Moody’s downgrades the Australian banks, a worry?

The ASX200 was firm yesterday gaining 31-points / 0.5% with the banks leading the gains, this should be no great surprise as the Super changes loom only 10 trading-days away. As we all know retail investors love the banks and a significant proportion of the extra funds which are pouring into equities before the 30th of June deadline are likely to be earmarked for the high yielding, perceived to be safe, “big 4” banks.

Ironically within an hour of our market closing Moody’s downgraded our banking sector, in this report we will look at the likely impact to their share prices moving forward.

Also, as expected the retail stocks were weak yesterday following the Amazon move into store front groceries e.g. Woolworths -3.3%, Harvey Norman -3.1% and JB Hi-Fi -2.7%. We considered addressing this topic in more detail but quickly decided there was no point, our conclusion would remain the same – we continue to believe Australian retail is simply too hard for investors for the foreseeable future and should be left alone.

The ASX200 remains on track to challenge, and probably break above, June’s 5836 high all else being equal but we will be concerned if the market breaks back below yesterday’s 5769 low. Undoubtedly today’s reaction to the Moody’s downgrade will have a large impact on the market.

We remain comfortable with our 10% cash holding as this bull market continues to mature in a choppy manner.

ASX200 Daily Chart

US Stocks

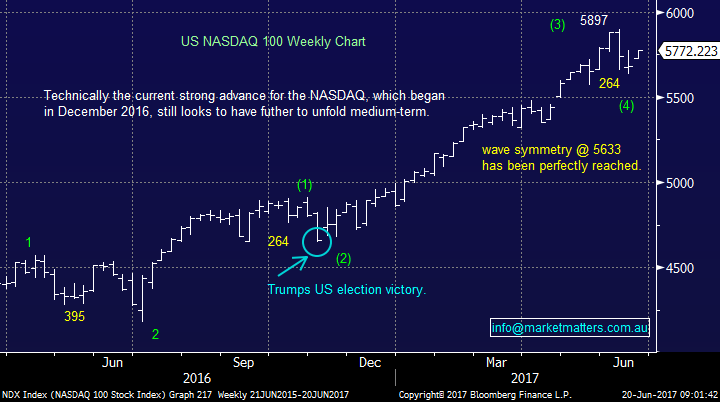

US stocks soared last night with the Dow and S&P500 making fresh all-time highs and the tech NASDAQ rallying an impressive 1.6% as it starts to regain the recent almost panic losses.

Our preferred scenario is the NASDAQ continues to rally towards the psychological 6000 area / ~4% higher before it again becomes vulnerable to a meaningful correction. This fits our mantra for 2017 for stocks of choppy gains, with some decent pullbacks along the way, as this 8-year bull market matures.

US NASDAQ Monthly Chart

European Stocks

We remain bullish European stocks both in the short and medium-term with our initial target for the Euro Stoxx the 3700 area, or another 3.5% higher to fresh 2017 highs.

Euro Stoxx Weekly Chart

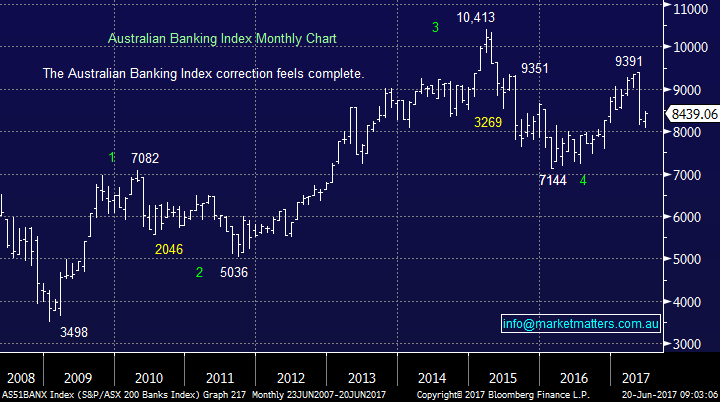

Australian Banks

Yesterday evening Moody’s downgraded Australia’s “big 4” banks, plus 8 smaller ones, from Aa2 to Aa3 on their long-term rating, while leaving their short-term rating unchanged. So Moody’s have finally joined the bank knocking party, the ratings agency who missed the whole GFC, so should we be concerned? Interestingly its rival the Standard and Poor’s rating agency recently only downgraded the smaller Australian banks, leaving the “big 4” alone for now - please note ratings agencies is an industry space we have limited respect for as they are usually too far behind the curve e.g. Surely any investor who was considering selling our banks due to property price concerns has already pressed the trigger.

Australian banks have corrected over 30% from their March 2015 high and 14% since last month’s high alone. The clear point is plenty of selling has already materialised leaving the banks now paying very attractive dividends e.g. on a grossed up basis ANZ 8%, CBA 7.3%, NAB 9.3% and WBC 8.7%.

Pretty attractive yields when it’s tough getting a term deposit paying 3%.

ASX200 Banking Index Monthly Chart

The quoted risk by Moody’s was increased debt of the average household primarily due to excessive housing prices, while income grows slowly, something we’ve all been reading about for ages:

"In Moody's assessment, risks associated with the housing market have risen sharply in recent year etc." – Moody’s.

Global investors are likely to steer away from our banks until they become comfortable with our housing prices with the below 3 points high on their reasoning:

1. Over 60% of Australian banks loan book is residential property, more than double that of the US.

2. Australian banks allow greater leverage, with 50% of loans made to people who have borrowed over 6x their income whereas in the UK 4.5x is the maximum allowed.

