Markets get the quartet of good news! (JHG, OZL, FMG, NAN, TLS)

The ASX200 closed marginally lower yesterday after looking extremely strong at midday, the $348m worth of Telstra (TLS) which was crossed close to the day’s 6-year low for the embattled telco probably took the wind out of a few buyers sails, at least short-term. If our banks in particular can break free of their recent shackles we could easily see the ASX200 leave the 6000 area in the rear view mirror into Christmas, last night’s news may be just the catalyst they require.

Overnight markets received a trifecta of positive economic news and totally ignored North Korea’s missile launch which again landed in Japanese waters. It clearly appears that Kim Jong-Un needs to up the ante before equity markets will pay him any attention and stroke his ego.

- Rumours are percolating through newswires that a BREXIT deal is close to completion which helped the UK FTSE rally over 1%, around double that of Europe in general.

- US corporate tax cuts inched closer to reality after passing another hurdle in the US senate.

- The likely new Fed Chair Jerome Powell said he believes that US banking regulation is more than adequate which saw the financials up 2% on the session

- While he also made it clear that the scene is set for further interest rate hikes, starting in December, but stressed that interest rate hikes would be gradual as would any sell down of the Fed $US4 trillion balance sheet.

Make no mistake, this was a very ‘markets friendly’ first public appearance from Trumps nomination to take over from Janet Yellen as the worlds most important central banker.

Today we are going to look at 3 topical and important issues to MM’s investment thoughts into 2018 i.e. should we add to our overweight banking / financials position? Should we accumulate more resources? Should we cut our 2 losers Telstra (TLS) and Nanosonics (NAN)?

ASX200 Weekly Chart

1 Is it time to add to our banks?

Following our switch from Challenger (CGF) to Fortescue (FMG) yesterday MM remains overweight financials, but with a little more room to accumulate further if we perceive prudent. However, note we still have over 50% of our MM Growth Portfolio in Financials which is clearly on the rich side.

- Banks – CYB, CBA, WBC and NAB for a total exposure of 28%.

- Financials – IOOF, QBE and Suncorp for a total exposure of 24%.

Following the good news on banking regulation, plus added bonus of an anticipated further US interest rate increase in December US banks soared last night and from a trading perspective can be bought with only a 2% stop.

- We are bullish US banks, targeting a further ~8% upside from this mornings close.

US S&P500 Banking Index Weekly Chart

On many metrics our banks are fairly priced at current levels, however if we think about NAB’s 6.74% fully franked yield, it remains compelling even in the face of rising interest rates. The risk of course remains if house prices really start to slide however even then, and we showed a good chart of this in Monday’s afternoon report, that typically doesn’t have a huge impact on bank balance sheets. Whatever the case, we doubt house prices will plunge, but will experience a softening which is part of normal market cycles, and nothing compared to the last 5-years advance.

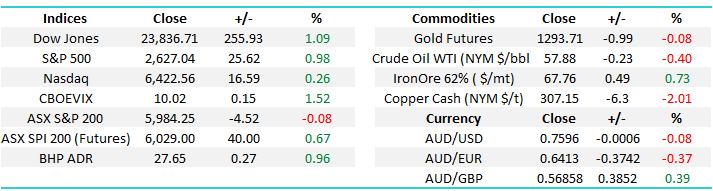

We are still considering increasing our CBA holding with one eye on February’s attractive dividend plus if we see a strong rally into 2018 we can take profit on one / part of our other bank holdings at better levels – remember CBA’s average gain in December since the GFC is 4%.

Commonwealth Bank (CBA) Daily Chart

On the financials front we are happy with our IOOF, QBE and SUN holdings, however we are also considering moving back into an old favourite Janus Henderson (JHG) which has made MM some nice returns over previous years. The combination of a deal with BREXIT, overseas earnings and position in the financial sector puts the stock in the cross-hairs of our macro view at present.

- We are bullish JHG with stops under $46, a comfortable ~3% risk basis yesterdays close.

*watch for alerts.

Janus Henderson (JHG) Weekly Chart

2 How aggressively should we accumulate resources?

Yesterday we allocated 3% of the MM Growth Portfolio in Fortescue (FMG) at $4.60, the stock has corrected 37% in 2017 and we simply feel its gone too far for now however please note our allocation leaves room to average at lower levels.

