MM’s thoughts of Trumps weaker $US and stronger tariffs rhetoric

Firstly and very importantly the MM team want to wish all subscribers a very happy Australia Day!

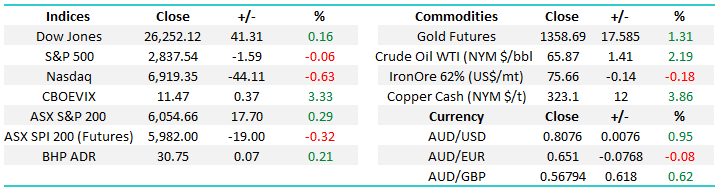

Following a relatively quiet day yesterday the local market feels likely to slip lower into the long weekend, with huge travel disruptions expected to hit Sydney both today, and on Monday, reduced volumes / activity are a strong possibility. The local ASX200 is set to open down around 20-points this morning and our buy areas for a few stocks are slowly coming into view including heavyweights CBA and BHP.

At the Global Economic Forum last night in Davos, Switzerland Donald Trump’s team were spouting the “America First” message sending the $US down to a 3-year low, while weighing on international equities except those benefitted by a weaker $US. Today we’ll discuss our thoughts and potential market implications of where the Trump administration appear to be heading.

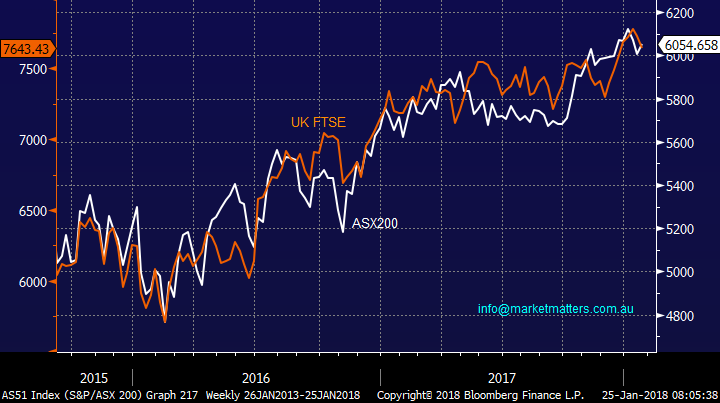

European stocks turned down strongly last night with the strong Euro damaging the regions competitiveness, importantly the Australian market is extremely correlated to European stocks which MM is now short-term bearish –see the second chart below comparing the ASX200 and UK FTSE.

MM ideally will look to invest a significant proportion of our 20.5% cash position within the Growth Portfolio back into the market between 5925 and 5950 area for the ASX200 but individual opportunities may arise in some stocks / sector beforehand.

ASX200 Daily Chart

ASX200 v UK FTSE Weekly Chart

Politics as most of us know is not the clearest or indeed cleanest game in town with most administrations focusing at least 50% of their efforts on getting re-elected as opposed to looking after the country / people i.e. quick fixes as opposed to laying long-term foundations. It appears to me from afar that Donald Trump’s thoroughly enjoying being President even if you believe the rumours that he did not want / expect to win the US election.

Both markets and corporate America more generally are still smiling following the recent huge US tax cuts, we wonder what comes next to maintain this momentum and give the voters an ongoing warm feeling into the looming mid-term elections - then before we know it the next US election on the 3rd November 2020. Perhaps last night’s comments at Davos gave us some clues.

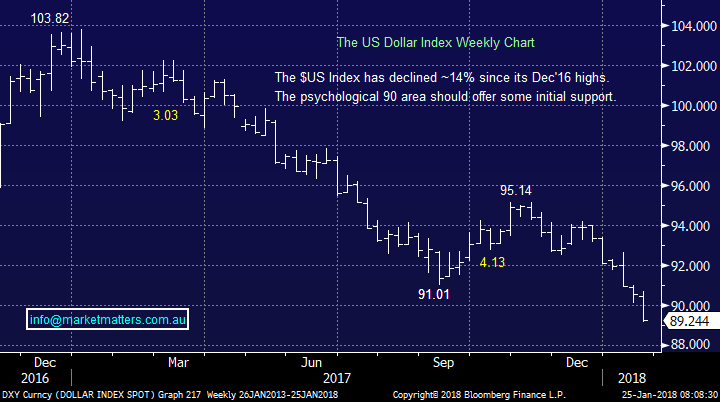

The US Treasury Secretary backs a weaker $US

The comments in Davos from the “Trump Team” are certainly significant short-term as we saw with the $US plunging to its lowest level in 3-years. However there is a huge difference between action and rhetoric which is all we have at this stage. History has shown many governments, from many countries, try and talk their respective currencies lower in an effort to become economically more competitive but economic fundamentals will always prevail over and above jaw boning in the longer term.

