Our buyers hat is being dusted off – 5 stocks / positions we are considering. (ORE, BHP, Z1P, CBA)

The ASX200 is set to open just above 6000 this morning, down around 1% so far in 2018. The US has come back from its holiday with a pretty disappointing performance falling marginally but more importantly closing over 1% below its record breaking intra-day high. We see a few of very interesting factors currently at play which overall MM feels is net negative short-term:

- Investors are very long stocks with a record $474m inflow into the “iShares Edge MSCI USA Momentum Factor ETF” last week alone i.e. basically bets that the high flying stocks will keep roaring higher into 2018.

- Cash holdings across US Funds is at a 5 year low, showing ‘high conviction’ in US stocks, and less flexibility for a mkt downturn

- The ‘Trump Tax cuts’ for corporate America are now in play which is obviously a positive, however analysts upgrades have not been aggressive suggesting that a large proportion was already factored in / positioned for. Interesting to see overnight that Citi took a massive US$22b hit courtesy of the changes given the bank was carrying tax losses. As is often the case, mkts look at an impending change through rose coloured glasses, and when reality hits, it may not be as positive. That is the genesis of the BUY the RUMOUR – SELL the FACT call.

If investors are all “betting” that US stocks will keep rallying this year a sharp snap lower is easy to comprehend and would almost be normal when the consensus call is a bullish one. Despite the current positive hype in market it currently feels pretty good to be sitting on a significant 26.5% cash position within the MM Growth Portfolio + a high degree of flexibility within our Income Portfolio given asset mix - we’re obviously wearing our “buyers hat” into weakness. Our ideal level in terms of the index is to accumulate stocks around 5950 but our preferred sector are the miners, which we may potentially start accumulating a touch earlier. They will be weak today with both RIO and BHP falling ~2.5% overseas.

As you know we believe the next 2 years will be about being smarter and more nimble than the classic buy and hold investor as the post GFC bull market enters its 9th year. We believe investors should be prepared to cast their net wider at times to obtain optimum returns, today we have looked at 5 stocks / positions we are considering in coming weeks / months.

ASX200 Daily Chart

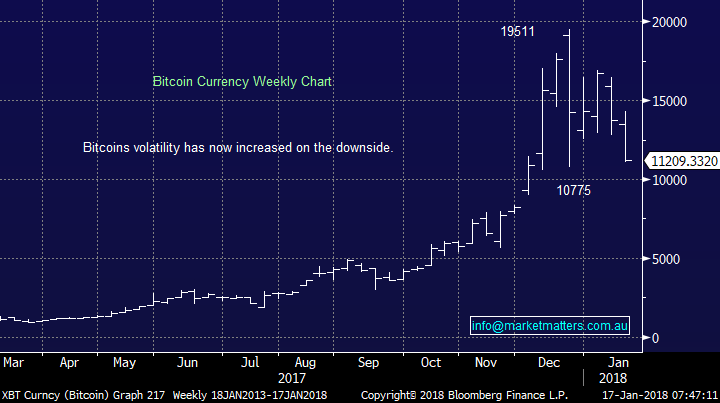

Firstly a quick note on the much discussed cryptocurrency space, most players are licking their wounds this morning.

Bitcoin

There is no such thing as easy money and bitcoin illustrated this perfectly last night,many ‘punters’ would have probably been hurt by its ~20% plunge. A number of subscribers have asked us our thoughts on Bitcoin and Denis (the youngest member of the MM team and by far the most technically minded) recently wrote an excellent piece for our MM subscribers but 2 points for those that are following closely:

- MM will not be playing in Bitcoin due to its volatile nature, we do not perceive it to be an investment despite some well credentialed commentators spending a disproportionate amount of time writing about it

- Technically, and if we were feeling enlightened, the buy zone would be sub-9000 with stops under 7800 as a high risk trade – but anything could happen here!

We cannot stress too heavily the degree of volatility which Bitcoin is exhibiting - this morning its trading over 40% below December highs – most definitely a highly speculative punt, not an investment.

Link to MarketMatters Bitcoin piece

Bitcoin Weekly Chart

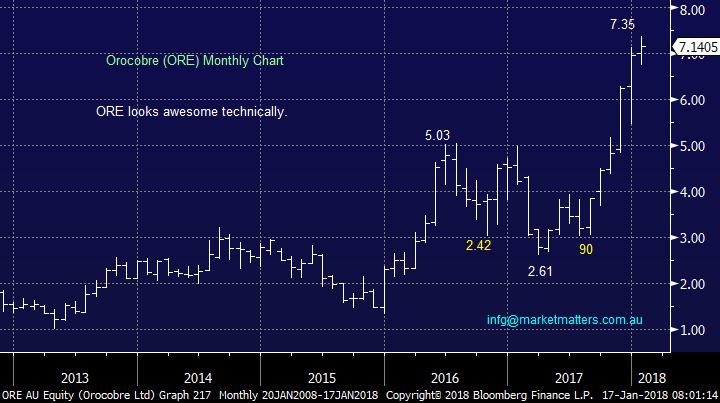

1 Orocobre (ORE) $7.14

Orocobre is focussed on Lithium which is clearly a “hot space” over recent times due to its use in batteries. This week Toyota has taken a $A282 / 15% stake in the company illustrating their belief in electric cars moving forward plus the company have offered a $6.55 rights issue to existing shareholders – the money is to fully fund its phase 2 capital expenditure at its Olarez lithium in Argentina.

