Next Chapter – Now the market rallies on bad news!

Over the last few days I’ve heard many, many comments from people in the finance industry around the subject of “beware Wednesday's CPI in the US, if its high stocks will crash” , well it came in high and the Dow is up over 250-points. Admittedly US stocks plunged almost 2% as the data was released, but the market recovered quickly and is now looking extremely strong. We touched on this yesterday afternoon, suggesting when the mkt is all thinking the same way, the response / reaction is probably not what the consensus thinks it will be.

The market’s reaction comes as no surprise to MM as we believe stocks have bottomed for now after providing a short-term buying opportunity last week – as you know we stepped up to the plate and went from a large cash position to almost limit long.

- “A market that rallies / holds on bad news is a strong / bullish market” - MarketMatters

At MM we believe the reason for the +10% aggressive correction by global stocks was a combination of huge stops / liquidation of “short volatility” positions and stops on “hot money” leading to mass selling of trends following strategies largely in passive index funds, plus to a lesser degree the market's increasing concern around the speed which interest rates will increase in the US / globally. I do think the US Wages Data earlier this month was the tipping point, pushing bond yields higher which lead to the initial sharp drop by US stocks, but this was simply the catalyst for what came next i.e. multiple stops. However, the following week's carnage was just a classic scenario of stops feeding on themselves providing a washout of stock markets which had become complacent – or in other words risk was not being priced correctly.

This morning the ASX200 looks set to open up close to 50-points, with gains likely to be led by the resources with BHP up well over 3% in the US. For the local market to have the strength to push over the psychological 6000 area we need our influential Banking Sector to regain its mojo and with the Financials the strongest sector in the US overnight they should hopefully get some love today.

Today we are going to maintain our to focus on what comes next in what we believe will be the most exciting year since the GFC, its certainly started that way! We must all keep our fingers on the pulse because MM believes this is definitely / clearly a year to be relatively active.

Local Index

Yesterday the ASX200 was largely unchanged after we include CBA’s $2 fully franked dividend. We still expect the local market to challenge the 5950 area short term but for us to become bullish technically the ASX200 we need to see a close back above 6000.

ASX200 Daily Chart

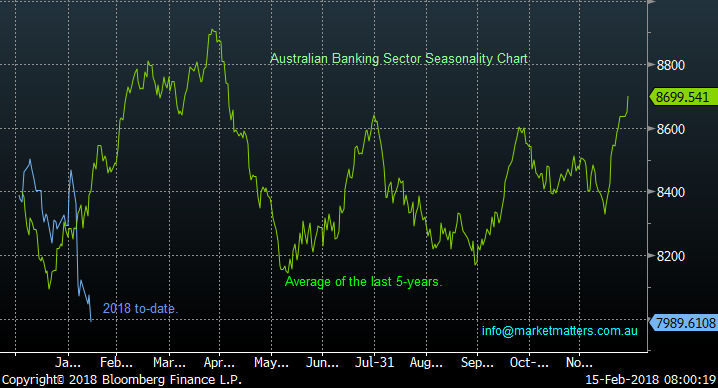

Banks

Earlier in the week we evaluated CBA with a view to buying the stock targeting a potentially “free” dividend with the statistical evidence extremely supportive of the strategy i.e.:

- With some careful exits on a couple of occasions this strategy has worked every year since the GFC!

This morning we are thinking about the overall Banking Sector and seasonally from now until April is usually extremely positive - the most bullish time of the year! Perhaps local investors become influential net buyers of say ANZ, NAB and WBC as their juicy fully franked dividends looming on the horizon in May become too attractive to resist.

We are watching carefully for signs of renewed confidence in our banks because this could easily provide the support for our market to make fresh high in 2018. We’ve actually just had Ian Narev, CBA’s outgoing CEO in the office this morning covering their results. All many known knowns – however one interesting aspect was around their funding profile, which they are lengthening, in essence locking in longer term debt to finance short term borrowings highlighting their views that interest rates are going higher from here.

Australian Banking Sector Seasonal Chart

Resources

Last week’s panic in stocks enabled us to take our resources exposure from very underweight to a substantial 24% as a number of stocks dropped into our buy zones. Due to our opinion that the impressive rally by our resources is fairly mature we expect to be adopting this strategy for the sector during 2018/9 i.e. sell strength and buy weakness, note be prepared to sell!

We will continue to watch 2 markets very closely as we tweak our planned exit from these holdings – remember we did say these would be short-term positions.

- The $US Index – Last night the $US fell 0.8% to be within striking distance of its 2018 low. This sent commodities like copper, oil and gold soaring. Our target is a test of the 88 area / over 1% lower.

- Emerging Markets (EEM) – The EEM’s have quickly bounced 8.2%, with our ideal target currently around the 54 area / 10% higher.

