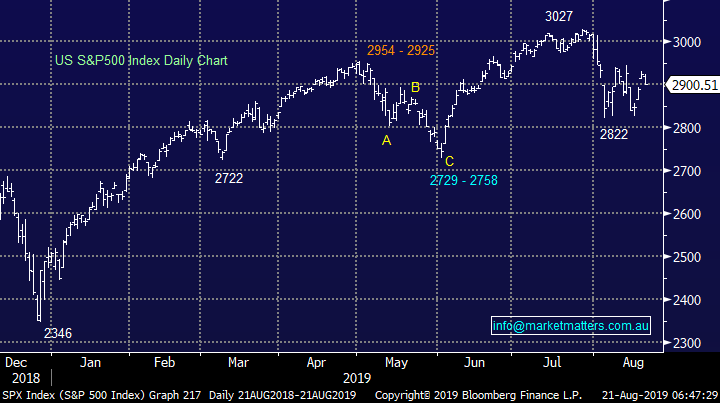

Overseas Wednesday – International Equities & ETF Portfolios (BHP, RIO, IPH, SEK, EEM, FB US, JPM US, DIS US, ABX US, GDX US, TYU9)

The ASX200 enjoyed an excellent Tuesday rallying +1.2% on broad based buying with over 80% of the index closing up on the day, every sector followed the market higher with the energy stocks best on ground surging by +2.4%. The gold sector continued to back track with a number of names from yesterdays “shopping list” now only ~2% away from our buy zones – we anticipate accumulating 1 / 2 names in the weeks ahead. Yesterdays company reports help buoy an already strong market with even BHP, who clearly missed expectations, enjoying an afternoon recovery to close up a few cents, perhaps a few investors were eyeing its 78c fully franked dividend payable in early September. Another big day of reporting today & tomorrow before fewer report on Friday. Reporting calendar available here. Of Note this am, DMP, EHL, SGP, CAR, ILU, STO, WOR, WTC, CWN, BXB to name a few. Initial thought here:

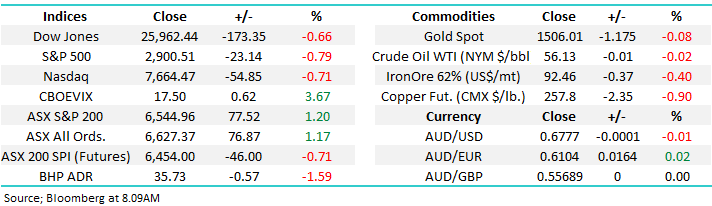

The ASX200 is following MM’s anticipated path illustrated on the chart below, I thought we would get it in once in case everything falls apart over the next few days, nothing mystical we are simply looking for a bounce / correction of the recent 479-point / 7% decline. If this picture continues to play out further downside is anticipated into Q4 of 2019 hence we are looking to skew our portfolio (s) towards a more defensive stance into any strength that prevails ahead of September.

MM remains comfortable to adopt a more defensive stance than during the first 6-months of 2019.

Overnight US stocks retreated with the S&P500 down -0.8% with the resources and financials the weakest sectors, not a good sign for the ASX200. The SPI futures are calling the ASX200 down around 50-points, with BHP down 2% in the US compared to its local close - that’s no great surprise.

In today’s report we are going to update our ideas and plans for our International Equities and ETF Portfolios while also considering a few stock situations in the local market.

ASX200 Chart

Growth Portfolio

Three stocks have caught my eye over the last 24-hours, below is a quick summary on our thoughts towards these particular companies. We are holding a few stocks in the MM Growth Portfolio that may not turnaround in a meaningful manner in the shorter term, they feel like a sitting duck bobbing up in the bath going nowhere, hence we are considering putting the money to work in better areas.

1 BHP Group (BHP) $36.30

Since early July BHP has pulled back over 15% significantly underperforming the index in the process. However the “Big Australian” managed close up following an average report yesterday which was encouraging but it looks set to open back around $35.70 this morning following fresh 2019 lows for iron ore overnight.