While we talked about, but missed, last year’s gains in ORE we remain bullish the stock.

We are keen buyers into any weakness that may follow the $6.55 rights issue.

Orocobre (ORE) Monthly Chart

2. Currency ETF’s

As you are no doubt aware MM believes that last year’s weakness in the $US may be close to completion with our current target around the 88 area for the $US Index. MM is strongly considering allocating part of our Growth Portfolio into $US over coming weeks and this can be done easily through the use of a currency ETF listed on the Australian market. Stay tuned for more information / insight into this.

$US Index Daily Chart

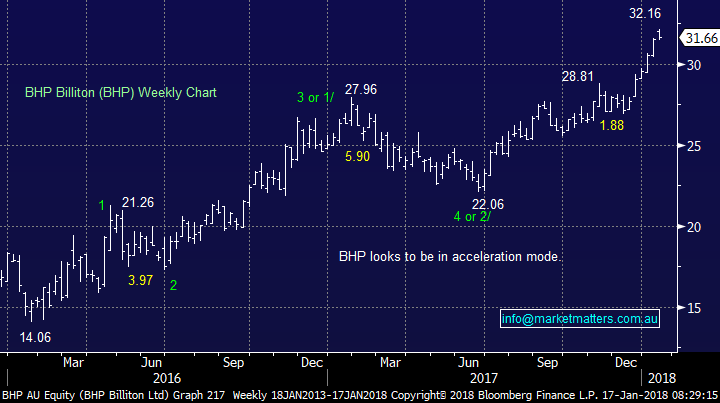

3 BHP Billiton (BHP) $31.90

We are keen on BHP in 2018 from both a bottom up valuation and technical perspective. However after such a strong advance pullbacks should be expected, this morning the stock is likely to open down almost 2.5% lower, under $31 and already 4% below the years high.

MM’s ideal area to start accumulating BHP slowly into weakness is under $31.

BHP Billiton (BHP) Weekly Chart

4 ZipMoney Ltd (Z1P) 82c

We touched on Z1P in yesterday’s afternoon report and basically we like the story and importantly the risk / reward from buying at current levels. Afterpays (APT) excellent corporate and stock performance aids confidence to the space i.e. buy now pay later, Vanessa in our office uses them all the time exhibiting the typical Gen Y behavioural trait of buy now – pay later!

APT currently has a cleaner more seamless / efficient system for the consumer but this leaves plenty of room for improvement by Z1P.

We are buyers of Z1P around 82c with stops under 73c targeting well over $1.

ZipMoney Ltd (Z1P) Weekly Chart

5 Commonwealth Bank (CBA) $80.58

In late December we sold half of our position in Westpac (WBC) with a view to potentially allocating some of the monies into CBA with the February dividend looming. WBC has fallen since the sale but CBA is not yet at compelling levels.

MM is considering increasing our CBA holding under $79 I.e. over 2% lower.

Commonwealth Bank (CBA) Daily Chart

Conclusion

While MM is wearing its buyers hat, we will be patient into current weakness.

We like ORE into any decent weakness, US currency ETF’s around 2-3% lower, BHP to accumulate slowly under $31, Z1P around 82c and CBA under $79.

Global markets

US Stocks

Last night’s strong reversal implies that the 2800 area may prove a stumbling block for a while at least.

US S&P500 Weekly Chart

European Stocks

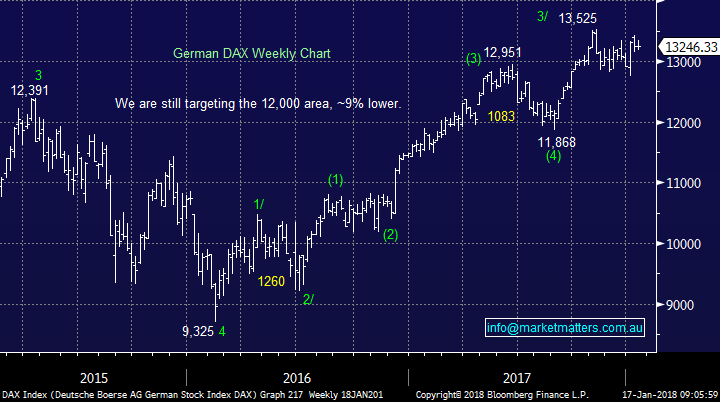

European stocks look set to make fresh recent highs the big question is will they fail or kick on. At this stage we are sitting on the fail side but only just!

German DAX Weekly Chart

Overnight Market Matters Wrap

· A strong start in the US indices overnight, touching all-time highs, only to fade early in the session and close in the red zone.

· The ‘safer haven’ stocks were clearly favourable, with the real estate and health care sectors outperforming, while the consumer discretionary, industrials, materials and energy sector being the laggard.

· The volatility (VIX) index rose ~15%, but still in its ultra-complacent levels at 11.71.

· BHP and its mining and energy sector is expected to underperform the broader market today, after closing an equivalent of 2.48% lower from Australia’s previous close towards $30.89.

· The March SPI Futures is indicating the ASX 200 to open 34 points lower towards the 6015 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/1/2018. 8.00am

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here