Overseas Wednesday – International Equities & Global Macro ETF Portfolios (GMG, 2330 TT, SHOP US, JPM US, QQQ US)

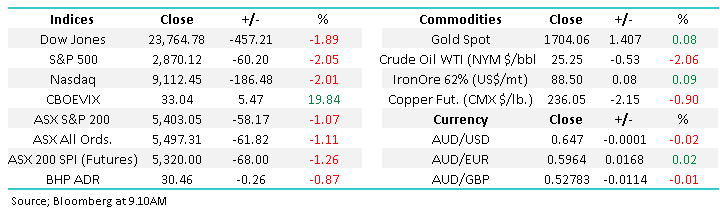

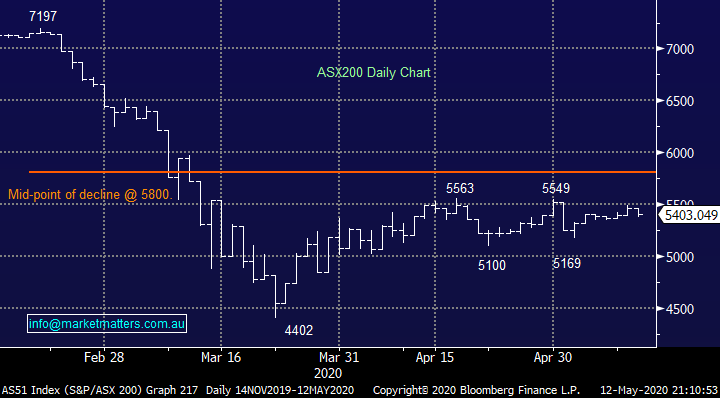

The ASX may have slipped -1.1% lower on Tuesday but yet again it found buying into weakness and after being down 87-points at lunchtime it rallied steadily throughout the afternoon to close down 58-points, retracing a third of its losses in the process. Yesterday was a classic reversion of the “risk on” character of the last few sessions with Energy, Financials and IT struggling while Healthcare rallied +1.5%. With over ¾ of the index closing down it wasn’t a good session, but we still remain firmly in the last months trading range – arguably our best call of 2020! Interestingly with US stocks getting hit overnight again the ASX has proved to be an excellent leading short-term indicator for global equities.

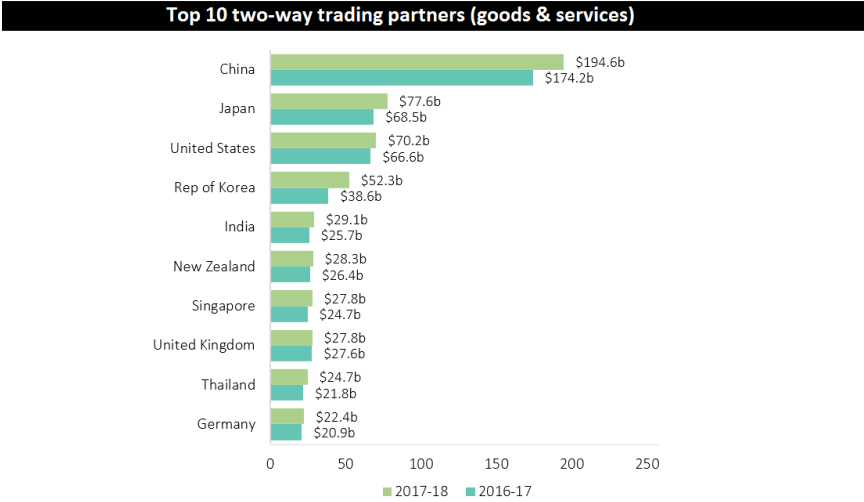

Overall, I feel it was a reasonable performance considering the evolving friction between Australia and China, if our trade relationship with the worlds 2nd largest economy goes pear-shaped it potentially spells disaster for the local economy. On Monday it was Barley and yesterday we saw China suspend beef sales into their country as our trade relationship becomes more delicate by the day, it almost feels like we’re playing a “Trump like game of dare with China” but the bullets in our gun are only rubber! To comprehend the risk of this crazy, stoush simply consider that China receives about a 1/3 our exports in $$ terms, a meaningful disruption here could cripple our economy just when things are slowly improving post COVID-19.

I feel the risk of escalation is not being fully priced into the ASX although we did see GrainCorp (GNC) slip another -3.5%, iron ore stocks underperform and Australian Agriculture (AAC) drop -3.7%.

