Not all Fund Managers are equal

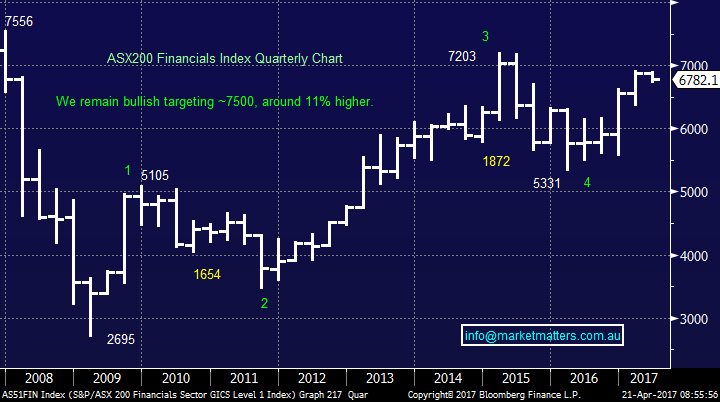

The ASX200 has been holding onto its 5800 major support in very quiet / lacklustre trade as school holidays slowly come to an end, plus Anzac Day is looming next Tuesday which will see many take another long weekend. Overnight US markets followed the MM script from Thursdays report perfectly with the Dow bouncing 174-points, almost half of the minimum 400-points we expected. Coincidentally with today's report the major strength came from the financials assisted by comments from the Treasury Secretary around tax cuts plus the odds for a June rate hike increasing - higher US yields are good for their Financial Sector. The rollercoaster ride of market interpretation around the speed that the Fed will hike interest rates continues!

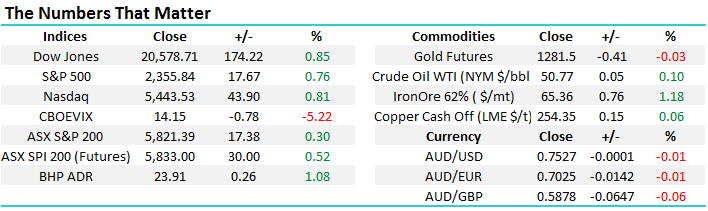

We thought this morning would be an ideal opportunity to look inside our favourite local index for the next few months - the very influential financials. The long-term Financials Index we have shown below includes the banks, insurers, investment managers and property trusts. We remain bullish the Financials Index targeting over 10% further upside and this is reflected by its dominance in our holdings within the MM Portfolio i.e. CYB, NAB, PTM, ANZ, CBA, HGG, QBE and SUN for an overall whopping 56.5% weighting.

Today we are going to specifically look at the fund managers to evaluate if our positions in PTM and HGG feel correct moving forward, no point looking backwards!

ASX200 Financials Index Quarterly Chart

The strength in US equities overnight impressively took the Tech. based NASDAQ back within 0.7% of its all-time high - we remain bullish the NASDAQ over coming months. We are 50-50 how US stocks will unfold into the seasonally weak May-June period but we would only consider selling for a classic "sell in May and go away" retreat if we saw all 3 of the Dow, S&P500 and NASDAQ make fresh highs in coming weeks, probably around 3% higher.

US S&P500 Weekly Chart

Moving onto today's main topic, firstly let's look at 5 major players in the sector since the equities Bull Market commenced in March 2009 and more recently since the start of 2016, during the same period the ASX200 has appreciated +86.5% and +10% respectively:

1. Magellan (MFG) +6147% and -14%.

2. Challenger (CGF) +1467% and +44%.

3. Henderson Group (HGG) +376% and -36%.

4. Perpetual (PPT) +268% and +11%.

5. Platinum Asset Management (PTM) +147% and -39.7%

Notably all 5 stocks have significantly outperformed the ASX200 since the GFC which makes sense as their sheer existence was questioned at the depths of the 2008/9 panic hence leading to an extreme panic sell-off. The obvious standout from our two current holdings is they have been distinct laggards over the last 15-months. If we are correct and the Financial Sector is going to appreciate at least 10% moving forward the question is will the weaker companies play catch up, or the strong / quality continue to dominate. A quick snapshot view on the 5 companies:

1. MFG $23.36 - Magellan has traded in a very choppy fashion since its high in early 2016 and is down 14% during this time, while the ASX200 has gained 10%. Basically both revenue and profits have declined during this period but the stock remains on a rich P/E for 2017 of 20.9x while yielding 3.3% fully franked. Overall we are neutral MFG with a slight positive bias.