Fortescue Metals (FMG) Daily Chart

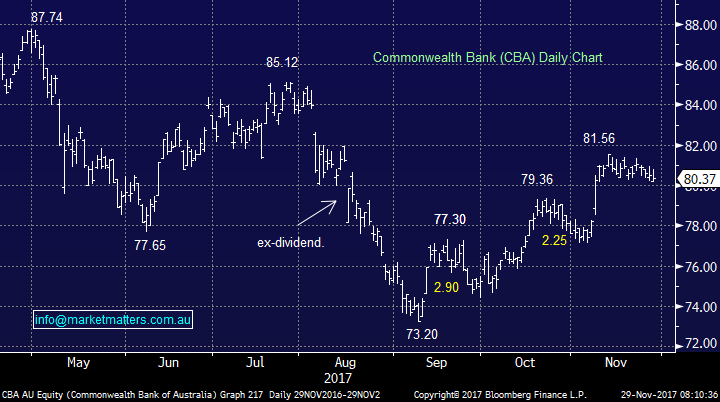

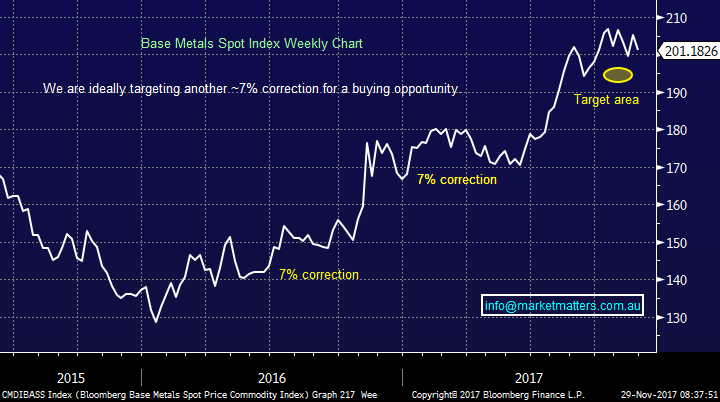

We have been “stalking” base metals over recent weeks, ideally targeting a ~7% correction in the underlying index. Following last night’s weakness, led by a 2% fall in copper, we are basically half way there.

Our preferred option remains OZL ~$8, or 5% below yesterdays close, hence we will remain patient increasing our resources exposure at this moment in time.

Base Metals Spot Index Weekly Chart

OZ Minerals (OZL) Daily Chart

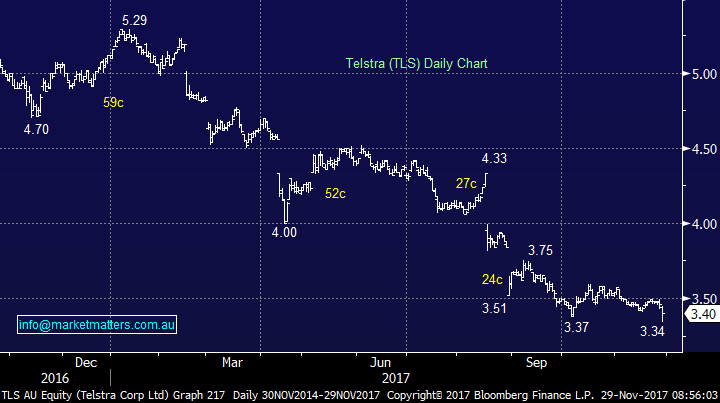

3 Is it time to cut our 2 main losers NAN and TLS?

We have 2 stocks in our MM Growth Portfolio that are causing us some angst i.e. Nanasonics (NAN) -9.7% and Telstra (TLS) -4.3%. We simply hate losing money, especially in a rising market! Our plan on these 2 positions is simple:

- Nanosonics (NAN) - we will exit the stock if it cannot hold above $2.60 today.

- Telstra (TLS) – while our paper loss is relatively small it’s still very annoying with TLS currently so out of favour it actually feels like a buy! However capital preservation is vital in investing and we will exit at least half of our position in the Platinum, Portfolio if TLS cannot close over $3.35 plus we are likely to exit 50% of our holding into any strength.

Telstra (TLS) Daily Chart

Global markets

US Stocks

The US continues to make fresh all-time highs and although we still need a ~5% correction to provide a decent risk / reward buying opportunity, no sell signals have been generated to-date.

The current strong rally since Donald Trump’s election adds to our confidence with buying a decent ~5% pullback.

US S&P500 Weekly Chart

European Stocks

European stocks look to be failing after their recent break out to fresh 2017 highs, we are now neutral / negative Europe over the next few weeks.

German DAX Weekly Chart

Conclusion (s)

1 - We remain bullish financials / banks but are already overweight the area, we are considering adding to CBA today.

2 – We are keen to buy resources but believe better opportunities are likely down the track.

3 – We are not married to NAN or TLS and will exit / reduce if the appropriate signals are generated.

*watch for alerts.

Overnight Market Matters Wrap

· The chances of an interest rate hike in the US next month is all but baked in, with Fed chair nominee Jerome Powell asserting the central banks independence. Powell also indicated a lightening of regulation in the financial sector, in particular the “re write” of the Dodd-Frank Volcker rule.

· US consumer confidence rose above analysts’ expectations, to a 16 year high.

· Copper and nickel fell 2% on the LME, while oil fell on Russian concerns regarding supply cuts and iron ore rose.

· The December SPI Futures is indicating the ASX 200 to storm out of the opening gates this morning towards the 6025 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/11/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here