Source: ABC

We don’t believe a full scale trade war will unfold with China, albeit primarily one-way, but I worry we could potentially be used as a pawn by our large Asian neighbours to show President Trump that they shouldn’t be messed with, just when he’s so vulnerable with Novembers election approaching rapidly. Watching Mr Trump in recent times shows how rattled he seems to be.

MM remains bullish equities medium-term, hence were in “buy mode”.

ASX200 Index Chart

The often intelligent $A did slip 1c on the China news but like the US S&P500 futures it ground higher from around midday only to be again sold-off in the early hours i.e. at the moment the $A is reacting like its normal quasi “risk on” vehicle as opposed to a currency running its own race led by potential trade concerns with China – for the traders, short-term the $A feels ready for a pullback.

MM remains bullish the $A with a medium-term target around 80c.

Australian Dollar ($A) Chart

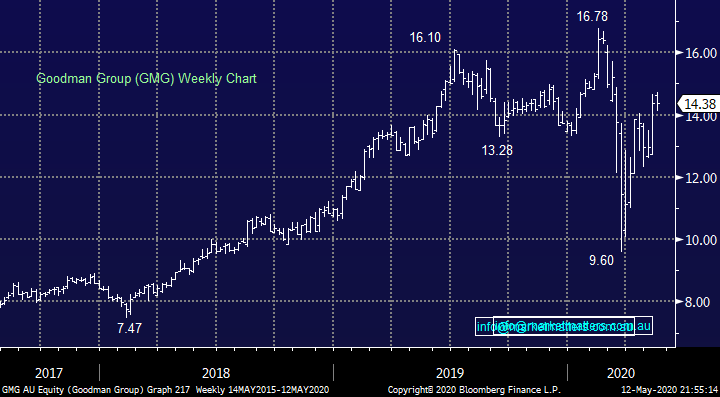

Yesterday we saw a little selling creep into the Real Estate Sector as billionaire Solomon Lew, the chairman of retail group Premier investments (PMV), warned that landlords are in denial that rents will return to their pre-coronavirus levels. PMV announced it would open most of its stores on Friday BUT they only intend to pay rent in arrears for all stores, at a gross % of sales transferring much of the business risk to the landlord in the process i.e. from one extreme to another. This feels like it might be his opening gambit but if the resolution is close to his demand then many landlords need to look in the mirror.

If we do see an aggressive dip in the sector, we are keen on GMG around $13, admittedly around 10% lower but we were there last week.

MM likes GMG from around the $13 area.

Goodman Group (GMG) Chart

Overseas equities

Overnight US stocks fell over 2% following two pieces of damaging news, it wasn’t a bad performance in my opinion although short-term I can see more downside when we consider the combination of the below, “the US is currently between a rock and a hard place” with Trump at the helm:

1 – We heard a testimony from Dr Anthony Fauci, top US public health expert, that COVID-19 is not under control in the US and opening too early is fraught with danger.

2 – The US Fed created a headwind for stocks as they stated “you will get business failures on a grand scale and you will be taking risks that you would go into depression” if the shutdown persists.

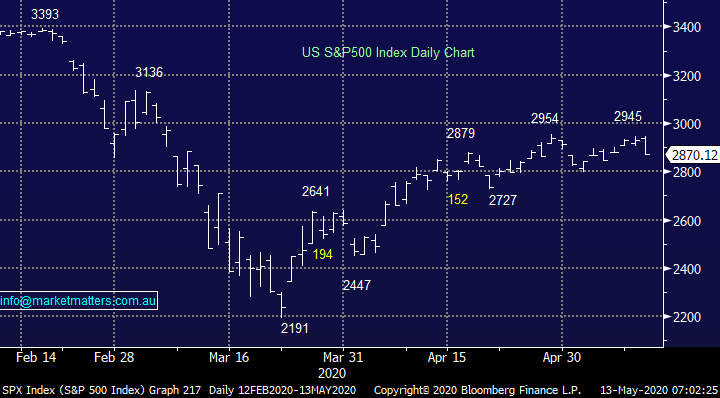

Our ideal short-term target for a pullback by the S&P500 is ~4% lower.

MM remains bullish US stocks in the medium-term.

