Markets correct – Is this the “big one” we have been targeting?

From James Gerrish, Primary Contributor

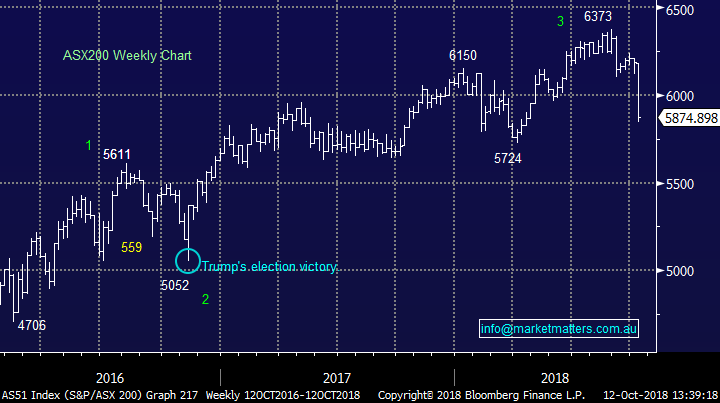

I wrote to you last week suggesting that a decent inflexion point seems to be looming in markets and that has clearly played out with some force over the past couple of days – perhaps more aggressively than I had envisaged! Yesterday we saw the ASX 200 down -166pts / 2.74% closing on the lows of the day at 5883.

ASX 200 Chart

I’ve been looking for a major market decline for some time and going into the drop we had bearish facing ETFs’ on our portfolio and a reasonable cash position of ~15% , the majority of which we spent into yesterday’s market decline. While the portfolio was in the red yesterday, having cash to buy weakness and a hedging positon in place, we did better than the market, and we’re now positioned for upside.

At around lunch time today the ASX is down 5% on the week – the total sell off from the 6373 high set on the 30th Aug is now -490pts / -7.68%. Clearly a big drop and we could fall further. The DOW Jones has fallen -2052pts to the close this morning or a similar ~7.61%. Worth noting that we do often see big falls at the start of October and more often than not, that provides a great buying opportunity ahead of the most bullish period into Christmas. Time will tell, however that’s our current view, and we played that view by buying stock yesterday when the majority were selling. If we’re wrong, we’ll put our hand up and take our medicine, however when I’ve stepped up at times like this in the past, ‘buy the panic’ has proven to be the right call. It’s a hard thing to do, and quite frankly pretty unconformable.

Today the market has settled in Australia and around the Asian region despite the Dow Jones falling another -545pts overnight. The obvious question is, what now?

1 – Where is the markets likely “bottom” – our preferred scenario is we now see a choppy period of consolidation.

This implies we should still buy panic weakness but be prepared to increase cash again into strength

2 – Is this the “big one” we have been targeting? Looking at assets other than equities suggests not. This is an equity correction at this stage, we’re not seeing any concerning movements in the credit markets that matter. Some high yield credit spreads have widened a touch, but not significantly so. Panic is focussed in equities which implies this correction stems from growth concerns.

While the fundamental picture has not changed, the aggressive nature of selling paints a negative technical picture. This is not generally that surprising i.e. mixed signals during corrections between fundamental and technical measures. I prefer to take the technical view on board into market panic, given that price action can often be a strong leading indicator for a change fundamentally. i.e. equities pricing lower global growth etc.

For now, we have allocated a large portion of available cash into stocks and some select ETFs. We plan to retain our leveraged short exposure on the US market through the BBUS for now (this position was up ~10% yesterday), however we’re vigilant that the aggression of the sell off and the volume was strong. While we’ll give the market the benefit of the doubt for now, but reserve the right to go to high cash if the outlook deteriorates.

Why such aggressive selling?

Thinking about the reasons underpinning this pullback, there have been two major pieces of global macro-economic news that have gathered momentum over the last few days to undo stocks i.e. rising US – China trade tensions and increasing bond yields (interest rates). Not fresh news but very significant with regard to share price valuations.

In my opinion, the Australian markets is around fair value but US stocks remain “rich” even after the last few days carnage.

Remember 3 facts from the September Bank of America Fund Managers Survey:

1 – Cash levels are at an 18-months high hence the buy buttons will be pressed at some stage leading to a strong bounce in stocks.

2 – Allocations to US equities was at an aggressive 21% overweight level – clearly the US has some room to underperform

3 – Allocations to emerging markets were sitting at 10% underweight, compared to 43% overweight in April, at the lowest level since March 2016 just before stocks soared.

I simply think that investors have been treating US stocks as an almost “safe haven” over recent months, a positioning fraught with danger and I add one we still believe accurate.

Clearly, some existing times ahead for markets with opportunities aplenty for the active investor. I encourage you to once again take a free 14 Day Trial of our service – CLICK HERE.

Have a good Weekend

James

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.