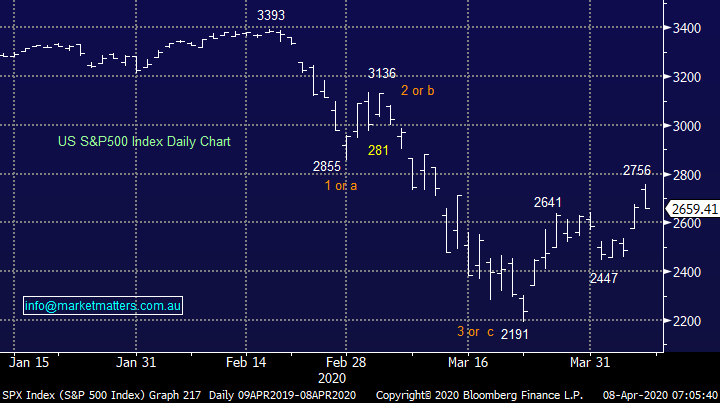

Overseas Wednesday – International Equities & Global Macro ETF Portfolios (NSR, MCD US, SBUX US, QQQ US, OOO)

Yesterday the ASX200 failed to embrace the bullish sentiment washing through global equity markets, the Dow rallied over 1600-points on Monday night and its futures were up another ~200-points as we closed at 4pm but alas the ASX200 drifted-0.65% lower even in the face of a tsunami of US strength. Throughout Asia the markets also danced a bullish jig with the Japanese Nikkei +2%, Hong Kong +2.1% and South Korea + 1.8% leaving our market feeling like an island of negativity. We put the disappointment down to a few salient points:

1 – The RBA kept rates on hold as expected however they signalled a potential reduction of their bond buying program after an initial front foot response which saw them buy around $36b worth of Govt and Semi Govt bonds as they work to stabilise the bond market / reduce the cost of borrowing.

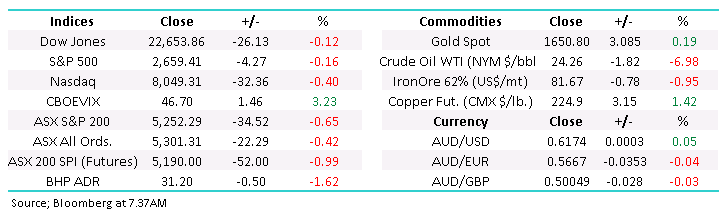

2 – The $A has surged towards 62c following the RBA’s update, it’s now ~10% above its spike low last month – in 2020 on a day to day basis a strong $A has translated to noticeable underperformance by the ASX.

3 – APRA appears to be pressuring the Australian banks to significantly cut their dividends although it hasn’t instructed them to be halted – a topic we cover in today’s income note.

4 – We might have seen some “funding selling” into strength following recent significant capital raisings which we discussed yesterday, or simply some pre-Easter book squaring started early.

5 – Also, again the ASX200 has picked the US overseas market “to a tee” as the Dow has surrendered an early 938-point gain to close marginally in the red – we are one heck of a crystal ball for traders of US markets!

Whichever reasons (s) were in play yesterday the local market was in a “glass half-empty mood” which considering its just rallied 23% in 11-days is no great surprise – amazingly we’ve experienced both a technical Bear & Bull Market in just 7-weeks!

NB The largely accepted definition of both a Bull & Bear market is a respective move of +/`20%.

Australian Dollar ($A) Chart

In our Weekend Report published on Sunday 22nd of March, the day before the major 4402 low, we wrote:

“MM still believes the ASX200 will bounce towards 5500 sooner rather than later, for the sceptic that’s only a 30% correction of the last few weeks decline.”

As we said last week, we now feel the “easy money” is behind us but we remain buyers of weakness in April. Our “Gut Feel” at present is the ASX200 will rotate between 5000 and 5200 for a few weeks, it deserves a breather after dropping 38% before quickly bouncing 23%, the poor things tired!

We believe the market is migrating towards a stock picker playing field after a brief period where it was all about COVID-19 inspired panic. Yesterday MM tweaked our Growth Portfolio through purchases of Ramsay Healthcare (RHC) and JBH Hi-Fi (JBH) funded by sales of Western Areas (WSA), Sims Metals (SGM) and trimming of Costa Group (CGC) – our cash position is now at 13% so a few days of decent weakness would likely result in further buying.

MM’s preferred scenario is we have already seen the low for 2020.

