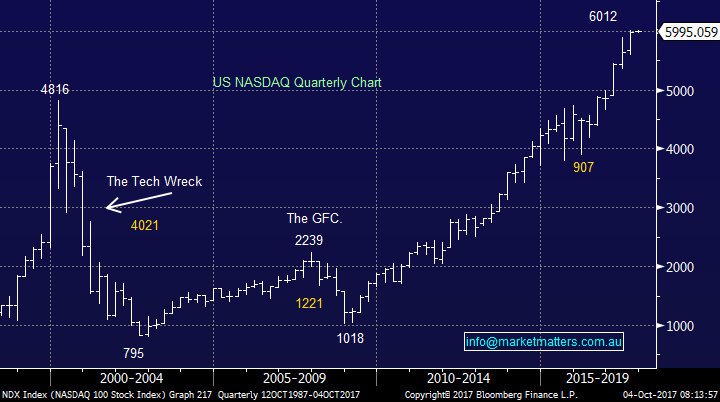

Overnight Market Matters Wrap

· The US equity markets continued to touch new all-time highs overnight, led by the telco sector.

· In the European area, the FTSE 100 is on its 8-week high and technically looks to follow the US and make all-time highs above the 7600 area in the medium term.

· Our little Aussie battler (AU$) recovered from yesterday’s lows of US77.89c post RBA leaving rates unchanged at 1.5%, to rally 0.6% this morning to US78.36c.

· BHP is expected to outperform the broader market today, after ending its US session an equivalent of +0.21% from Australia’s previous close.

· The December SPI Futures is indicating the ASX 200 to open 10 points higher towards the 5710 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 4/10/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here