However, for now the $US is falling with increased momentum towards our 88 target and we would now not be surprised to see the 86 area challenged i.e. another 3-4% lower.

The $US Dollar Index Weekly Chart

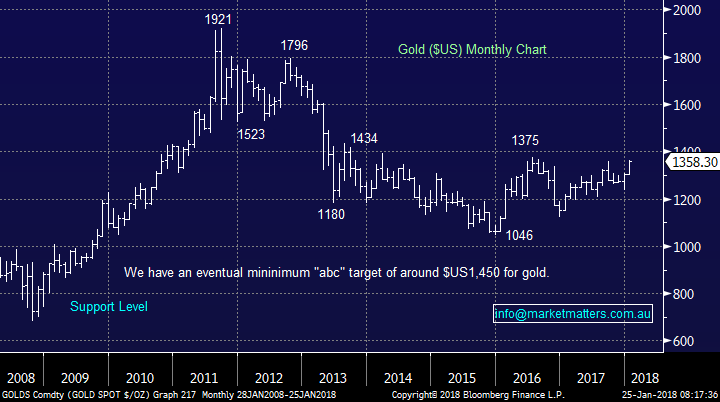

Last night’s aggressive move in the $US as would be expected noticeably helped the commodities denominated in $US with oil hitting a 3-year high and gold nudging towards its best level in 18-months, with Gold ETF’s up almost 3%.

MM sees no reason at this stage to change our view that the $US will bottom in January / February 2018 with the Treasury Secretary’s comments potentially assisting our view.

MM is still planning to take profit on our Newcrest Mining Position (NCM) into strength over coming weeks and importantly, we’re likely to enact our view on the US currency by buying a $US ETF.

Gold ($US) Monthly Chart

Gold ETF Monthly Chart

Stronger US Tariffs

Increasing US tariffs may put “America First” but it’s a big step in the wrong direction for equity markets – a global trade war would quickly change the upward direction of stocks. Last night alone the comments initially sent the Dow down almost 300-points in fairly quick time, although the market recovered, the warning signs are slowly emerging.

Earlier in the week Donald Trump increased tariffs on solar panels and washing machines in an effort to revive domestic industries but that is a slap in the face of foreign competition i.e. China. Love him or loathe him, undoubtedly the US President is implementing the popular policies he promised during his election campaign which in itself is refreshing / rare from a political standpoint.

However the more we hear about tariffs the closer we will come to a very dangerous trade war…….has Donald Trump got the ability to walk such a precarious tightrope? At this point we believe there is a strong possibility that trade tariffs might be the undoing of the almost 9-year bull market in stocks moving forward as Donald Trump strives to win looming elections.

US NASDAQ Weekly Chart

Conclusion

No change, at this stage MM remains keen to stocks into weakness and sell gold (NCM) into strength.

In the bigger picture investors should watch carefully for any signs of a dangerous pending trade war.

Global markets

US Stocks

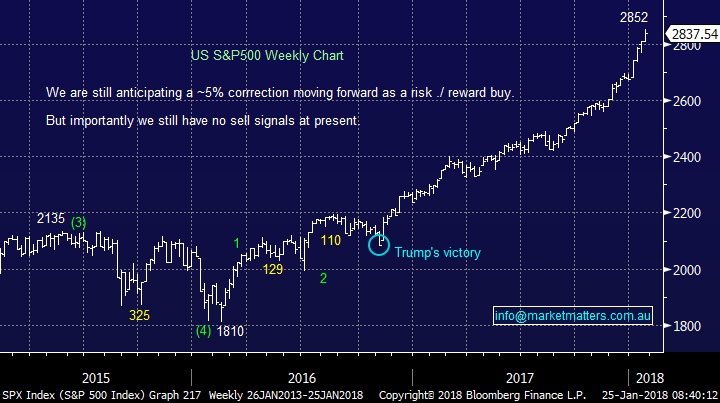

The S&P500 has continued its record breaking advance and with no sell signals at present investors should be long, or out.

US S&P500 Weekly Chart

European Stocks

European stocks look set to make fresh recent highs the big question is will they fail, or kick on. At this stage we are sitting on the fail side but only just!

German DAX Weekly Chart

Overnight Market Matters Wrap

· The US equity markets closed marginally mixed overnight, with the financials outperforming the broader market.

· The $US Bloomberg Dollar Index is at a three year low after US Treasury Secretary Steve Mnuchin said a weak $US “is good for us as it relates to trade and opportunities”.

· European markets closed lower as America First protectionism seems to be the message coming from US officials in Davos.

· The weak $US saw commodities rally hard. All metals on the LME were strong, with copper +3% and nickel +5%. Oil, gold and iron ore eked out gains.

· The March SPI Futures is indicating the ASX 200 to open 15 points lower towards the 6040 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/1/2018. 9.00AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here