US S&P500 Index Chart

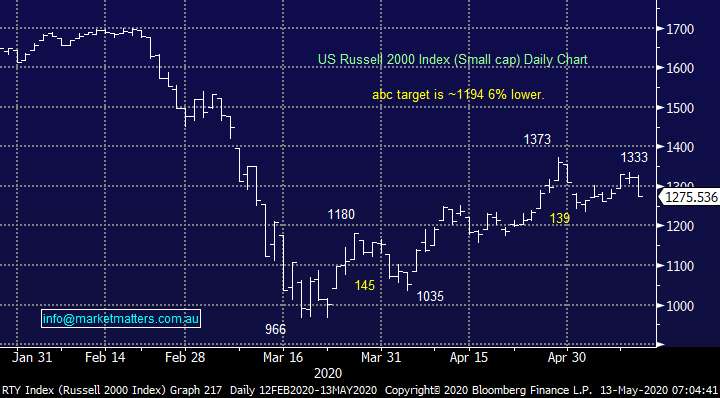

The small cap Russell 2000 Index has been an underperformer for much of the last few years as its doesn’t enjoy contributions from the likes of Apple (AAPL US) and Microsoft (MSFT US). Not surprisingly we are looking for a deeper pullback from this index with a test of 1200 our preferred scenario.

MM’s short-term target for the Russell 2000 is ~6% lower.

US Russell 2000 (Small Cap) Index Chart

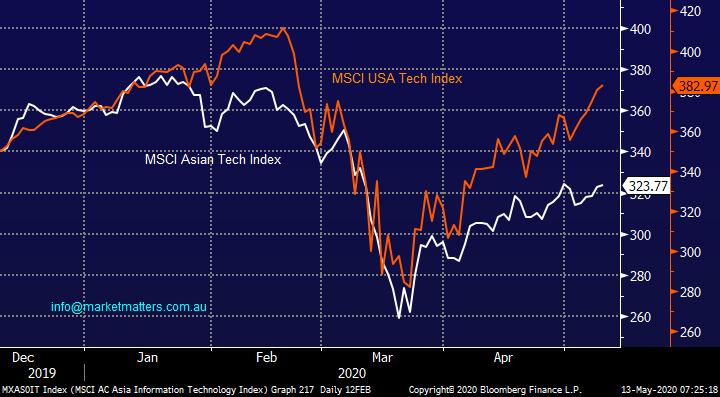

Asian & US IT stocks.

Asian technology stocks have underperformed their US peers in 2020, a move which is on the surface understandable but could be offering some opportunities in our region. As we’ve said previously the coronavirus pandemic has accelerated peoples move up the curve of working, shopping & playing online. Our International Portfolio already has holdings in Alibaba (BABA US), Tencent (700 HK) and Samsung (005930 KS) all of which we like, the question we asked ourselves is do we increase our exposure or switch from one of our US high flyers like Apple (AAPL US) or Microsoft (MSFT US) in anticipation of a period of relative catch up.

In a nutshell we don’t believe that MM should skew particularly towards each region as opposed to evaluating each individual stock on their own merits – our 19% exposure to Asian IT stocks feels about right although I have reviewed one more below. Also we have no interest dumping / trimming our major winners like AAPL and MSFT, we remain medium-term bullish and trying to be too clever with these holdings over recent months would have in all likelihood hurt our performance in 2020.

Hence this morning I have simply looked at 2 IT stocks form both regions, neither of which MM has purchased in the past, shame!

MSCI USA & Asian Tech Indices Chart

Taiwan Semiconductor Manufacturing (2330 TT) as one would imagine manufactures and markets integrated circuits, the more the IT industry grows the better off they should become. The company has found itself walking a tricky tightrope between China and the US as their trade issues rise and fall month to month e.g. Trump wants to disrupt the purchase of Taiwan’s microchips because it supplies Huawei, all a bit too hard from an investment perspective standpoint. This is a great business but we want it cheaper because of the geopolitical risks.

MM likes 2330 TT with ideal entry under 275TWD.

