Overseas Wednesday – International Equities & Global Macro ETF Note (GDX, SIQ, MSFT US)

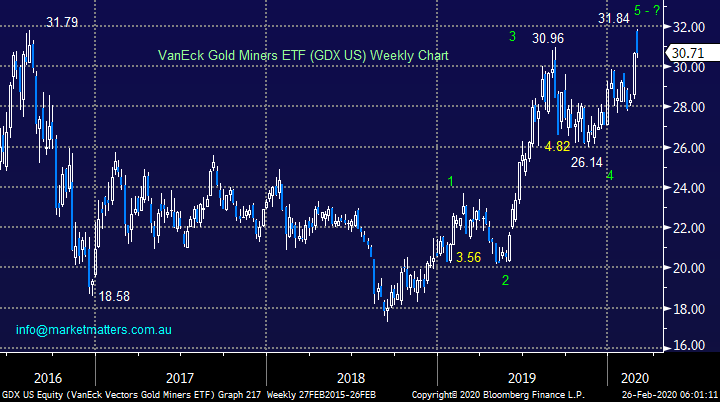

The ASX200 endured a tough and volatile day Tuesday with the ASX200 finally closing down -1.6% but it did manage to end the day 1% above its intra-day low – the optimist in me would say the markets “looking for a low” but it certainly still remains extremely nervous. In 2-days we’ve wiped out all of Februarys gains and yesterdays close below the previous July and November swing highs is a concern from a technical perspective. I was impressed that 14% of the market managed to close up on the day and its was looking like being potentially more around lunchtime before traders became understandably worried about what the US would deliver overnight – which provide correct with the Dow Jones down another ~879-points as the US Centre for Disease Control and Prevention (CDC) told Americans to prepare for 'severe' disruption.

The theme throughout most of yesterday was ironically similar to our own i.e. “mild risk on” into the panic selling, I can imagine the confusion amongst many of our subscribers when I say a market which fell -1.6% was experiencing risk on / defensives off, hence I thought I would explain my simple reasoning:

1 – Defensives off : gold stocks were literally dumped from the opening bell to ultimately underperform the market after opening strongly - Evolution (EVN) for instance traded down more than 6% from its high to the day’s low.

2 – Risk on : The high beta stocks (those that usually move more aggressively than the underlying index) enjoyed a strong day e.g. the majority of the IT sector managed to close up on the day after opening significantly lower, today will be another big test.

Unfortunately the US has not shared our markets optimism over night, it will be fascinating to see if any sustained buyers emerge today. In my experience when people try and pick bottoms things can often be uncomfortable for a day or two before we find out if we’ve been clever. Around lunchtime the market had regained an impressive 100-points of its early losses but not surprisingly it didn’t have the confidence to make an attempt at bouncing further which has been vindicated by US stocks overnight, its uncanny how often the ASX picks or leads the US / European markets with its afternoon price action.

MM needs to see a close back above 6900 to become cautiously optimistic.

Overnight US stocks continued to struggle with the Dow down another -879points, the SPI is calling the ASX to again gap lower towards 6700, down around ~160pts / 2.3%.

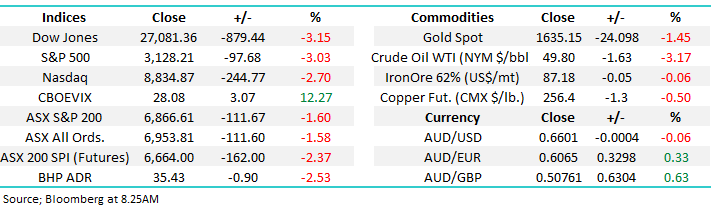

The chart below shows the spike in volatility overnight to levels not seen since December of 2018, and above levels seen during Brexit, however it also shows that volatility spikes, then dissipates, spikes then disappoints – worth remembering on a day like this.

Volatility Index (VIX) Chart

We know the catalyst for the sharp decline is the spread of the coronavirus outside of China, the simple view being that if China’s centralised administration can’t contain the spread, how will the likes of Italy and Iran? It also seemed last night that a combination of a general warning from the CDC around the potential disruption of the virus in the US with a number of companies coming out talking about the impact on business is ultimately what rattled the cage. The question being with interest rates already so low, what ammunition do central banks have to deal with an unexpected shock such as this? The answer is plenty, however the natural reaction has been to sell equities first after a very strong run, and ask questions later.

Today we’ve focused on triggers that will confirm our tilt into risk assets yesterday was correct, when markets become this volatile its important to have an exit plan in case we are wrong.