3. The growth of interest only loans over recent years concerns many people, although the regulator has now capped this growth.

However in Monday nights statement Moody’s also altered their outlook from negative to stable hence the impact of the downgrade should in theory be minimal as its was totally flagged, although a clear headline grabber.

The downgrade is likely to lead to a small increase in the banks’ funding costs but as we know this is likely to be passed onto the consumer.

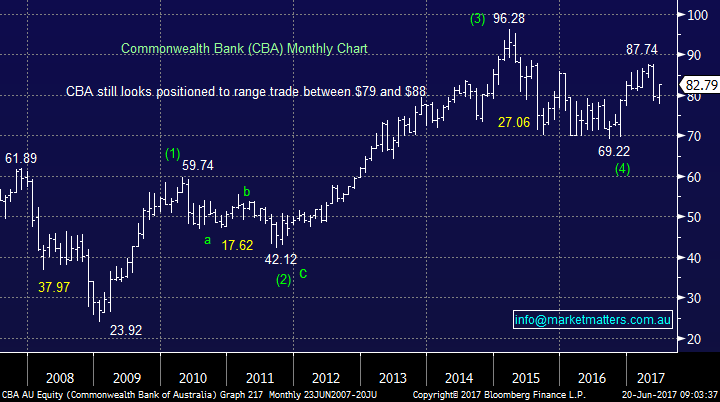

Technically CBA remains bullish and a stock we would consider adding to our position if excessive selling were to unfold.

Commonwealth Bank (CBA) Monthly Chart

Interestingly Moody’s did exactly the same to Canada’s big banks, again because of concerns of an overheating housing market just over a month ago. The correlation between the major Australian cities and Canada’s housing market is huge hence this downgrade should come as no surprise to local investors, we actually flagged it back in mid-May following the Canadian decision.

The result in Canada was the banks fell ~3% over two weeks before rallying strongly to be back above where they were when the downgrade occurred. Considering the Canadian banks were already correcting a phenomenal 51% rally since December 2015 none of these moves are a major concern at this point in time.

Canadian S&P/TSX Banking Index Weekly Chart

Our view is long-term interest rates will continue to be the main driver of banking stocks assuming Australian property does not collapse, and we think it won't.

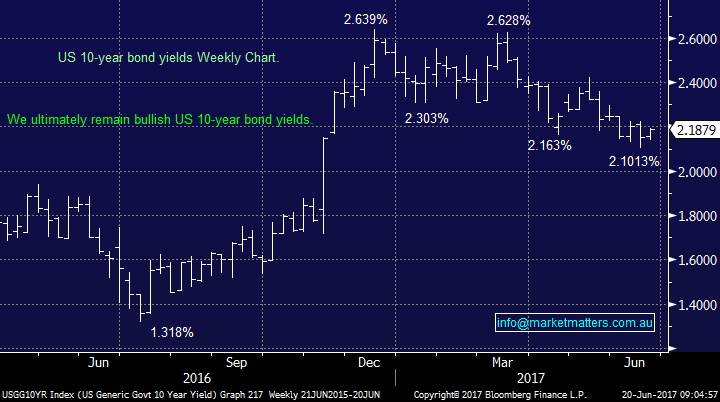

A hint of renewed strength in the US economy and / or a pick-up in inflation should send US 10-year bond yields back over 2.2% and potentially towards 3%, a very bullish scenario for bank margins. At this stage we think the market is wrong in terms of US rate expectations and they will rise more inline to the Fed view than current market positioning.

US 10 year bond yields Weekly Chart

Conclusion(s)

We regard Mood’s downgrade of the local banks as “market noise” and something that will be forgotten in a few days. We believe the 2 main drivers of our bank stocks will be the below:

1. Long term bond yields - we are bullish long term interest rates which should be very supportive of bank stocks as it leads to larger margins / profitability.

2. Housing Prices - Undoubtedly a fall in housing prices will lead to increased bad debts for Australian banks and reduced profitability but we believe a huge amount of this potential move is already baked into bank stocks.

If our bank stocks do soar into the months end as investors get set before the Super changes we would consider writing call options for the sophisticated investor.

Overnight Market Matters Wrap

· A strong rebound in the technology sector saw both the Dow Jones and S&P 500 indices rise strongly to record levels overnight with the Dow closing above 21,500 and the S&P above 2450.

· Apple jumped 3%, leading a strong rebound in the tech sector and the Nasdaq 100 rally 1.4%, its strongest move since November, albeit it remains slightly below its record levels set earlier this month.

· Commodities were mixed, with iron ore rebounding above US$56/tonne but oil remaining weak as US oil drilling activity continued to increase - the benchmark WTI fell below US$45/bbl. The US$ found support after recent weakness, with the A$ rate back below US76c.

· Locally, focus will be on yesterday's downgrade by Moody's Investors of the bank sector credit rating, citing elevated household debt levels, albeit the downgrade from Aa2 to Aa3 only brings it in line with the other major ratings agencies S&P and Fitch. Events to watch for will be today's decision by Morgan Stanley on whether China, the world's 2nd largest market with capitalisation of US$6.8trillion, after three previous attempts, finally gets included in future MSCI weightings .

· The June SPI Futures is indicating the ASX 200 to open marginally higher, up 4 points towards the 5810 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/06/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here