Importantly subscribers should understand assuming we are correct MM intends to slowly take profit on our holdings as they reach our targets, we are happy to leave some on the table for the fussy.

“Fortunes are made by buying low and selling too soon” – Baron Rothschild.

$US Index Daily Chart

Emerging Markets Index (EEM) Weekly Chart

This morning BHP is set to open well over $31, around 3% below its 2018 high, also BHP is set to pay a nice fully franked dividend in early March.

- At this stage we are targeting $32.50-$33 for BHP but we may scale out our selling just as we did our buying.

BHP Billiton (BHP) Weekly Chart

Conclusion

No major change, at this stage on the macro / index level, MM is bullish moving forward short-term BUT our “selling hat” is being dusted off following the recent movement to basically fully invested.

Global markets

US Indices

Overall US stocks are now in the area where we can see a low forming, if it hasn’t already, and our opinion is they will be higher in say 1-2 months’ time.

No major change from yesterday,

- While we expect US stocks to rally to fresh highs the likely manner of the advance is far more choppy / indecisive than the almost exponential gains we have witnessed from late 2016.

Similar to both 2010 and 2014 we believe that US stocks have given the market a relatively friendly warning over recent days – a nudge around what could be on the horizon. At this point in time I expect investors to slowly forget the recent volatility and refocus on all the bullish fundamental reasons to be in stocks ideally pushing global markets back up to fresh all-time highs before buying the next dip will become very dangerous. MM view from here:

- Global markets are likely to regain their bullish euphoric mood through February / March and push prices back to all-time highs.

- Following later in 2018/9 will be a ~20% correction back to the lows of 2016 i.e. hence our recent buying is relatively short-term in nature.

US Dow Jones Weekly Chart

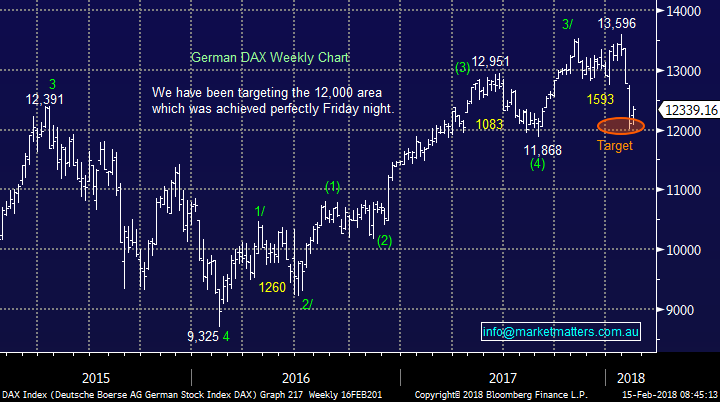

European Stocks

European stocks made fresh recent lows this week as expected, a rally back over 13,000 by the German DAX will look great for fresh all-time highs in 2018.

German DAX Weekly Chart

Moving onto our close neighbours in Asia, the Hang Seng has bounced from our “buy zone below the 30,000 area”.

Hang Seng Weekly Chart

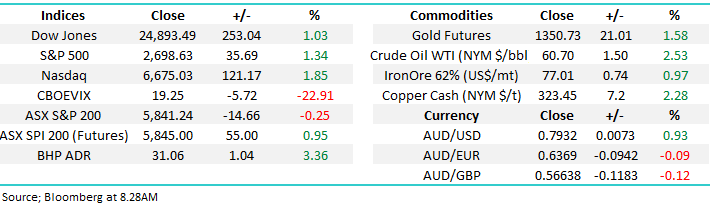

Overnight Market Matters Wrap

· The US Equity markets ignored a higher than expected inflation number in January (+0.5%) and rallied strongly overnight, as investors focused on the underlying strength of the US economy, with all three key indices higher, in particular the Nasdaq 100 ending its session up 1.85% towards the 6675 level again.

· Commodities surged across the board with gold, seen as an inflation hedge, rallying nearly 2% to a recent high of US$1355/oz. Base metals rose similarly as did the oil price on expectations of strong underlying US and global demand – nickel led the charge (+4.8%) to 3 year highs, while copper retested its December high of ~US$3.25/lb. The Brent oil price continued its rebound, rising nearly 3% to around US$64.50/bbl. Demand for global resource stocks saw BHP and Rio having one of their best nights in a while, up between 3.5% and 4% respectively.

· The US bond market however reacted by selling off to new 4 year highs, with the benchmark 10yr bond breaking through 2.9% on concerns that the higher inflation data would spur not 3 but possibly 4 rate hikes this year under the new Fed chairman.

· The March SPI Future is indicating the ASX 200 to open 50 points higher, towards the 5890 area this morning

Have a great day

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/02/2018. 8.24AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here