Technically BHP looks set to bounce back towards $38 or over 5% higher which is easy to comprehend following its recent underperformance and very attractive dividend due in early September. Similarly RIO which traded ex-dividend almost 2-weeks ago looks set to rally towards $90 or 4-5% higher.

MM is long RIO and a switch to BHP, legged over a few days / weeks would usually feel opportune but there’s the issue of franking credits to consider following RIO paying a $3.0758 dividend a fortnight ago ($4.394 grossed up). Any purchase of BHP would potentially be hedged via a bearish ETF (BBOZ) into strength i.e. we expect BHP to outperform from current levels.

MM likes BHP for a quick bounce towards $38.

BHP Group (BHP) Chart

RIO Tinto Ltd (RIO) Chart

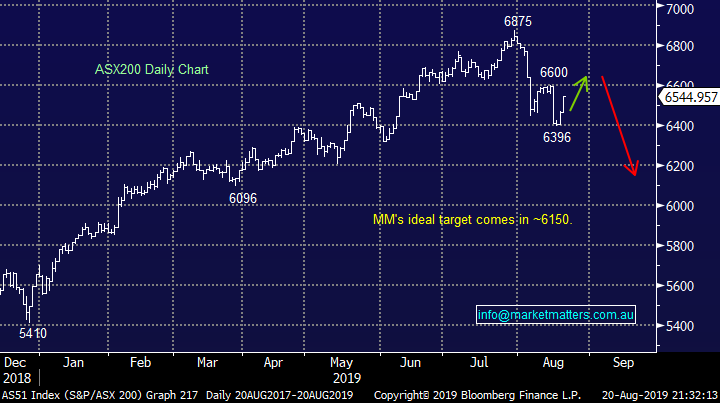

2 IPH Ltd (IPH) $9.45

IPH is an Australian intellectual property business who delivered an strong report yesterday which showed a greater than 30% gain in full year net profit on a revenue increase of 15%. The only issue with the stock is its valuation, 25.5x Est 2020 earnings is not cheap although with the current growth protectory that’s no great surprise, a part franked 2.75% yield is ok but not too exciting.

We like the stock but as its challenges its all-time high the risk / reward has diminished but a dip back towards $9 would do a lot to rectify this concern.

MM likes IPH around $9.

IPH Ltd (IPH) Chart

3 Seek (SEK) $20.03

On-line jobs business Seek (SEK) rallied 5% yesterday after initially dipping lower after delivering its 2019 financial year numbers – revenue up over 18% to $1.54bn with NPAT (net profit after tax) rising marginally after one-offs to over $180m.

The stock clearly loved the outlook for next year of revenue growth of between 15-20%, ahead of expectations. We like the business but it’s all about at what price, the Est P/E for 2020 of 43x is a touch daunting as we saw in late 2018 when P/E contraction hit the market, SEK fell almost 30%.

MM is neutral / bullish SEK.

Seek (SEK) Chart

International Equites Portfolio

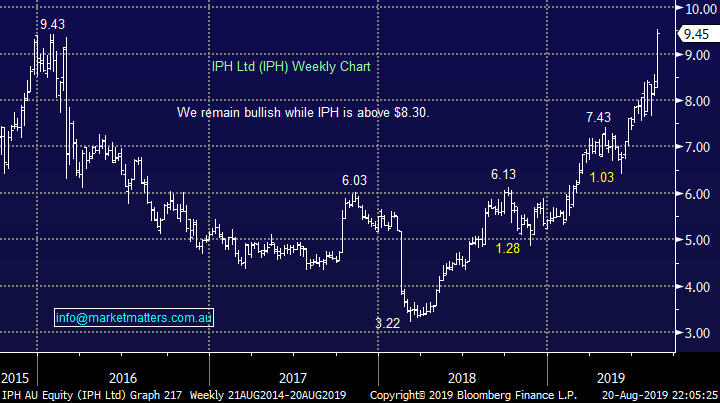

The US S&P500 remains only 4.4% below its all-time high posted in July but things have certainly heated up on the volatility front for investors. We expect further choppy action, probably into September, before another leg to the downside. A pop towards 2950 would be ideal as it will probably stop out all the “weak shorts” making it easier to decline – remember markets like to move in the path of most pain.

