Overseas Wednesday – International Equities & Global Macro ETF Portfolios (GS US, CAT US, VALE US)

The ASX surged another +1.8% on Tuesday posting a fresh 10-week high in the process although we did finish well below our intra-day high, marginally above the psychological 5600 level. Over 70% of local stocks rallied with the heavy lifting again performed by the Resources Sector with BHP Group (BHP) already up more than +10% for the week. The stock / sector rotation continued in earnest with “risk on” the current main game in town while the likes of a2 Milk (A2M), Cochlear (COH), CSL Ltd (CSL) and the Gold Sector all endured tough days at the office. We’ve been large advocates of “risk on” since late March but after bouncing more than 27% in under 10-weeks we’re now a lot more on the fence, at least for now.

MM has switched to a neutral equities / risk short-term.

Importantly we’re not saying throw in the towel and sell but after holding a fairly aggressive stance towards equities, spearheaded by a 29% direct weighting in Resources we are contemplating taking some $$ off the table. Our small 7.5% cash position in the Growth Portfolio offers limited flexibility but I stress any selling is very unlikely to be directed toward the likes of BHP and RIO, as we discussed yesterday this is likely to be a core position for MM into 2021. However we still see further decent upside in overseas equities hence patience is likely to prevail at least over the coming days / weeks.

Yesterdays advance by global equities was fuelled by the Fed and hopes of a vaccine for COVID-19, unfortunately the later could evaporate just as fast as it surfaced. Risks are increasing for Australia who is now attracting headlines on Bloomberg for all the wrong reasons, last night it was “China considers more economic pain for Australia on virus spat” – I can’t imagine who authorised this verbal aggression towards Asia’s superpower, we had zero to gain and potentially huge amounts to lose - no risk / reward considered in my opinion. Markets are currently largely ignoring the 80% tariff on barley but if it becomes the first of many it could unravel very quickly. Clearly, China is asking Australia to pick sides in their contest with the US, offering a gentle reminder of why we should pick them.

MM remains bullish equities medium-term.

ASX200 Index Chart

I remain surprised that the $A is ignoring the increasing tensions with China, instead the market appears to simply be regarding the $A as the perfect vehicle / quasi play on risk i.e. strong nights on Wall Street are being accompanied by strength in the Aussie. Until this relationship falters we should keep a cautionary eye towards China as opposed to panic with regard to their intentions.

MM remains bullish the $A with a medium-term target around 80c i.e. bullish risk.

Australian Dollar ($A) Chart

This week we learned that Warren Buffett had dumped his holding in investment bank Goldman Sachs (GS US) netting over $US3bn in the process. Berkshires cash holding has now increased to ~$US137bn, up around 8% for the first quarter of 2020, this investment house certainly has some flexibility if we do see major secondary outbreaks of the virus, conversely a “V-shaped” recovery is likely to make its tough year for Messrs Buffett and Munger. Personally I see further upside in the stock but with positions of this size its far more practical to be selling into periods of strength.

Technically Goldman’s looks remarkably like the small cap Russell 2000 and German Dax, if our interpretation of these 2 indices is correct GS is likely to reach but struggle in / around the psychological $US200 area.

MM likes GS initially targeting another ~8% upside.

Goldman Sachs (GS US) Chart

Are International Resources as strong as our own?

One of our major “calls” for the next few years remains that inflation will rise courtesy of the massive global stimulus that central banks are injecting into their respective economies, this should in turn lead to outperformance by the Value Stocks for the fist time since the GFC. Assuming this outlook proves correct we should by definition see base metal prices rally, a move that has not unfolded over the last 2-years although iron ore has remained very resilient which is encouraging. The global “return to the work” by much of the developed world might just be the required catalyst but at this stage it’s all quiet on the Western front. However stocks often lead by 6-months or so and there are some distinct rumblings on this level.

Medium-term MM remains bullish Base Metals.

Blomberg Base Metals Index Chart

The European based resources index has enjoyed a strong fortnight, similar to our own. I wouldn’t be surprised to see a pullback in coming weeks after the 40% rally but we feel this is an index to buy into weakness as opposed to selling into strength.

European Resource stocks support our bullish outlook for the local sector.

European STOXX Basic Resources Index Chart

Caterpillar (CAT US) is the world’s largest manufacturer of mining equipment and as such is often regarded as an excellent leading indicator of the future health of the sector. The picture here is again similar, we are bullish CAT although its going to be tough to maintain its 3.6% dividend in today’s environment with sales down 17% in March on a rolling 3-monthly basis – a major yield for a heavyweight US stock. However lower funding has reduced the companies costs leading to higher profit margins so never say never with regard to the dividend, they have the cash to cover it.

MM is bullish CAT.

Caterpillar Inc (CAT US) Chart

Brazil based Vale is a the major global competitor to BHP and RIO, we’re currently seeing underperformance compared to its peers due to the major COVID-19 breakout in South America which looks likely to significantly impact production over the months ahead. However if we see the world succeed in going back to work with limited further outbreaks it should provide a positive read through for Vale moving forward although we do unfortunately believe countries such as Brazil will suffer badly at the hands of this invisible enemy.

MM is neutral / bullish VALE.

Vale (VALE US) Chart

Conclusion

A quick delve into parts of the International Resources markets supports our medium-term bullish outlook for the sector.

Overseas equities

Overnight US stocks sold off fairly aggressively into the close with the S&P500 finishing down just over 1% although the tech based NASDAQ fared better only declining -0.36%, at MM we still believe the growth sector has further outperformance to enjoy but this trend is feeling very long in the tooth. The late weakness in equities was fuelled by concerns that the Moderna vaccine trials were questioned, something we’ve flagged as almost inevitable over the last 24-hours but we still have the Fed lurking in the background and their rhetoric remains bullish - the “Fed is not out of ammo”.

MM remains bullish US stocks in the medium-term but is now neutral short-term.

German DAX Index Chart

Please excuse the repetition on this theme but we believe it will be one of the major market changes moving forward i.e. Value stocks will reverse their huge multi-year underperformance. Its hard to imagine but effectively what we are saying is the best market returns will be achieved from switching from the likes of Apple (AAPL US) and Microsoft (MSFT US) into the unpopular stocks like the banks however one thing we do know is market “elastic bands of value” do invariably stretch too far plus however good a company is the shares can only be worth so much. We remain patient because long entrenched trends do not roll over without a fight but we are watching this like the proverbial hawk.

MM prefers Value over Growth through the next 12/18-months.

US S&P500 Value & Growth Indices Chart

Overnight Market Matters Wrap

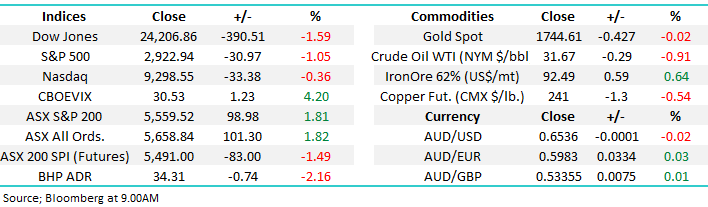

- The US sold off overnight led by the retail and financial sector. The number of reported infections globally has now reached 4.9m and the death rate over 320,000, with the US accounting for about 1.5m infected and 91,000 deaths.

- Commodities were mixed, with gold higher and oil and copper little changed, crude oil is hovering at US$31.67/bbl.

- BHP is expected to underperform the broader market after ending its US session off an equivalent of 2.16% from Australia’s previous close.

- The June SPI Futures is indicating the ASX 200 to open 67 points lower, testing the 5500 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.