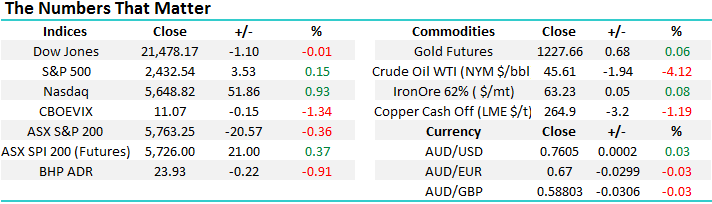

Our view on key Commodities; Oil, Gold, Iron Ore & Copper

The Australian market ran into some profit taking yesterday after a strong move the previous session, the ASX down by -20pts although the miners continued their recent strength adding +0.92% led by a strong performance in BHP following a number if broker upgrades. That suggests to us the ‘easy’ money might have been made in the short term as analysts chase share price moves!

US stocks were more or less flat overnight however the NASDAQ did bounce, up by +0.67%. We’ve been targeting a ~5% correction for US stocks in the short term and we’ve seen the NASDAQ correct by -4% to date, however the S&P 500 has only dropped by -1.9% - the selloff being small with low conviction. Both indices remain medium term bullish and we continue to target higher levels, best guess ~6-8% higher. This of course will be dictated largely by the upcoming US reporting season which kicks off shortly , with the market optimistic on US Corporate earnings. We’ll cover this theme in upcoming notes.

Crude Oil

At the start of the year we flagged a likely range for the Oil price of $US40/b to $US60/b and we’ve seen a range play out between $US42/b and $US55/b, so we’re on track in terms of our bigger picture expectations. Oil settled overnight at $US45.61/b, down around ~3% on news of rising OPEC exports. The selloff followed the best rally in Crude in over a year so probably more a result of profit taking and the media ‘curve fitting’ for a reason.

We hold BHP in the portfolio which is our only exposure to Oil at this stage, and it seems the Oil price is too 50/50 at this point to warrant a straight out Oil play. We think the range will continue to hold for now, and would only look for good risk/reward trading opportunities at the extremities of the range i.e. BUY around $US40 / SELL around $US55-60.

Crude Oil Weekly Chart

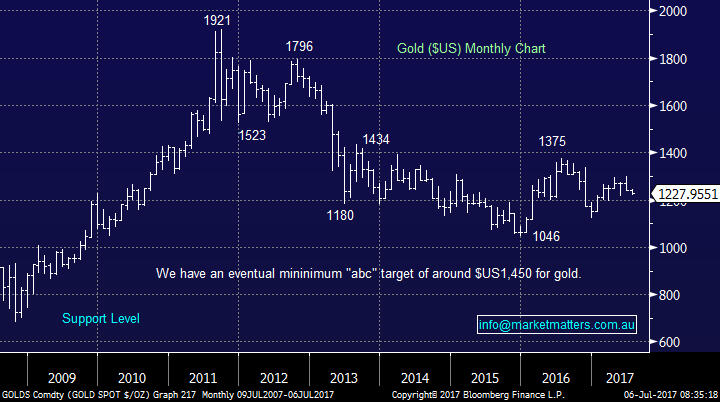

Gold

Gold has been weak in recent times trading from a June high of ~$US1300 to a low of $US1218 a few days ago. Some small buying overnight despite a strong US currency and Gold is now starting to look interesting as a hedge against potential volatility. We’re reasonably big participants in the options market dealing for both retail and institutional clients on a daily basis and right now we’ve got this eerie feeling that risk is not being correctly priced. Volatility is very low and therefore option premiums are low. We’re generally sellers of options to earn premium, and quite simply, we’re not being compensated for the risk - this is relevant for Gold. Gold is used as a hedge against a lot of things, but the main thing that supports Gold is risk. Risk and Gold prices tend to track each other fairly nicely.

The recent weakness in Gold is a clear indication that the market is comfortable, and that might be the correct positioning for now given that cash levels remain high and fundies will buy weakness, however our ‘gut feel’ suggests that volatility has more room to move on the upside rather than the downside at the moment, and that would be supportive of Gold. We own Newcrest as our Gold play and we’re down on the position, however we’re more likely to increase our gold exposure from current levels than reduce it.

