Our market has become ruthless

We may finally be getting a little volatility in global stock markets courtesy of Donald Trump but locally we have already seen some tremendous moves within the market itself on the stock level in 2017. It's very important to keep abreast of what's unfolding within our market to try and avoid the landmines that appear scattered throughout the Australian share market e.g. Virtus Health (VRT) down 17.7% yesterday.

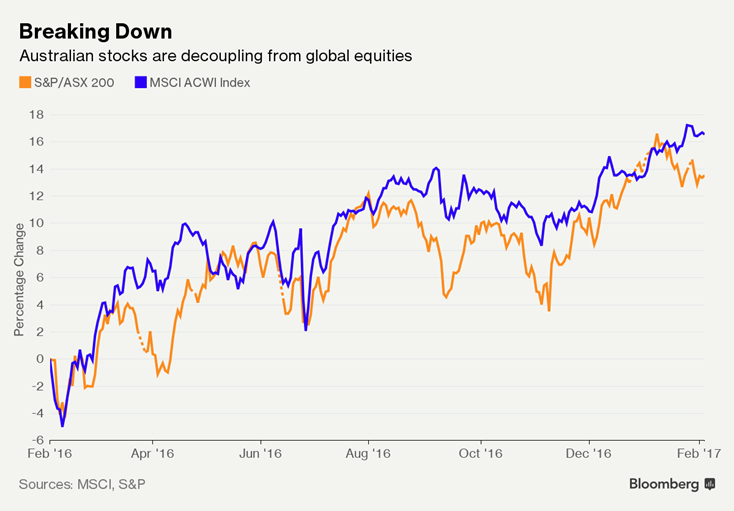

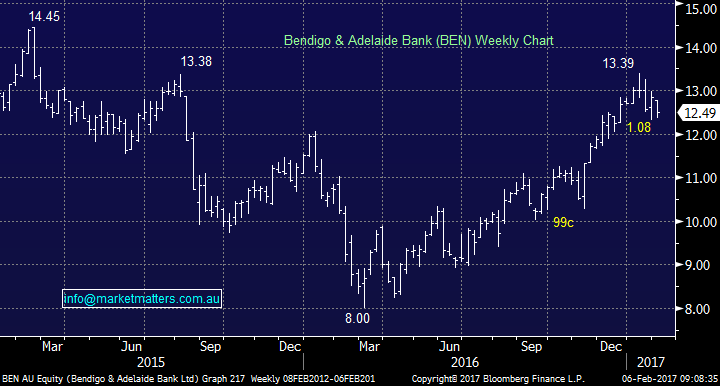

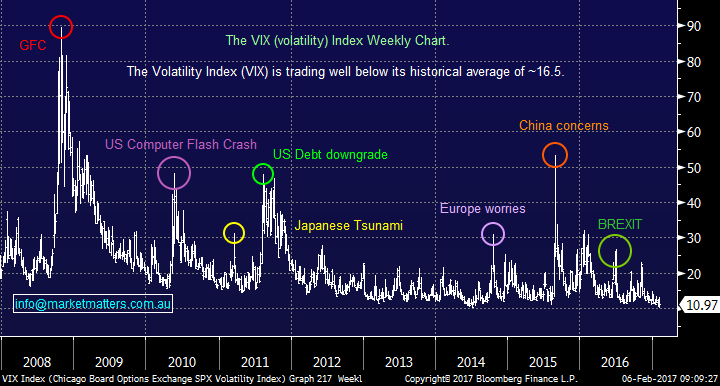

Firstly, let's keep our finger on pulse of how major markets are currently unfolding as opportunities are certainly presenting themselves. When we look at the Volatility Index (VIX) in the US it's clear that markets remain extremely complacent to a major downturn with the VIX trading around 30% below its recent average, even after the jump over recent days. We believe this will hurt many traders in 2017, but later in the year.

US Volatility Index (VIX) Weekly Chart

US stocks have already corrected 1.7% after the spiked over 20,000 but insightfully the pullback is fairly begrudging on an intraday basis with buying appearing into any decent weakness. The current price action is aligned with our view that this pullback can be bought targeting fresh highs in 2017 but we do anticipate the current pullback will eventually be around 4%.