MM believes the risk / reward for US stocks is on the downside for the next few months.

Our preferred scenario is the S&P500 will test the 2750 area when the next leg lower commences, or another 5% lower.

US S&P500 Index Chart

MM is still holding 75% in cash plus 2 market hedges via 5% negative exposure to US stocks via an ETF (SH US) and 5% in Barrick Gold (GOLD US) an ideal mix while we are short-term bearish global equities: https://www.marketmatters.com.au/new-international-portfolio/

We continue to anticipate pressing the “Buy button” in an aggressive manner later in 2019 but at this stage patience continues to be a virtue paying the proverbial dividend, if anything we are likely to add to our bearish ETF into a decent bounce moving forward.

Also, we anticipate being active buyers of Asian facing stocks later in the year if / when we see a classic final capitulation sell-off in the region – our target for the EEM shown below is ~35-36 or 10% lower. Stocks on our radar will be the likes of Tencent (700 HKL), Ping An Insurance (2318 HK) and Alibaba (BABA).

Emerging Markets ETF (EEM) Chart

Below are 3 stocks we like into further weakness as quality businesses get dragged down by the recent general negative market sentiment. In our opinion the key is to buy the correct quality stocks into weakness while increasing our defensive / negative skew into strength, hence some of the below buy levels are all below today’s market price.

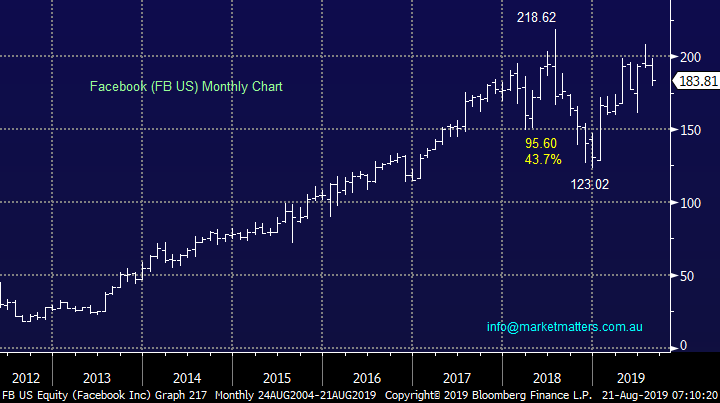

1 Facebook (FB US) $183.81

Social media goliath Facebook has traded in a choppy manner for the last 12-months but we feel when markets finally regain their mojo a push towards fresh all-time highs is a strong possibility.

As always it’s all about the risk / reward, short-term the stock looks heavy while around the $US160 area things look far more attractive.

MM likes FB around $US160, or over 10% lower.

Facebook (FB US) Chart

2 JP Morgan (JPM US) $107.31

Investment bank JP Morgan (JPM US) has performed admirably in this low interest rate environment and it still looks destined for a 15-20% advance.

MM remains bullish JPM targeting fresh all-time highs.

JP Morgan (JPM US) Chart

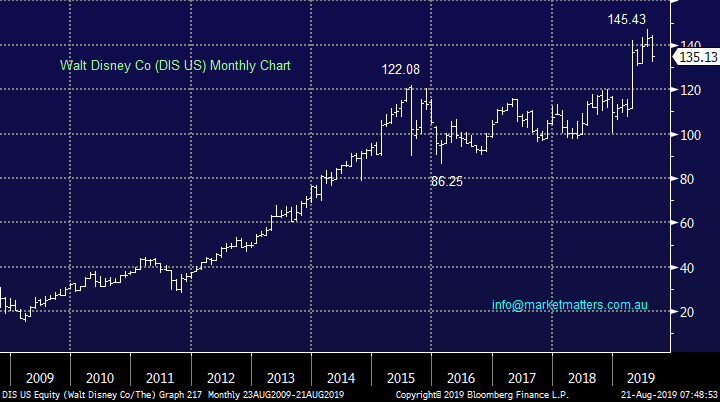

3 Walt Disney (DIS US) $US135.13

The “Happiest Place on Earth” is how Disneyland is often referred to and its certainly appears to make the “rug rats” feel that way! However the stock has also been making investors feel good in 2019 after recently making fresh all-time highs above $US145. We like this global entertainer around 4-5% lower, easily achievable in a few days in today’s choppy market.