Gold Weekly Chart

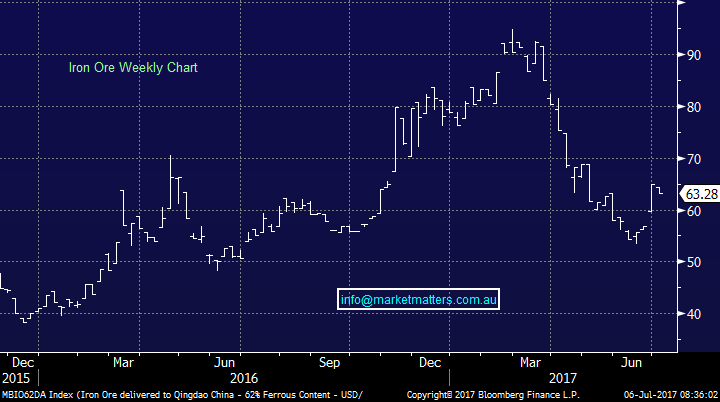

Iron Ore

Iron Ore is in a ‘Bull Market’ according to media headlines with a run up from $US53/t to $US65/t in the last week or so. The strength follows a run of better ‘growth data’ from China but also improving demand for Steel in Europe and other major global markets. We expect Iron Ore to be extremely volatile this year and trading the Iron Ore names rather than holding and hoping makes perfect sense in this type of environment.

Iron Ore Weekly Chart

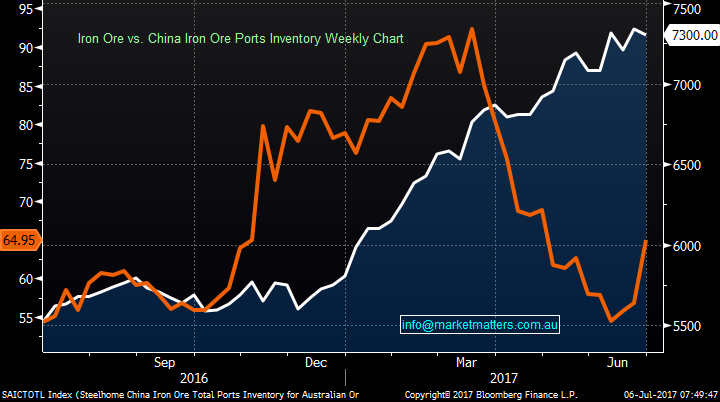

We think high volatility for a few reasons however the two main ones create cross currents for Iron Ore prices. Better global growth data which will underpin higher Global Interest Rates as we’re expecting will be a positive for Iron Ore prices, however production of Iron Ore is rising and stock piles are high. Any slip in terms of growth data, the markets attention will focus on high production and inventories, and the price will fall. At this juncture, we own FMG, RIO & BHP with Iron Ore exposure. All have enjoyed strong rallies but are approaching short term resistance.

Iron Ore (Orange) vs Inventories (White)

Copper

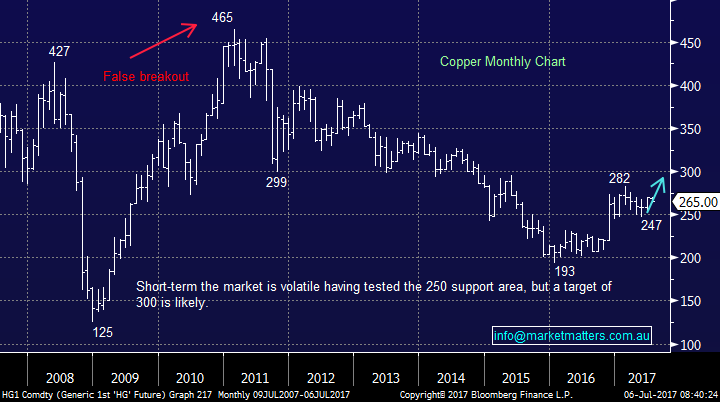

Copper has been more muted / less volatile in calendar year 17 thus far however overall we remain short term bullish Copper, targeting a move up to the 300 region after testing 250 recently. Copper has been weak for the past 5 years more than halving in price on big global oversupply. That balance is slowly changing and the Copper market is expected to go into deficit in 2018. Like all commodities, expect volatility to be high and Copper remains in our trading basket. We own Oz Minerals (OZL) as our core Copper exposure.

Copper Monthly Chart

Conclusion (s)

- We are neutral Oil at current levels and are happy being square the sector for now

- We will be active around our Iron Ore exposures predicting a very volatile year for Iron Prices

- Gold has traded back to reasonable levels and we are looking to add to our Gold exposure **Watch for Alerts**

- We are short term bullish on Copper

Overnight Market Matters Wrap

· The US resumed its market overnight and ended mixed with marginal change as investors are digesting mix signals from Fed officials following its policy meeting.

· Oil resumed its medium term slide, losing 4.12% overnight – expect our local energy sector to underperform the broader market today.

· The June SPI Futures is indicating the ASX 200 to open 35 points higher, towards the 5780 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/07/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here