ASX200 Chart

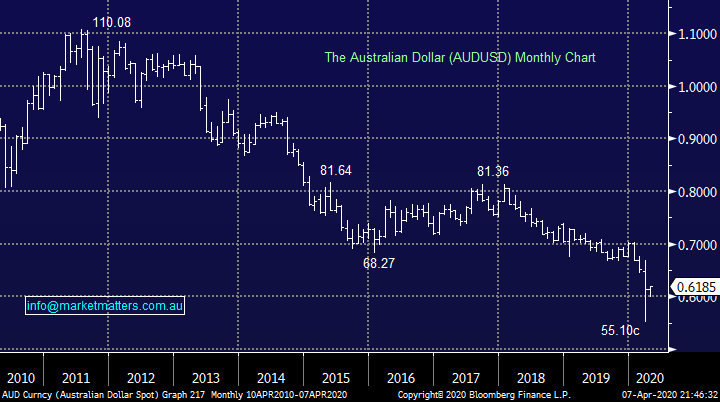

Yesterday morning I looked at the National Storage (NSR) REIT pondering whether it might actually be a candidate for the MM Growth Portfolio, definitely not our normal hunting ground but it has bounced well over 40% from its March low, gains that nobody could sneeze at! NSR is the largest storage property owner in Australia and if we follow in the footsteps of the US in terms of storage capacity per person there remains huge growth opportunities moving forward for this business.

US Public Storage REIT withdrew its $2.40 bid for NSR last month due to COVID-19 but a return in 2021 would not surprise – note this was one of 3 unsolicited indicative offers.

MM likes NSR around $1.50, or 6% lower.

National Storage REIT (NSR) Chart

Overseas markets

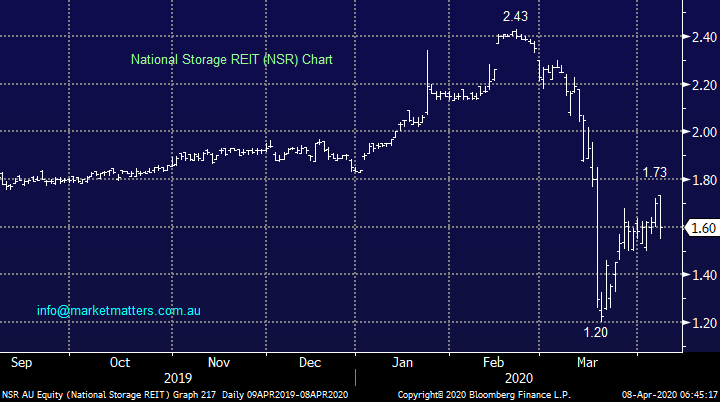

Overnight US stocks struggled with the DOW falling ~1000-points from its intra-day high however we should be mindful that the S&P500 has now bounced 25% in just a couple of weeks, like our own ASX a rest is overdue, especially with Easter looming i.e. who wants to go home long over a 4-day break, unfortunately anything can happen with COVID-19 in 4-5 days as we’ve seen in recent times.

At MM our preference is equities have seen their low for 2020 hence any pullback in April we regard as a buying opportunity.

MM is accumulators of weakness in equities this month.

US S&P500 Index Chart

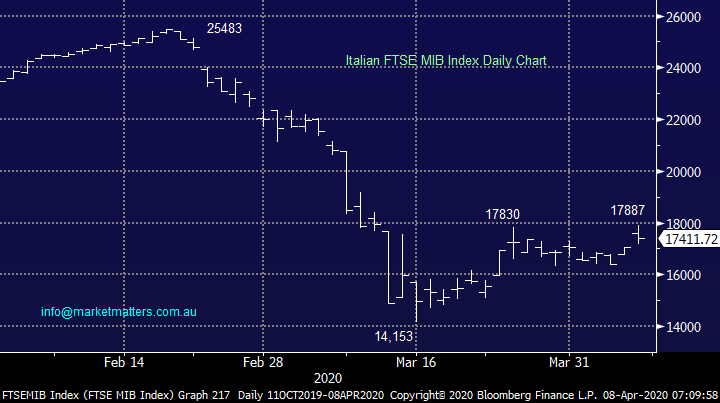

Italy has endured an awful time with COVID-19, currently it has over 135,000 reported cases and more than 17,000 deaths, simply horrendous numbers. The picture for Italian equities can be interpreted in a number of different ways but MM is confident on a couple of levels:

1 - Italian equities are now correcting their 26% bounce from their mid-March low, a further 5% downside feels probable with some of that likely when it reopens tonight.