MM likes DIS around $US130.

Walt Disney (DIS US) Chart

Barrick Gold (ABX US) Chart

MM ETF Portfolio

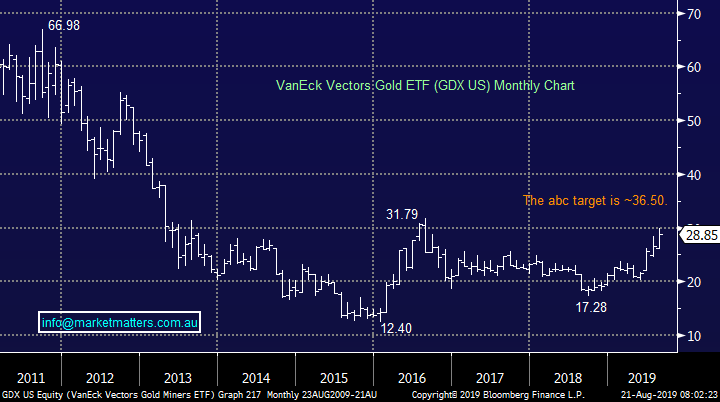

No change, MM continues to hold 3 positions in the portfolio, sorry for the boring start here but investing for the sake of it rarely pays dividends: we are long gold, long the $A and short US stocks while still holding 80% in cash: https://www.marketmatters.com.au/new-global-portfolio/

We remain comfortable with these 3 positions but tweaks feel very close at hand:

1 – We plan to average the long $A following the local currencies fresh multi-year lows below the 67c area level, we are now looking for an optimal technical set-up, not far away now.

2 – We are looking to increase our bearish exposure to US stocks into the current rally, a move above 2950 for the US S&P500 feels correct i.e. around 26.50 for the ProShares short S&P500 ETF which we currently hold.

3 – We are looking to increase our gold exposure, potentially by simply increasing our GDX position.

4 – As looked at earlier we feel that Emerging markets are poised for a final spike lower, Our preferred vehicle is the ProShares Emerging Markets Short MSCI ETF (EUM US). Details of this ETF are explained on this link : https://www.proshares.com/funds/eum.html

VanEck Gold ETF (GDX US) Chart

The other market which remains on our radar is the very topical bond market which is continues to move in the opposite direction to stocks as it acts like a safe haven. MM remains bullish bonds but recognises they are in a mature bull market and currently look to be in the middle of a short-term pullback.

Our preferred long vehicle is the iShares US Treasury ETF (GOVT US). Details of this ETF are explained on this link : https://www.ishares.com/us/products/239468/ishares-us-treasury-bond-etf

We are considering taking exposure to US bonds ~129-16 basis the 10-year notes.

NB with US bond futures 1 point is separated into 32nds i.e. 131-11 represents 131 11/32.

US Ten-year Notes (TYU9) Chart

Conclusion (s)

MM likes sitting on our hands at this stage but we are dusting off the buy button in the likes of Facebook (FB US), JP Morgan (JPM US) and Walt Disney (DIS) – we actually like JP Morgan (JPM) around todays $US107 level.

Conversely we are looking to increase our bearish / defensive plays around 2% higher for the S&P500 i.e. increase our ProShares short S&P500 (SH US) ETF position and potentially increase our gold exposure simply through buying more Barrick gold (GOLD US)..

Overnight Market Matters Wrap

· The key US equity indices closed lower overnight, following President Trump’s comment that he is not prepared to make a trade deal with China.

· Commodities were mixed, with copper, aluminium and iron ore all easing while the spot gold price rallied to US$1507/Oz.

· BHP is expected to underperform the broader market after endings its US session off an equivalent of 1.59% from Australia’s previous close.

· Locally, corporate reporting season continues at pace today with results due from leading companies including APA, BXB, CAR, CWN, DMP, ILU, ORG, SGP, STO and WOR.

· The September SPI Futures is indicating the ASX 200 to open 40 points lower, testing the 6500 level on a busy day of corporate earnings.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.