We also have a raft of companies reporting results, including: AP Eagers (APE), Healius (HLS), IVE Group (IGL) – held in the income portfolio, Nanaosonics (NAN), Nine Entertainment (NEC), Regis Healthcare (REG), RIO Tinto (RIO) – after market, Steadfast (SDF), Virgin (VAH) & Woolworths (WOW). Note Telstra (TLS) trades ex-dividend today.

For an (updated) reporting season calendar courtesy of Shaw & Partners Research – Click here

Importantly MM flagged the coronavirus would cause another wave of panic selling and ultimately a buying opportunity, this is still unfolding according to plan on International indices although the ASX does look set to correct deeper than we expected - no major concerns just yet.

ASX200 Chart

US markets tech based NASDAQ Index has now corrected over 8% in quick fashion, its undoubtedly an unsettling move for investors. Overnight we pulled the trigger on a number of moves in our international portfolio’s (as outlined in the afternoon note yesterday (click here) into market weakness, a move that feels uncomfortable but they always do when markets are sliding. We have been targeting a pullback, not as aggressive as what has transpired however markets often don’t listen as intently as we like!

For now we have no reason to doubt our view but if we are correct a bounce should be close to hand.

MM has now transitioned to neutral / bullish stance on US equities.

US NASDAQ Index Chart

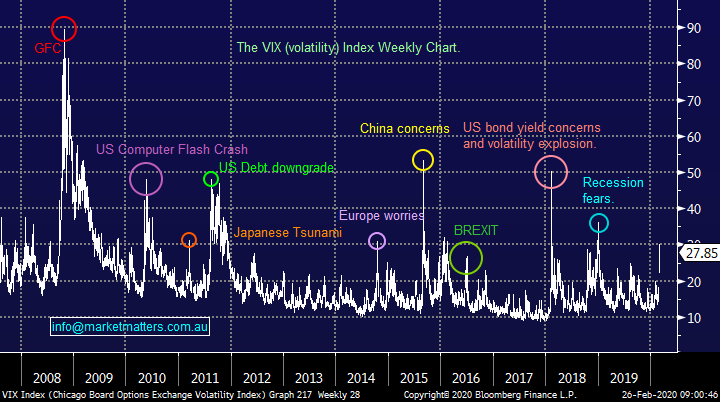

Similarly MM has been calling a low for bond yields around current levels and as MM pointed out previously we probably needed a panic event like the coronavirus to create this potentially blow-off move. Obviously time will tell if we are correct but we’ve certainly got Part A of the equation, a panic flight to bonds sending bond yields down towards all-time lows.

MM believes the flight to the safety of US bonds is causing a top in price / bottom in yield.

US 10-year bond yield Chart

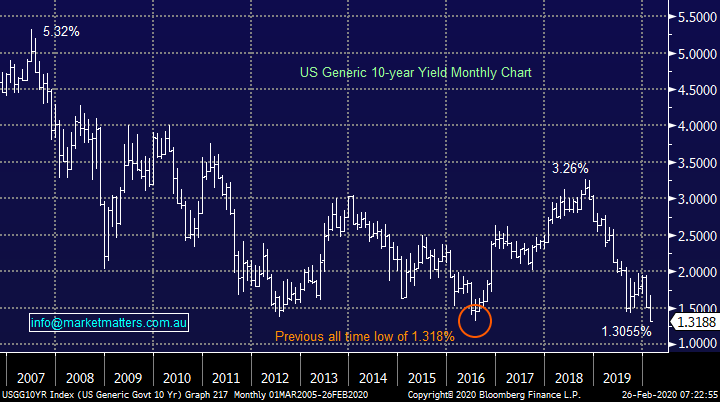

Similarly, safe haven gold appears to have already experienced its blow off top this week having already fallen back towards its weekly lows after spiking higher yesterday, while the stock market has clearly not bottomed, assets like Gold have shown signs of a top.

MM is now neutral / bearish gold stocks.

VanEck Gold Miners ETF (GDX US) Chart

The Australian dollar is regarded by many as a barometer for the health of the global economy with special attention paid to our largest trading partner China. At this stage the only consolation to our contrarian bullish view towards the $A is it’s not accelerating lower but for us to be correct here I feel we need to see a vaccine for the coronavirus plus global central banks push the stimulus button in a major way, not an unlikely scenario but its arguably a question of when.

MM is looking for a low for the $A as downside momentum wanes.