2. CGF $12.62 - Challenger has killed it with its annuities business over almost any timeframe since its 86c low during the GFC - we enjoyed a decent portion of this advance but alas have so far left too much on the table. The company continues to perform admirably on the corporate level and the share price is likely to follow until we get a major correction in equities. However we also believe the market is long / overweight CGF which will act as a headwind, we are keen buyers around $10.50 if a decent pullback unfolds. The stock is trading on a reasonable valuation of 18.9x while paying a 2.65% fully franked yield.

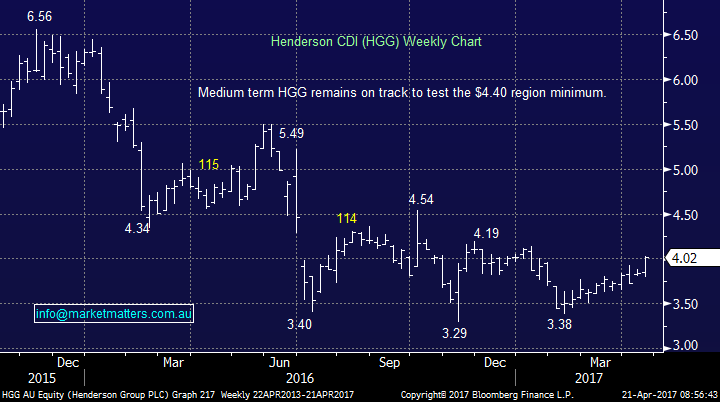

3. HGG $4.02 - Henderson has recently merged with Janus and we are keen on both this synergy and its exposure to Europe / British Pound. The company looks cheap trading on an est. 2017 P/E of 14.15x while paying a grossed yield over 6%. Technically HGG looks great targeting the $4.40-$4.50 area minimum. We remain very keen on our 8% holding in HGG which is currently showing a 5% paper profit.

4. PPT $51.80 - Perpetual has had a relatively tough time but recently its half-year result was solid showing a positive increase in both revenue and profit. The stock is now trading on an est. P/E for 2017 of 18.2x while yielding 5% fully franked. Overall we are neutral PPT with a slight positive bias.

5. PTM $4.87 - Our 7.5% holding in Platinum Asset Management is not surprisingly concerning us at present with it showing a ~5% paper loss, one of the reasons we have given this position some room is our comfort with the overall sector. The stock is relatively cheap trading on a est. P/E of 16x while yielding an impressive 6.4% but remember Telstra when I say a high yield does not necessarily mean a good stock to own long-term. Technically we are neutral with the stock range trading between $4.64 and $5.86 since late 2016.

Platinum has seen net outflows during recent times, which has hurt profitability but the company’s funds continue to perform well and management remain optimistic that better days lay ahead. The short-term key is what are PTM doing with their $300m war chest which was supposed to be buying back stock? The notice was lodged last September of the huge buyback BUT zero shares have been purchased, if this kicks in the buying of almost 59 million shares should produce a strong performance from the stock short-term.

Henderson Group (HGG) Weekly Chart

Conclusion

Four stand out conclusions today:

1. We remain very bullish the Financial Sector targeting at least 10% further gains.

2. We are very happy with our holding in HGG believing it may be an outperformer within the sector.

3. We are slightly more concerned with PTM here but primarily due to its relatively cheap valuation and our positive view on the sector we will persist for now.

4. We like CGF and will be keen buyers under $11 if a pullback unfolds.

Overnight Market Matters Wrap

·The US major indices rallied after their index expiry, as optimism returned with an overall positive earnings season so far.

·The Volatility (VIX) Index dissipated, with Iron Ore gaining some of its recent losses this week.

·BHP is expected to outperform, after ending its US session up an equivalent +1.08% from Australia’s previous close.

·The June SPI Futures is indicating the ASX 200 to open 35 points higher, towards the 5855 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/04/2017. 8.50AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here