Taiwan Semiconductors Manufacturing Co. (2330 TT) Chart

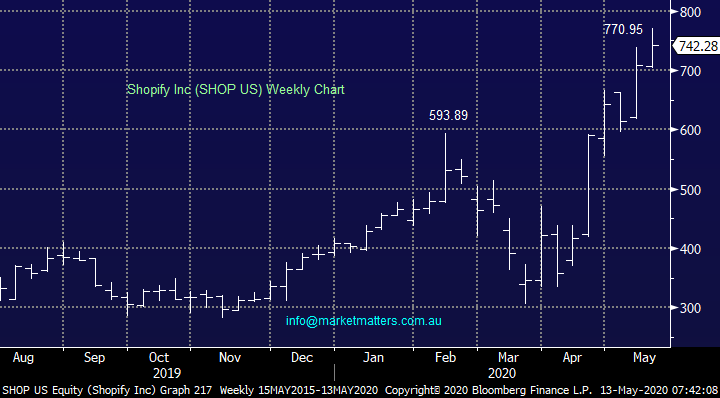

Shopify (SHOP US) provides a cloud based commerce platform which allows businesses to promote and sell things online, it’s been great execution by a business in the right place at the right time - the share price in 2020 clearly demonstrates this. We’ve recently talked up the merits of Amazon which is a stock that remains on our radar, however Shopify is more focussed in the online retail / payments space, is smaller and is growing more aggressively – certainly one worth due consideration, just price the main issue.

MM likes SHOP and will be evaluating entry levels.

Shopify Inc (SHOP US) Chart

International Equites Portfolio

MM still holds 8% in cash following our recent purchase of Exxon (XOM US) and The Trade Desk (TTD US) with TTD already making fresh all-time highs. We are considering increasing our equity market exposure if / when opportunities arise in May but we will be fussy as were close to fully invested : https://www.marketmatters.com.au/new-international-portfolio/

Our thoughts continue to evolve with fresh buying likely to be evenly focused across cyclical / value & growth names with the former still not feeling ready to outperform. However, there’s no change with our opinion that stocks will rally into Christmas in a staircase like manner as we see ongoing swings of sentiment hence in general we will continue to look to buy weakness while not being opposed to selling strength. Short-term we believe a pullback commenced by stocks last night hence we are poised to buy:

We have again updated our 5 most likely purchases / sales moving forward:

1 – Shopify (SHOP US): As discussed earlier we like SHOP, especially into a little weakness, while Amazon remains on the radar at lower levels.

2 - JP Morgan (JPM US): MM is considering increasing this holdings up from 5% to 8% with sub $US80 our ideal averaging area – no hurry yet.

3 – Taiwan Semiconductor Manufacturing (2330 TT) : As discussed earlier we like this stock around 275TWD

4 – LVMH (MC FP): MM is considering taking a relatively small loss on this luxury retailer but while we are bullish over the 1-2 months, we are being pedantic with sell levels.

5 – United Health (UNH US): We are considering taking a ~30% profit on this high flyer if / when we migrate our portfolio further towards Value and away from Growth NB our target still remains at fresh all-time highs, ~10% higher.

*Watch for alerts.

JP Morgan (JPM US) Chart

MM Global Macro ETF Portfolio

MM’s cash position remains at 14% in the Global Macro ETF Portfolio, we remain happy with the portfolios latest purchases in the ProShares Short VIX ETF (SVXY US) & BetaShares Global Energy ETF (FUEL US) : https://www.marketmatters.com.au/new-global-portfolio/

No major changes, moving forward we still only have 2 positions on our radar around current levels:

1 – Buy / Sell Invesco Geared Bullish NASDAQ ETF (QQQ US) : No change, in line with our choppy bullish stance towards US equities, we are considering averaging this 5% position now around $US210 and taking profit above $US230 BUT we will remain “fussier” sellers as we’re bullish.

2 – Buy Invesco Bearish $US Index ETF (UDN US): we like the UDN where it is now, sub $US20, MM is looking for at least a 15% appreciation in this ETF. However we already have exposure to the $A, too early in hindsight, hence any position taken here is likely to be around ½ usual size.

We continue to give our SLVP position more room as its looking good and does coincide with our longer-term outlook for the global economy:

3 – iShares MSCI Global Silver & Metals Miners (SLVP US): MM is now monitoring this position, we may take our $$ if it pops higher as equities weaken.

*Watch for alerts.

Invesco QQQ Trust (QQQ US) Chart

Overnight Market Matters Wrap

- The key US equity indices slid overnight with concerns about the economy the catalyst

- The Fed Reserve of New York overnight started purchasing corporate bond ETFs, a first investment through this vehicle.

- On the energy front, crude oil gained as traders placed bets the reduction in production would help ease the storage issues.

- The June SPI Futures is indicating the ASX 200 open 53 points lower, testing the 5325 level this morning with trade tensions with China still lingering.

Have a great day

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.