Australian Dollar ($A) Chart

To visit the Market Matters Portfolios – click here

MM Growth Portfolio

Yesterday MM used the markets severe early weakness to increase our exposure to equities, buying Macquarie Group (MQG), plus adding to National Australia Bank (NAB), Westpac (WBC) & Beach Energy (BPT), while selling our 3% position in Evolution Mining (EVN) - this has reduced our cash position to a fairly aggressive ~5%.

NB we deliberately avoided the high valuation stocks because these are usually the worst performers when a correction accelerates i.e. we bought but in a relatively conservative manner.

At this stage we like our portfolio mix, however if we become increasingly concerned that a far deeper pullback is unfolding we are likely to utilise the BetaShares Leveraged ASX200 Bearish ETF (BBOZ) to hedge part of that potential risk.

BetaShares Australian Equities Leveraged Bearish ETF (BBOZ) Chart

MM Income Portfolio

Yesterday we reduced our exposure to hybrids by selling our CBA Capital Note Mar-22 (CBAPF) – an action we’ve flagged for a few weeks. At the same time we’ve moved up the risk curve through buying SmartGroup (SIQ) which currently yields 6.18%, the stock actually closed up yesterday but today will undoubtedly bring another fresh test. The portfolio is now skewed back marginally in favour of equities over more defensive income securities.

We also increased our positions in both BHP Group (BHP) and RIO Tinto (RIO) by 2% each, we believe the China end of the coronavirus carnage has almost played out – bellwether copper only fell around -0.5% overnight which offers a glimmer of optimism.

SmartGroup (SIQ) Chart

MM International Equites Portfolio

MM went shopping overnight after holding a relatively large cash position through 2020. In summary:

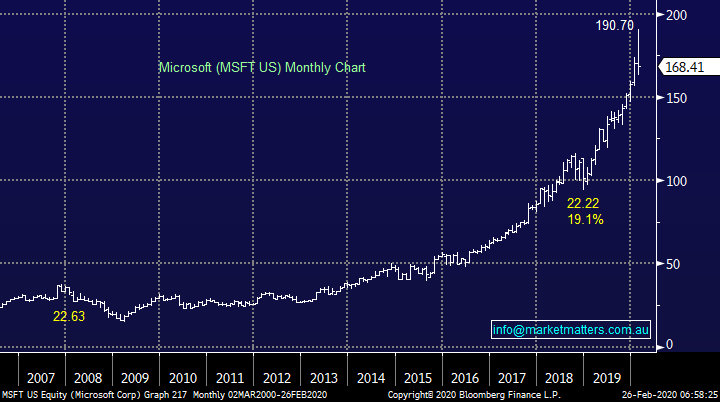

Buy: Alibaba (BABA US) added 2%, Microsoft (MSFTUS) new purchase 5%, LVMH Moet Hennessy Louis Vuitton (MC FP) new purchase 4%, UBS Group (UBS US) new purchase 4%

Sold: ProShares Short S&P500 (SH US) and Barrick Gold (GOLD US).

Our cash position has now reduced to 19%, our likely action moving forward if the declines continue is to add to our existing positions, with likely emphasis on fresh purchases last night.

Microsoft (MSFT US) Chart

MM Global Macro ETF Portfolio

MM pressed the action switch overnight into the stock markets panic, after remaining patiently on the sidelines in 2020:

Buy : iShares Emerging Markets ETF (IEM) add 2%, ProShares Short 20+ Year Treasury (TBF) new purchase 10%, Invesco DB Agriculture Fund (DBA US) new purchase 6%.

Sold : VanEck Gold Miners ETF (GDXUS) and ProShares Short S&P500 ETF (SH US).

Our cash position is now at 39% with our iShares MSCI Global Silver Miners ETF (SLVP US) still in our sell sights, on the buy side we are most likely to increase our existing holdings plus potentially go long US equities when things appear to have calmed.

ProShares Short 20+ year US Treasury ETF (TBFUS) Chart

Conclusion (s)

While markets are selling off, its important to keep a cool head. We added to positions yesterday, now we wait and asses what other changes are needed, if any

Overnight Market Matters Wrap

- Risk off continues across the globe with the 3 key US indices plunging a further ~3% as fears grew of the coronavirus epidemic significantly impacting global growth.

- Investors retreated to the safety of government bonds, sending the US 10 years and 30-year treasuries to all time low levels for the first time since the GFC at around 1.33% and 1.8% respectively.

- On the metals and comodities front, gold, copper and crude oil lost its session’s battle, all ending lower with BHP expected to underperform the broader market after ending its US session 2.53% further from Australia’s previous close.

- The March SPI Futures is indicating the ASX 200 to extend its weakness and open 162 points lower, towards the 6700 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.