US Dow Jones Daily Chart

The ASX200 has definitely led the decline by equities since its euphoric highs earlier in January, declining by 3.8% in fairly quick fashion. We remain buyers around the 5600 area and expect we will soon start to outperform, especially if the $US continues to decline as it did last night. A weakening $US will support commodity prices and hence resource stocks which are an influential part of the ASX200 e.g. Even with the Dow again falling over 100-points overnight BHP is set to open up 50c and the local market up ~10-points.

The ASX200 Daily Chart

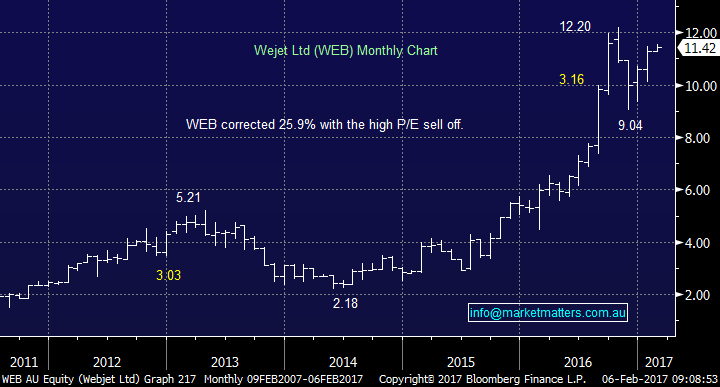

The stocks that have recently been hammered in the local market are dominated by the high P/E stocks starting with the big end of town and unfolding all the way down to the smaller / medium size businesses. These high valuation stocks are basically priced for perfection and as we have been witnessing any adjustment to their trading outlook is leading to a savage rerating of the company's share price. The average return on high P/E stocks within our universe over the last 6-months is around -35% in a market that has rallied! This is a scary number with around twice as many of the stocks in the group falling compared to those rallying, some standouts are below:

1. Losers - Aconex (ACX) -62%, Domino's Pizza (DMP -21%, Ramsay Healthcare -15% and Sydney Airports (SYD) -23%.

2. Winners - Clearview Wealth (CVW) +39% and Computershare (CPU) +45%.

However it should be remembered that 6-months is a relatively long time in stocks and investors now avoiding the high P/E stocks will also provide excellent opportunity, a great example is CSL that we bought after it corrected ~$10 being fundamental fans of the business, unfortunately the stock got caught up in the "sell all high P/E stocks sentiment" leading to an almost $30 fall / 24.4% before issuing a profit upgrade that saw the stock rally $20 instantly - quality reigns.

CSL Ltd (CSL) Monthly Chart

Three businesses in the high P/E sector we currently like are Cochlear (COH) which is on 38x, Treasury Wines (TWE) on 46x and Ramsay Healthcare (RHC) on 31x. While our targeted buy areas may seem almost a dream at present the current sentiment and volatility makes them far more realistic plus in the current environment it makes sense to be fussy on entry:

1. Cochlear (COH) $125.17 - We are buyers around $120 or 4% lower a realistic target for a volatile stock that is 13% under its 2016 highs and 11% above its recent low.

2. Treasury Wines (TWE) $11.63 - We are currently targeting a $3 pull back to buy TWE.

3 Ramsay Healthcare (RHC) $66.80 - We are buyers under $60, over 10% lower but the stocks has already corrected ~$17, or 20.5%.

Ramsay Healthcare (RHC) Monthly Chart

Summary

- We remain sellers of strength and buyers of weakness which is currently unfolding nicely as anticipated.

- We will be cautious buying high p/e stocks where the risk / reward has been dangerous in today's environment but if opportunities arise in stocks we like we still buy weakness - see COH, TWE and RHC above.

Overnight Market Matters Wrap

- Weakness continued in the US equity markets, with the Dow down 107 points (-0.54%) to 19,864 and the S&P 500 off 2 points (-0.09%) to 2,279.

- The Utilities sector outperformed the broader market, gaining over 1%, along with the Health Care sector, up 0.9%. This was offset by the Financials and Industrials sector, losing 0.8% and 1% respectively.

- Gold continues to creep higher, with the futures contract settling 1.29% higher to US$1,208.60/oz.

- The March SPI Futures is indicating the ASX 200 to open marginally higher by 8 points, testing the 5,630 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/02/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here