2 – Whether we see Italian stocks hold 16,000 or actually re-rest 14,000, MM is very confident that a break above 18,000 will unfold in the months ahead.

MM is in “accumulation mode” for Italian, and global equities.

Italian FTSE MIB Indices Chart

MM International Equities Portfolio

No change to our International Portfolio, MM currently holds 18% cash and are still “looking to go shopping” into any April weakness in equities: https://www.marketmatters.com.au/new-international-portfolio/

No change to our general rhetoric, we believe this is a time to keep things simple via buying companies with solid balance sheets who look well positioned moving forward. We have again tweaked the 4 purchases we are considering over the weeks ahead; in our opinion the next market swing low will be the time to “load up”:

1 - LVMH Moet Hennessey (MC FP): Louis Vuitton has a solid balance sheet and strong exposure to China which is already “going back to work”. MM continues to like this quality retailer and are considering increasing our exposure from 4 to 6% around Eur330.

2 – Visa (V US): Visa is another company enjoying a strong financial position to whether the current economic downturn, MM continues to like this quality business and are considering increasing our exposure slightly from 5 to 6% below $US160.

3 – McDonalds (MCD US): While the world is going to want to go out as soon as possible post COVID-19 discretionary spending is likely to be monitored more closely than over past years, a perfect backdrop for Macca’s, MM likes McDonalds around $US170.

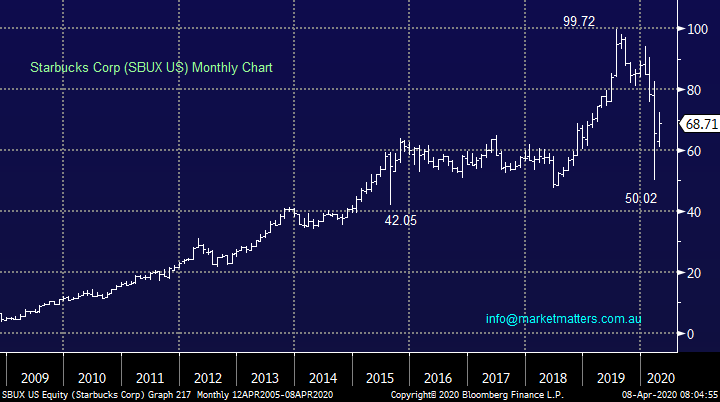

4 – Starbucks (SBUX US) : this Seattle based coffee household name is undoubtedly going to struggle short-term but we believe it’s well positioned to recover in 2021, we like the coffee conglomerate below $US65.

MM is looking to slowly deploy our 18% cash position into further weakness.

McDonalds Corp (MCD US) Chart

Starbucks (SBUX US) Chart

MM Global Macro ETF Portfolio

Again, no change, MM’s cash position remains at a very healthy 39% in our Global Macro ETF Portfolio as we sit poised to act into the current market volatility. Similarly, to the International Portfolio MM have 4 “tweaked” plays in our sights as we continually asses how we see financial markets evolving post COVID-19, undoubtedly a very fluid situation at present:

1 – Buy the BetaShares crude oil ETF (OOO) around current levels for the underlying commodity

2 - Buy Invesco Geared Bullish NASDAQ ETF (QQQUS), this is a position MM is considering “scaling into” during April with our first buy level ~190 – note this $US84.7bn Trust is leveraged ~1.9x.

3 – increasing our position in the Invesco DB Agricultural Fund (DBA US) from 6% to 10%.

4 – Buy Invesco Bearish $US Index ETF (UDN US), we are looking for at least a 15% appreciation in this ETF.

Invesco QQQ Trust (QQQ US) Chart

BetaShares Crude Oil ETF (OOO) Chart

Overnight Market Matters Wrap

- The US equity markets experienced another large swing overnight, erasing all of its intraday gain of 3.5% to close marginally lower.

- The unknown remains whether the spread of the coronavirus has slowed, it certainly has in Australia.

- Crude oil lost close to 7% overnight as traders’ question whether cuts to production are looming.

- Copper futures continued to climb, in hopes that this pandemic is receding, however it will take time for the health of our global growth to return.

- The June SPI Futures is indicating the ASX 200 to lose 36 points this morning, testing the 5215 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.